One of the most well-known companies on the planet is aviation giant Boeing (NYSE:BA). Even though the company operates in a space that should always see growing demand in the long run, the past few years have been downright painful for the business and its shareholders. To put this in perspective, over the past five years, the S&P 500 has appreciated by 61.4%. That’s even dealing with significant amounts of economic uncertainty, geopolitical challenges such as war, and COVID-19. Over the same window of time, shares of Boeing have dropped 34.2%, with reinvested distributions included into the mix. Over the past decade, the S&P 500 is up 347.5% compared to the 141.8% seen by this aviation behemoth.

To many investors, such underperformance over such a long period of time may be a sign that the company is a lost cause. I don’t necessarily fall in that camp. After all, the firm is showing some really positive signs of improvement. Ultimately, these improvements should help the company generate even more value for its shareholders. In that sense, I do see the picture for the company getting better. In fact, absent anything else coming out of the woodwork, I would argue that the next five years for the company will likely be healthier than the last five years were. But this doesn’t necessarily translate into a bullish outlook from an investment return perspective. Even though the picture for the company is improving from a fundamental perspective, I would argue that the stock is, at best, likely to be fairly valued once it works out all of its pain points. Because of this, I’ve decided to rate to the business a ‘hold’.

A brief refresher on Boeing

The overwhelming majority of people, including those who don’t invest, likely know Boeing and what it does. But a quick refresher it’s not necessarily a bad idea. Right now, the company has four different operating segments. The first of these is the Commercial Airplanes segment. As its name suggests, this unit of the company produces and sells commercial jet aircraft, largely to commercial airline participants. This is the largest portion of the company, accounting for 38.8% of revenue during 2022. Next in line, we have the Defense, Space & Security segment. Through this, the company researches, develops, produces, and modifies manned and unmanned military aircraft. It also does the same for weapons systems, surveillance and mobility aircraft, and a variety of other technologies. It even provides satellite systems for both governments and commercial enterprises, and it engages in cyber and information services. This unit was responsible for 34.8% of the company’s revenue last year.

The third segment is the Global Services segment. This unit is responsible for providing services to both its commercial and defense customers across the globe. This includes supply chain and logistics management services, upgrading and converting aircraft, providing spare parts, providing pilot and maintenance training systems and services, engineering, and more. This unit was responsible for 26.4% of the company’s revenue last year. And finally, we have the Boeing Capital segment. This unit helps customers with financing and it engages in some other miscellaneous services.

Tough times are nearly over

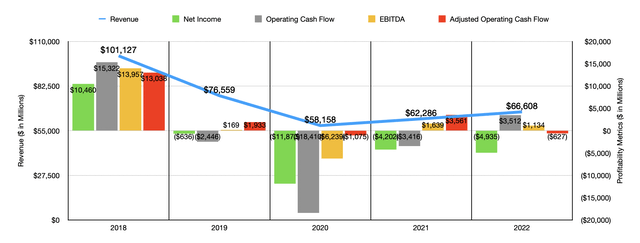

If you look at the operating history of Boeing, the past few years have been downright ugly. Revenue fell year after year from 2018 through 2020. It was only in 2021 that the business started to see some improvement on the sales front. The drop in sales from any given year to any other year is difficult to summarize because of how many working parts there are. From 2018 to 2019, for instance, revenue plunged from $101.1 billion to $76.6 billion. That was driven largely by a decline in commercial airplane revenue thanks to lower 737 MAX deliveries and an $8.3 billion hit for estimated potential concessions and other considerations to customers because of disruptions and associated delivery delays related to the global 737 MAX grounding that was occurring at that time.

Author – SEC EDGAR Data

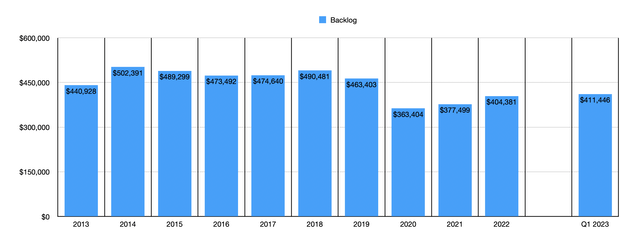

Even as that picture began to show signs of improvement, COVID-19 took a hammer to the company. Production issues associated with its 787 aircraft also hurt the company. Revenue for 2020 ended up coming in at only $58.1 billion. Fortunately for investors, the picture did start to improve after that. In 2021, revenue grew to $62.3 billion before hitting $66.6 billion in 2022. This was accompanied by an increase in the company’s backlog. After seeing backlog fall from $490.5 billion at the end of 2018 to $363.4 billion in 2020, it finally began to show signs of growth. By the end of 2021, it had expanded to $377.5 billion. And by 2022, it had grown further to $400.4 billion.

This doesn’t change the fact that bottom line results for the company suffered mightily and continue to do so to this day. For each of the four years between 2019 and 2022, the company generated net losses. Three of those four years saw losses in the billions of dollars. The cash flow picture for the company has been better to some extent. But it is far from great. Adjusted operating cash flow, for instance, which measures operating cash flow without factoring in changes in working capital, came in negative to the tune of $627 million in 2022. That pales in comparison to the positive $13 billion in adjusted cash flow that was generated in 2018 before the bottom fell out.

Author – SEC EDGAR Data

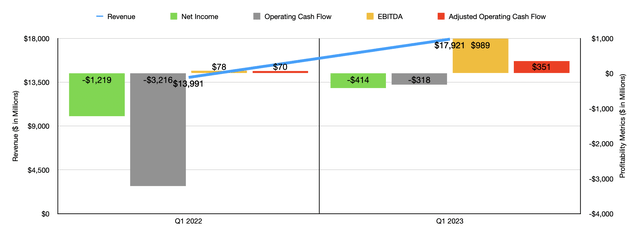

As you can see in the chart above, the 2023 fiscal year is bringing with it continued improvements for the company. Revenue of $17.9 billion during the first quarter of the year dwarfs the $14 billion generated the same time last year. All of the company’s profitability metrics are better year over year. And some of this can be chalked up to stronger demand in the industry. Backlog for the company continues to rise. At the end of the first quarter of this year, for instance, it came in at $411.4 billion. That’s an increase of $7.1 billion in the course of only a three-month window.

Author – SEC EDGAR Data

We can look beyond the backlog data to see that the industry is truly returning to health. At the end of the day, it’s the amount of demand for flights that will dictate how much revenue Boeing can generate. According to one source, for 2022, international air traffic had grown to 62.2% of the level that it was prior to the pandemic. That was up from 24.6% in 2021. By March of this year, air traffic had recovered to 88% of what it was the same month of 2019. And according to data that I pulled from the TSA that I referenced in another article that I wrote, domestic travel has essentially recovered compared to what it was prior to the pandemic. This is a massive sigh of relief because the pain during just 2020 and 2021 combined was astronomical. It’s estimated that the industry lost $390 billion during that time.

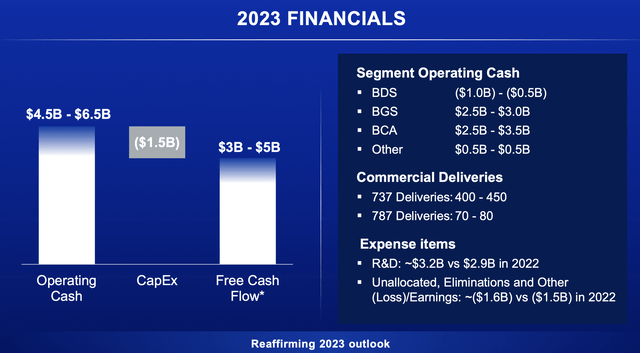

Thanks to these improvements, management believes that operating cash flow for 2023 will come in at between $4.5 billion and $6.5 billion. This would be the first time that it has been positive since 2018 and only the second time, if we ignore changes in working capital, that it has been positive since 2019. Even though this is a nice improvement, it still stands far away from what the company consistently generated in the years leading up to the firm’s troubles.

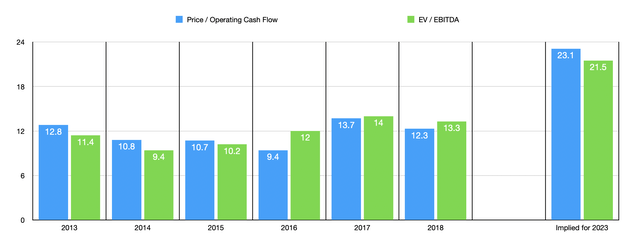

Boeing

At this point in time, if we assume that management is correct about operating cash flow, the firm is trading at a forward price to operating cash flow multiple of 23.1. The forward EV to EBITDA multiple, then, is about 21.5 if we make some rough estimates to arrive at EBITDA for the year of $7.8 billion. As part of my analysis, I decided to look at the trading multiples of the company in the six years ending in 2018. As you can see, the company demonstrated remarkable consistency during this window of time. The average price to operating cash flow multiple was 11.6, while the average EV to EBITDA multiple came in at 11.7. We do see that backlog for the company is growing and the market obviously assumes that trend will continue. Given the industry data we have looked at, this wouldn’t be surprising to me. It’s unclear when the company will revert back to the kind of health it was prior to 2019. But if it is to trade at those same multiples without the stock price changing, it would need operating cash flow of nearly $11 billion and EBITDA of $14.3 billion.

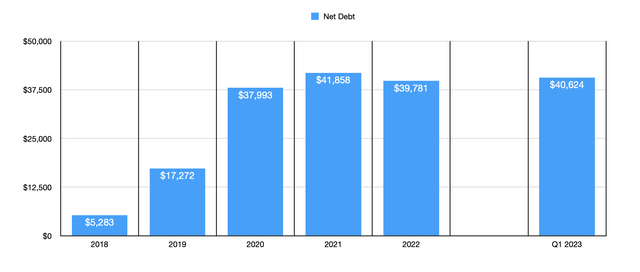

Author – SEC EDGAR Data

I think a solid case could be made, also, that the company might need to trade lower than these average multiples that the stock traded at prior to 2019. I say this because the health of the business from a balance sheet perspective has also changed. The tough times have taken the company from having net debt of only $5.3 billion at the end of the 2018 fiscal year to having that debt today of $40.6 billion. That obviously increases the risk for shareholders, though I don’t believe that it creates some existential crisis scenario for the enterprise. Rather, it just warrants a lower trading multiple than if the company did not have this amount of debt on its books.

Author – SEC EDGAR Data

Takeaway

Operationally speaking, the picture for Boeing is absolutely improving. Even though the broader economy might face some pain later this year and next year, I believe that the long-term outlook for the company is positive. Absent anything unexpected coming out of the woodwork, I think that the most difficult times for the enterprise are now over. But this doesn’t mean that the company makes for an attractive investment at this time. Yes, backlog is growing consistently. I definitely expect that trend to continue. But shares look very pricey and I would argue that the market is pricing in these continued improvements that I am suggesting will occur. I wouldn’t go so far as to turn bearish on the business. After all, it is a high-quality industry leader that has a bright future ahead of it. But I do think that the stock is no better than a ‘hold’ candidate right now.

Read the full article here