Investment Thesis

Boston Properties (NYSE:BXP) is a real estate investment trust (REIT) in the USA which owns, manages, and develops premier workplaces. The company pays an attractive dividend yield which makes it a good investment in my view to consider in times of recessionary pressures. It has also reported solid second-quarter results where it has outperformed market expectations and performed well despite economic headwinds.

About BXP

BXP is a self-administered & self-managed REIT that owns, manages, and develops premier workplaces. The company possesses properties in 6 markets: Boston, New York, Seattle, Los Angeles, San Francisco, and Washington, DC. The company’s portfolio comprised 194 commercial real estate properties which included 54.1 million net rentable square feet of premier workplaces. The company’s Boston portfolio is 94% leased and contributes 24.5% to the company’s total rental revenues. BXP has carried out about 304,000 square feet of leases in the New York region with 88% of the properties under lease which generate 23.7% of the total rental revenues. The properties in the Los Angeles region are 88% leased and earn 20.2% of total rental revenue. Seattle properties are roughly 88% leased and contribute approximately 1.1% to the total rental revenues. The company originated 225,000 square feet of leases in the last quarter in the San Francisco region and leased about 89% of the total properties in this region. This segment accounts for 18.1% of the total rental revenues. Washington DC properties are 88% leased and contribute 12.4% to the total rental revenues.

Financials

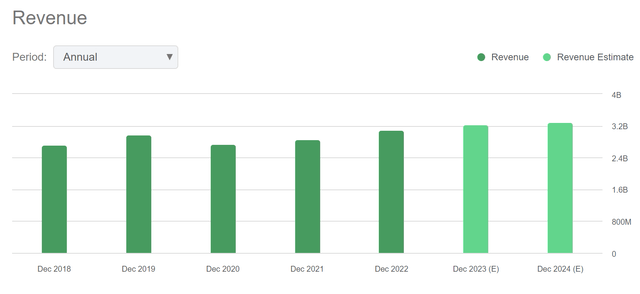

Revenue Trends of BXP (Seeking Alpha)

BXP has maintained a stable revenue range in the last 5 years. As we can observe in the above chart, even during the period of covid-19 pandemic, it has managed to sustain a high sales level. The company’s revenue has stably increased from $2.72 billion to $3.09 billion resulting in a 5-year CAGR of 2.58%. The reason behind this stable revenue range is high-quality properties and stable market demand.

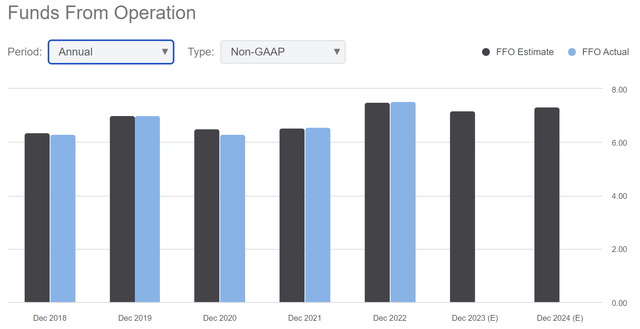

Funds From Operation Trends (Seeking Alpha)

The company has even conserved stable FFO growth in the last 5 years. Its FFO per share has risen from $6.30 to $7.53 which is a 5-year CAGR of 3.63%. The stable FFO growth indicates that the company has healthy profitability as the FFO growth can keep up with revenue growth.

BXP reported on August 1st its strong Q2FY2023 and outperformed market expectations. The company has reported revenue of $817.2 million in Q2FY23 which is 5.6% YoY growth compared to $773.9 million of last year’s same period. The reported revenue of the company is 1.72% higher compared to market expectations. This growth was mainly fueled by an increase in lease income resulting from acquisitions and rising rental inflation. Despite the revenue growth, BXP’s net income has experienced a dramatic decrease in net income due to rising interest expenses which are driven by rising interest rates. It reported a net income of $104.2 million in the last quarter which is 53.22% YoY compared to $222.9 million in Q2FY22. Decreased net income resulted in a diluted EPS of $0.66. The company’s operating expenses increased slightly which has resulted in a decrease of Funds from operation.

Funds from operations experienced a 3.84% YoY decrease from Q2FY22’s $304.5 million to $292.8 million in Q2FY23. A decrease in funds from operations resulted in a diluted FFO per share of $1.86 compared to $1.94 of the last year’s same period. It has managed to beat EPS market expectations by 11.3% even with the significant net income decline. The company has managed to outperform FFO market consensus by $0.06 or 3.24%. The company’s EBITDA stood at $468.9 million, up 3.49% compared to $453.1 million in Q2FY22. It managed to execute 938,000 square feet of leases in the second quarter which had a eight-year weighted average lease term. It also commenced services at 2100 Pennslyvania Avenue in Washington DC covering a premier workplace of 476,000 square feet. It ended its second quarter with $1581.5 million in cash & cash equivalents.

The real estate industry has experienced a dramatic downturn over the last few years resulting from the pandemic and then inflationary pressures. Vacancy levels increased significantly over the quarters which led to low performance of participants in this industry. However, the demand has varied as per the quality of properties. It was observed that nationwide demand for high-quality properties has been high compared to the other properties. This positive factor has helped the company to sustain its growth as it owns and operates properties in dynamic markets where occupancy has remained healthy despite economic downturns. I believe the company can sustain this growth in the future as it is continuously making opportunistic acquisitions in high barriers-to-entry markets. In addition, the company is also focused on acquiring a high-quality and diverse pool of clients such as Google, Salesforce, Microsoft, Fannie Mae, Biogen, and WeWork which helps to gain a competitive advantage and capture additional market share which can further expand its profit margins. The quarter was slightly affected by increasing interest rates however the result surpassed the company’s guidance & market expectations and I believe the company can perform well in the coming quarters as a result of its continuous focus on acquisitions in dynamic markets. Even BXP’s management has updated its guidance for the current quarter (Q3FY23) and full-year result, which represents an optimistic outlook for the company’s growth. According to the BXP’s Q3FY23 forecasts the company anticipates diluted EPS to be in the range of $0.63 to $0.65 and FFO per share to fluctuate from $1.83 to $1.85. The company’s optimistic Q3FY23 guidance has also led to optimistic full-year guidance. BXP has estimated FY2023 EPS in the range of $2.42 to $2.47 and FFO per share in the band of $7.24 to $7.29. I think the company’s guidance perfectly captures the effect of strategic acquisitions and growth plans which can potentially generate higher cash flows in the coming period.

Dividend Yield

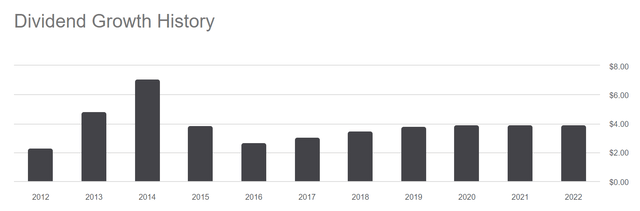

Dividend Payment History of BXP (Seeking Alpha)

The firm has a long and remarkable track record of dividend distributions, indicating its healthy market position. The company has been paying dividends for the last 25 consecutive years which suggests the safety and consistency of dividend payments. BXP distributed an annual dividend of $3.92 which represents a dividend yield of 5.84% compared to the current share price. In FY2023, it distributed a $0.98 dividend in each of the first two quarters.

I believe BXP can maintain its annual dividend of $3.92 which is a forward dividend yield of 5.84% compared to the current share price as the company has strong cash positions and growth prospects. The company’s updated guidance also justifies the forecast dividend payment of $3.92 per share. BXP’s forward dividend yield is 25.05% higher compared to the sector median dividend yield of 4.67%. This appealing dividend yield makes the firm an attractive option for risk-averse and retired investors seeking predictable regular income as well as capital appreciation.

What is the Main Risk Faced by BXP?

The company is highly exposed to the risk associated with refinancing. A significant rise in inflation levels has fueled the rise in the interest rates which has ultimately increased the cost of financing for the company. If the interest rates surge, it can negatively affect the company’s operations due to high finance costs and may generate comparatively lower cash flows which can also further affect its dividend payout by contracting its profit margins. The increased interest rates can also negatively impact the asset valuation which can further lead to a reduction in net income.

Valuation

The company is continuously focused on expansion and operates in a high barriers-to-entry market which reflects tremendous growth opportunities in the future. In addition, it is also focused on acquiring industry-leading clients which can help it to create a strong position in the market. After reporting the strong Q2FY23, the company has reiterated its full-year guidance which I believe justifies the stable demand and acquisition of industry-leading clients. According to the management, the company’s FFO per share might be in the range of $7.24 to $7.29. To keep my estimates conservative, I am taking an average guidance range that I think justifies the impact of the stable demand and acquisition of industry-leading clients. Therefore, I am estimating the FY2023’s FFO per share to be $7.265 which gives the forward P/E ratio of 9.21x.

After comparing the forward P/E ratio of 9.21x with the sector median of 12.89x, I think the company is undervalued. I believe the company might steadily grow in the coming quarters as a result of its recent opportunistic acquisitions which can help it gain momentum in coming years. However, rising interest rates can affect the financial performance of the company during adverse economic conditions and force BXP to trade below its sector median. Therefore, I estimate the company might trade at a P/E ratio of 11.5x in FY2023, giving the target price of $83.54, which is a 24.48% upside compared to the current share price of $67.11.

Conclusion

The company operates in dynamic markets which has helped it to sustain its growth despite the macroeconomic headwinds. This growth is also reflected in its strong quarterly results. I believe there are tremendous growth opportunities for the company as it is focused on acquiring properties in high barriers-to-entry markets which can help it to gain a competitive advantage and increase its profit margins. Further, this growth can also act as a primary catalyst to sustain its high dividend payout. BXP is an attractive stock for risk-averse investors due to its high dividend payout, which helps mitigate recessionary pressures. Based on the relative P/E valuation method, BXP appears undervalued, and there is potential for a 24% growth as a result of ongoing expansion activities. Considering these factors, I assign a buy rating to BXP.

Read the full article here