Summary

Following my coverage on Bowlero Corp. (NYSE:BOWL), I recommended a buy rating due to my expectation that BOWL can continue to grow for a very long time and consolidate market share in this fragmented industry due to its scale and strong balance sheet. This post is to provide an update on my thoughts on the business and stock. I continue to recommend a buy rating for BOWL as I remain positive about the growth potential. While recent comp sales performance is not the best, there are several tailwinds that suggest it should improve in the upcoming quarter. Lastly, I believe BOWL’s scale will continue to give it an advantage against smaller players, as evident from the lower cost of borrowing.

Investment thesis

Starting with the results that BOWL reported 3 weeks ago, 1Q24 sales were down ~1% year over year to $227 million, which is pretty much in line with the consensus estimate of $229 million. While overall comp sales were down 5.5% in 1Q24, note that comp sales growth was up 9% for events and 12% for leagues. BOWL also reported 1Q24 adj EBITDA of $52.1 million, in line with management’s internal estimates.

BOWL is performing just as expected, and while the comp sales seem weak on a y/y basis, I expect them to perform much better in the coming quarters. Management mentioned that same-store sales performance in October and early November is flattish, which is, by default, already at 550bps improvement sequentially. I believe the underlying driver is structural improvements to BOWL’s business model, which means that this comp sales improvement should last. Recall that BOWL went through a period (early 1Q24) of testing multiple sales strategies (adjusting pricing and attempting to push for more upsell opportunities). That experience has enabled management to figure out the optimal pricing for the midweek and weekend crowds. With that knowledge, BOWL made a strategic shift in mid-week pricing, which has resulted in a significant improvement in mid-week comp performance. The revision in pricing strategy yielded tremendous results, as comp sales on Mondays improved by 20 to 25 points and traffic acceleration, notably within walk-in retail (which went up by 10 points from 60% in 2Q23 to 70% in 1Q24). Aside from the organic improvement from the change in pricing strategy, comp sales also benefit from multiple tailwinds, which should drive acceleration:

- 2Q24 will see easy 2Q23 comps due to the Groupon deal and gift card offering last year.

- 2Q24’s Christmas will fall on a Monday this year, giving it an additional day of elevated traffic compared to last year.

- CY2023 winter will be warmer, which should be helpful for traffic.

- More corporate bookings.

As such, I believe comps sales will accelerate from here onwards.

The other key part of the growth equation, unit growth, remains very healthy as well. In 1Q24, BOWL opened 18 new centers, 17 from acquisitions (costing a total of $130 million) and 1 new build. Management plan is to continue investing heavily in the business, with $160 million allocated to acquisitions, $40 million to new builds, and $75 million to conversions. More importantly, management’s mentioned that the unit pipeline remains as strong as it has ever been, with more new builds executed in a year than ever before. This is a very strong statement by management and also suggests that unit expansion will largely rely on execution (i.e., building the units without hiccups).

I believe management comments have further reinforced my view that the growth runway remains very long. In the call, they mentioned that new builds are returning 45% cash-on-cash [COC] returns, acquisitions are returning 35–40% COC, and conversions are returning 25–30% COC. To put things into perspective, I believe it is as good as a stock going up 25 to 45% a year—very magnificent returns. The fact that the returns are still very attractive suggests to me that there is still plenty of room to expand in the industry (the market is implied to be saturated when there are no excess returns available, i.e., returns = cost of capital). On this point, I think BOWL has a leg-up against sub-scale players with regards to cost of capital, allowing them to be more aggressive in pursuing locations to expand. The recent financial transaction proves this point: the VICI sale-leaseback and partnership provide BOWL with additional financial capacity of ~$433 million in capital at an attractive rate of 7.3%, which is around 120bps lower than BOWL’s current 8.5% cost of borrowing. The typical sub-scale player will never be able to get such a deal because of their size.

“So we’re always going to look at opportunities to look for lower cost funding sources, like right now, we can hit sort of the debt markets for 8%, 8.5%, but if we can get something below that we will.” 4Q23 earnings results call

Lastly, as of 1Q24, BOWL has a net debt of around $1.25 billion, which translates to around 4x net debt to LTM EBITDA. Management is also being very vocal in their share buyback plans. Importantly, BOWL said that they will keep repurchasing its stock at these levels because they believe the stock is undervalued; they repurchased 12.1 million shares for $130 million during the quarter. While this is not the best indicator of a stock being undervalued, it is certainly good to know that the company is aggressively buying back its own shares.

And so the market we’re taking advantage of the market being so focused on the short-term comp, not being really focused on what these new builds, the M&A, the M&A synergies — and by the way, when we refill our SOB pipeline we just do it again. So, we’ll continue buying back our stock at these levels because we do feel like we’re dramatically undervalued. 1Q24 earnings results call

Valuation

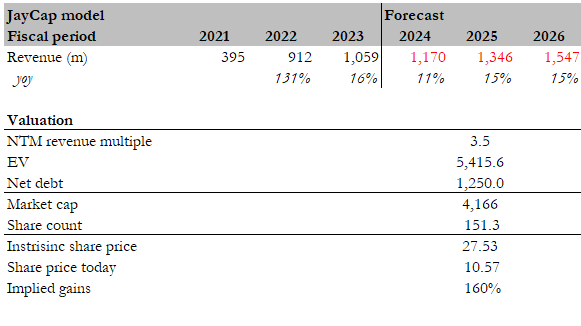

Own calculation

My target price for BOWL, based on my model, is $27.53. Updating my model based on management FY24 guidance, I expect FY24 revenue to grow by 11% as comp sales improve over the next few quarters after a weak 1Q24. As the business lapses the 1Q24 weakness, I expect FY25 and FY26 to revert back to the mid-teens growth that was seen in FY23. Reiterating a point from my previous post, I believe BOWL should continue to trade at a premium to other entertainment facility peers (Six Flags Entertainment, Cedar Fair, AMC Entertainment, Cinemark, and Live Nation Entertainment) that are trading at an average of ~2.2x forward revenue, as BOWL has a much better growth outlook (peers are expected to grow at an average of mid-single digit percentage).

Risk

BOWL’s growth trajectory relies on management’s ability to successfully grow units. This includes acquiring bowling centers, integrating their operators, constructing new bowling centers, and transforming them into more upscale entertainment centers. This comes with the possibility of the target’s potential being overestimated by management and could have a major effect on performance.

Conclusion

I reiterate my buy rating for BOWL. Despite the weak comparative sales, adjustments in pricing strategies have already displayed promising results. There are also several tailwinds that should also accelerate comp sales growth from 1Q24. Notably, BOWL advantageous cost of capital enhances its competitive edge over smaller players.

Read the full article here