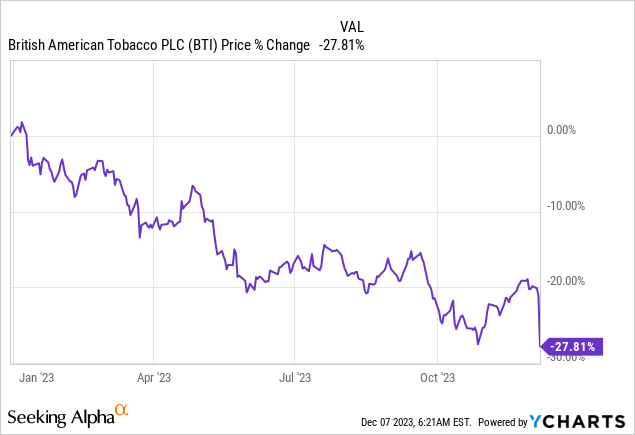

Shares of cigarette maker British American Tobacco (NYSE:BTI) got whacked yesterday after the company said that it would write down the value of its U.S. cigarette brands by approximately $31B due to challenges in the U.S. combustible market. The announcement caused the company’s ADR price to drop 9% which I believe is a buying opportunity. The decline in British American Tobacco’s share price is likely exaggerated, in my opinion, as the tobacco company confirmed that its EPS growth target is not affected. I don’t see the dividend being at risk after the impairment announcement and I believe the drop constitutes an attractive buying opportunity for dividend investors looking for an entry into a 6X P/E value stock!

Previous rating

I recommended shares of British American Tobacco in the third quarter because the company’s vape products, marketed under the Vuse brand name, are performing very well and seeing considerable revenue and gross margin momentum. Yesterday, shares of British American Tobacco came under significant selling pressure as the market overreacted to a trading update that laid out the company’s plans to write down the value of its U.S. cigarette brand holdings. Since the dividend should not be at risk, I am aggressively accumulating BTI’s shares.

British American Tobacco takes $31B impairment, EPS guidance and dividend are unaffected

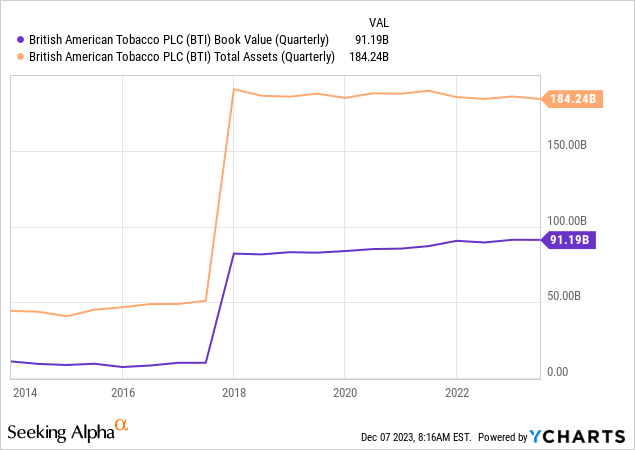

British American Tobacco disclosed in a new filing with the stock exchange that, given continual pressure on the U.S. combustible market, the firm has decided to write down the value of its cigarette brand holdings by £25B which comes out to about $31B. The write-downs relate to U.S. cigarette brands like Camel, Lucky Strike, Newport, and others which British American Tobacco added to its portfolio through the $49B acquisition of Reynolds American in 2017.

The transaction boosted BTI’s equity and asset values at the time. Currently, British American Tobacco’s book value exceeds $91B which will be significantly reduced (by the above stated amount) once the impairment charge has been taken. From a risk perspective, additional write-downs are likely and BTI may ultimately seek strategic actions for its remaining U.S. cigarette brand portfolio.

British American Tobacco’s impairment charge relating to its U.S. cigarette brands is the first time that a major tobacco company is lowering the value of its core tobacco investments in the combustible market, indicating that management sees continual headwinds for the traditional cigarette market. Headwinds, which have been well-discussed in the past, include a declining share of smokers which is negatively impacting industry cigarette volumes, but also increasing regulation that is making it more difficult for tobacco companies to grow their top lines.

In fact, almost all of the top line growth that companies like British American Tobacco or Altria (MO) are seeing relates to growth in non-traditional product categories like vape products, heated tobacco sticks, or nicotine pouches. British American Tobacco also said yesterday that given the headwinds in the U.S. combustible market, it will seek to generate 50% of its revenues by 2035 from non-traditional tobacco products.

The takeaway from British American Tobacco’s filing is three-fold: 1) The long-term values of U.S. cigarette brands are impaired and it is likely that other tobacco companies will follow suit and also write down the value of their cigarette brands, 2) BTI may accelerate its transition to non-traditional product categories and choose to sell off its remaining U.S. cigarette brands, and 3) The impairment charge is not going to impact British American Tobacco’s earnings growth guidance. The tobacco firm continues to expect mid-single figure adjusted diluted EPS growth in FY 2023 (in constant currency terms).

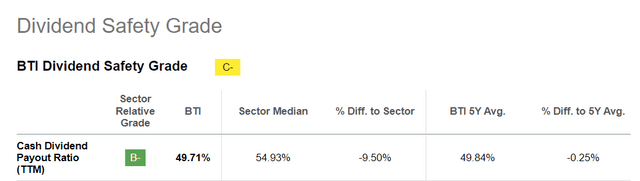

Since BTI pays out less than 50% of its earnings, I believe the dividend (and the 10% yield) will not be affected by the impairment announcement. For comparison, Altria had a cash dividend payout ratio of 79% in the last year.

Seeking Alpha

Buy the panic: get a 10% yield + a 6X P/E value stock

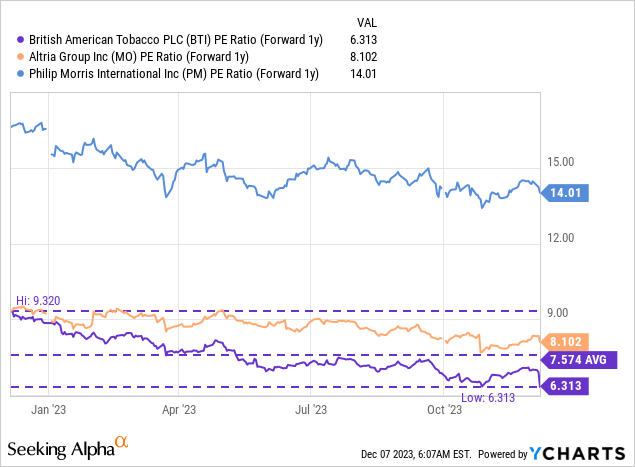

Since British American Tobacco’s ADR price crashed 9% yesterday, dividend investors are confronted with a unique investment opportunity as they can capitalize on yesterday’s exaggerated sell-off. Shares of British American Tobacco are priced at 6.3X FY 2024 earnings and, therefore, trade at a massive 16% earnings yield. BTI now also trades 17% below its 1-year average P/E ratio and 22% below Altria’s P/E ratio.

Because the impairment is a non-cash accounting event that won’t affect BTI’s actual earnings or cash flow, the drop in pricing is a good opportunity to buy the panic aggressively, in my opinion. I believe British American Tobacco could reasonably be valued at 8-9X forward earnings considering that the tobacco firm supports its dividend with earnings. An 8-9X P/E ratio implies 35 upside revaluation potential and, on a mid-point basis, a more moderate earnings yield of 12%.

Risks with British American Tobacco

British American Tobacco’s regulatory filing showed that the company continues to expect growing pressure on its U.S. combustible business as less people smoke and the U.S. government seeks to lower the nicotine levels in cigarettes and may move to outlaw menthol cigarettes in 2024 altogether. As a result, additional impairment charges from British American Tobacco and other tobacco companies may follow.

Final thoughts

Investors are likely overreacting to British American Tobacco’s announcement yesterday as the FY 2023 EPS growth projection and the ability to pay the dividend are not affected. British American Tobacco is well-positioned in the vapour market, which I previously indicated, and is seeing strong growth momentum in this market. In my opinion, dividend investors have a unique opportunity here to take advantage of the sell-off and add BTI to their portfolios. Since British American Tobacco also trades at an irresistible 6X P/E ratio (16% earnings yield), I am buying the panic and am accumulating shares aggressively!

Read the full article here