Broadcom (NASDAQ:AVGO) jumped around 10% on Monday based on news that Citi was resuming coverage on the stock with a Buy rating. I will explain some of the reasons why it is a good time to cash in.

Citi sees core business strength and VMware synergies

The latest jump in Broadcom’s shares took the chipmaker over the $1,000 mark. Citi’s analysis has limited upside with a target price of $1,100.

The bank’s analysts said the company reported strong fourth-quarter results, driven by AI revenues, which are “expected to double from $4.0 billion in FY23 to more than $8.0B in FY24.”

Adjusted earnings of $11.06 per share on $9.3 billion, were higher than expectations of $10.96 per share on $9.28 billion in revenue. The company’s semiconductor solutions revenue came in at $7.3 billion, up 3% year-over-year.

Citi analysts saw the company benefiting from AI infrastructure sales, which would offset the slowdown in semiconductors. Broadcom recently closed its huge $69 billion acquisition of VMware, which Citi believes can add 34% to the full-year 2025 EPS.

“We believe Broadcom should eventually achieve gross margins of 78% and operating margins of 58% for peak EPS of $60.00,” Citi analysts added.

Little upside value in holding Broadcom here

The analysis from Citi implies a 5.77% upside to its price target, assuming the company ticks all the boxes mentioned by the investment bank.

I would see that leap across $1,000 as a perfect chance to cash out on a strong run. History has shown us that blockbuster M&A deals are not always an easy transition. Broadcom is also paying for the design aspect of chips at a time when artificial intelligence demand is only in its infancy.

The valuation metrics tell a similar story for Broadcom’s current price. According to Seeking Alpha data, the current price/earnings ratio is already 32.4% above the company’s five-year average. Meanwhile, revenue growth at the firm has been 12.44% on average over the same period.

The current stock valuation is being driven by forward revenue growth of 18.4% which is 80% higher than the five-year average, but the price/sales ratio is already up 55% over its standard five-year performance.

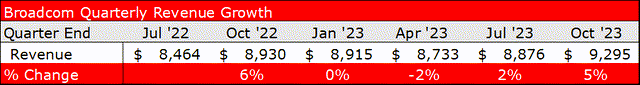

Broadcom Revenue Growth (Seeking Alpha, Author)

Too many unknowns for a fully-priced stock

With a meaty valuation already afforded to Broadcom, it would be wise to avoid a company with so many unknowns ahead.

The first issue is the trade war between the U.S. and China over chip technology. Beijing approved the deal for VMware, but that doesn’t mean that it is surrendering its previous stance on critical chip technology.

The second issue is Broadcom’s leveraged exposure to Apple (AAPL) and China. The chip and software maker is reported to have 20% exposure to Apple and 36% exposure to the Chinese economy.

Apple was seen giving and taking in its relationship with Broadcom this year as it announced a multi-year, multi-billion dollar deal for 5G components. However, that followed news in January that Apple was building its own version of the Wi-Fi and Bluetooth chips it buys from Broadcom starting in 2025. Agreements for the technology were estimated to generate around $15B in sales for Broadcom.

Apple is one of many tech giants now building their own chips in-house and it highlights a headwind for chipmakers that are being valued for an AI boom. There is also demand risk at Apple after a reported iPhone ban for government workers in China, while the Chinese economy is now grappling with deflation.

Gita Gopinath, the IMF’s deputy managing director, said last week that the continued trade wars, especially between the U.S. and China, risked wiping out 2.5% to 7% of global GDP.

“While there are no signs of broad-based retreat from globalization, fault lines are emerging as geoeconomic fragmentation is increasingly a reality,” she said. “If fragmentation deepens, we could find ourselves in a new Cold War.”

China-U.S. tensions have been unsteady over the last year with Taiwan, a big player in the world of semiconductors, a big part of the tensions. The country will hold elections next month which could have a bearing on Chinese relations.

The semiconductor sector has also seen some meme-like status recently with Bloomberg reporting on Korean retail traders’ love of leveraged Exchange Traded Funds with exposure to chipmakers.

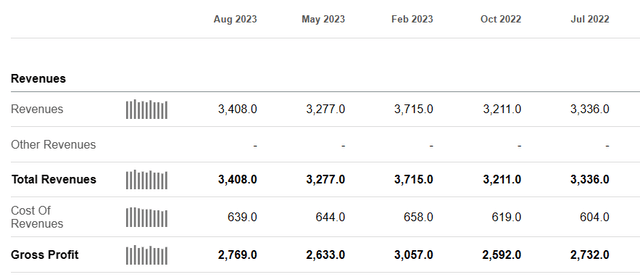

Digging deeper into the VMware picture, we can see a similar trend in revenue with sluggish gains in recent quarters. Although the company does benefit from high-profit margins and is now a feeder design company for Broadcom’s brand.

VMware Quarterly Revenue (Seeking Alpha, Author)

Conclusion

With many corporations considering a move to artificial intelligence products, Broadcom is expected to see its revenue in the sector double by 2025. This has the potential to be a driver of Broadcom’s stock price over the next year if the company sees a faster uptake, or delivers an important new product.

But with the current valuation, I feel that the risks are to the downside and investors should consider selling the stock. Broadcom has done well on its profit margins over the last five years, while its forward earnings are stretched higher against the five-year sales performance. I believe that analysts are placing too much weight on the core business, growth pricing is based on some AI hype, and ignoring larger headwinds that can be a headwind for its current price metrics.

Read the full article here