The Broadcom Investment Thesis

Broadcom Investor Presentation

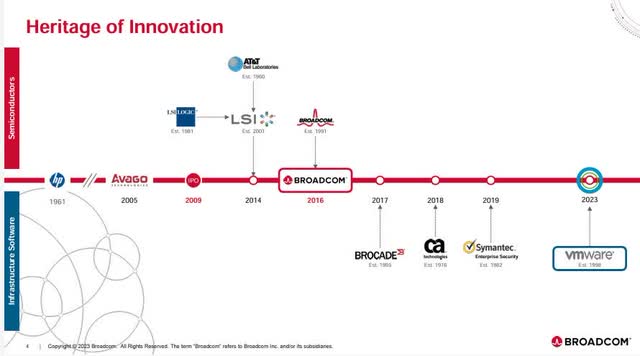

After Broadcom Inc. (NASDAQ:AVGO) benefited from the market environment in 2023, 2024 will be the year of transformation for the company. With the acquisition of VMware (VMW) finally approved, a new era begins. Prior to 2024, sales were 79% semiconductor or hardware and only 21% software, but with the new acquisition, the projection for 2024 is that software will be 40%. And that is the turning point.

Prior to the VMware deal, the top 5 end customers accounted for 35% of net revenues and WT Microelectronics alone accounted for 20% of net revenues. Therefore, the deal minimized the risk of this constellation. Especially since Apple has plans to build its own chips and could disappear as a customer in the future. While they still have a long-term contract with Broadcom, things can change quickly in this industry, and with the new revenue from VMware, Broadcom is no longer as dependent on the top 5 customers.

VMware, with its mission-critical cloud software that is the foundation for many applications, seems to have good synergies with Broadcom’s portfolio. It also helps Broadcom in the generative AI market because

NVIDIA (NVDA) and VMware are working together through VMware’s Private AI Cloud, which works with NVIDIA’s CUDA software solution. And CUDA is currently NVIDIA’s competitive advantage over AMD (AMD). But AMD and several other players are trying to attack NVIDIA’s moat because they want to have open source software as a standard that uses Ethernet. And even in that case, Broadcom would benefit because they have a large Ethernet offering and deep expertise. So Broadcom has positioned itself well no matter who wins the race.

Since I find AMD very interesting and think that they can steal market share from NVIDIA, you can read my latest article about them here if you are interested in the battle between the two giants in the GPU market.

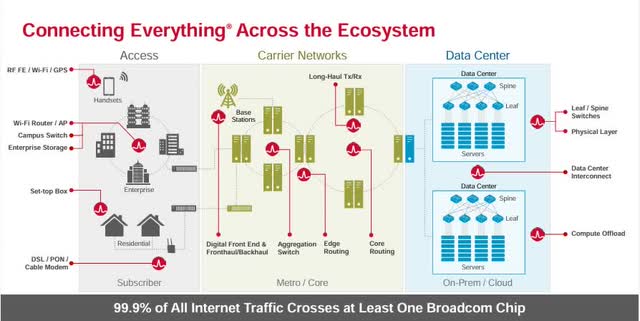

Broadcom Investor Presentation

Broadcom, which went from being a hardware company to a semiconductor company and is now transitioning to being half software and half semiconductor/hardware, has a large portfolio of many small electronic parts that we use every day without even realizing it. Just the fact that 99.9% of all Internet traffic passes through at least one broadband chip is crazy when you think about it. That sounds like a big moat to me.

Broadcom has built a strong ecosystem and deep industry expertise. The combination of storage, Ethernet, PCIe, and Fiber Channel means that many customers are dependent on Broadcom. Broadcom is the market leader in Wi-Fi, with nearly 80% of the infrastructure relying on Broadcom, 1 billion Broadcom DSL connections installed worldwide, and Broadcom server storage is used by a very large portion of enterprise server customers.

And thanks to high reliability, which is very important for mission-critical tasks, low latency, and high power efficiency in the desired areas, Broadcom is very popular with its customers. And the focus on software and especially data centers should pay off in the coming years.

Broadcom’s Metrics and Balance Sheet

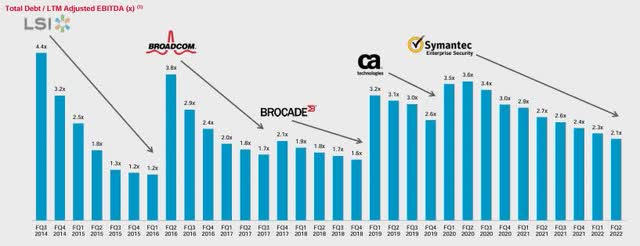

Broadcom Investor Presentation

The most significant change is the increase in net debt from $25 billion to $70 billion to $80 billion as a result of the VMware deal. But as we can see in the picture above, this is part of Broadcom’s strategy. They buy strong companies with debt, then improve their margins, and then deleverage the balance sheet. And historically they have been very successful with this strategy.

And for me personally, the current level of debt is higher than I would like. I usually prefer companies that have no more than 4 times net income as net debt. However, since Broadcast’s net income was only $14 billion in its last report, this is not the case. But we have to adjust the net income for the income that VMware will generate in 2024, and if we add that in, the net income could be over $20 billion, which would make the debt situation more comfortable.

In addition, Broadcom has plans to divest Carbon Black and EVC, and depending on how that goes, that could generate revenue. And FCF is also very strong at $17 billion. And if we adjust that for SBC, which is $2.7 billion, we get an SBC-adjusted FCF of about $15.3 billion. That should be enough to satisfy shareholders, buy growth, and ease the balance sheet.

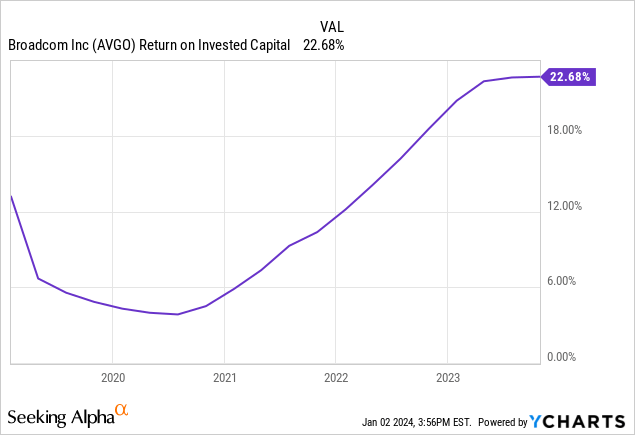

ROIC And Capital Allocation

Broadcom has done a fantastic job in terms of ROIC over the last couple of years. They have taken it from the low single digits to 22%. And if we look at Broadcom’s WACC, which I calculate to be about 9% based on a 4.5% cost of debt and a 9% cost of equity, we get a ROIC-WACC spread of 13%. A very strong number. Broadcom is clearly creating value through its M&A activity and also through organic growth. But maybe the ROIC will be a little bit lower now for the first year or two after the VMware acquisition, and then hopefully it will go back up.

Broadcom Investor Presentation

With a large portion of FCF devoted to dividends and their phenomenal growth, shareholders have been handsomely rewarded. In addition, Broadcom has repurchased a lot of stock, further demonstrating that Broadcom’s management is very shareholder-friendly.

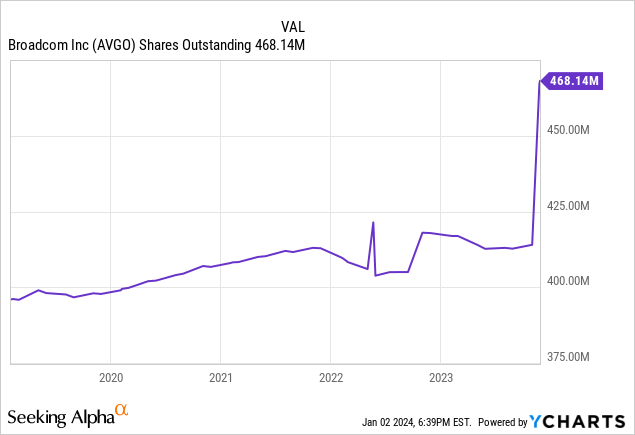

Unfortunately, the buybacks were more to offset the dilution from SBC than to significantly reduce the share count. Still, Broadcom has been able to grow EPS and create shareholder value, even though the share count has increased since 2019. Their capital allocation in the form of M&A has simply been outstanding. Hock Tan’s playbook of buying companies, cutting costs, and making them more profitable has been successful in recent years, but synergies are often overestimated and M&A is a tough playing field. But his track record is extraordinary when it comes to the success rate of his acquisitions. A clear case of exceptional management where most would fail.

However, it will be interesting to see how the large increase in shares outstanding from the VMware deal will affect EPS.

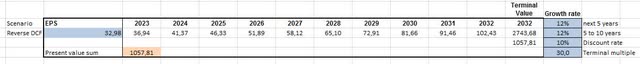

Broadcom’s Reverse DCF

Author

An excellent tool for determining whether a company is fairly valued is a reverse DCF. This involves looking at what is included in the stock price. And if we take the TTM diluted EPS of $32.98, we see that the stock is currently pricing in a 12% EPS growth rate over the next 10 years. But the historical EPS CAGR over the last 10 years is a whopping 31.15%. Well above the required target.

I do not think that Broadcom will achieve the same rate in the next 10 years, but I can definitely see them achieving a CAGR between 15% and 20% if the VMware integration goes well. This would make the shares look somewhat undervalued in this context.

What could EPS look like in 5 years?

Seeking Alpha Earnings Tab

EPS estimates also see a 16% CAGR over the next 5 years through October 2028, further fueling the positive outlook. If EPS is $80 to $85 in 5 years, the stock could trade over $2000 depending on the multiple. I don’t think Broadcom has that much room for multiple expansion, but even a 25x multiple would give the stock almost 100% upside.

Risks

The risks of Apple producing its chips in the future have been discussed, but I think the two biggest risks are definitely TSMC (TSM) and the M&A activities. TSMC produces 90% of Broadcom’s wafers and also produces for almost every competitor. This gives it unparalleled market power and pricing leverage. Broadcom needs TSMC’s products, and TSMC can almost dictate prices because no other company can currently deliver the same level of quality. The advantage in terms of know-how is simply very large at the moment.

The second risk is that Broadcom is a serial acquirer and will likely need new M&A targets to fuel growth as VMware ages. VMware has brought in significant recurring revenue, but what is the impact of this really big software acquisition? And will there be enough attractive targets left that won’t be blocked by antitrust regulators?

And Hock Tan’s age, 72, is a risk because he is responsible for much of the success. Will the success story continue when he retires? A difficult question to answer.

Conclusion

All in all, the stock looks undervalued from a long-term perspective. Over the next 5 to 10 years, the VMware deal and data center focus should drive strong earnings growth. And given the company’s shareholder-friendly management, the dividend should continue to grow strongly to reward shareholders. Even if the multiple comes down a bit, earnings growth and dividend increases should be enough to support returns.

But it is important to remember that this is the largest and most transformative acquisition in Broadcom’s history. And just because everything worked so well in the past does not mean it will work as well in the future.

Read the full article here