Brown-Forman Corporation (NYSE:BF.B) produces and sells strong alcoholic drinks. The company has well-known brands such as Jack Daniel’s, Herradura, Woodford Reserve, Fords Gin, and Sonoma-Cutrer. Brown-Forman has been able to stably grow revenues throughout the company’s history through the well-managed brands and very select acquisitions, such as the acquisition of the Diplomatico Rum brand in late 2022.

As revenues have grown, Brown-Forman’s stock has done the same – in the past ten years, the stock has appreciated at a fair CAGR of 7.1%, on top of which Brown-Forman pays out a dividend with a current yield of 1.48%.

Ten Year Stock Chart (Seeking Alpha)

Stable Financials

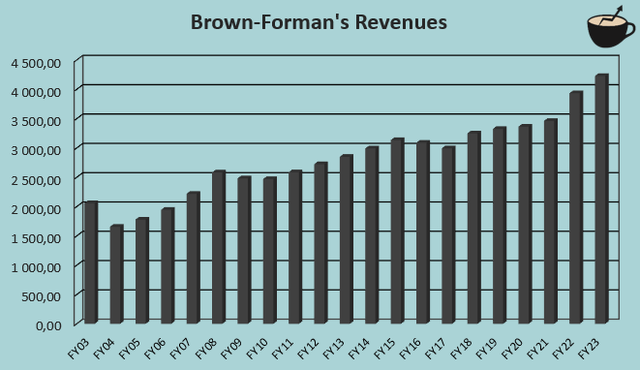

As told, Brown-Forman has been able to grow revenues modestly in a stable manner. From FY2003 to FY2023, the company has achieved a compounded annual growth rate of 3.7%, with a clear acceleration in FY2022 and forward as inflation has soared:

Author’s Calculation Using TIKR Data

For FY2024, Brown-Forman is guiding for a growth of 5% to 7%, as told in the company’s Q1/FY2024 presentation. I believe that a part of the higher growth in FY2022 to expected FY2024 figures is mainly a result of higher pricing due to inflation instead of higher volumes – the volume growth should mostly be in line with the historical modest figure. The company has some growing product verticals, but overall, the brands seem mostly like stable performers in the markets that they serve.

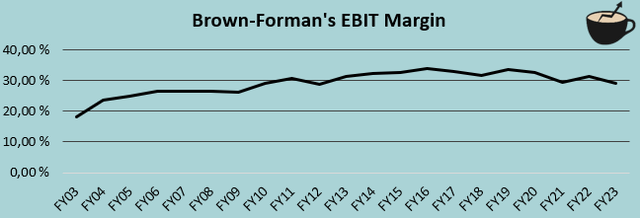

Brown-Forman has been able to keep up a very healthy and stable EBIT margin level – from FY2003 to FY2023, the average margin has been 29.2%:

Author’s Calculation Using TIKR Data

Currently, the trailing margin stands at 28.4%, near the historical average, despite high inflation and many discretionary consumer products facing demand issues. In Q1/FY2024, the EBIT margin fell slightly year-over-year, though, as marketing expenses increased widely due to the collaboration launch with Coca-Cola. I would expect that the margin will rise back, as the marketing initiatives start to contribute more to revenues over time. Brown-Forman also guides for an operating income growth of 6% to 8% for FY2024, slightly higher than the revenue growth, signalling very slight margin expansion.

Growth in Selected Products

Despite a mostly flat Q1, Brown-Forman did have products with high growth. Most notably, Jack Daniel’s new Tennessee Apple whiskey, El Jimador, and ready-to-drink mixed drinks grew well year-over-year. The El Jimador’s growth attributed to an attractive 12% organic year-over-year growth in the tequila segment. On the other hand, the Tennessee Apple growth partly eats away from other Jack Daniel’s products – the Jack Daniel’s brands’ revenues only grew by 2% year-over-year.

The ready-to-drink category grew by 5% as a result of an interesting collaboration between Coca-Cola and the Jack Daniel’s brand – the two companies have together launched a mix of Coca-Cola and the Jack Daniel’s whiskey in a can. Currently, the product is expected to expand into 30 markets before the end of calendar year 2024 from a current figure of 11, as told in Brown-Forman’s Q1/FY2024 earnings call. I expect that the collaboration should contribute into growth in the future, as the product is being expanded into new markets and Brown-Forman has extensively marketed the launch in the latest quarter, largely contributing to the year-over-year marketing expense increase of 19 percent.

Valuation – Something Isn’t Right

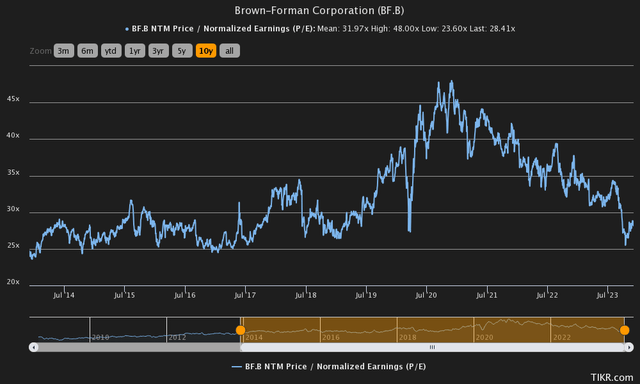

Brown-Forman’s valuation seems very excessive – despite working on a low-ESG industry, the company trades at a forward P/E multiple of 28.4, slightly lower than the very high ten-year average of 32.0:

Historical Forward P/E (TIKR)

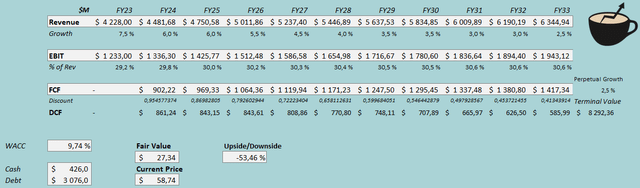

The valuation seems to price in too much. To further illustrate the expensive valuation, I constructed a discounted cash flow model in my usual manner. In the model, I estimate Brown-Forman to grow by 6%, the middle point of the company’s current guidance, in FY2024. For FY2025, I estimate the same growth as the Coca-Cola collaboration should fuel growth. Afterwards, I estimate the growth to come down in steps into a perpetual growth rate of 2.5%. Altogether, the DCF model’s revenue estimates represent a revenue CAGR of 4.1% from FY2023 to FY2033, slightly higher than Brown-Forman’s 3.7% CAGR from FY2003 to FY2023.

I also estimate the margins to have some leverage – I estimate Brown-Forman’s EBIT margin to reach 30.6% eventually, 1.4 percentage points above the achieved FY2023 level. The estimated margin expansion is very slight, and represents some improvement as cost inflation slows down, and the recent marketing costs realize fully to higher sales. Brown-Forman’s cash flow conversion is fairly good, although the company does seem to have a large amount of capital expenditures to fuel future growth.

With these estimates and a cost of capital of 9.74%, the DCF model estimates Brown-Forman’s fair value at $27.34, around 53% below the stock price at the time of writing. The stock doesn’t seem to be priced for fair financial assumptions at all, making the risk-to-reward very poor in my opinion, despite the company having some growth catalysts in new products.

DCF Model (Author’s Calculation)

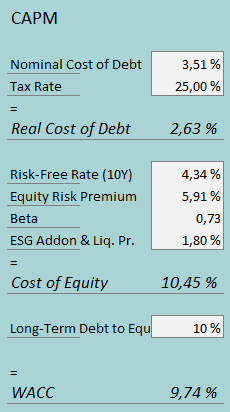

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1/FY2024, Brown-Forman had $27 million in interest expenses. With the company’s current amount of interest-bearing debt, Brown-Forman’s annualized interest rate comes up to a low figure of 3.51%. Brown-Forman leverages debt quite moderately despite the stable earnings; I estimate the company’s long-term debt-to-equity ratio to be 10%.

For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.34%. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the United States, made in July. Yahoo Finance estimates Brown-Forman’s beta at a figure of 0.73. Finally, I add a small liquidity premium of 0.3% and an ESG add-on of 1.5%, crafting a cost of equity of 10.45% and a WACC of 9.74%.

Peer Comparison Doesn’t Save the Valuation

As alcohol consumption stays very stable even in turbulent economies, the high valuation could potentially be a result of perceived low-risk operations. When looking at other operators’ valuations in the industry, this notion doesn’t seem supported, though – compared to Brown-Forman’s forward P/E of 28.4, Constellation Brands has a forward P/E of 20.2, MGP Ingredients a P/E of 15.3, Diageo a P/E of 17.5, and the Duckhorn Portfolio a P/E of 15.1 – compared to the average of these competitors, Brown-Forman trades at a premium of 67%. Other similar companies seem to be priced way more appetisingly.

Takeaway

Brown-Forman has had a stable financial performance, and continues to have one. Despite financial stability, the valuation seems highly unsustainable as markets seem to have troubles in pricing in fair assumptions – the DCF model downside of 53% is very significant for a company with such stable financials. Even when not including the ESG-addon and liquidity premium in the CAPM, the stock would have a downside of 37% according to the DCF model. Despite a good launch of the collaboration drink with Coca-Cola, I see the stock’s current risk-to-reward as very poor – until the stock price falls significantly, I believe a sell rating is constituted.

Read the full article here