BT Group plc (OTCPK:BTGOF) is really much in the same boat as other major country Telcos, which is that they have to roll out a lot of fiber through their Openreach subsidiary. We think the latent CAPEX burden is going to be massive, probably around 15 billion GBP, based on our rule of thumb calculations from the sector. This makes it hard to pay their dividend, and their net debt continues to grow. Their FCF will be under pressure for years. This is a burdened company that will unlikely demonstrate a vigorous performance.

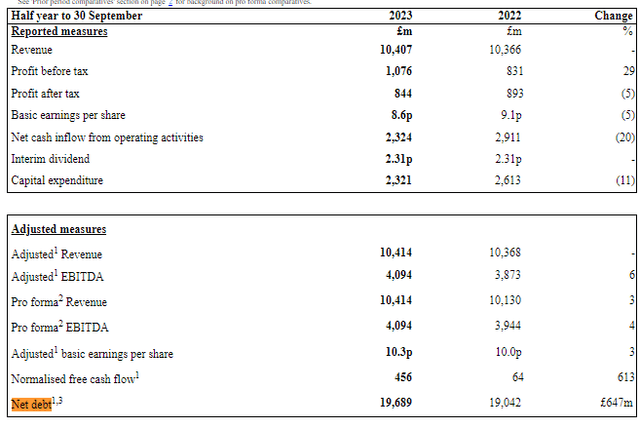

Debt

The net debt continues to grow, now 19.8 billion GBP, with an underfunded pension scheme with a shortfall of around 3.7 billion GBP. This puts EV above 35 billion GBP. Its EV/EBITDA multiple is quite compressed at around 4x, but this is on account of large burdens of CAPEX faced by the company in the coming years for its rollout. This is not unique to BT. Many companies are dealing with this and suffer in terms of valuation. Proximus (OTCPK:BGAOF) is also burdened and features a similar 3.45x EV/EBITDA. Swisscom is less burdened, and would you look at that: 7.3x EV/EBITDA for Swisscom on screeners which excludes that CAPEX burden.

Burden

What’s BT’s burden?

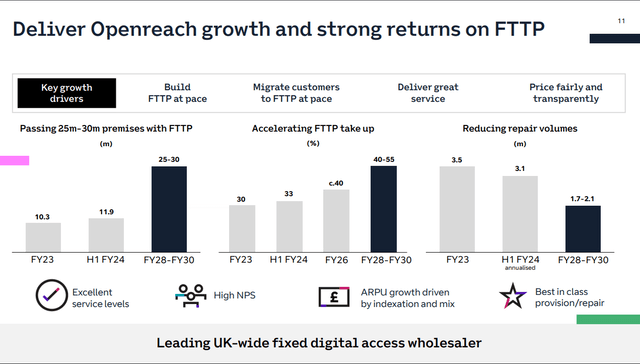

Fiber Plans (H1 2023 Pres)

They are targeting another 15-20 million households in the UK with FTTP. The rule of thumb is 100 million EUR, or 86.7 million GBP per 100k households. Midpointing targets, that would mean around 15 billion GBP latent CAPEX burden for the rollout up to the FY 2029 midpoint targets.

When you add that to EV, things start lining up. A 6.2x EV/EBITDA after that CAPEX burden.

Bottom Line

A 6.2x EV/EBITDA is actually not too high considering all outstanding CAPEX and various other obligations – just comparing it to Swisscom which is less burdened thanks to a smaller population, but it’s lower than other companies whose rollouts are more complete in their respective markets. In principle, there could be a valuation case on that basis. But in our experience, no one will take a hopeful look at this stock for another couple of years. What doesn’t help is that FCFs are extremely low, leaving little for the dividend, hence the growing net debt. For H1 2023, the operating cash flows were eclipsed by the CAPEX. The industry isn’t booming either, being highly regulated to allow intense competition as a critical public good. Revenue is barely up despite inflation, and operating leverage is limited by inflation as well, with EBITDA only up around 3% or so.

Snapshot of OPCF (H1 2023 PR)

It would be a disaster for the stock price if anything happened to the dividend. Management probably knows that, but still.

The bottom line is that there are dozens of excellent investments in growing, completely unhindered businesses at lower valuations than this with none of the complexity in better financial markets, specifically in Japan. Going for one of the least obscure European telcos is not a move we’d probably ever make, and certainly not now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here