Company Website

Blackstone Secured Lending Fund (NYSE:BXSL), managed by Blackstone Credit BDC Advisors LLC, stands as a key player in the Business Development Company (BDC) sector. This report delves into BXSL’s investment strategy, portfolio composition, financial performance based on the latest Q3 2023 Earnings Report, and comparative analysis with industry standards, notably Ares Capital (ARCC).

Investment Philosophy and Strategy

BXSL aims to generate both income and capital appreciation, primarily through investments in first-lien senior secured loans. This conservative approach targets secure debt positions, focusing on larger-scale businesses in historically low-default sectors.

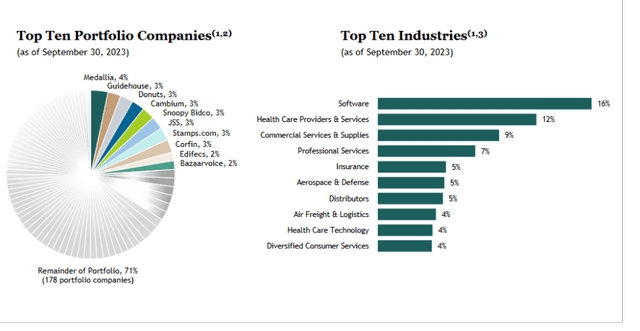

Portfolio Composition and Industry Diversification

As of Q3 2023, BXSL’s portfolio value was approximately $9.5 billion. The portfolio is heavily skewed toward first-lien senior secured loans, comprising 98.4% of investments. This signifies a strong preference for secured debt, mirroring strategies seen in other BDCs like ARCC.

Financial Performance Analysis (Q3 2023)

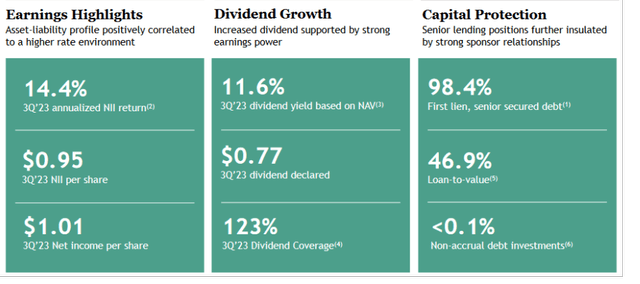

BXSL Q3 Earnings Report Snapshot (Investor Presentation)

Net Investment Income and Net Income

BXSL reported significant growth with a net investment income of $161 million ($0.95 per share), a 19% year-over-year increase. The net income stood at $171 million ($1.01 per share), marking a substantial 74% rise from Q3 2022.

Portfolio Yield

The portfolio yield for Q3, 2023 is 11.6% based on net asset value, NAV compared to 9.7% for ARCC.

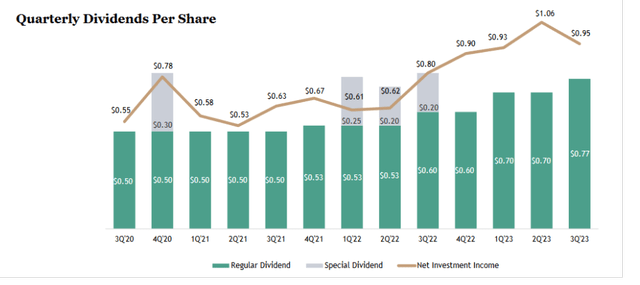

BXSL Dividend Trend (Investor Presentation)

NAV/Share Trend

BXSL’s NAV per share growth is indicative of the fund’s asset appreciation and effective portfolio management. The trend remains a critical marker of long-term shareholder value.

Non-Accruing Loan Ratio

The fund’s non-accruing loan ratio, at less than 0.1%, indicates a robust credit quality and effective risk management, favorably compared to ARCC’s 1.5%.

Dividend Declaration and Coverage

BXSL declared a Q4 2023 dividend of $0.77 per share. The dividend coverage ratio of 123% in Q3 2023 demonstrates the fund’s strong ability to sustain its dividend payments.

Leverage and Liquidity

The fund’s leverage ratio was 1.08x, reflecting a continued de-leveraging strategy. With $1.5 billion in cash and undrawn debt facilities, BXSL maintains a strong liquidity position, crucial for future investments and operational flexibility.

Investment Activity

New investment commitments in the quarter totaled $656 million, with net funded investment activity of $185 million, showcasing active portfolio management and strategic investment approach.

Comparative Analysis with Ares Capital

ARCC’s diversified portfolio and middle-market focus offer a comparative perspective to BXSL’s strategy. Both BDCs emphasize senior secured lending, yet BXSL’s management under Blackstone provides distinctive advantages, leveraging global expertise and resources.

Dividend Analysis

BXSL’s competitive dividend yield of 11.28% and a coverage ratio of 123% highlight its commitment to shareholder returns, supported by operational efficiency and stable earnings.

BXSL Portfolio (Investor Presentation)

Risk Assessment

BXSL, like all BDCs, faces risks including interest rate fluctuations, credit risks in private company investments, market volatility, and potential fee conflicts. These risks necessitate continuous monitoring and strategic adjustments.

Conclusion and Recommendations

BXSL showcases a balanced blend of conservative investment strategy, robust financial performance, and strong shareholder returns. The latest earnings report underscores the fund’s effective management and potential for continued growth. However, investors should consider the inherent risks associated with BDC investments and align them with personal investment goals.

Read the full article here