We continue to be buy-rated on Cadence Design Systems, Inc. (NASDAQ:CDNS); the stock outperformed the S&P 500 by 26% since our initial buy-rating note. Our positive outlook on the stock is based on our belief that the company will experience top-line growth driven by increased demand for chip design post-AI boom. CDNS operates in the Electronic Design Automation (‘EDA’) business and hence is positioned to outperform due to two main factors. The first is the company’s higher resilience relative to the semi peer group; the EDA space is more resilient to semiconductor slowdowns and corrections in spite of its cyclical nature. This is due to the strategic nature of spending in chip design; last year, despite the semi-correction cycle, CDNS was raising FY23 outlook and beating guidance because of increased design activity. The second factor is CDNS’s unique position due to its exposure to the EDA market through services for chip design in ML/AI, computing, auto, 5G communication, and IoT markets. We think the company is now better positioned to grow its top line as the semi corrections are almost complete, in our opinion, with auto and industrial being the last. We expect capex spending to reaccelerate, particularly in chip design, as the industry transitions to more advanced nodes. We expect CDNS to continue to outperform in 1H24.

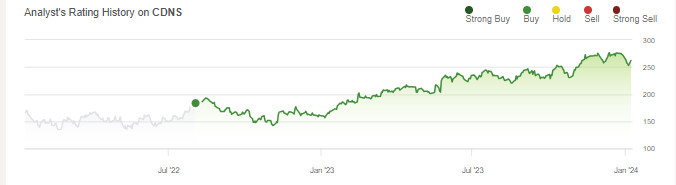

The following outlines our rating history on CDNS.

Seeking Alpha

We also think CDNS’ product mix across a wide range of markets makes it better positioned to experience double-digit growth; we expect this sentiment to be reflected in management’s FY24 guidance that should be announced next quarter. We already saw this positive outlook on last quarter’s earnings call when CDNS exceeded its Q3 guidance and raised the FY23 outlook, noting the “updated outlook for fiscal 2023 is, revenue in the range of $4.06B to $4.1B from the previous outlook of $4.05 billion to $4.09B” which management also raised a quarter prior.

We think CDNS is not immune to macro weakness, but we think it’ll be more resilient than the semi peer group and expect the stock to continue outperforming the SOX index and S&P 500 in 2024. We think CDNS may see some near-term challenges due to the tough macro backdrop that could weigh on the spending rebound more than expected and cause customers to be more cautious about capex spend. We’re not too worried about CDNS deal cycles being weighed down by macro headwinds as we think macro weakness will be offset by higher demand for AI and compute related design. Additionally, we expect the Biden administration’s export ban on advanced tech to China will have minimal impact on CNDS; management also touched on this, noting, “We are so diversified geographically, and in terms of customers, that’s not a significant impact either. And all our guidance that we gave includes the impact of all these regulations that were announced recently.” We’re also constructive on management’s plans to acquire Invecas Inc, a provider of design engineering, embedded software, and system-level solutions, as we think it’ll help strengthen CDNS’s position to leverage the increased design activity in accelerating trends, such as digital transformations. We see a favorable risk-reward profile for the stock in 2024 and recommend investors explore entry points at current levels.

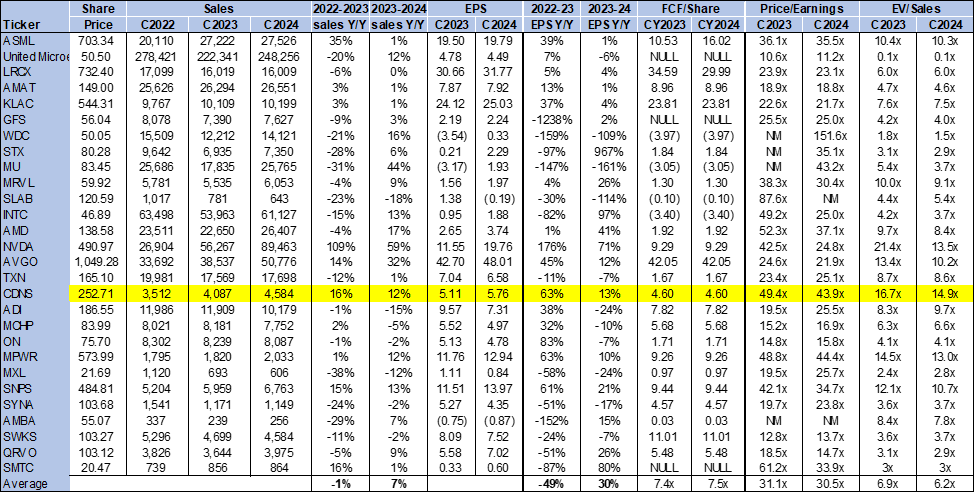

Valuation

The stock is expensive, particularly on the EV/Sales metric, which we use as the main metric to value CDNS. The stock is trading at 14.9x EV/C2024 Sales versus the peer group average of 6.2x. On a P/E basis, the stock is trading at 43.9x C2024 EPS $5.76 compared to the peer group average of 30.5x. We think the higher valuation is justified due to CDNS’s position as the second-largest EDA player by market share after Synopsys (SNPS) which is also trading above the peer group. We recommend longer-term investors begin exploring entry points into the stock in 1H24. While CDNS is not cheap, the company’s business has proven to be extremely resilient, and we expect CDNS to maintain its revenue and earnings growth even in uncertain market conditions.

The following chart outlines CDNS’ valuation against the peer group.

TSP

Word on Wall Street

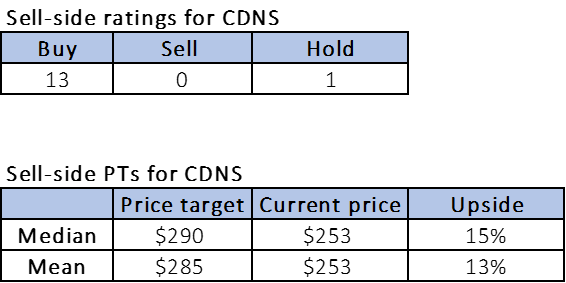

Wall Street shares our bullish sentiment on the stock despite the higher valuation. Of the 14 analysts covering the stock, 13 are buy-rated, and the remaining is hold-rated. The stock is currently priced at $253 per share. The median sell-side price target is $290, while the mean is $285, with a potential 13-15% upside. We share Wall Street’s upside expectations for the stock in 2024.

The following outlines Wall Street’s sentiment on the stock.

TSP

What to do with the stock

While we understand investor hesitation about CDNS due to its premium multiple, we think the stock is better positioned to continue top-line growth in the double-digit range in FY24. We see increased capex investment in chip design as well as semi industry recovery supporting growth in 2024. We still see some near-term challenges as macro headwinds spill into this year, but we think the nature of CDNS’s position in the EDA business will make it relatively resilient to the market downturn.

Read the full article here