Cadence Design Systems (NASDAQ:CDNS) and Synopsys (SNPS) dominate the semiconductor electronic design automation (EDA) software space, each with over 30% market share. The bulk of Cadence’s business is selling software used to design and validate integrated circuit products. Their customer base spans across the entire semiconductor chip design industry. Cadence’s revenue is tied to overall chip design activities, rather than chip volumes.

I believe that overall chip design activities will accelerate over the next decade due to increasing demands in data centers, automotive chips, and industrial automation. Cadence, as a software company, boasts a very high operating margin and remarkable sales growth rate, making it a high-quality growth company. While the valuation of the company is not attractive currently, investors should put this company on their watchlist.

The Market Size and Growth

According to Businesswire, the global electronic design automation software market size is anticipated to reach USD 22.21 billion, expanding at a 9.1% CAGR from 2023 to 2030. The increasing design complexity in electronic designs, particularly in AI, industrial, automotive, consumer electronics, and other high-impact markets, has led to a higher demand for EDA tools, making them increasingly crucial.

These EDA tools play a vital role in enhancing productivity for chip design and reducing design errors. Semiconductor companies often enter into multi-year contracts with Cadence to utilize their software, resulting in a substantial portion (85%) of Cadence’s group sales being recurring in nature.

Investment Thesis

Rising demand for chip design activities: Cadence’s growth is closely tied to overall chip design activities. I believe that end-market demands on data centers, automotive chips, renewable energy, and industrial automation will accelerate over the next decade.

For example, the popularity of AI and machine learning applications has surged, and they heavily rely on specialized chips like GPUs or efficient processing of complex computations. Chips with manufacturing processes under 14 nm are critical for AI and machine learning, as they offer a combination of strong performance and lower power consumption. These growing end-market demands are expected to drive chip design activities higher, subsequently leading to Cadence’s growth in the future.

Increasing Complexity and Higher Failure Costs for Semiconductor Design: In line with Moore’s law, the number of transistors on a chip roughly doubled every two years, although the pace has slowed in recent years. Consequently, chip design complexity has increased. Due to this complexity, electronic design automation software has become crucial for chip design, as manual processes are almost impossible for designing new node chips.

Additionally, I believe that the failure costs for chip design are increasing over time. While EDA software represents a small component of the overall chip design costs, it plays a crucial role in ensuring success and mission-critical outcomes. Overall, I consider the EDA industry to be a very attractive sector for stock investment, especially considering that there are only two major companies globally in this space.

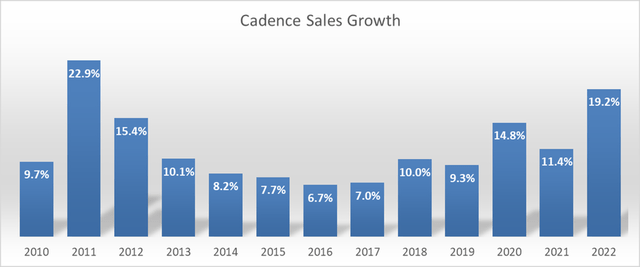

Cadence has experienced remarkable growth at double digits since 2018, further underscoring the potential of the EDA industry.

Cadence 10Ks, Author’s Calculation

AI Strategy: Cadence introduced Virtuoso Studio and Allegro X AI recently.

Virtuoso Studio leverages 30 years of knowledge to accelerate heterogeneous system design. Through AI-powered layout automation and optimization, it provides an average 3x productivity boost for designs in the notably complex analog domain. Their customers include MediaTek, Renesas, Analog Devices, and TSMC.

Allegro X AI technology utilizes the latest innovations in generative AI to accelerate PCB design, resulting in more than a 10x reduction in turnaround time.

Although these AI initiatives are still in the infant stage, Cadence’s technology can deliver better-optimized designs, greatly improve engineering productivity, and accelerate design closure.

I believe these investments in AI can strengthen Cadence’s leadership in the chip design automation industry and fuel their growth in the future.

Cadence’s technologies are relevant to two key areas of AI: accelerated computing and AI simulation. The increasing demand for accelerated computing requires GPUs, and GPU acceleration serves as a significant growth driver for system design and analysis due to its complexity.

Additionally, EDA has a long history of workload optimization and simulation. With the generative AI technology, these workload optimization and simulation processes can become even more productive when combined with EDA software.

Key Risks

China Restrictions: In FY22, China represented more than 14% of the group’s revenue. However, in August 2022, the US Bureau of Industry and Security announced a new ban on exporting semiconductor technology to China, including specific electronic design automation software used for making 3nm and more advanced chips.

I believe that the current rules against China have already been reflected in Cadence’s financials, indicating that the company has managed the situation well so far. Nevertheless, these uncertainties could potentially impact Cadence’s stock price in the future if any new rules are introduced.

Sales of emulation and prototyping hardware and individual IP licenses: 15% of Cadence’s revenue comes from the sales of emulation and prototyping hardware and individual IP licenses, which are not recurring in nature. Their emulation and prototyping hardware encompass all individual PCBs, custom ICs, and FPGA-based prototyping components. Chip design companies have the option to defer some of these hardware or IP license purchases if they anticipate weak end-markets in the near term.

Outlook and Valuation

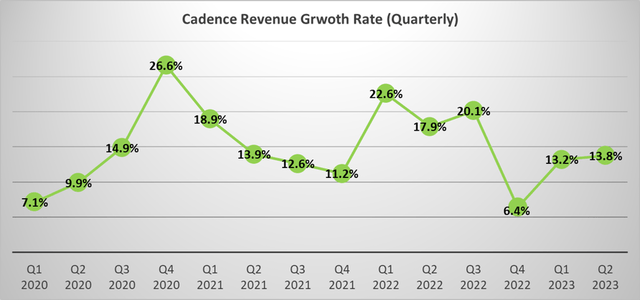

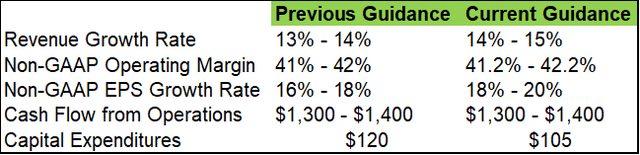

Cadence reported their Q2 FY23 result on July 24th, and they raised the full year outlook for revenue and operating margin.

Cadence Quarterly Results, Author’s Calculation Cadence Q2 FY23

At the mid-point of their current guidance, Cadence is expected to deliver a compound annual growth rate of 15% in revenue from 2020 to 2023, and a 22% growth in adjusted EPS. The operating cash flow is projected to be in the range of $1.3 billion to $1.4 billion, and the company plans to use at least 50% of their annual free cash flow to repurchase Cadence shares.

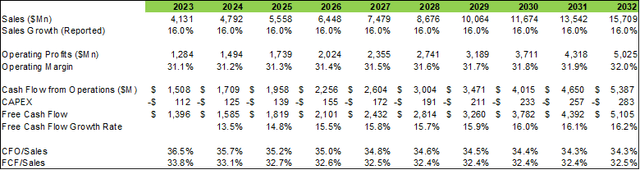

Based on the recent results, I used a 2-stage DCF model to estimate the fair value of Cadence. The model assumes 15% normalized organic sales growth and 1% acquisition growth. The organic growth assumption aligns closely with the actual growth rate seen in the past three years.

Cadence already maintains a high margin, exceeding 30%, and I don’t anticipate significant margin expansion in the model. The operating margin is estimated to reach 32% in FY32 in my model, with the margin expansion primarily driven by operating leverage.

Cadence is a capital-light business, and their capex spending is relatively low. The free cash flow conversion is calculated to be 32.5% in FY32 in my model.

Cadence DCF Model – Author’s Calculation

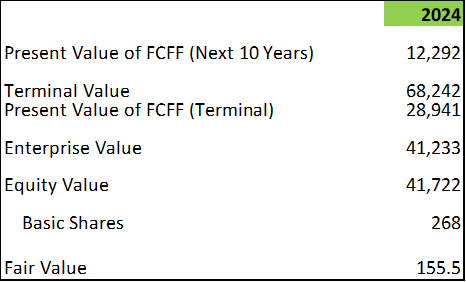

Cadence is guiding 17.5% of tax rate for FY23, thus I am using the same tax rate in my model. In addition, I am using the 4% of terminal growth rate and 10% of WACC, the same assumptions across all my models.

With these assumptions, the present values of FCFF over the next 10 years and terminal are $12 billion and $28 billion, respectively. Adjusting the cash and debt balance, the fair value is $155 per share, as per my estimates.

Cadence DCF Model – Author’s Calculation

Conclusion

Monopoly or duopoly companies are usually excellent investment ideas. Cadence and Synopsys are the two best companies in EDA market, a structural growth industry rising with the overall semiconductor market.

While the current stock price is overvalued, I don’t think their stock price is going to get cheaper in the near future. The market tends to offer a higher premium to these quality and high-growth stocks. Most importantly, I don’t see any imminent and material risks associated with Cadence. As such, I assign “Hold” rating to Cadence.

Read the full article here