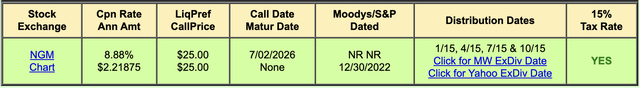

The broad collapse of preferreds from the Fed’s fight with inflation has created an intense opportunity to build positions in tickers with high dividend yields and significant capital growth potential wrapped within the safety of the quasi-fixed income instrument. Preferreds rank higher on a company’s capital stack than common shares and provide a higher claim to dividends and its assets. I’ve been using these tickers to build the base of my income portfolio since last year and recently came across the Cadiz (NASDAQ:CDZI) Series A preferreds (NASDAQ:CDZIP). These immediately stuck out as they’re currently trading for $13.45 per share, a roughly $11.35 difference or 46% discount to their $25 par value. They pay out a $2.21875 annual coupon for what’s currently a 16.5% yield on cost. They’re perpetual preferreds so will trade indefinitely until Cadiz chooses to redeem them at any point after 2 July 2026.

QuantumOnline

The preferreds would offer a yield to redemption of 37.4% if we assume that Cadiz can arrange cheaper financing at its redemption date to retire them. However, this seemingly terrific return profile is haunted by the specter of substantial losses, free cash burn, and a declining liquidity position. The discount reflects market fears that the company faces quite substantial going concern risk. The temptation to chase yield sometimes feels compelling but Cadiz offers material uncertainty to its preferreds holders beyond my level of comfort.

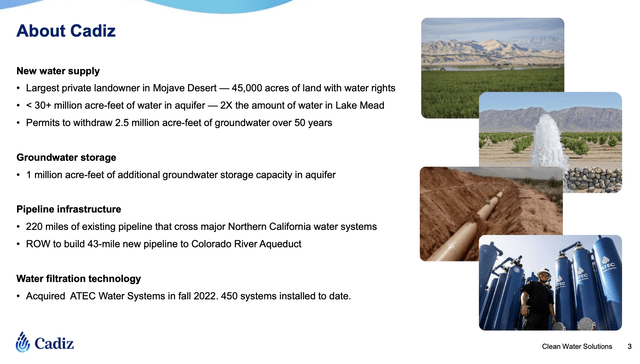

What’s Cadiz?

Cadiz May 2023 Investor Presentation

Los Angeles-based Cadiz is pushing to play a major role in the future of California’s water infrastructure. The region sometimes suffers from drought and water shortages and has for decades underinvested in critical water infrastructure. The last regional dam for water supply built in California was completed in 1979 despite the state’s population growing by 16 million since then and its agricultural economy being the largest in the US and generating over $100 billion in economic activity annually. Cadiz owns 45,000 acres of land in the Mojave Desert that overlies a large aquifer.

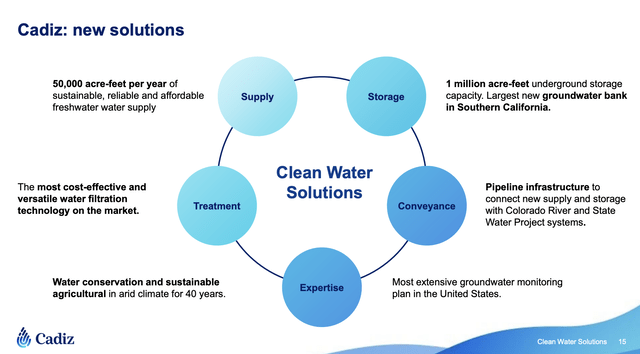

Cadiz May 2023 Investor Presentation

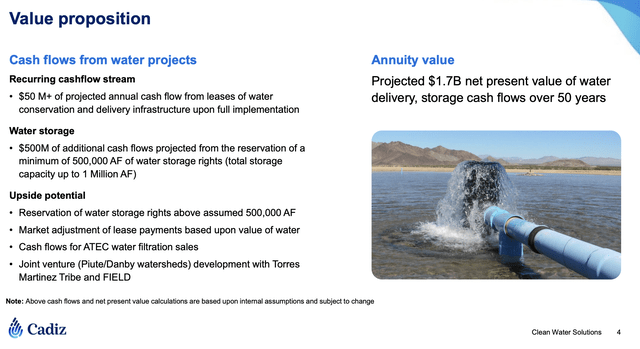

There is a massive 30+ million acre-feet of water in the aquifer, more than the water capacity available in the largest US reservoir Lake Mead. The project has faced intense environmental opposition to its plans to pump and market water from the aquifer. Critically, there is currently no clear pathway for the company to bring its project online as other solutions to address California’s water scarcity pull ahead. The ticker and the preferreds are essentially a speculative play on the aquifer being monetizable at some point in the future. This could generate a $50 million recurring cash flow stream.

Cadiz May 2023 Investor Presentation

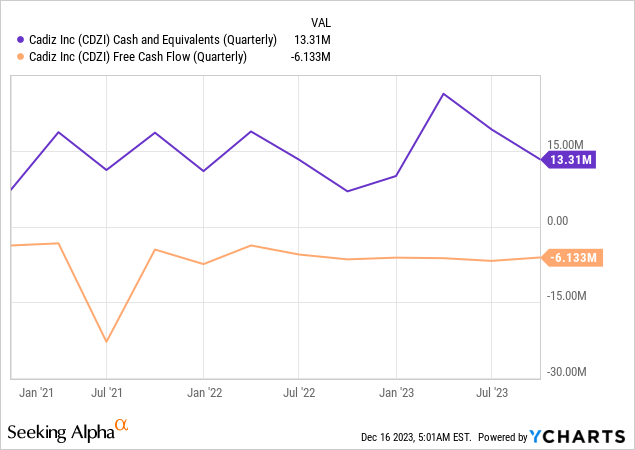

The company has no operations to speak of but did acquire a water filtration company ATEC Systems in 2022. Cadiz recognized roughly $400,000 in revenue for its fiscal 2023 third quarter with a net loss of $6.9 million and free cash burn of $6.1 million. The company is offering a legitimate solution to what has at times been a critical problem but the risks to the Mojave Desert seem real with environmentalists flagging the aquifer as a core reason the Mojave supports various fauna and flora from the Joshua tree to bighorn sheep and tortoises.

Are The Preferreds A Buy?

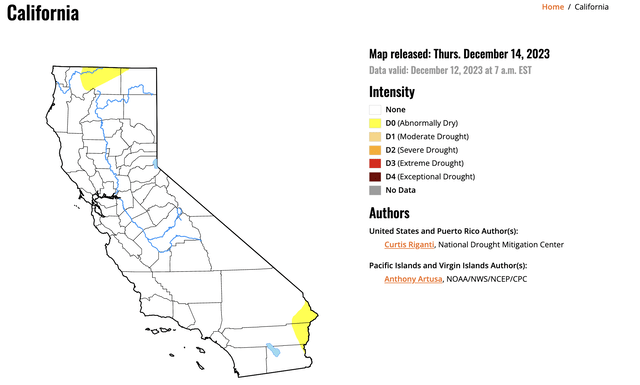

US Drought Monitor

The criticality of the proposed project has been dampened this year with California being declared drought-free in November after a year of intense rainfall that’s set to remain into 2024. The state currently just faces some dry conditions in north and south California. Lake Mead, which supplies water to California and Arizona, has also risen by more than 20 feet due to above-average precipitation and melting snowpack. Further, Sacramento completed its $1.7 billion EchoWater Project this year in a move that will treat an average of 135 million gallons of wastewater each day for discharge to the Sacramento-San Joaquin Delta. The project will help alleviate future water pressures on California farmers by supplying tertiary-treated water to agriculture and habitat lands in southern Sacramento County. During the 2022 drought, 600 square miles of farmland in Sacramento Valley had to be left fallow.

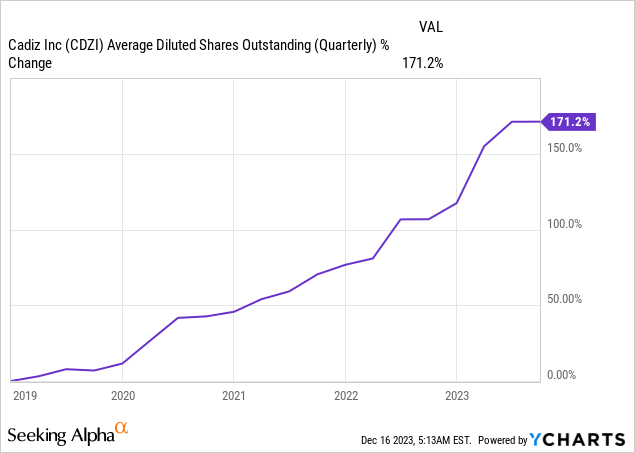

Cadiz has been heavily dependent on dilution to bridge its liquidity gap and will need to raise more funds against its current cash runway as implied by cash and equivalents of $13.3 million at the end of the third quarter against free cash burn of $6.1 million. This dilution is integral to the company’s solvency and could be possible with the market cap of Cadiz at $222 million enough to support an offering similar to its January 2023 $40.32 million direct offering of 10.5 million shares. The offering was partially led by Odey Asset Management, a London-based hedge fund that shut down in October. Hence, the preferreds are simply a play on Cadiz being able to continually monetize its shares as the prospects for Californian water supply improve in the near term. It’s hard to see these as a good buy within my portfolio against the risk.

Read the full article here