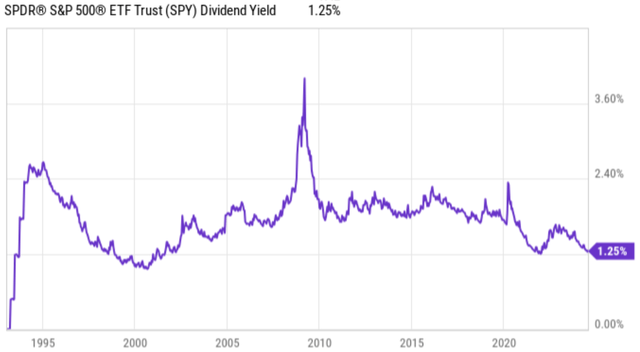

Funding a retirement isn’t what it used to be. For one thing, an investor was able to buy into the S&P 500 (SPY) and get a 2.4% dividend yield in the mid-1990s. Today, however, an exuberant market combined with rise in values of non-dividend or low-dividend paying stocks has driven the yield back down to historical lows again.

As shown below, SPY yields just 1.25% at present, sitting around the same level as where it was in the year 2000, just before the tech bubble burst. Moreover, the last time SPY touched this level was in 2022, which was also followed by market volatility, particularly amongst tech stocks.

YCharts

Buying the current market index comes the risk of overpaying in a frothy market. Moreover, having too much capital invested at such a low yield places an undue burden on the investor, having to market time their stock sales in order to fund retirement income.

That’s why I continue to prefer higher yielding stocks that have competitive advantages, enabling them to deliver consistent returns to shareholders.

This brings me to Capital Southwest (NASDAQ:CSWC), which I last covered in April, highlighting its strengths with a ‘Buy’ rating. The stock has given investors an 8.4% total return, besting the 6.7% rise in the S&P 500 over the same timeframe.

In this article, I revisit CSWC and discuss why it remains a good ‘buy’ for high income, particularly after its recent drop in price, so let’s get started!

Buy The Dip On This Cash Cow

Capital Southwest is just one of a few internally-managed BDCs on the market today, alongside peers Main Street Capital (MAIN), Hercules Capital (HTGC), and Trinity Capital (TRIN).

Perhaps unbeknownst to some investors, CSWC has generated market-beating returns over the past 10 years, besting its peers, the S&P 500 Index (SPY) and the VanEck BDC Income ETF. As shown below, CSWC has produced a 387% total return over the past 10 years.

Seeking Alpha

One of the key reasons for why CSWC has outperformed is due to its smaller size compared to aforementioned peers, which means that it doesn’t take as many deals to move the needle for CSWC. At the same time, it’s made substantial improvements in operating leverage through enhanced scale.

As shown, operating leverage, measured as operating expense as a percentage of total assets, has declined every year since FY’16, and currently stands at 1.7%, equating to a 20 basis point improvement over the prior year. CSWC is also well on its way to achieving the parity with MAIN, which carries an industry-leading operating leverage ratio of 1.3%.

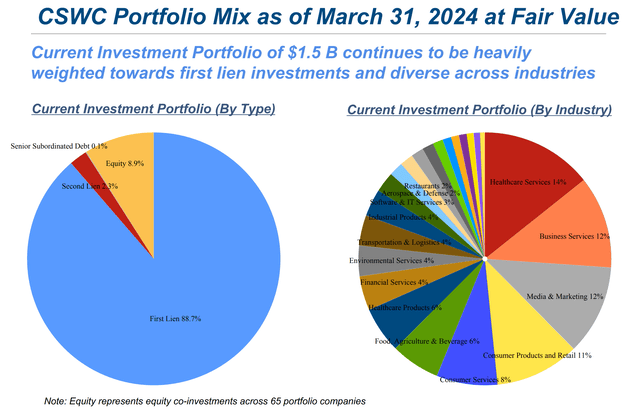

Meanwhile, CSWC carries a conservatively run portfolio that’s comprised of 89% first line secured loans, followed by 2.3% exposure to second line and 8.9% in Equity investments. Its portfolio is also well-diversified, with nearly half the portfolio being invested in defensive segments of healthcare, business services, media, and consumer products, as shown below.

Investor Presentation

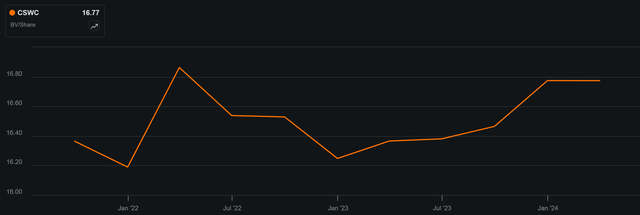

CSWC continues to benefit from high interest rates, given that 97% of its income-bearing investments are held at a floating rate. It’s also seen meaningful NAV per share growth of $0.40 over the prior year period to $16.77 at the end of fiscal Q4 2024 (ended March 31st).

As shown below, CSWC’s NAV per share has nearly fully bounced back since declining in early 2022, when rising interest rates resulted in economic uncertainty and lower mark-to-market valuations in CSWC’s portfolio.

Seeking Alpha

Moreover, CSWC grew NII per share to $0.68 in fiscal Q4, up $0.03 from $0.65 in the prior year period, driven in part by accretive equity issuances and a significant premium to NAV. This also resulted in coverage over the $0.57 regular dividend rate, equating to a 119% NII-to-Dividend coverage ratio, and enabled CSWC to pay two $0.06 special dividends so far this year.

Risks to CSWC include potential for economic headwinds, which could impair borrowers’ ability to repay their loans. In addition, its non-accrual rate of 2.3% is higher than some peers like Ares Capital (ARCC), which carries a non-accrual rate of 0.6%. While CSWC’s non-accrual rate sits below the 2.5% that I would consider to be generally safe for BDCs, it’s worth monitoring in the next reporting quarter’s results. In addition, potential for rate cuts may result in pressure to grow NII per share.

CSWC recently announced preliminary fiscal Q1 2025 results, in which NII per share is expected to remain steady at $0.68 to $0.69 (compared to $0.68 in Q4 2024). NAV per share is expected to decline slightly to $16.60 (from $16.77), but leverage is to remain solid at 0.75x.

This represents a decline from 0.82x on a sequential QoQ basis and sits well below the 0.9x to 1.25x range for most BDCs, and below the 2.0x statutory limit, implying plenty of dry powder with which to make opportunistic investments.

Admittedly, CSWC isn’t cheap at the current price of $26.02, although the drop in price over the past week from $27 gives consolation. CSWC appears to be expensive at a Price-to-NAV of 1.57x, based on the aforementioned expected Q1 2025 NAV/share of $16.60.

However, I continue to believe that well-run internally-managed BDCs with efficient cost structures deserve to trade at a higher premium than externally-managed ones. For one thing, CSWC’s low expense ratio is what enables it to yield 8.8% at present while trading at such a high premium.

Plus, CSWC doesn’t appear to be excessively valued from the perspective of a forward PE at 10.0x. With a near-9% regular yield, potential for a 9.7% total yield including special dividends, and a very strong balance sheet, CSWC seems well-positioned to deliver strong shareholder returns.

Investor Takeaway

Capital Southwest stands out as a compelling long-term investment for those seeking high income and consistent returns, particularly in a challenging market environment with low dividend yields. CSWC has delivered market-beating performance over the past 10 years and maintains a robust, conservatively managed portfolio.

It also maintains strong operating leverage and one of the best balance sheets in the BDC sector, which combined with an attractive dividend yield make it a worthwhile consideration for income-focused investors.

Read the full article here