Investment Thesis

Capstone Copper Corp. (OTCPK:CSCCF) is forecasted to more than double output by 2026 as it ramps up two mining projects in Chile, and is looking to lower production costs by over 40% during the process. However, new economic reforms in Chile will raise the company’s tax rate dramatically, thereby dealing a crippling blow to the stock’s intrinsic valuation. Hence, I rate the stock a hold.

Clear Growth Path

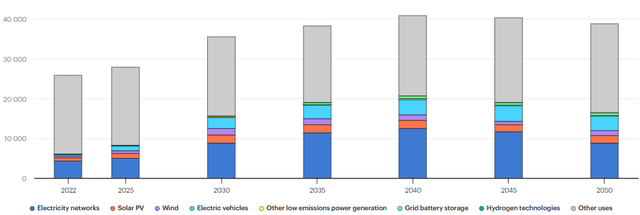

The IEA this week came out with an updated analysis of the critical minerals situation worldwide. According to the IEA’s Net Zero Emissions by 2050 (NZE) Scenario, copper demand will rise about 38% to just over 35mln tonnes annually by 2030. This is higher compared to the 2021 report which targeted just over 30mln tonnes by 2030. The 2040 demand target of just over 40mln tonnes is also higher than last year’s estimate of about 32mln tonnes.

IEA Copper Demand Forecast (IEA Critical Minerals Data Explorer, Updated 7/11/23)

Meanwhile, the report also estimates supply by 2030 to reach only about 25mln tonnes, implying a shortfall of around 10mln tonnes.

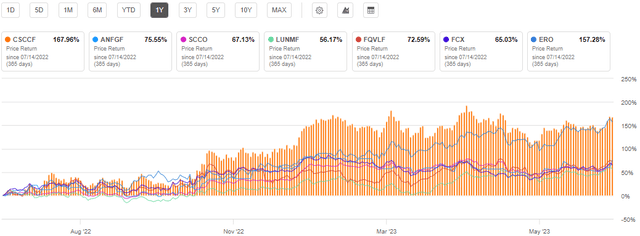

Copper stocks were already running hot based on previous projected shortfalls. Capstone’s stock is up over 160% in the past 12 months, one of the highest performers – if not the highest performer – among companies I call “pure plays” – those that derive over half of their revenue from copper.

‘Pure Play’ Copper Stocks 1Y Performance (Seeking Alpha)

Capstone, however, looks quite expensive, currently trading at over 50x earnings and 34x cash flow. The stock’s EV/EBITDA forward ratio of 12.69 is 60% higher than the sector median.

What is not reflected in the relative valuation metrics, is the long-term path to growth that Capstone is carving itself. This is of course building upon a positive growth trend. Capstone’s sales grew at a CAGR of 16% in the past ten years while EBITDA and EBIT both grew around 10 percent.

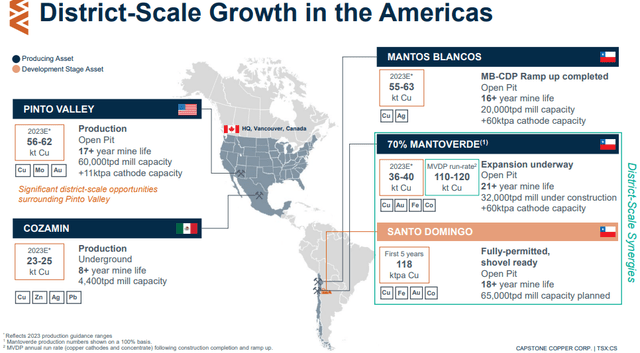

Capstone’s current footprint in the U.S. Mexico, and Chile, as illustrated in its July corporate update, is projected to produce about 180kt of copper in 2023, based on the midpoint of the guidance.

Capstone Production Projections (Capstone July 2023 Corporate Update)

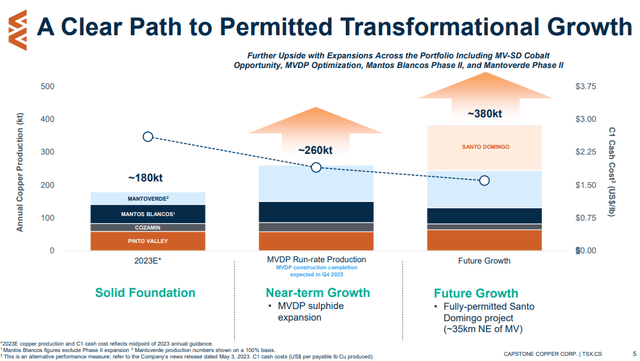

As a result of the Mantoverde (MVDP) project hitting its full run rate, production is expected to grow about 44% in 2024, from 180kt to 260kt/year. It will then grow to 380kt of yearly copper output when Santo Domingo, which is already fully-permitted, hits its full run rate.

Capstone Production/Cost Forecast (Capstone July Corporate Update)

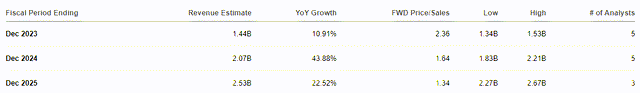

The company in 2024 will be nearly fully focused on MDVP. It will take some time to fully construct Santo Domingo. Hence, I think it would be reasonable to assume Santo Domingo gradually reaches its full run-rate by 2026. And, at the same time, as the slide indicates, costs are expected to drop by about 40% from $2.60/lb to about $1.60/lb. As a result, analysts are estimating Capstone’s revenue to rise from $1.3 billion in 2022 to $2.5 billion in 2025.

Analyst Consensus Sales Estimates (Seeking Alpha)

But now, unfortunately, comes the bad news.

Valuation Undermined

This investment at first appeared to be a “no brainer,” according to the initial DCF valuation based on current tax regimes. However, that scenario quickly dissolved into fantasy when Chilean lawmakers passed tax reforms in May that will raise the tax rate to 46.5% starting in 2024. As a result, Capstone’s effective weighted average tax rate for the next ten years will be 41%.

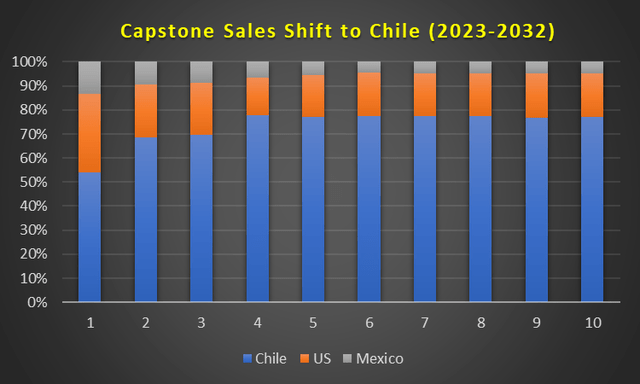

The timing is quite tragic, with Capstone planning to shift taxable income to Chili over the next ten years. Chile as a % of Capstone sales will go from just over 50% today to nearly 80% starting in about 2026.

Capstone Projected Sales Mix by Country (MH Analytics)

The new taxes may represent the highest the industry has ever seen. These reforms will most certainty impact the valuations of other copper pure plays with operations in Chile, such as Antofagasta plc (OTC:ANFGF), Freeport McMoRan Inc. (FCX), and Lundin Mining Corporation (OTCPK:LUNMF).

Antofagasta said it is reevaluating whether to move forward with $3.7 billion in investments because the new royalty impacts competitiveness. Meanwhile, Freeport McMoRan put a freeze on Chile investment decisions, according to Reuters.

Capstone itself had warned that, if enacted, the new tax bill would have significant negative implications for future investment in the Chilean copper industry more broadly, while reducing the attractiveness of new copper projects.

According to the company’s Annual Information Form, the U.S. taxes Capstone at a rate of 21% while Mexico’s tax rate is 37.5% combined (30% corporate tax plus 7.5% mining royalty). Currently, most miners in Chile are hit with a total tax rate of 35%. This includes a 27% Corporate Income Tax (CIT) plus a Withholding Tax (WHT), according to the Taxand global advisory firm.

Assuming a Chilean tax rate of 35%, Capstone would end up with an effective tax rate of about 32%. If we plug that number into our DCF model, the stock looks undervalued by about 15%.

Post-Tax Change Valuation

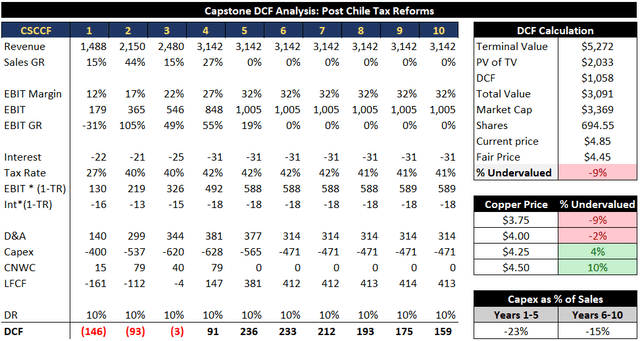

However, when we plug in the higher rate driven by the Chilean tax law, the stock appears overvalued by almost 10%. As you can see below, in year one we go with the TTM tax rate of 27% before shifting to a nine year average of 41%.

This is also assuming EBIT margin grows from 12% in year 1 to 32% starting in year 5. Capital investment assumptions are a bit heavy in the first five years with capex averaging about 23% of sales before reducing to 15% in years 1-6.

Author’s Capstone DCF Analysis – Post Chile Tax Reforms (MH Analytics)

The model is based on a copper price assumption of $3.75/lb. If you raise the price to $4.00/lb, the model has the stock overvalued by 2%. It looks undervalued by 4% based on $4.25/lb and 10% based on $4.50/lb.

Risks

I will mention a couple risks involved with continuing to hold onto the stock. Capstone in its most recent filing indicated that potential tax hikes in Mexico and the United States could also be forthcoming. The company said there are uncertainties around the Biden administration’s “Made in America Tax Plan” which may increase Pinto Valley’s future tax obligations.

Also, any significant delays in construction, expansion, or production ramp-up of either of the main projects will have major negative impacts on sales, profits and cash flows. This includes potential conflicts with local communities and activists along with labor disputes, among other potentially disruptive developments.

Conclusion

Capstone is one of the hottest pure play copper stocks momentum-wise in the past year as it positions itself to double output by 2026 while reducing costs dramatically. Upon initial inspection, a DCF analysis found the stock undervalued by about 15%. However, this was before taking into account Chile’s new reforms that will raise taxes on copper miners to 46.5%. The significant tax hike deals a devastating blow to Capstone’s valuation. Based on the new tax regime, Capstone’s stock looks overvalued by almost 10%. Although I do not recommend a buy, the stock is still definitely worth holding onto given the company’s path to growth and the ever growing forecasted gap between copper demand and supply.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here