I have covered Cargojet Inc. (OTCPK:CGJTF) before, and back then I pointed out that a bullish view on the stock itself might not quite be justified. During the pandemic, it was booming times for companies in the logistics chains. Air freight carriers also benefited, as PPE needed to be transported globally quickly, so maritime shipping was no option. At the same time, e-commerce took flight, so it was a really good time to be an investor in air freight companies.

Those times seemingly are over, and Cargojet’s CEO also has recognized this: Despite the recent downward trend in the inflation rate over the last few months, we do not expect interest rates to decline in the near term. Therefore, we are focusing hard on our cost management across the entire business, and more specifically number one, working closely with our largest customers to right-size our network to reduce block hours while maintaining delivery standards.

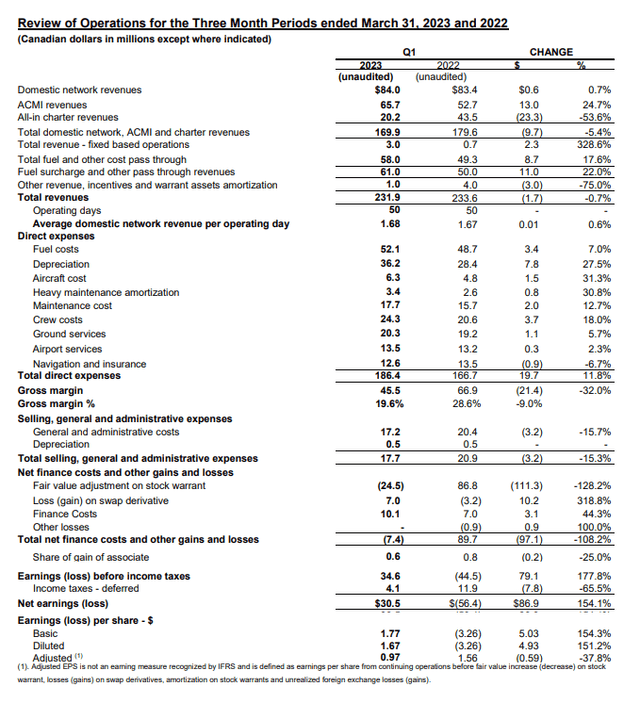

Cargojet Topline Growth Stalls

Cargojet

Cargojet revenues declined by 0.7%, which isn’t too bad. Cost pass through rose by 22%, which is nothing more than the airline receiving some compensation for some of the costs it incurred. So, what we see in the top line also gets filtered out on the way to the bottom line. More interesting is revenue development at the domestic, ACMI and charter revenues. Those declined by 5.4%, and even that isn’t too bad. The domestic revenues remained more or less stable while Cargojet’s bet on ACMI (Aircraft, Crew, Maintenance & Insurance) is paying off with a 25% increase in revenues, but charter revenues declined more than 50%, which was driven by a one-off opportunity last year.

Unit fuel costs rose 24.5% year-over-year for a total increase of 7%. For many airlines, the fuel costs weigh heavily on profitability. For Cargojet, that is not so much the case, as much of the fuel cost is offset via pass through revenues. The bigger challenge for Cargojet is the fact that the company operated 0.7% more block hours year-over-year while its fleet is 25% bigger, and 20% bigger when excluding passenger airplanes. So, costs such as depreciation are higher without the assets are utilized and optimized for profits.

The Macro Reality For e-commerce

The current macroeconomic state is a complex one. During the pandemic, governments kept companies afloat, and that prevented many businesses from having to close down and employees basically kept their paycheck. With no holidays or social activities to spend the money on, e-commerce took a flight and that benefited the freighter airlines as passenger cargo capacity was running minimal due to the global passenger fleet being almost completely grounded.

Those times are now over, businesses and consumers are feeling the pains of high energy prices due to the war in Ukraine and in some way the high inflation we are seeing now likely had to happen at some point because the pumping of money into the system as we saw during the pandemic comes at a price and we are seeing that now. During the pandemic many jobs were secured by government loans or handouts and disposable income was high. E-commerce rode that wave where demand was high but ability to supply was not and prices of products increased. The result is that many products became very expensive and now that we are hit with day-to-day living being more expensive, those expensive products that consumers would have no problem paying for years ago are all of a sudden very expensive. That hits companies like Cargojet, which plays an important role in the express delivery chain in Canada.

It’s About Cost Control Now

So, right now it is all about cost control, and the CEO has understood this. The company initially planned on expanding its fleet with 8 Boeing 777 airplanes. Four are destined to operate for DHL and that plan still stands, but the other four that were destined to support growth have been deferred. One airplane that would serve as feedstock for conversion was never bought and the other three have been put up for sale. In February 2023, a tentative agreement was reached to sell two airplanes and a third tentative agreement is pending meaning that the company successfully sold off its excess feedstock and with airplane shortages for passenger operations that can happen at relatively favorable terms. Overall, this reduces the net CapEx to around $200 million CAD down from $350 million CAD previously estimates.

That is one way to ensure liquidity and right size the airline. Furthermore, the company is looking for opportunities for 4 to 5 surplus Boeing 757 airplanes in the ACMI or dry leasing space and works with partners to optimize block hour efficiency as flying the same volumes with less block hours significantly reduces costs since many cost elements are driven by block hours output. Apart from that, the company aims to reduce overtime and temporary work force to save dollars.

Is Cargojet Stock A Buy, Hold or Sell?

Wall Street analysts see 36% upside for Cargojet share prices and while I see some challenges ahead. I can somewhat see why that is the case. I have entered the numbers into my stock valuation model that will soon be launched to subscribers of The Aerospace Forum and while there is no upside based on the industry enterprise multiple median, Cargojet trades at an expanded multiple and based on that there is 31% upside. So, indeed when it comes to the price target my view does not differ much from Wall Street analysts. I am, however, sticking to my Hold rating. That is not because the upside is not present but the 31% upside is with 2024 performance in mind and 2024 is a relatively long time from now given the risks faced. In that time we could see further softening in demand and we have to see how successful the cost control is, but the upside is certainly there. I just would feel more comfortable seeing the first signs of the cost control or perhaps some stabilization in the macroeconomic or improvement in the macroeconomic indicators.

Conclusion: Cargojet Stock Could Offer Long-Term Value

While the way Cargojet is approaching the freight market is extremely interesting and it seems that they are doing a good job, I don’t believe that Cargojet stock is a buy at this point due to the expected weakness ahead. I would like to see some stabilization in the macroeconomic indicators and the cost control to have stronger effects. I am, however, not questioning the business approach which I believe justifies higher EV/EBITDA multiples compared to the industry.

Long term, e-commerce should continue to benefit the Cargojet Inc. business, but in the near term there are some bumps, and the company is prudently altering its capacity plans for that. So, you could even consider buying Cargojet Inc. because the upside compared to projections is there but it is the risk element I am not fully comfortable with. So, I am sticking with a Hold rating for at least another quarter.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here