After years of losses and oversupply it might finally be time to invest in senior housing. The sector appears to have hit a fundamental bottom with tenant troubles reaching a conclusion and margins near their lows. However, the forward outlook is much improved due to the following factors:

- Reduced development activity

- Strong demand drivers

- Culling of the weak operators

From its bottomed out state, there is room for occupancy to rise as much as 900 basis points and margins can improve by up to 1100 basis points. In combination it represents substantial growth albeit in the form of recovering former net operating income (NOI) that was lost.

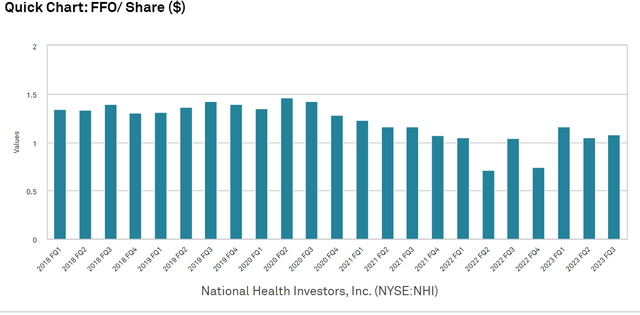

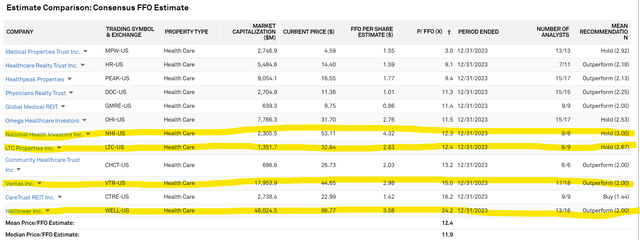

With any cyclical industry, the “correct” market pricing behavior is for earnings multiples to be at their highest when earnings are at the trough. National Health Investors (NYSE:NHI) has not properly traded according to this rule which I believe makes it opportunistic.

The Buy Thesis

NHI is trading at 12X trough FFO which might be far too cheap given the recovery potential ahead. An anticipated rebound in senior housing profitability will grow NHI’s earnings directly through their SHOP (senior housing operating portfolio) and indirectly through making their triple net stronger which will eventually pay off upon re-leasing.

Given the growth and improved stability I think a 14X multiple is more appropriate for NHI, implying roughly 15% upside from today’s price.

The oversupply that led to the troubles

Certain trends capture the imagination of developers resulting in building well beyond levels that make sense.

Office towers are glamorous and up until recently were considered trophy assets. Many wanted their name associated with the next landmark tower resulting in more and more building even as vacancy rates exceeded 10% nationally.

Senior housing development, rather than being motivated by glamour, was an attempt to capture a very real demographic trend of what has been dubbed the “Silver Tsunami”.

In a vacuum it makes sense to develop in anticipation of the demand surge, but the problem here was how widely publicized the aging of the population became. Too many developers simultaneously had the bright idea to build resulting in a truly extreme wave of new supply.

Much of the supply hit just before or during the pandemic which had two main effects on the sector:

- Move-ins became very cumbersome due to regulations

- Tragically, COVID related deaths were concentrated in the demographic most likely to occupy senior housing.

As a result, vacancy shot up and operators lost a large portion of NOI. The REITs were mostly exposed through triple net leases but also had some operating senior housing. Operating losses hit right away while the triple net took longer to impact the bottom line. Their tenants struggled for a while and eventually the properties were either vacated or leases were renegotiated lower.

NHI was among those hit due to its large concentration in senior housing.

S&P Global Market Intelligence

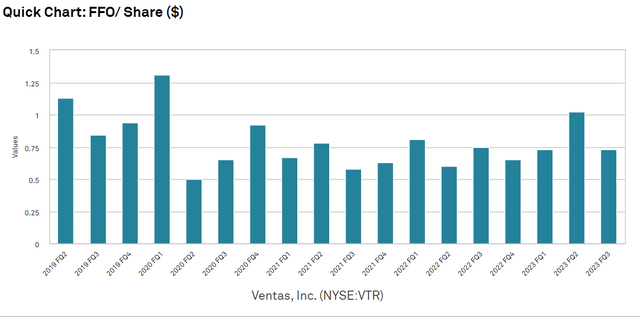

To be clear, this was not an NHI specific problem, but rather the sector. Giants like Ventas (VTR) suffered a similar loss of FFO over the past few years.

S&P Global Market Intelligence

These tenant issues continue to filter through so it is not smooth sailing quite yet, but I do believe the sector is on the cusp of some sort of recovery.

The operating environment has largely normalized as operators are now well versed in COVID protocols with the remaining problem being the lingering oversupply of the physical properties from the supply surge.

Supply is moderating while demand is filling in vacancies

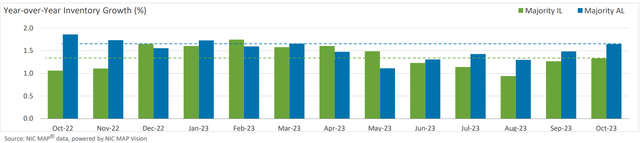

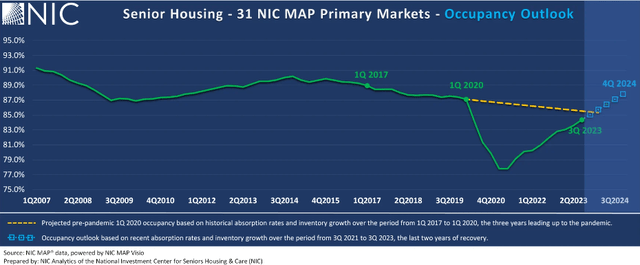

The pandemic instilled fear in developers ushering in a new era of much lower supply. Based on NIC data below, new construction in both independent living (IL) and assisted living (AL) has been hovering around 1% to 1.5% of standing inventory annually.

NIC

That is in contrast to the 4% or even 5% inventory growth during the excitement.

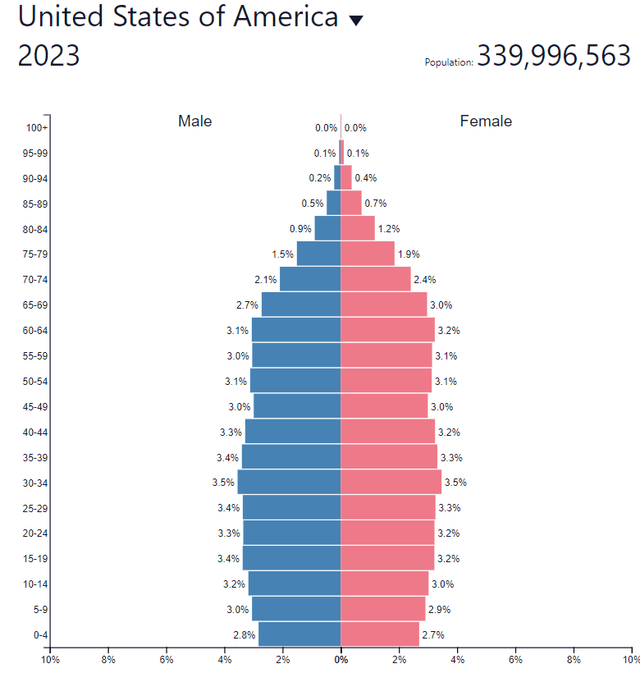

Thus, the supply growth has factually moderated while the demand boom is still in process. Developers may have been overly excited about the silver tsunami, but it is still a very real thing.

populationpyramid.net

As that meaty part of the graph above between 60 and 74 keeps aging, a higher and higher percentage of them will need senior housing.

Given the now much lower supply, demand is expected to significantly outpace supply resulting in occupancy recovery.

NIC sees stabilized occupancy at 88%

NIC

NHI fundamentals are starting to recover

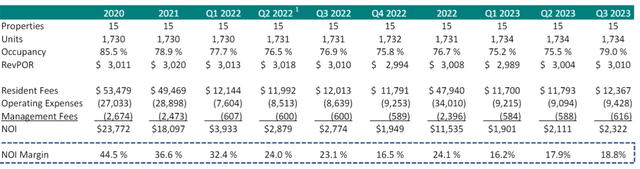

I believe the first quarter of 2023 was the fundamental bottom for NHI. Occupancy in the SHOP hit its low of 75.2% and NOI margin dipped to 16.2%.

NHI

In the data above, note that in 2Q23 and 3Q23 occupancy recovered to 75.5% and then 79%. Also note that NOI margins recovered to 17.9% and then 18.8% in 3Q23.

This is not a result of seasonality, as you can see above 1Q22 was better than 2Q22 and 3Q22. Instead, I think it is a reflection of the sector operating environment improving.

A long way to go up

Just a few years ago, NHI had 44.5% margins in its senior housing operating portfolio. I don’t think numbers that high will return, but 30% is quite plausible which would still be about 1100 basis points of upside from here.

NIC’s projected sector level occupancy is 88% in 4Q24 which would be about 900 basis points of occupancy gains from here.

Flow through to FFO/share

NHI peaked at $5.60 of FFO/share in 2020 falling to $4.30 in 2022. Not all of this will be recovered as some permanent damage was done.

NHI tends to manage rather conservatively which means some properties were sold to reduce exposure to the more troubled areas. Specifically, 34 properties were sold with a weighted average EBITDARM coverage of 1.14X (weak properties/tenants).

In my opinion, the cautious approach was the correct one given the immense difficulties of the sector. It has resulted in NHI’s balance sheet remaining quite healthy today.

- Debt to total capital: 33.7%

- Recurring EBITDA coverage of interest expense: 4.1X (higher is better)

- Net debt to adjusted EBITDA 4.4X (lower is better)

These numbers look great. Most REITs try to stay within a 4X to 7X debt to EBITDA range putting NHI on the low debt side.

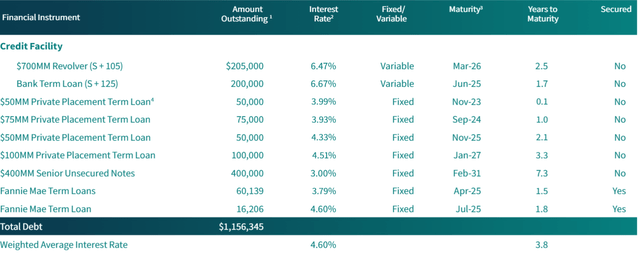

Cost of debt is fairly high for NHI right now due to $405 million of variable rate debt which as of 3Q23 was costing 6.57% on average.

NHI

Oddly enough, that is actually a good thing in terms of growth going forward.

Given NHI’s reasonably low leverage they could refinance that at closer to 5.5%-6% if they wanted secured debt or even simply leaving it variable will probably get cheaper as interest rates have come down recently.

The biggest concern in terms of debt maturities would be the November 2023 note which was at 3.99%. Obviously, this will get more expensive in refinancing, but fortunately it is only $50 million.

Recovering the $5.60 FFO/share is probably not possible in the near term due to lost NOI from property sales and the now more expensive debt (compared to 2020).

However, I do see quite a bit of upside from the current level. SHOP NOI will probably grow rapidly as occupancy and rental rates recover. SHOP is a fairly small component of NHI which leans heavily into triple net.

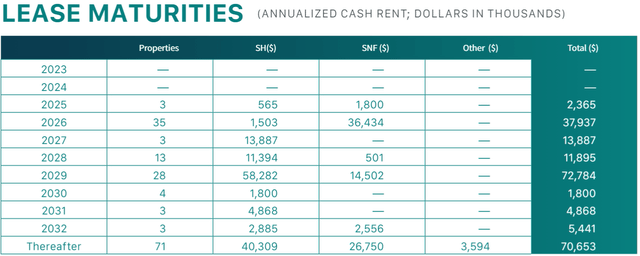

Triple net revenues will take longer to adjust upward due to existing contracts. There is a nice chunk of expiries in 2026 with another big opportunity in 2029.

NHI

Until these roll over, it is largely just going to be in-place lease escalators.

Consensus estimates call for NHI consistently growing a few percent a year.

S&P Global Market Intelligence

I largely agree with this outlook.

Valuation

The market seems to be aware of the recovery in senior housing with the healthcare REITs focused SH being at the top of the sector multiples.

S&P Global Market Intelligence

I find it interesting how much higher Ventas and Welltower (WELL) trade compared to NHI and LTC Properties (LTC). Some premium for size is valid, but the magnitude of gap in FFO multiples strikes me as far too large.

In my opinion, 14X forward FFO would be the correct multiple for NHI. This idea is based on it being at trough earnings with a clearly positive trajectory going forward, even if that growth is somewhat slow to kick in due to the contractual nature of its business.

At 12X, NHI is arguably an opportunity to get into the senior housing recovery without having to pay up for it as one would with VTR or WELL.

Why the multiple gap?

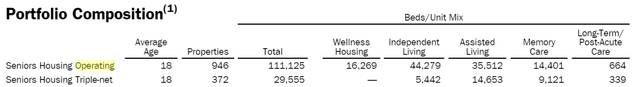

I suspect the reason the market is so much more excited about VTR and WELL is that they have more exposure to operating SH instead of mostly triple net like NHI. Welltower’s SHOP, as shown below, dwarfs its triple net.

WELL

The operating portfolio grows earnings in real time without having to wait for contracts to expire. As such, VTR and WELL are likely to grow earlier than NHI.

While I agree that it is preferable to hit the growth spurt earlier, I think the extremity of the gap in FFO multiples is overvaluing the importance of the 2024-2027 period.

At the end of the day, senior housing properties are physically the same whether they are SHOP or triple net. The recovery will come to triple net too, it just requires a bit more patience.

If we are looking at the total timeline of future earnings, growth coming a few years earlier really shouldn’t warrant such a multiple gap.

Risks to NHI

There are still some lingering tenant issues. Bickford represents 14% of revenues and remains at a fairly low EBITDARM coverage of rent.

In my opinion, tenant issues are in the 8th or 9th inning for the sector, but there could be some surprises still. It is certainly something on which to keep an eye.

Read the full article here