CD Projekt (OTCPK:OTGLY) has regained the favor of the gaming community with the critically acclaimed Cyberpunk 2077: Phantom Liberty expansion. While the expansion’s attachment rates were a bit lower than expected given how well the expansion was received, CD Projekt has rebuilt a strong foundation for the future. Not only did CD Projekt rebuild its reputation among gamers, which is incredibly important in a hype-driven industry like triple A gaming, but it also restructured its company for the better.

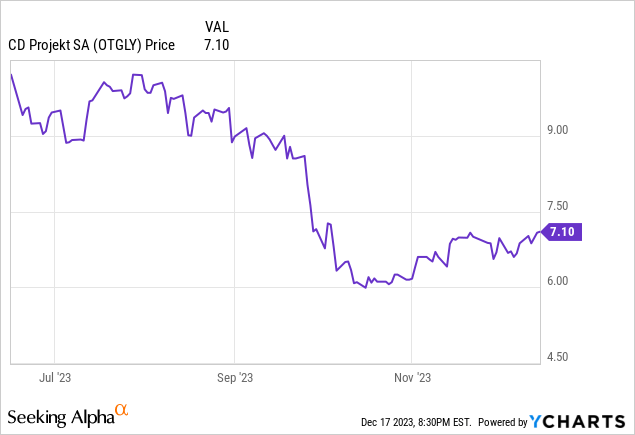

While attachment rates for the Phantom Liberty expansion were not as high as expected, which contributed to the company’s somewhat stagnant price movement in recent months, the expansion has helped CD Projekt salvage its reputation.

Robust Lineup

The resurgence of Cyberpunk 2077 has once again cemented CD Projekt as a premier gaming company. All of CD Projekt’s flagship franchises are now leaders in their respective genres, with Cyberpunk 2077 leading in futuristic ARPGs and The Witcher leading in fantasy ARPG. No other pure play video game company, with the exception of Take-Two Interactive’s (TTWO) Rockstar Games, has built such loyal fanbases with so few titles.

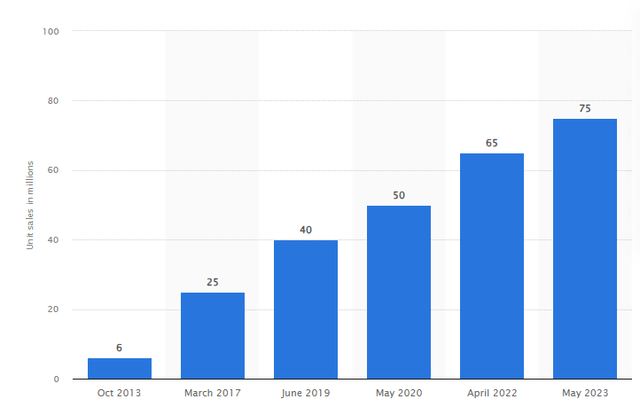

The Witcher, in particular, still holds great appeal among the gaming audience. In fact, the game is still a cash cow for the company with the continued strong sales of the Wild Hunt expansion and the Gwent card game expansion. As of May 2023, the Witcher series has sold a whopping 75M, with ~10M of those sales coming in the last ~13 months alone. Moreover, the announced Witcher 4 will likely be another blockbuster release for the company and will likely blow past The Witcher 3 sales given how much the Witcher IP has grown since then.

The Witcher series remains a powerhouse franchise for the company. Sales continue to rise at an impressive rate.

Statista

Restructuring

The disastrous initial launch of Cyberpunk 2077 has motivated CD Projekt to restructure its business in a meaningful way. In a mini-documentary with GameSpot, company insiders talked about how they restructured their teams to integrate members of traditionally different departments into single teams. This allows the company to mitigate issues of silos and lack of communication between different departments.

This new approach has clearly worked given how successful Cyberpunk 2077’s recent patches, releases, and expansions have been. What’s more, this restructuring and changing of culture could give CD Projekt an edge over competitors who have not gone through the fire like CD Projekt had with Cyberpunk 2077. The company’s ability to adapt clearly contrasts with other major studious like Bethesda, which has been criticized for utilizing the same formula for over a decade.

Healthy Financials

CD Projekt reported strong Q3 results as a result of a successful Cyberpunk 2077: Phantom Liberty expansion. The company surpassed expectations for both revenues and net profits, which came in at $112.57M and ~$52M respectively. The company also boasts ~$290M in total current assets, which should help the company weather any potential economic downturns or negative headwinds.

Large Challenges Remain

While CD Projekt has made an incredibly successful turnaround, at least from a reputational standpoint, the company still faces a great deal of challenges ahead. Perhaps the most obvious is the increasingly competitive nature of the gaming industry. As technology improves, graphics, game mechanics, and game design also improve, which means that older games face obsolescence at a relatively rapid rate.

This is an especially large challenge for CD Projekt, whose business is incredibly top-heavy in that it primarily relies on its two large IPs. Given the large amount of time in between releases, much of the company’s future hinges on the success of the major releases from these IPs. Even one major release failure from a sales standpoint could devastate the company. What’s more, much of the gaming industry is consolidating, with big tech companies like Microsoft (MSFT) increasingly acquiring smaller studios. This means that many of CD Projekt’s competitors now have far greater resources.

Talent acquisition will also be increasingly difficult as other top-tier studios like Rockstar Games or Activision Blizzard vie for talent. Take-Two Interactive, in particular, is competing directly against CD Projekt for talent as they occupy similar spaces. With GTA 6 garnering unprecedented hype, CD Projekt could have a harder time in the near term attracting talent as developers flock to Rockstar Games.

Competition in gaming has never been bigger. Industry hype surrounding titles like GTA 6 will likely act as a magnet for talent, making it harder for CD Projekt to acquire talent of its own.

Rockstar Games

Conclusion

CD Projekt has laid the groundwork for a promising future by rehabilitating its image. The company’s relentless work to fix and even improve Cyberpunk 2077 will likely pay large dividends in future game sales. CD Projekt still has more room to grow at its current valuation of $2.87B, considering how other pure plays like Take-Two Interactive are valued. CD Projekt continues to grow its consumer base and will likely continue to break its own sales records with future releases.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here