With Celsius (NASDAQ:CELH) up strongly since I put a “Buy” rating on the stock in my initial write-up in February, I want to take a close look at the stock and its most recent earnings report.

Q1 Earnings

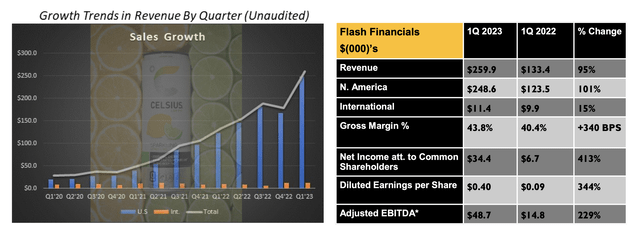

For the quarter, CELH recorded revenue of $260 million, a 95% increase versus a year ago. North American revenue soared 101% to $249 million, while international revenue increased 15% to $11.4 million. The consensus was for total sales of $219.6 million.

The company attributed the revenue growth to distribution increases, more SKUs per location, and increased days inventory outstanding at the mixing centers of its largest distributor PepsiCo (PEP). PEP increased its inventories by a between $20-25 million.

The company said that according to IRI, it was now the third-largest energy drink company in the U.S. with 7.5% share. That is more than double its 3.7% share a year ago.

ACV, or All Commodities Volumes, was 95.4% versus 69.5% a year ago. In the convenience channel, ACV was 93.4% versus 55.7% a year earlier.

Company Presentation

Discussing its results on its Q1 conference call, CEO John Fieldly said:

“We continue to see growth across all channels, including those non-tracked, with the Club channel sales totaling over $47 million for the quarter ending March 31, 2023, up 77% compared to $26 million in the first quarter of 2022. We also just hit a new record on Amazon. Celsius is now the second largest energy drink brand with a 19.1% share of the energy category as of the last 4-week period ending April 22, 2023 per stack line energy drink category total U.S. data. In addition, we continue to expand growth opportunities and non-tracked food service channels and are gaining more distribution in colleges, universities, hospitals, hotels, eateries and casinos and more. Overall, food service represented approximately about 10% of our PepsiCo revenues, and we see significant opportunities to scale and grow over time. We have been extremely happy with our PepsiCo partnership and see a long runway of growth ahead of us across a variety of channels, including expanding in retail, convenience, and foodservice. “

Gross margins improved 340 basis points to 43.8%. The company said the gains were from a reduced mix of international cans and cost savings initiatives. It said the improvement could have been higher if not for some inventory write-offs and increased freight expense as it moved its distribution over to PEP.

Adjusted EBITDA jumped 229% to $48.7 million. Adjusted EPS rose from 9 cents a year ago to 40 cents, a 344% increase. Analysts were looking for EPS of 19 cents.

The biggest opportunity for CELH I discussed in my original write-up was distribution gains from its new deal with PEP. The benefits of that increased distribution showed up quickly, with CELH reporting fabulous results across the board. While there was some transition costs in Q4 and Q1, overall there was very little disruption in the process of switching distributors.

The key for CELH in the deal was getting its ACV percentage up, which measures what percentage of the market that the company is able to reach through the stores it is in. Now the goal going forward will be increasing its SKU count a bit and most importantly increasing velocity, which is the speed at which the product sells at a store.

Outlook

CELH didn’t give any formal guidance. It said one of its biggest opportunities this year was gaining better placements in locations, especially more cooler placement. International, meanwhile, will be more about planning this year, with market launches rolling out in 2024.

Discussing its market share opportunity on its Q1 call, Fieldly said:

“Think we’ve just seen this ACV, we’re quite amazed with how quickly the ACV has come together at a 95%. Internally, we thought we were going to at least take potentially another 12 months, 18 months to get to that 95% ACV. Totally really give hats off to our sales team, our key accounts team, and also all our partners at Pepsi has done just an amazing job. I think they see the opportunity we have here with Celsius that is bringing in new consumers to the category. And I think when you look at it, we have a lot to learn over the next probably a quarter or 2 to see how this product, this portfolio performs in the channels that it’s expanded in, especially in the convenience channel so quickly. I think we’ll have a better view of that probably the end of next quarter and especially at the end of Q3. But when you look at the number of items per store, we’re at 13.6. When you look at some of the current velocity numbers we had on a per SKU item and you look at gaining 15 to 17 items per store by the end of the year, that’s potential, that gets you close to that 10% opportunity, 10% share in the category. We’re really excited to hit the 7.5% share most recently at the end of the first quarter, and there’s lots of opportunities ahead.”

CELH distribution gains since the PEP deal closed came more quickly than expected, which now turns the focus of velocity, or how quickly it can sell through its products at these new stores. The distribution gains are probably the easier part of the story, so it does get a little more difficult from here. However, the popularity of CELH’s products can’t be denied, so there is no reason to think that it won’t do well at this point. It’s a crowded market, but it’s been gaining a lot of share.

Valuation

CELH trades around 55x the 2023 consensus EBITDA of $178.4 million and over 36x the 2024 consensus of $269.5 million.

It trades at a forward PE of 89x the 2023 consensus of $1.40. Based on 2024 analyst estimates of $2.08, it trades at 60x.

CELH is projected to growth its revenue over 68.6% in 2023 and nearly 34% in 2024.

Comparatively, fellow energy drink maker MNST trades at nearly 27x 2023 EBITDA of $2.15B and a forward PE of 37.5x based on the 2023 consensus of $1.54. It’s expected to grow revenue nearly 13% in 2023.

Analyst estimates have gone up nicely since I last looked at CELH. Meanwhile, given where 2H estimates are, I think that with the quick distribution gains, that there is still plenty of opportunity for the company to surpass current analyst expectations for the year.

Conclusion

CELH’s results over the next couple of quarters should continue to be driven by the distribution gains from the PEP deal. After that, velocity and then international expansion will come much more into focus, as will adding SKUs. As the third-largest energy drink company by market share in the U.S., the company continues to have a nice opportunity to make in-roads into this growing market.

While its valuation is a bit pricey, the stock is unlikely to get cheap anytime soon given the opportunity ahead of it and its shown ability to execute. It feels like the company has found a nice niche in the energy market, and one that is much more appealing to young, female consumers. As such, I think investors should continue to ride this wave higher. I continue to rate CELH stock a “Buy.”

Read the full article here