Investment Thesis

Cemex, S.A.B. de C.V. (NYSE: CX) should benefit from pricing strategy, bolt-on acquisition, and relevant fiscal stimulus to generate increased revenue Y/Y in FY2023. However, the slowing in demand for the residential market should pose a headwind in the coming quarters. Moreover, I anticipate the margins of CX to improve in the coming future, thanks to its strategy which focuses on price hikes and operational efficiency. The company is currently trading at a discount to its 5-year average P/E ratio, making me give a buy rating on this stock.

Pricing Strategy

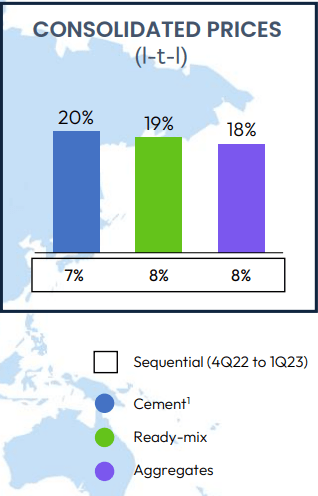

Over the last two years, Cemex witnessed higher input costs due to unprecedented inflation, resulting in lower profitability and margins. However, the company has recently introduced a strategy with the goal to recover its 2021 margins. This strategy involves raising prices in the coming quarters to more than compensate for the inflationary costs faced in the past two years. In line with the strategy, the company has increased consolidated prices for cement, ready-mix, and aggregates businesses by 18% Y/Y to 20% Y/Y during the first quarter of FY23. Therefore, I believe that the carryover impact of the recent price hike, combined with the strategy to further increase prices, should provide a growth boost for CX in the upcoming quarters.

Pricing momentum (Investor presentation)

Residential Market

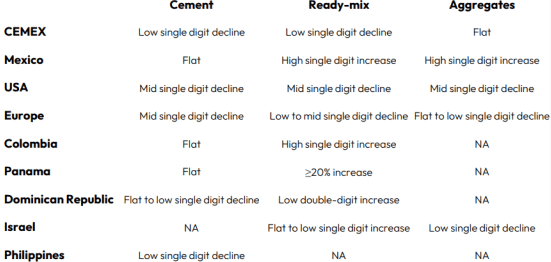

I anticipate that the residential market is expected to face challenges in FY2023 due to the high-interest rate in the market. Recently, Federal Reserve announced its 10th interest rate hike in just over a year which should further deteriorate potential buyers in making investments in the housing sector. Moreover, housing starts stood at a decline of approximately 17% Y/Y as of March 2023 which also indicates declining demand in the residential market in the coming quarters. This should result in a sales volume decline across the cement, ready-mix and aggregate business of Cemex in the coming quarters.

2023 expected volume outlook (Investor presentation )

Relevant Fiscal Stimulus

In my opinion, both Infrastructure Investment & Jobs Act (IIJA) and the CHIPS & Science Act should be supportive of the sales volume of Cemex in the coming quarters. Many companies involved in chip manufacturing have recognized the challenges posed by supply chain constraints and have therefore begun onshoring manufacturing facilities in the United States. To expedite the onshoring process, Federal Government has introduced the CHIPS & Science Act which allocates $52.7 billion for the American chip industry. For instance, spurred by the CHIPS Act, Micron (MU) has allocated $40 billion in chip manufacturing. Such investments in constructing new manufacturing facilities are expected to benefit Cemex throughout FY2023. Moreover, through IIJA, Federal Government has invested $110 billion of new funds for roads, bridges and other major projects. So, I believe the funds flowing from IIJA presents a promising growth opportunity for Cemex.

Long-Term Growth Opportunities

While the near-term outlook of the residential market looks a bit challenging, secular trends like underbuilt homes should drive growth in the long term. The current situation of underbuilt homes in the U.S. has created a need for an additional 17 million housing units to satisfy the rising demand which should be beneficial for the residential market in the future years. Furthermore, the management of CX anticipated £2 trillion in infrastructure spending in Europe in the coming years. This projection is rooted in the need to rebuild approximately 35 million buildings across Europe in order to achieve a reduction in CO2 emissions by 2030. Additionally, the management also expects substantial infrastructure investment of $1.6 trillion in the United States in the long term. Considering these factors, I firmly believe that CX is in a favourable position to capitalize on the emerging opportunities in the years ahead.

Bolt-on Acquisition

As of May 2023, the net leverage of the company stands at 2.62x, a sequential reduction of 0.22x. This indicates the company’s strong cash flow and solid balance sheet position. With its strong financial standing, I expect Cemex to continue pursuing its bolt-on acquisition strategy in the years ahead. Notably, Cemex recently completed the acquisition of Atlantic Minerals United in late April 2023. This acquisition is projected to increase the company’s US reserves by 20% and further enhance its presence in the aggregate market. As a result, I anticipate that the revenue generated from this recent acquisition should serve as a growth catalyst for Cemex in the coming quarters.

Margin Expansion

As previously explained in the article, Cemex has recently announced a strategy to recover 2021 margin levels. This should be driven by favourable price/cost and operational efficiency. The unprecedented cost inflation over the last two years has negatively impacted the margins. However, the management has started to see signs of easing cost inflation. For example, fuel prices have already reached their peaks and started to decline now. Even if inflation persists in the coming quarter, particularly with regard to high raw material and electricity costs, the management aims to increase prices to more than offset the higher input cost. This should result in favourable price/cost and should be accretive to the overall margins of CX in the coming quarters.

Valuation

Cemex is currently trading at a 10.64x FY2023 consensus EPS estimate of $0.62 and a 9.62x FY2024 consensus EPS estimate of $0.69. It is worth noting that these valuations represent a substantial discount of approximately 50% to its 5-year average P/E ratio of 21.15x. Furthermore, in comparison to the sector median of 13.02x, the company is trading at a discount of roughly 19%.

Risk

My thesis is built upon the assumption that there should be a decline in CEMEX’s sales volume, ranging between low-single digits to mid-single digits. However, it is important to consider the possibility that if the residential market experiences more severe challenges than anticipated, it could have an additional detrimental effect on CEMEX’s sales volume and stock performance.

Conclusion

Cemex is trading at a discount to its historical levels due to the anticipation of a decline in its sales volume in FY2023. However, I am of the opinion that CX should sail smoothly throughout FY2023 thanks to the benefits of pricing strategy, relevant fiscal stimulus, and recent acquisition. Moreover, I believe in the company to capture value-driven opportunities in the long term. Therefore, I recommend a buy rating on CX stock.

Read the full article here