The United States economy doesn’t appear to be responding to the Fed’s rate hikes, which I believe is an unsustainable trajectory in the medium term. Growth securities outperformed value securities as well as income securities in the first half of the year. Such performance was primarily fueled by big technology and artificial intelligence (AI), which I believe is due for a correction. Going into the second half of the year, I believe dividends to be a safer bet than growth. When faced with the decision of growth and income going into the second half of 2023, I believe the Capital Group Dividend Value ETF (NYSEARCA:CGDV) could be a quality pick. I rate this ETF a Buy.

Though personal spending and income improved recently, the Federal Reserve is still planning on hiking more before the end of the year. Too few investors may be pricing this into their decisions, which I believe could age poorly. Inflation remains high and continues to erode the spending power of many individuals’ savings. Therefore, dividends may have a silver lining as they provide a relatively stable source of income that is not directly tied to inflation. Furthermore, CGDV dabbles mainly in large, established, blue chip stocks with histories of growing and maintaining their dividends.

Strategy and Holdings Analysis

CGDV tracks the Capital Group Dividend Value Index and uses a fundamental analysis technique. This ETF’s managers analyze the relative performance, competitive standing, and future growth prospects of contending stocks. CGDV is also actively managed.

Stocks selected must have a market capitalization of at least $5 billion and a yield of no less than 1%. Such companies must have increased their dividends for at least 3 of the past 5 years, with also a maximum dividend payout ratio of 60%. This ETF’s benchmark index has averaged a dividend growth rate of 5.12% during the past 10 years. CGDV is rebalanced quarterly and also offers a dividend reinvestment plan (DRIP), allowing investors to immediately reinvest their dividend earnings into additional shares of this ETF.

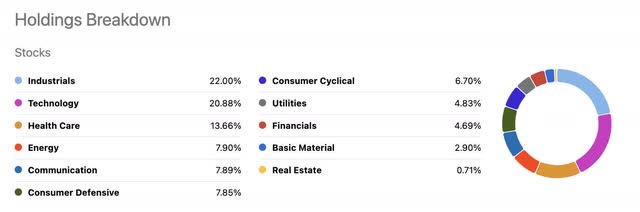

This ETF invests in stocks within many sectors, the most represented being industrials, which account for just under a quarter of this ETF. The top three sectors in this ETF also account for just over half of this ETF’s total sector composition, as seen below.

Seeking Alpha

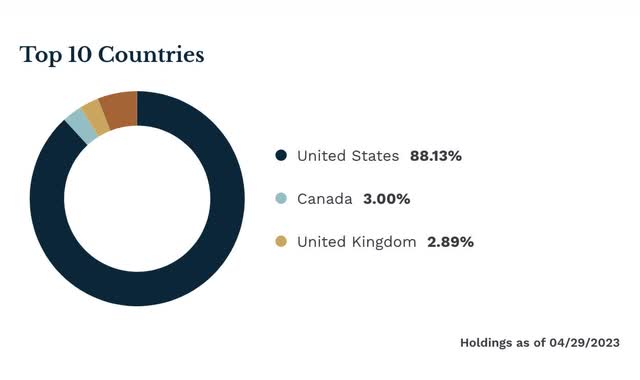

CGDV’s holdings lie mainly within the United States, which much smaller representations from both Canada and the United Kingdom.

etf.com

The top 10 holdings in this ETF account for just under 45% of the total fund, which consists of just over 50 securities. Additionally, the top five holdings alone comprise roughly a quarter of CGDV. This both aids this ETF’s transparency and creates concentration risk, the threats, and opportunities of which should be assessed by investors beforehand.

Seeking Alpha

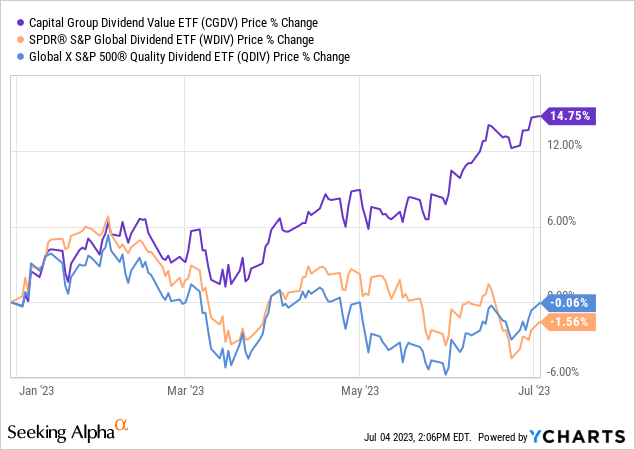

Relative Performance: CGDV may have more muscle than its peers

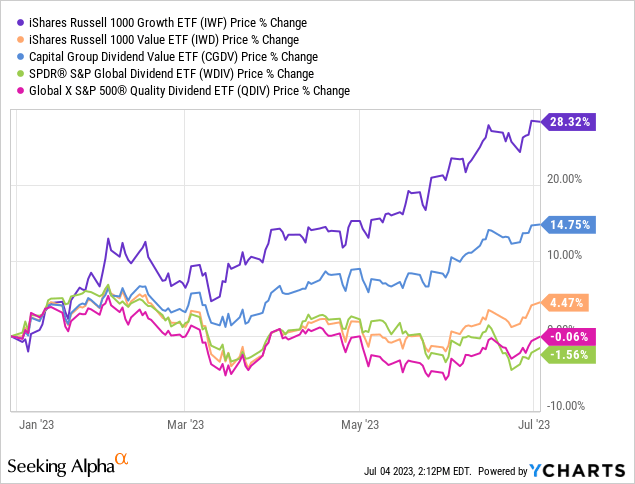

CGDV’s performance appears much stronger than its potential alternatives when looking at this ETF’s performance so far this year. I believe CGDV has more upside compared to its peers.

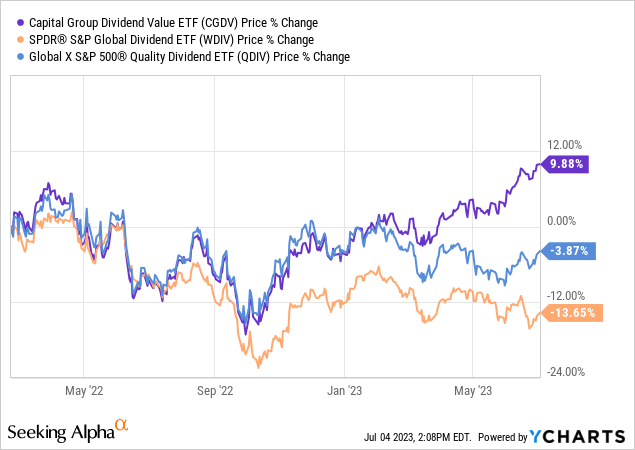

A similar case appears when looking back three years, as this ETF’s growth aspect has served it quite well. CGDV also exhibits smaller price fluctuations than both the Global X S&P 500 Quality Dividend ETF (QDIV) and SPDR S&P Global Dividend ETF (WDIV), making both relative stability and momentum a plus in this ETF.

Broadcom and Microsoft: Top holdings in CGDV and quality picks for 2023 and beyond

Broadcom (AVGO) and Microsoft (MSFT) together comprise almost 15% of CGDV and have not failed to make headlines and gain momentum this year. Aside from these companies’ publicity, I believe they’re strong at the core and offer a powerful growth aspect on top of this ETF’s strong dividend focus.

Broadcom

Broadcom made headlines in May after entering a deal with Apple (AAPL) to use United States-manufactured chips in its operations. This deal is expected to close in the second half of the year. Broadcom started the year strong and reached new heights at this deal’s announcement.

TradingView

In the medium to long term, I believe Broadcom could establish a significantly larger presence in the United States’ growing semiconductor market, which could do quite well for this company’s stock as well as CGDV. This could also help Broadcom’s business by helping this company secure a long-term supply of chips as well as win government contracts as semiconductor production becomes a greater priority on a federal level.

Microsoft

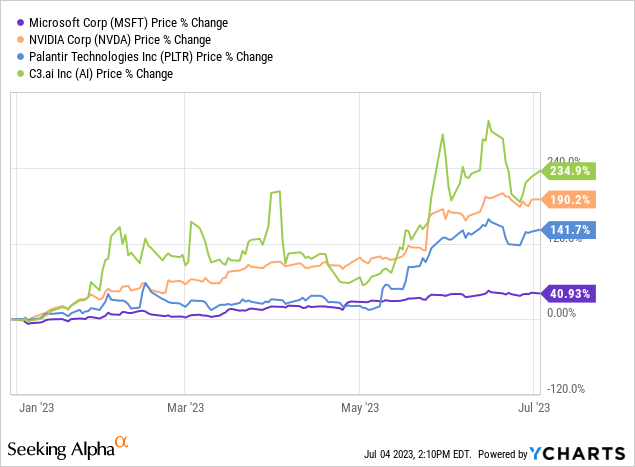

Microsoft remains one of the leaders in the artificial intelligence rally which is partially fueled by speculation and fear of missing out (FOMO) regarding this revolutionary system. However, I believe Microsoft to be a higher-quality blend of long-term growth and income compared to other AI players like NVIDIA (NVDA), Palantir (PLTR), and C3.ai (AI).

Though Microsoft is still somewhat overvalued as it trades at roughly 36x earnings, I believe this blue-chip giant’s performance will age better than that of its more AI-powered peers. In the end, I think Microsoft will generously contribute to CGDV’s momentum in the long term.

Where I could be wrong: Growth stocks’ strong entrance into Q3

Persistently high inflation and a hawkish Fed typically provide growth securities with an uphill battle. However, despite recession fears and persistent rate hikes during the first half of the year, growth stocks soared above value stocks. As seen below, the iShares Russell 1000 Growth ETF (IWF) accelerated past the iShares Russell 1000 Value ETF (IWD) beginning in January and is going into the second half of the year with a full head of steam.

CGDW fell between IWF and IWD, with WDIV and QDIV doing the worst. Dividends could be a rather safe bet going into the second half of the year where conditions might not favor growth. However, such conditions might also fail to warrant any response from consumers as they did in the first half of 2023. In this case, CGDV buyers could experience FOMO versus if they invested in IWF, even though conditions deemed it risky.

Conclusion

Though growth stocks’ momentum is yet to cease going into Q3, I’m still skeptical of this rally’s sustainability. That being said, I would not be surprised if more investors turned to dividends, especially if growth finally started to dwindle at the hands of the Federal Reserve. CGDV could serve as an effective hybrid for capitalizing on both growth and income during this fork in the road. I rate this ETF a Buy.

Read the full article here