At the beginning of this year, we said that the Fed would move to 5% on the overnight rate and sit tight for the remainder of the year as we navigate the uncertainty of the economic environment. It’s been a bumpy road along the way with the bank failures and disinflation, but the more recent economic data points to the Fed remaining “higher for longer”. While our base case is a “muddle through” economy for the next few years the “higher for longer” case exacerbates the risks of some of the outlier scenarios because it forces more firms and households to adjust to the new high rate environment. For instance, firms with a low cost of capital are now being forced to renew contracts at these higher costs. And the longer this goes on the more this impacts more debt contracts. This is one of the primary reasons Monetary Policy has famous lags – it takes time for debt contracts to renew and rollover. Credit doesn’t tighten overnight because most debt contracts aren’t overnight contracts.

This creates a lot of uncertainty for aggressive investors because it means that the next few years are fraught with credit risk. This means stocks and corporate bonds are likely to be riskier than they are on average. So, even if you have a long investment time horizon the near-term is loaded with unusual credit risk because the Fed’s been so aggressive and wants to tighten credit. That’s the bad news about higher for longer.

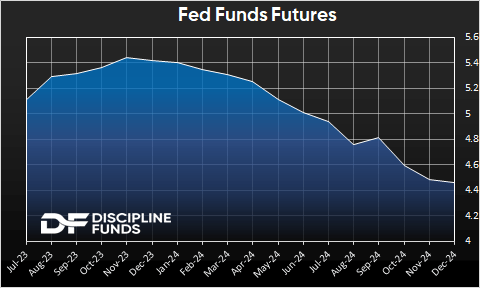

The good news about higher for longer is that conservative investors are having a field day with cash. We haven’t seen 6-month T-Bills at 5.5% for 20 years. You can build a 3/6/9/12 month ladder of T-Bills right now with an average yield of 5.51% with no state taxes. This will beat virtually any conservative high-yield savings account, especially after taxes and fees. And the really good news about “higher for longer” is that Fed Funds Futures are now forecasting little/no change in interest rates until almost halfway through 2024. In other words, if you build a T-Bill ladder today you have a very high probability of being able to lock in 18 months of 5% returns with no principal risk. That’s one heck of a good deal if you need liquidity and certainty in the coming years.

NB – People sometimes ask us about the real inflation-adjusted returns on T-Bills. I don’t like to view T-Bills and bonds as inflation protection instruments. Bonds are specifically principal hedges. They give you the certainty of principle over very specific time periods. That’s a crucial element of our All Duration strategy. Instruments like stocks are very long-duration instruments. They give you very little short-term principal certainty, but very high long-term purchasing power protection. Cash and T-Bills are the opposite. They give you very little purchasing power protection, but very high principal certainty.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here