Chimera Investment Corporation (NYSE:CIM) is a New York REIT focusing on residential credit investments, especially mortgage loans and related securities. CIM was founded in 1994, with its IPO in November 2007. CIM operates on a blend of debt and equity to optimize returns and manage risks. The company has to navigate a changing market affected by inflation, fixed-rate mortgages, and the hikes of the FED’s interest rates. Ultimately, CIM’s valuation equation comes down to how much it returns to investors as dividends. The current 8.87% yield is undoubtedly attractive. However, in my valuation analysis, I believe CIM’s loan portfolio remains challenged and could only be a good investment for investors with an improving macroeconomic view. Moreover, I anticipate margin headwinds as well. Thus, it’s prudent to rate CIM a “hold” despite the seemingly attractive dividend yield.

A Residential Operation: Business Overview

Chimera Investment Corporation is a Real Estate Investment Trust [REIT] that invests in residential credit, such as mortgage loans and related securities. Its mission is to give investors high returns while carefully managing the associated risks. CIM was founded in 1994, and it had its IPO in November 2007. The company is based in New York. CIM’s business model uses debt and capital to fund assets to increase returns and manage the associated risks. Unlike traditional REITs, CIM doesn’t focus on owning the properties but owns mortgages related to different real estate types. This is typically a highly lucrative business as mortgages offer above-average returns, though it’s a highly cyclical venture and sensitive to macroeconomic factors. CIM’s strategy is to use the company’s capital to fund residential mortgage loans for individuals purchasing homes with non-recourse repo financing to manage its risk and cash flow exposure.

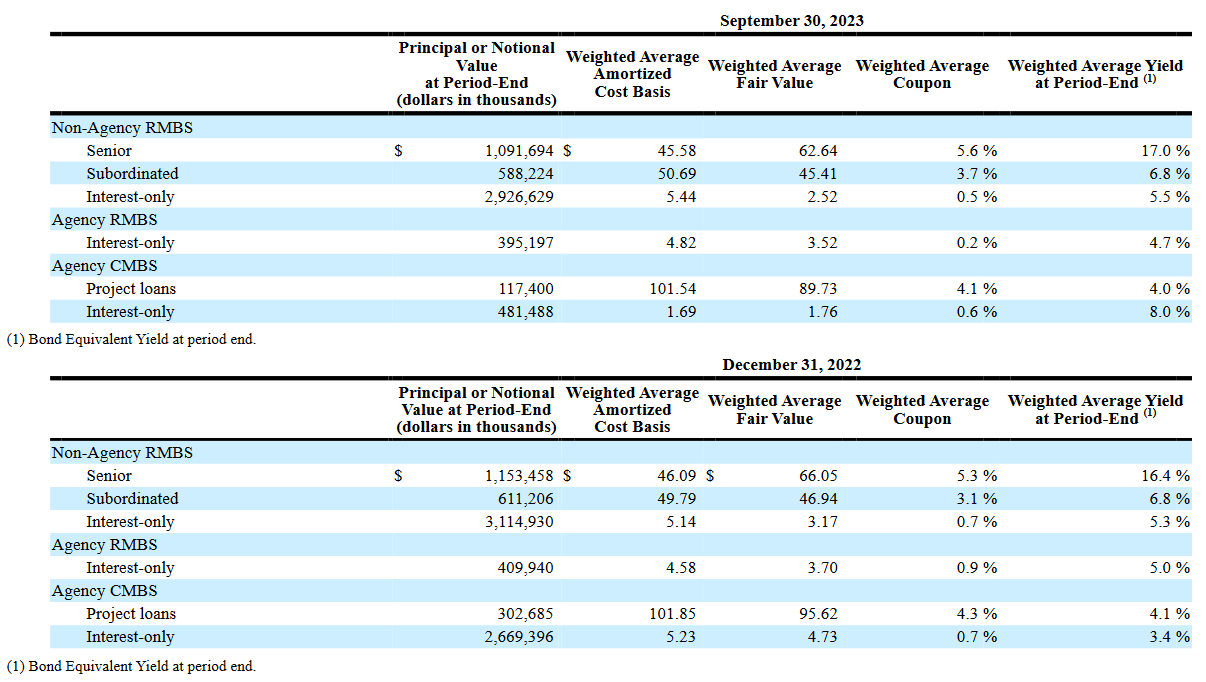

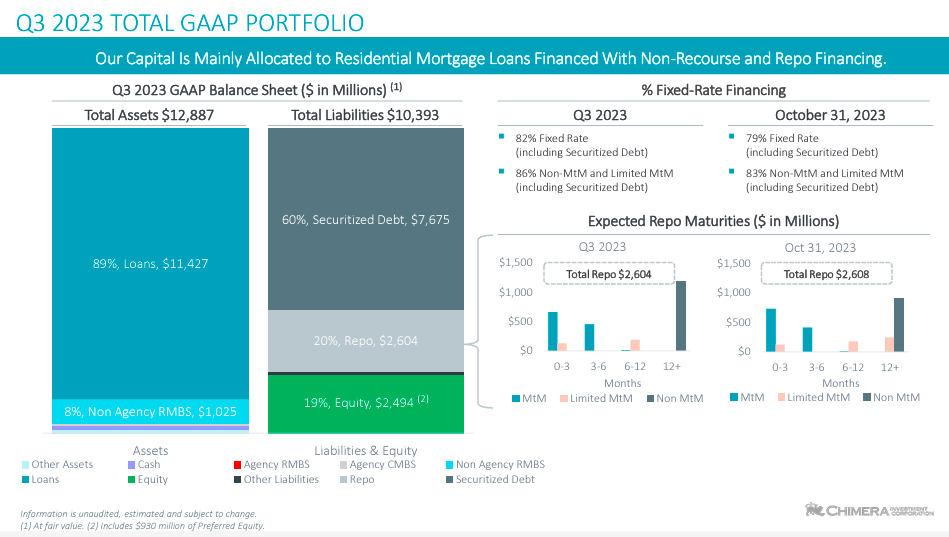

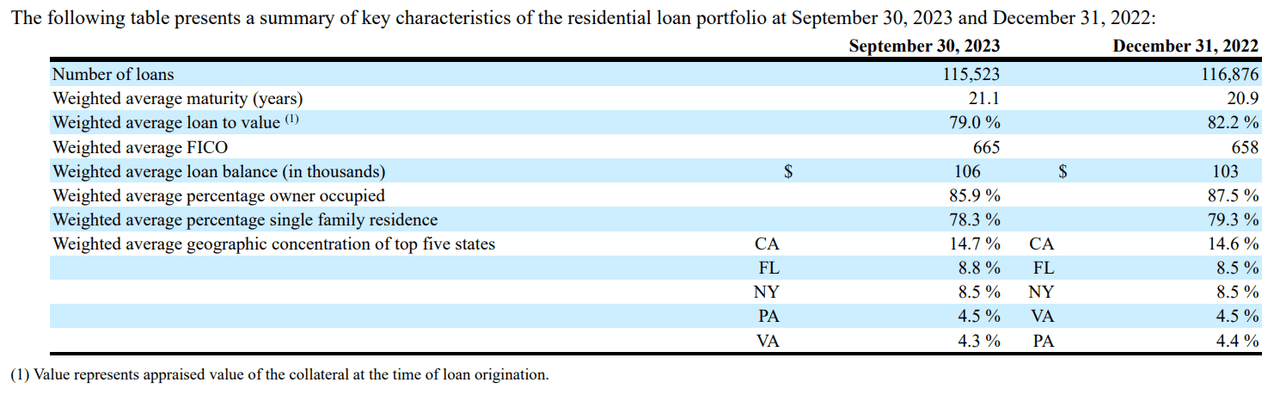

As of September 30, 2023, CIM’s equity capital is approximately $2.5 billion, including roughly $1.6 billion in common stock and $930 million in preferred stock. CIM’s portfolio consisted of an unpaid balance of $12.2 billion formed by 116,000 individual mortgage loans with an average size of $106,000 and a weighted average coupon of interest of 5.96% with an average loan age of approximately 15 years. However, the weighted average YTM of CIM’s portfolio remains significantly higher, as shown in the figure below.

Source: CIM’s latest 10-Q report.

CIM’s primary income source is the net spread between the income earned on its assets minus the financing and hedging costs to counteract potential losses for financial risks. As of the same date, the company has completed 104 security transactions with $52 billion in mortgage assets. Moreover, CIM holds roughly $12.9 billion in mostly mortgage-related assets, except its cash reserves of $138.6 million. To finance this, CIM has $10.4 billion in liabilities. CIM uses securitization to fund acquisitions and manage risks, improving its portfolio’s liquidity.

CIM’s 2023 Maneuvers: Challenges and Opportunities

The CIM’s 2023 activity for the nine months ended on September 30, 2023, presents highlights toward managing and optimizing the mortgage loan portfolio, leveraging securitization, and implementing hedging to mitigate risks. In this sense, it is the acquisition of $1.3 billion in residential mortgage loans, the securitization of $841 million in Seasoned RPLs, and $475 million in Non-QM investor loans. Moreover, CIM also decreased the recourse leverage from 1.3x in Q4 2022 to 1.0x. CIM also protects about 53% of its floating rate liabilities using interest rate swaps with a fund of $1.5 billion, providing flexibility for a scenario where the interest rates could remain high for an extended time.

Source: Investor Presentation, November 02, 2023.

In the news, some developments from October to November that negatively and positively affected CIM’s stock were presented. On October 18, 2023, the 30-year fixed-rate mortgage reached 8.0%, the highest value in 23 years, with a notable impact on mortgage REITs such as CIM, with declines ranging from 4.1% to 5.4% in its stock.

Afterward, on November 2, 2023, the CIM stock had a 5.9% reduction after cutting dividends by more than a third after the Q3 earnings fell short of expectations, from $0.18 per share to just $0.11. At the end of Q3, the cash position fell to $121 million from $139 million, and its unencumbered assets fell to $380 million from $476 million.

Source: Company website.

On November 14, 2023, the stocks related to homebuilding, including CIM’s, increased in value due to the investor optimism that brought the news from the Consumer Price Index [CPI] report that indicates a probable reduction of the inflation rates leading to the possibility of rate reduction by the Federal Reserve.

A Mixed Bag: Valuation Analysis

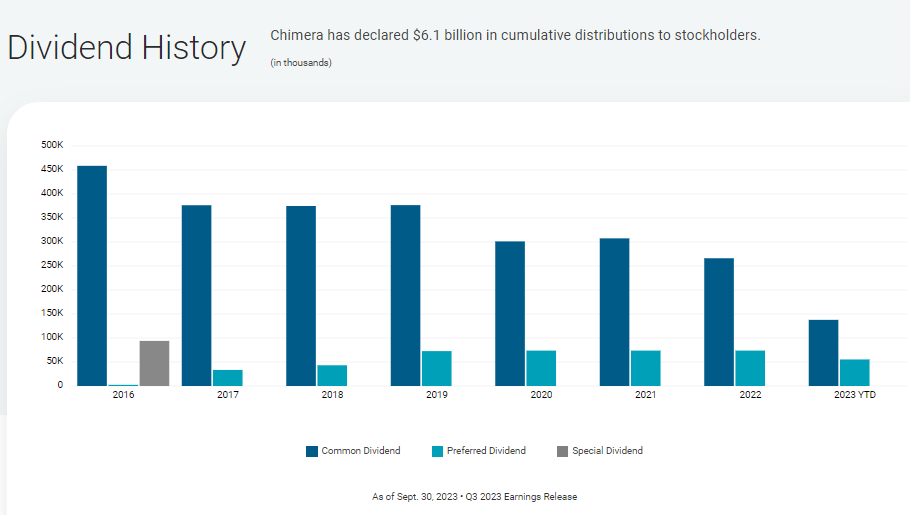

CIM has declared $6.1 billion in cumulative dividend distributions to stockholders. This figure shows why mortgage-backed securities are so attractive from an investment perspective. The power of high yields over time quickly compounds into relatively safe returns as long as the investment portfolio is healthy. 2008 was a reminder that high yields come with risks, and sometimes, such risks can result in total capital loss. Today, it’s no different. Mortgages offer high rates precisely because macroeconomic conditions suggest tough times lie ahead in residential and commercial properties. Still, it’s worth noting that commercial real estate is likely the gloomiest part of the sector at this time, and CIM has relatively low exposure to these.

Source: CIM’s latest 10-Q report.

In fact, as of the latest quarterly information, 91% of CIM’s total interest-earning assets are residential mortgage loans, and 8% are non-agency RMBS. Therefore, it’s safe to say that CIM is mostly exposed to the residential side of real estate. Interestingly, most of these mortgages have FICO scores 665, which falls into the “fair” range and usually has an APR of roughly 7.064%.

On the other side of the equation, CIM finances its operations via securitized debt collateralized by Non-Agency MBS and the securitization of its loan portfolio. The rate CIM can get varies depending on the duration and collateral, but looking at the latest 10-Q, a good referential rate is its weighted average borrowing rate of 7.99%. This means that the spread from which CIM is supposed to profit is essentially inverted now, aligning with its recent contraction of profit margins. This doesn’t mean CIM suddenly becomes structurally unprofitable, but it does illustrate that CIM’s margins are facing substantial headwinds now. I believe this situation will likely persist for the foreseeable future until easier economic conditions arise.

CIM’s 8.87% dividend yield is undoubtedly attractive. If you believe easier economic conditions are imminent, then locking in CIM’s yield of 8.87% could make sense. However, worsening economic conditions would only exacerbate CIM’s headwinds. Thus, CIM is a relatively high-risk, high-reward kind of REIT. But on balance, given the ongoing macroeconomic headwinds and the challenged margins, I think it’s best to err on the side of caution and rate CIM a “hold” at these levels.

Source: TradingView.

Conclusion

Overall, CIM is a particularly interesting REIT, mostly due to its concentration on residential exposure in its portfolio. Its dividend yield is likely the single most compelling feature of CIM, which could be an attractive investment for more speculative investors with a favorable long-term macroeconomic view. However, ignoring CIM’s ongoing challenges is difficult, so I think it’s prudent to rate CIM a “hold” for now.

Read the full article here