Introduction

Generally speaking, I am not a big fan of restaurant stocks, which explains why I have never discussed Chipotle Mexican Grill (NYSE:CMG) on Seeking Alpha or anywhere else.

What has kept me from buying restaurant stocks is my focus on wide-moat businesses. More often than not, restaurants are exposed to severe competition on top of the usual economic risks like consumer health and input inflation.

According to BinWise (emphasis added):

Approximately 60% of restaurants fail within the first year of operation and 80% fail within the first five years.

These numbers may seem off-putting, but the remaining 20% of restaurants go on to find long-term growth and success.

Apparently, eight out of ten restaurants fail within five years!

This is caused by factors like bad locations, inexperienced management and employees, inflated costs, pricing problems, a lack of marketing, and disorganization, which is related to inexperience.

Having that said, if we focus on the 20% of successful players, we can buy some real gems.

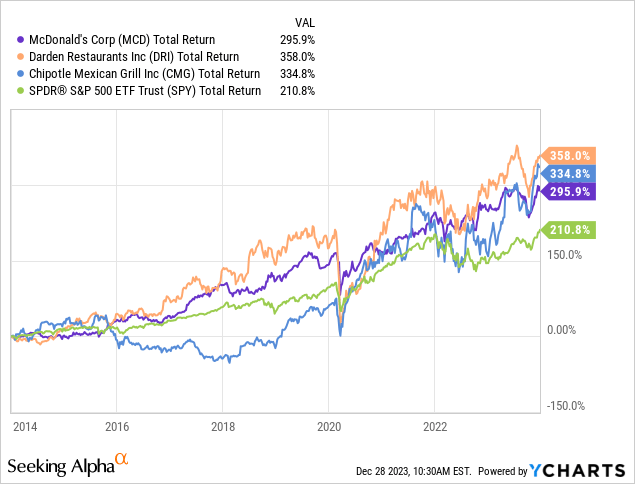

The three best that come to mind are McDonald’s (MCD), Darden Restaurants (DRI), which owns a wide variety of brands, and Chipotle, the star of this article.

Every single one of these players has outperformed the S&P 500 over the past ten years.

The reason I decided to cover Chipotle is because I have put some time into understanding its business model. Like McDonald’s, it reminds me a bit of a “utility.”

By that, I mean they are everywhere, and customers know what they can expect when they set foot in one of their restaurants.

This is the perfect basis to build a successful global expansion that could potentially lead to elevated future gains on top of the 24% annual gains investors have enjoyed since the company’s IPO in 2007.

So, let’s dive into the details!

What Makes Chipotle So Unique?

Founded in 1993 in Denver, Colorado, Chipotle started this year with more than 3,100 owned and operated restaurants in the United States and slightly more than 50 international locations.

On a side note, this shows that Chipotle is still a very U.S.-focused business, which, I believe, makes sense, as the popularity of Mexican food varies per region. McDonald’s and Domino’s (DPZ), to name another successful operator, have food items that are much easier to scale globally.

Nonetheless, that’s not necessarily a bad thing. It’s like saying, “Ferrari (RACE) has a model that is hard to scale as the average consumer cannot afford it.“

With that in mind, Chipotle’s mission revolves around “Cultivating a Better World,” focusing on five key strategies:

- Running Successful Restaurants: Emphasizing a people-accountable culture for Food With Integrity and delivering exceptional in-restaurant and digital experiences.

- World Class People Leadership: Developing and retaining diverse talent at all levels.

- Technology and Innovation: Amplifying digital growth and productivity through technology and innovation.

- Brand Visibility and Love: Enhancing overall guest engagement by making the brand visible, relevant, and loved.

- Access and Convenience: Accelerating new restaurant openings to expand access and convenience.

Although Chipotle is far from cheap, it knows it can charge better prices, as it is positioning itself as a place for better fast food, to put it bluntly.

Essentially, Chipotle emphasizes serving high-quality, responsibly raised meats and responsibly grown produce.

According to the company, its commitment to sustainability and animal welfare is evident in its “Responsibly Raised” branding for meats.

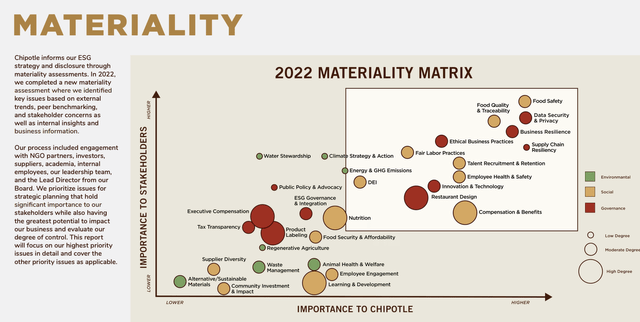

On its website, it has a very long sustainability report, which includes charts like the one below, which explain how the company addresses key sustainability issues while satisfying as many stakeholders as possible.

Chipotle Mexican Grill

To satisfy the demand of its restaurants, the company operates 26 regional distribution centers while carefully selecting suppliers based on quality, price, and adherence to Food With Integrity standards.

With that in mind, scaling any business nowadays involves technology.

The company has enhanced digital capabilities, including the digitization of restaurant kitchens, expanded partnerships with third-party delivery services, and the introduction of Chipotlanes for customer pick-up.

What Is Chipotle Up to And What Does It Mean For Shareholders?

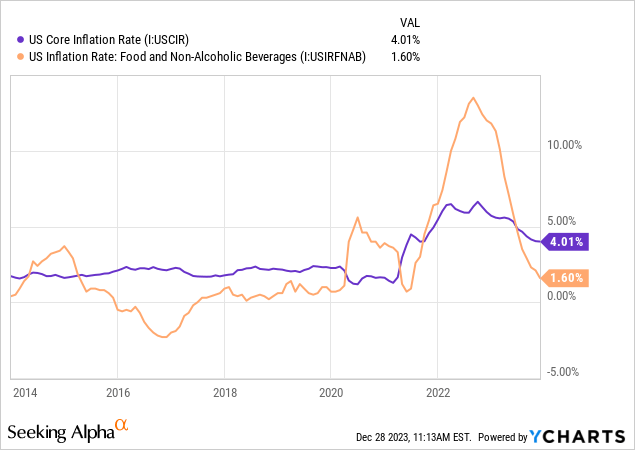

As almost everyone knows (and feels), inflation is still an issue. Although inflation rates have come down, core inflation is still at 4.0%, twice the Fed’s 2.0% inflation target.

Furthermore, while food inflation is down to 1.6%, that’s on top of double-digit in 2022, which explains why so many people are struggling with expensive groceries and food in general.

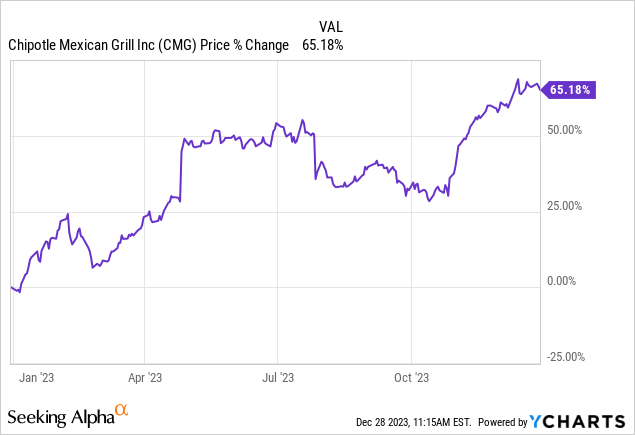

Despite general weakness in consumer sentiment, CMG shares are doing well.

Year-to-date, CMG shares are up 65%, making it one of the best performers on the market.

The company’s results confirm this.

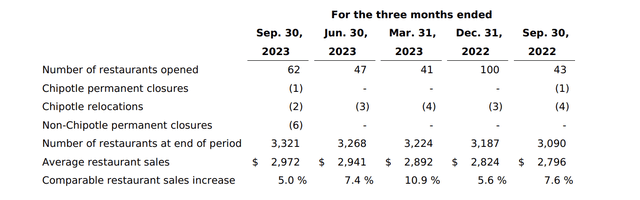

- Sales in the third quarter grew over 11% year-over-year to reach $2.5 billion.

- Comparable sales increased by 5%, driven by a 4% growth in transactions.

- The restaurant-level margin was 26.3%, up about 100 basis points from last year.

Earnings per share, adjusted for unusual items, were $11.36, representing a 19% year-over-year growth. The third quarter incurred $1 million in unusual expenses related to corporate restructuring.

One driver of EPS growth was cost control.

The cost of sales in the quarter was 29.7%, a decrease of about ten basis points from last year. Menu price increases benefited, but inflation in food costs, particularly beef and queso, offset some of those gains. Q4 cost of sales is expected to be around 30%.

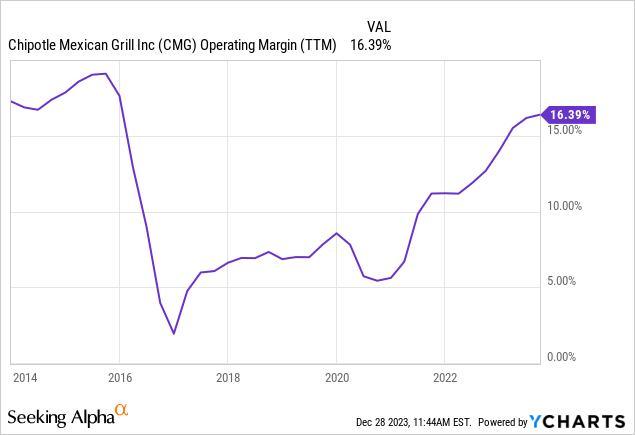

Looking at the chart below, we see that the company has considerably grown its operating margins over the past few years.

It is also expanding its footprint.

In Q3, 62 new restaurants were opened, with 54 featuring Chipotlanes.

The company remains on track to open between 255 to 285 new restaurants this year and plans to open between 285 and 315 new restaurants in 2024, with at least 80% having drive-through capabilities.

While permitting and inspection delays are impacting the timeline, the company aims to approach 10% new restaurant openings by 2025.

Chipotle Mexican Grill

Its expansion plans also include a bigger focus on smaller parts of the U.S., which are underrepresented markets, so to speak.

Wall Street Journal

As reported by the Wall Street Journal (note the comments regarding its distribution network, which I briefly mentioned as well):

Chipotle is reaching into some cities far from any of its existing locations, along with places with roughly 10,000 residents, such as Newton, N.J., and Covington, La. Attracting a Chipotle can boost towns’ broader development and brings an amenity that caters particularly to younger residents, local officials said.

[…] Chipotle relies on fresh food in its restaurants, which has sometimes led to outages of ingredients, the company said. Stretching into new terrain could lead to supply challenges and costs, though Chipotle likely has enough sway with its distributors to mitigate interruptions, said Bob Goldin, co-founder of the food-industry consulting firm Pentallect.

Based on this context, Chipotle introduced two key initiatives to enhance throughput.

The first involves adjusting the cadence of digital orders to better balance labor deployment.

The second is a renewed focus on throughput training in restaurants.

According to the company, positive feedback indicates that these initiatives are improving the number of entrees served during peak periods.

Furthermore, with regard to the aforementioned strategy to improve brand awareness and “love,” the company’s marketing efforts focused on achieving exactly that.

For example, the reintroduction of the carne asada limited-time offer received an enthusiastic response.

The company also engaged in sports partnerships, leveraging the Real Food for Real Athletes platform. Creative gaming integrations, such as the Chipotle IQ digital trivia game, were utilized to connect with fans.

Additionally, progress was reported on the development of an automated digital makeline tested at the cultivate center.

Partnerships with Hyphen and Autocado aim to increase capacity, speed, and accuracy in food preparation. While still in the testing phase, these innovations could contribute to a more efficient and balanced operation between the front and digital makelines.

It also has a healthy balance sheet, which is expected to end up with $700 million in net cash at the end of this year. This means the company has more cash than gross debt.

On a side note, and with regard to its partnerships and technology implementation, CMG founder Steve Ells is known for combining restaurant niches with advanced technology/services.

He’s currently in the process of growing his new business called Kernel, which focuses on meat-free sandwiches, salads, and related.

I will keep a close eye on that, as I’m curious how he is going to grow a business in an even tougher niche: vegetarian/vegan.

Valuation

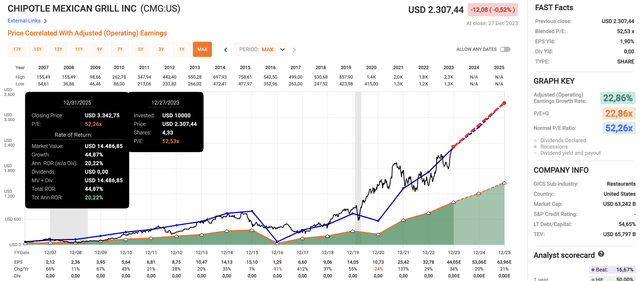

In this article, I mentioned that CMG shares have returned 24% per year since the IPO. Odds are that elevated total returns continue.

Using the data in the chart below:

- CMG is currently trading at a blended P/E ratio of 52.5x.

- Its long-term normalized P/E ratio is 52.3x.

- This may be an “elevated” P/E ratio. However, this year, the company is expected to grow EPS by 34%, followed by 20% potential growth in 2024 and 21% growth in 2025.

- These numbers warrant an elevated P/E ratio and could suggest 20%ish annual returns if the company maintains its current valuation.

FAST Graphs

I’m obviously not promising that this will happen, as macroeconomic developments could impact both growth expectations and investors’ willingness to apply elevated multiples.

However, the stock remains in a great spot to continue generating elevated returns, even if investors start to slowly adjust the valuation multiple to the low-40x range over time.

Going forward, I would like to own CMG. I just haven’t figured out how a non-dividend payer fits into my strategy, especially in light of my focus on companies that operate higher up the supply chain.

Nonetheless, the takeaway here is that I expect CMG’s recipe for success to do its job for many more years, potentially leading to elevated returns for investors.

Takeaway

Despite my usual reservations about restaurant stocks, CMG stands out with its successful model akin to a “utility.” The commitment to sustainability, responsible sourcing, and technology integration positions it as a leader backed by solid results.

The recent financial performance is impressive, with shares up 65% year-to-date, reflecting robust sales growth, expanding margins, and strategic expansion plans.

Despite a seemingly elevated P/E ratio, CMG’s expected EPS growth suggests continued potential for investors.

While I’m yet to incorporate a non-dividend payer into my strategy, the takeaway is clear—CMG’s recipe for success could yield elevated returns for years to come.

Read the full article here