Synopsis

Choice Hotels International (NYSE:CHH) is a company that is known for its portfolio of diverse brands that caters to a wide variety of market segments, from upscale to economy. It operates in the hotel and resort industry.

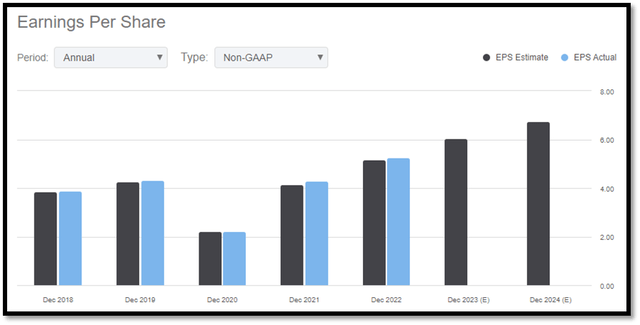

CHH’s historical financial results have shown robust revenue growth and recovery from the COVID-19 impact. In addition, margins have expanded over the years. As a result, both diluted EPS and dividends have grown annually. Its 3Q23 earnings results also share the same sentiment, as it continues to report robust revenue growth. 3Q23 margins were temporarily impacted by one-time expenses, which I do not anticipate will have a long-term impact on future margins.

CHH is actively and aggressively expanding its market share through new openings, strategic partnerships, and acquisitions in order to capture market share in the growing global hotel market. In my valuation model, which utilizes a conservative P/E ratio, it still shows double-digit upside potential in its share price. Given all the tailwinds, I am recommending a buy rating for CHH.

Historical Financial Analysis

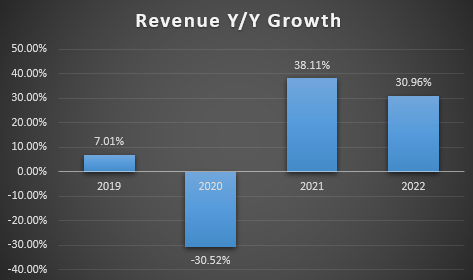

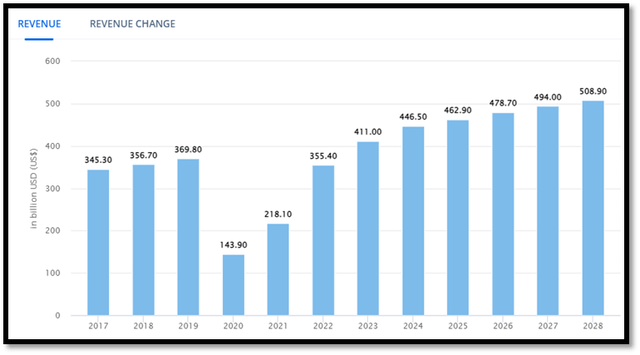

Over the last four years, CHH’s revenue growth has shown strong growth and recovery. In 2019, it grew 7.01%, while 2020 suffered a decline of -30.52%, mainly due to the negative impact of COVID-19, which severely affected the tourism and hospitality industries in which CHH operates. In 2021 and 2022, it reported strong double-digit growth rates as the pandemic eased and borders around the world started to open.

Author’s Chart

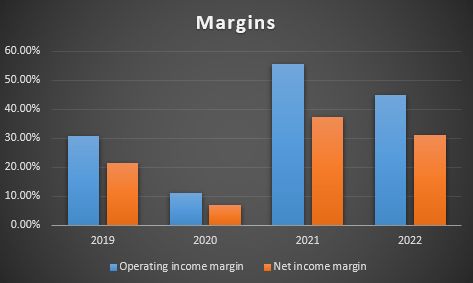

In terms of profitability, both its operating income margin [OIM] and net income margin [NIM] have expanded significantly over the last 4 years. In 2019, OIM reported 30.60%, and it has expanded to 44.77% in 2022. For its NIM, it was 21.41% in 2019 and has expanded to 31.07% in 2022.

Author’s Chart

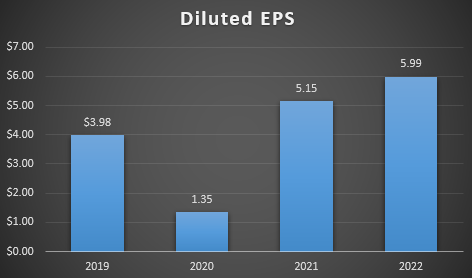

As a result of its strong revenue growth and robust margin expansion, CHH was able to consistently grow its diluted EPS throughout the years. In 2019, it was $3.98, and it has grown to $5.99 in 2022. This represents a growth rate of ~50%.

Author’s Chart

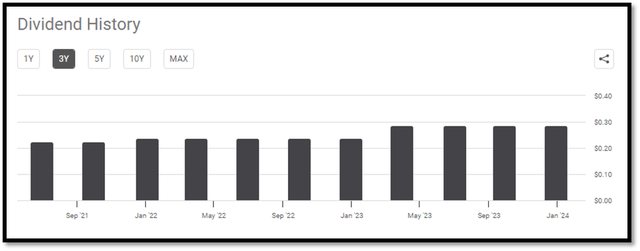

In addition to solid diluted EPS growth as a result of its robust financial performance, CHH was able to grow its dividend. Its quarterly dividend grew from $0.23 per share to $0.29 per share over the last 4 years.

Seeking Alpha

Analyzing CHH’s 3Q23 Earnings Results

CHH reported strong 3Q23 earnings results. Its total revenue for the quarter grew 3% year-over-year to ~$425 million. If excluding reimbursable revenue, it reported a year-over-year growth of 9%, which shows that the core revenue growth of the company is still robust. Management attributed the strong growth to effective royalty rate growth and the successful integration of Radisson Americas.

CHH completed the acquisition of Radisson Americas in August 2022. This acquisition added ~67,000 rooms for CHH and expanded its market presence in the higher revenue full-service segment. In addition, it also strengthened its core midscale hospitality segment. Through this acquisition, it added nine more brands to CHH’s portfolio.

Moving onto profitability, its 3Q23 net income fell 11% year-on-year to $92 million. Management stated that the decrease in net income was due to a one-time expense resulting from the Radisson Americas acquisition as well as one-time termination fees. As a result, diluted EPS also decreased 2% year-over-year. On an adjusted basis, net income grew year-over-year by ~6% and diluted EPS grew ~17%.

On a 9-month basis [9M23], its adjusted revenue grew ~21% year over year, reflecting strong growth in its core revenue. In terms of adjusted net income, it grew ~6.3%, in line with 3Q23 growth. Lastly, adjusted EPS grew ~16% as well.

Strong Growth in Global Hotel Market and Stable ARPU

Based on the following chart, the global hotel market is anticipated to continue growing until 2028 with a CAGR of ~3.3%. In 2022, the global hotel market was valued at $355 billion, and it is expected to reach $508 billion by 2028. Therefore, the strong growth in this market will give CHH the tailwind to drive its future revenue higher.

Statista

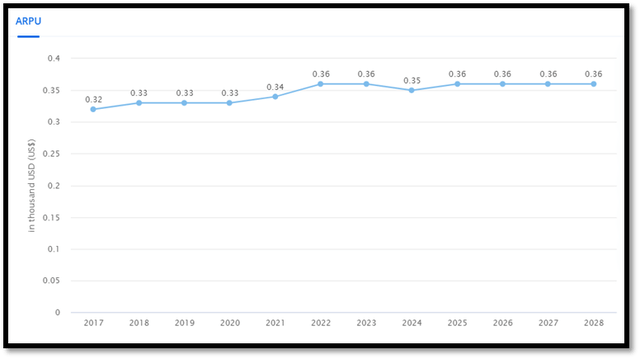

Apart from the strong anticipated growth in the hotel market, average retail per user [ARPU] is expected to remain robust until 2028, averaging $360 per user. ARPU is an important metric as it provides insights on customers’ spending trends. With stable ARPU, we can anticipate that room pricing will not create any challenges for CHH in the years ahead. As long as volume increases, it will drive revenue growth.

Statista

Openings, Partnership, and Acquisition to Increase Volume

During the earnings call, management stated that CHH averaged about four openings weekly, and this resulted in 24% growth in openings year-over-year. On top of these openings, CHH’s brand image is also improving, as evident in its improved guest satisfaction score. With strong growth in openings combined with a solid brand image, I expect these combinations to drive future revenue upwards as ARPU is expected to remain stable. On the international front, CHH has also announced its new strategic collaboration with one of the largest hotel operators in Mexico. This collaboration is expected to grow its international segment, thus further bolstering CHH’s future revenue growth.

The hottest topic for CHH right now is its proposed acquisition of Wyndham Hotels & Resorts (WH). Based on the management’s words, it is clear that they are sending a strong signal to CHH shareholders that they are very keen and are determined to complete the acquisition.

Quote: “Our goal is to resume a constructive dialogue with Wyndham’s Board to make this combination a reality”.

Management is confident that the acquisition will create significant value for CHH shareholders, as Wyndham’s business model complements well with CHH’s business model. As both businesses operate on an asset-light fee-for-service model, CHH is confident that the acquisition will generate even higher revenue and profitability, which ultimately results in higher cash flow, which will allow accelerated deleveraging of debt compared to operating in silos. In addition to Wyndham, CHH has also acquired Radisson Americas which I have discussed in depth above. This acquisition added ~67,000 rooms for CHH.

Overall, CHH is aggressively expanding its business and market size through openings, collaboration, and strategic acquisitions. With stable ARPU, I expect these expansions strategy to bolster CHH’s future revenue.

Comparable Valuation Model

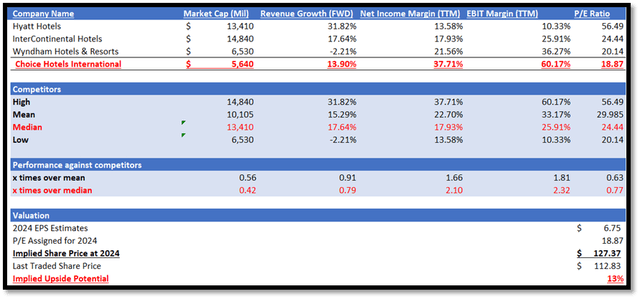

In terms of market size, CHH is 0.42x competitors’ median market capitalization, meaning it is less than half of their size. CHH’s market capitalization is $5.64 billion vs. competitors’ median of $13.41 billion. Moving onto the forward revenue growth rate, CHH underperforms its competitors as its forward growth rate is 13.90%, lower than the median of 17.64%.

Despite its smaller size and weaker growth outlook, it outperformed its competitors in terms of profitability. CHH’s EBIT margin TTM is 60.17% vs. the median of 25.91%, which represents 2.1x over the median. CHH’s net income margin TTM is 37.71% vs. the median of 17.93%, representing 2.32x over the median.

Currently, CHH’s P/E trades at 18.87x, 23% lower than the competitor’s median. In addition, CHH’s valuation is also below its 5-year average of 27.44x. Given that it has a lower forward revenue growth outlook and its smaller size, it’s fair that CHH is trading lower than the median P/E. In order to remain conservative in my valuation, I am going to use its current P/E ratio of 18.87x.

The market revenue estimate for CHH is expected to be $1.55 billion in 2023 and $1.58 billion in 2024. The market EPS estimate for 2023 is $6.04 and $6.75 for 2024. Given the growth outlook and the strong financial results discussed in depth above, these positive estimates are justified.

By applying 18.87x P/E to its 2024 EPS estimate, my 2024 target price is $127.37, which represents an upside potential of 13%. My target price is in line with Wall Street’s estimate, further supporting its reasonableness. Even at such a conservative P/E, I am getting double-digit upside potential, so I am recommending a buy rating for CHH.

Author’s Valuation Model Seeking Alpha

Risk

One downside risk would be in relation to its proposed plan to acquire Wyndham. If the acquisition fails to go through, it will cause shocks and potentially negatively impact shareholders and the general market’s confidence. Apart from sentiments, the growth outlook might be revised downward to adjust for the failed acquisition, which will ultimately affect its valuation.

Conclusion

In conclusion, CHH’s past financial results have demonstrated robust growth. In the last two years, revenue growth has been at double-digit rates. In addition, its margins expanded significantly in 2021 and 2022, which resulted in year-over-year growth in diluted EPS and dividends. Its most recent 3Q23 results also continue to show strong revenue growth. However, margins declined due to one-time expenses related to the Radisson Americas acquisition. Therefore, I do not expect this to be long-term and have an impact on its future margins.

The global hotel market is anticipated to grow strongly for the next five years, while ARPU is expected to remain stable. Therefore, I do not foresee pricing causing any issues for CHH. In order to capture market share from this growing market, CHH is aggressively increasing its volume through new openings, strategic partnerships, and acquisitions, such as an attempt to acquire Wyndham. If successful, this acquisition is expected to generate significant value for shareholders due to the synergistic nature of the two businesses.

In my comparable valuation model, I employed a conservative P/E ratio. I believe this P/E is fair because CHH is much smaller than its competitors and has a lower forward revenue growth outlook. Despite a lower P/E, my target share price indicates double-digit upside potential.

Given its strong growth outlook, robust financial performance, and double-digit upside potential, I am recommending a buy rating for CHH.

Read the full article here