By Michael Kagan & Stephen Rigo, CFA

Risk Aversion Ready for a Bumpy Ride

Market Overview

Despite a fast start to the year — a broad-based rally propelled the S&P 500 Index (SP500, SPX) +2.8% in January — the market struggled for traction in the first quarter of 2025. Post-election animal spirits faded in February and March as investors grappled with on again/off again tariff announcements and consternation over the AI outlook. By the end of the quarter, the S&P declined -4.3%, breaking the index’s streak of five consecutive quarterly advances.

Outside of energy, the best-performing sector in the quarter, the market’s sector performance exhibited a defensive posture with health care, consumer staples, utilities and real estate the next-best performing industries. The energy sector outperformed as oil price stability provided air cover for stocks to recover from the deeply oversold level many shares entered the year. Within health care, investors found shelter in biotechnology and pharmaceutical shares as well as the beaten down managed care industry. Finally, regulated utilities and the real estate sector offered their usual haven status during choppy waters.

Technology bore the brunt of underperformance. Yes, the consumer discretionary sector appears as the market laggard (-13.8%), but this was primarily driven by downside in shares of Tesla (TSLA) and Amazon.com (AMZN), which declined -36% and -13%, respectively. The information technology sector underperformed the index in each month of the quarter, the first three-month losing streak for IT since August–October 2022. Although IT underperformance was broad-based, AI-levered names bore the worst of the selling as investors fretted about the impact of Chinese advancement in AI combined with the still uncertain ROI on significant capital outlays.

Outlook

The onset of the Trump administration’s tariff shock therapy caused a sharp decline in the first week of the new quarter and shifted the market dialogue. The last time the world saw tariffs this high was during the Great Depression after the U.S. implemented the Smoot-Hawley tariffs. We caution about drawing too close a parallel to that era. The U.S. and the world were entering a serious recession in 1929, and while the tariffs added fuel to the fire, they were by no means the major cause of the depression.

As the second quarter of 2025 begins U.S. economic fundamentals are benign. Current measures of liquidity are conducive for risky assets. Credit spreads remain tight by historic standards; the yield curve is positively sloped with risk-free rates relatively stable at benign levels; bank deposits are growing at an accelerated pace while loan underwriting standards ease; M&A and IPO activity is thawing; and the Fed plans to slow balance sheet runoff. An unstable economy like in 1929 is a lot easier to knock off kilter than the stability we see now.

“An unstable economy like in 1929 is a lot easier to knock off kilter than the stability we see now.”

We view the tariff issue as two-pronged. First, the current lack of policy visibility creates uncertainty. While the announced tariffs are very large, their eventual level will be determined by international reaction and the Trump administration’s willingness to take the pain the tariffs will create. The uncertainty seems likely to create a slowdown (or pause) in corporate capital expenditures. How can we ask our business leaders to make multiyear, growth-creating, job-generating investments in property, plants or equipment without knowing whether these investments will be impacted by broad-based tariffs? Simply put, these multiyear investments require policy stability. Markets will be volatile until we know what the tariffs will be.

The second issue with tariffs is the potential impact on inflation, Fed policy and interest rates. We view broad-based tariffs as a one-time step-up in the price of impacted goods, which could be far reaching. That said, we worry more about the potential knock-on effects of tariffs. First, with lower-income consumers already stretched by high prices, goods inflation elevates the risk of slower consumer spending (recall consumer spend accounts for two-thirds of U.S. GDP). Americans will have to budget for the rising cost of necessities such as food at the expense of discretionary items such as travel and entertainment. Second, higher consumer prices could lead to another bout of wage inflation as people fight to have income keep pace with rising costs. If realized, these two knock-on effects could significantly change the U.S. economic backdrop.

In sum, while both our tariff concerns could be considered transitory or one-time in nature, the biggest risk in our view is the potential for lost economic momentum. Should capital investments go from deferred to delayed or consumers from optimistic to pessimistic, reigniting the engine of economic growth and investment may prove challenging.

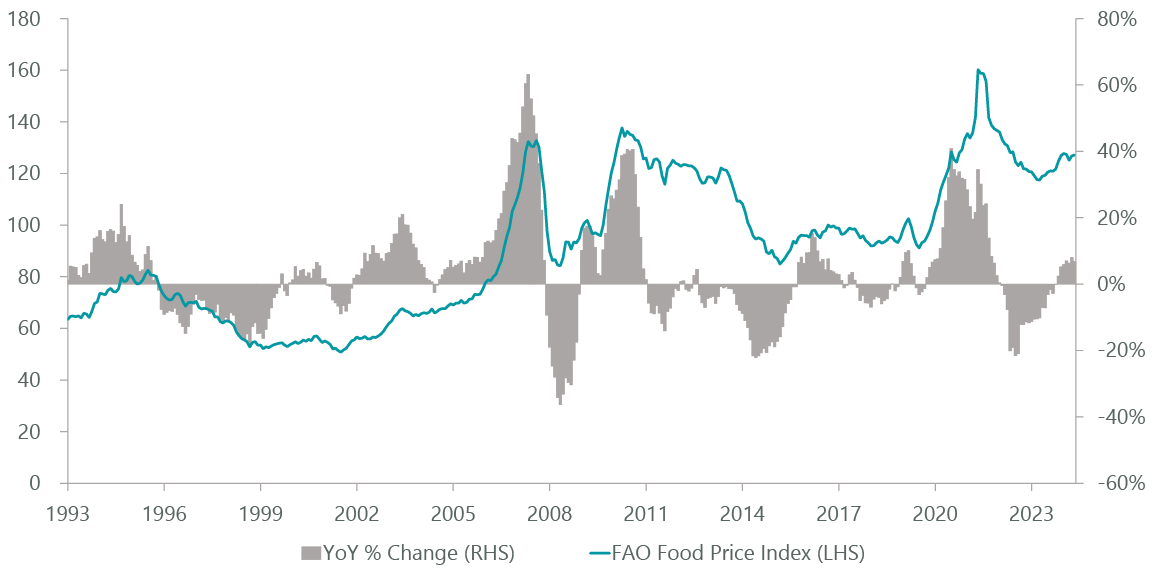

Exhibit 1: World Food Prices

As of March 31, 2025. Source: ClearBridge Investments, United Nations, Bloomberg.

In addition to tariff uncertainties, the second potential risk we see to the markets involves the evolution of generative AI. Entering the year, expectations of the impact generative AI will have on economic growth were sky high despite lacking evidence of monetizable consumer applications. Agentic AI, a type of AI that can make decisions autonomously with limited human supervision, became a Silicon Valley buzzword but remains an efficiency tool more akin to table stakes for software services than a step function monetization opportunity.

In addition, the emergence of DEEPSEEK, a China-based low-cost large language model, stoked fears about the returns investors should expect from the massive investment being made in the AI ecosystem. At a minimum, the DeepSeek revelation was a trigger event that shifted investor attention from chasing an open-ended dream to a more discerning incremental investment dollar. Investors are finally asking questions like: If models can be trained on lower-cost GPUs how many Nvidia (NVDA) clusters does the world need? If inference can be done on CPUs, what does that imply from a hardware ecosystem standpoint? How many large language models does the world need and what is the return potential from the proliferation of these models? We view investor focus on tangible ROIs following the initial AI gold rush phase as a painful but necessary transition akin to the rationalization Internet investors experienced in the late 1990s and early 2000s.

Conclusion

Our economic and market outlook has become somewhat binary in nature and incrementally more cautious. On the one hand, we believe if policy certainty comes soon current growth concerns could prove transitory with tariff impact perhaps manageable. On the other hand, the current “on again/off again” policy environment has meaningfully raised the risk of an economic slowdown, one that risks being concurrent with rising consumer prices, a potentially bad outcome for risky assets.

Although today the economic backdrop remains conducive for equities, we can no longer overweight this as a base case in our outlook. As such — and as risk-conscious investors focused on outperforming through a market cycle via downside protection — we believe incremental caution is warranted as we digest incoming information. Rather than trying to bet on near-term earnings trends or government policy outcomes, we believe it is better to look out two to three years and make investment decisions based upon our assessment of a company’s longer-term sustainable growth rate versus what’s implied in today’s share price. Given rising odds of a bumpy ride, we believe our Strategy is well-suited to the current environment.

Portfolio Highlights

The ClearBridge Appreciation Strategy (MUTF:SHAPX) outperformed the benchmark S&P 500 Index in the first quarter. On an absolute basis, the Strategy had gains in six of 11 sectors. The financials, energy and health care sectors were the main positive contributors to performance, while the IT sector was the main detractor.

In relative terms, stock selection in the financials and consumer discretionary sectors, underweights to the IT and consumer discretionary sectors and financials and materials overweights contributed positively to performance. Conversely, stock selection in the IT and communication services sectors detracted.

On an individual stock basis, the biggest contributors to absolute performance during the quarter were Berkshire Hathaway (BRK.A, BRK.B), Visa (V), Waste Management (WM), AbbVie (ABBV) and Travelers (TRV). The biggest detractors were Microsoft (MSFT), Nvidia, Apple (AAPL), Broadcom (algo) and Alphabet (GOOG,GOOGL).

During the quarter, we initiated new positions in WEC Energy (WEC) and Entergy (ETR) in the utilities sector, McCormick (MKC) in the consumer staples sector, Workday (WDAY) in the IT sector and Tesla (TSLA) in the consumer discretionary sector. We exited Mondelez (MDLZ) in the consumer staples sector, Comcast (CMCSA) in the communication services sector, Marvell Technology (MRVL) and Adobe (ADBE) in the IT sector and Sempra (SRE) in the utilities sector.

Michael Kagan, Managing Director, Portfolio Manager

Stephen Rigo, CFA, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2025 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here