By Anna Bui, Hilary Frisch, Naveen Jayasundaram & Mary Jane McQuillen

Climate Strategy is Business Strategy

For almost 40 years ClearBridge has been incorporating climate risks and opportunities into our fundamental investment strategy. As climate has become more and more relevant in our portfolios, we have taken steps to enhance our process and ensure material climate metrics are appropriately captured.

Company engagements are a key pillar in ClearBridge’s climate strategy as we seek to understand and manage company-specific climate-related risks and opportunities. ClearBridge engagements on environmental, social and governance (ESG) topics generally have two overlapping objectives:

1. Research: Gaining a better understanding of ESG issues that could impact our investment thesis.

2. Impact: Encouraging specific changes at the company to better align its operations with sustainability best practices.

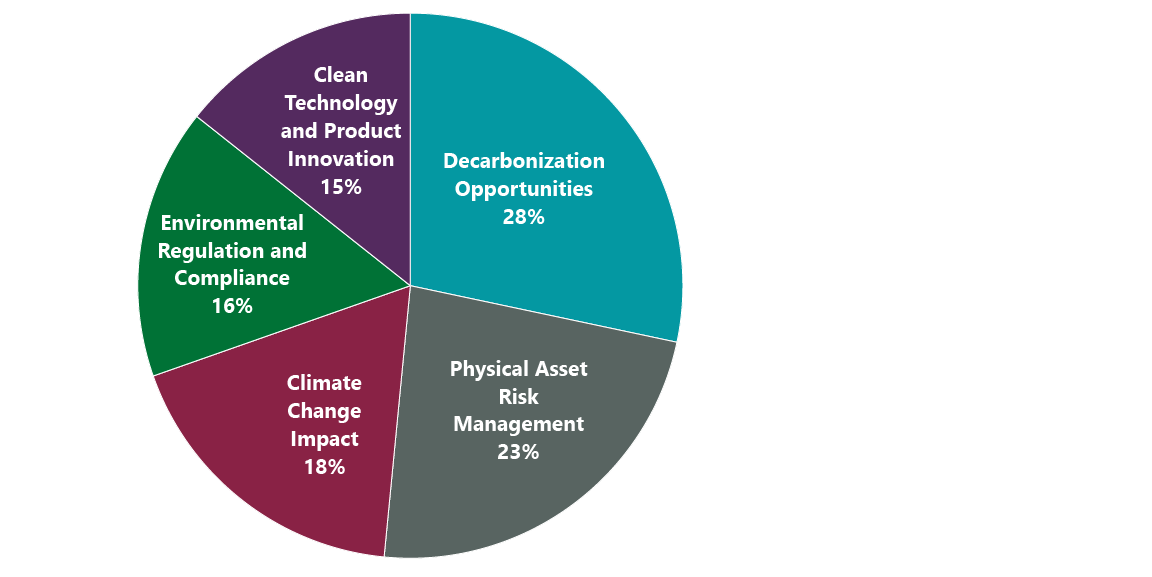

Across these two objectives, our engagements span many different climate-related topics (Exhibit 1), with engagements primarily focused on higher-emitting sectors.

ClearBridge’s model for ESG integration, which includes ESG discussions as part of fundamental company research led by our investment teams, allows climate-related engagements to be thoughtful and well-rounded discussions on climate topics. As the following examples show, our analysts and portfolio managers cover very different topics in discussions with companies in very different sectors while still focusing both on companies’ climate strategies and the connection of these strategies to the companies’ business case.

Exhibit 1: Top Environmental Factors Engaged Upon in 2024

As of Dec. 31, 2024. Source: ClearBridge Investments.

Amazon.com: A Fully Integrated Approach to Climate

In September 2024, ClearBridge joined Amazon for a group discussion with the company’s ESG and Energy Sustainability teams as part of Climate Week to discuss Amazon’s environmental strategy. Amazon went into the many components of its company-wide initiative to achieve net zero by 2040. Each business unit — grocery, studios, AWS — has dedicated sustainability leads, with a team led by Head of Energy and Sustainable Operations Chris Roe ensuring carbon goals are embedded in annual plans and reviewed by leadership. In setting its strategy, Amazon focuses on metrics specific to different business units like carbon per dollar of gross merchandise value (GMV) in retail and per unit of compute in AWS. Amazon has also launched a $2 billion fund to accelerate decarbonization technologies into commercial products.

Cost and carbon are highly correlated in Amazon’s climate strategy as retail operations get more efficient. Major challenges include reducing Scope 1 emissions from middle-mile logistics, where diesel trucks remain a bottleneck. However, progress is evident in last-mile delivery: 680 million packages were delivered by EVs in the previous year. Efficiency gains in packaging have also led to a 40% reduction in packaging waste over nine years.

Internally, Amazon uses climate risk models to anticipate energy usage and drive real estate design. Factors in the models include generative AI’s future energy needs, growth of Amazon’s fleet, locations of logistics facilities and water availability for different sites.

While ClearBridge encourages emissions reduction targets aligned with the Science-Based Targets initiative (SBTi), Amazon appears to have a responsible approach of setting internal science-based targets per business unit, although these are not formally verified by the SBTi. Amazon does, however, work with both SBTi and academics to align with International Energy Agency pathways. The company avoids offsets for interim targets, reserving removals like direct air capture for residual emissions — which are expected to be mostly Scope 3 by 2040.

This discussion provided us with a better understanding of Amazon’s climate strategy and we remain positive about its climate efforts. Our biggest takeaway was how well resourced and data driven Amazon’s climate efforts are from an organizational standpoint, driving down the cost/carbon impact per dollar of value with the value metrics being defined at a segment level: e.g., carbon footprint per unit of compute for AWS or per dollar of GMV in Retail.

Microsoft: Powering AI Responsibly

In November 2024, ClearBridge held a call with Microsoft’s sustainability investor liaison to discuss shareholder concerns on energy efficiency, as with the huge growth of AI has come a massive demand in energy as well. We discussed Microsoft’s AI energy needs and its goals to become carbon negative. Microsoft reconfirmed its commitment to achieving its climate goals with its recently announced power purchase agreement for nuclear power with Constellation Energy, which involves restarting Three Mile Island. Microsoft clarified it won’t own or operate this facility, but will be a customer of Constellation, with which Microsoft has maintained strong supplier conduct statements. When asked about safety concerns, Microsoft explained the reactor slated to be restarted was functioning safely and effectively for decades before being turned off for economic reasons in 2018. This represents a significant part of Microsoft’s commitment to nuclear power. The company sees this agreement as part of achieving its 2030 and 2050 carbon emissions targets (for net negative emissions).

As it relates to renewables, Microsoft continues to encounter the issue of intermittency (as do peers). It is conducting research on power battery storage and other mechanisms to solve this issue and includes deals for wind and solar in its portfolio approach to its power generation needs.

We were encouraged to hear Microsoft is still committed to bringing carbon emissions back down as energy needs increase. Since this engagement, Microsoft has also announced many agreements to purchase offsets, as the energy efficiency of AI, particularly in data centers, is still a challenge. We continue to see Microsoft’s climate strategy as leading among peers and will continue to engage with the company on this topic.

Anna Bui, Senior ESG Associate

Hilary Frisch, CFA, Senior Analyst – Software Services & Enterprise Technology

Naveen Jayasundaram, Sr. Analyst – Media & Internet

Mary Jane McQuillen, Head of ESG, Portfolio Mgr.

|

Past performance is no guarantee of future results. Copyright © 2025 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here