Clearway Energy (NYSE:CWEN) (NYSE:CWEN.A) has essentially been flat for the last two years and is currently down around 6.5% since the start of the year. The renewable energy yieldco has been incredibly resilient to broader market angst around the March regional banking panic and a Fed funds rate that’s been hiked to its highest level since 2008. The yieldco last declared a quarterly cash dividend of $0.3818 per share, a 2% increase from its prior payout for a 5.34% forward yield on the class A shares. Clearway has now had 12 consecutive dividend raises with a dividend growth rate of 7.61% over the last 12 months, surpassing its sector median growth rate of 5.41%. Further, Clearway’s 15.83x forward price-to-earnings ratio sits 10% below its sector median and at a nearly 50% discount to its 5-year average. The yieldco could be a play on a potential multiple expansion on the back of a brightening of the current gloomy macroeconomic conditions.

Is the stock now a buy? It depends. The yieldco business model is geared towards taking on a substantial level of leverage to drive dividend payments from long-term contracted income derived from power purchase agreements. Clearway held long-term debt of $6.8 billion as of the end of its fiscal 2023 first quarter. This comes with different maturity dates, the earliest not being until 2028, and are all mostly fixed. The yieldco will still need to finance investments in developments from its sponsor’s pipeline with higher interest debt. This pipeline had grown to 29.3 GW, including 6.9 GW of late-state projects expected to reach commercial operation within four years as of the end of the first quarter. Clearway’s portfolio consisted of 1,652 MW of utility-scale solar, 332 MW of distributed solar, 3,658 MW of wind, and 2,472 MW of conventional power-generating assets like natural gas-fired power plants.

Targeting A 5% to 8% Annual Dividend Per Share Growth

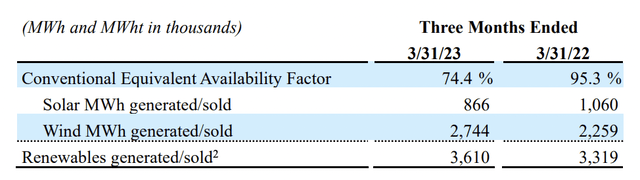

Clearway’s investment pitch is built around its yield and the outlook for its growth. The yieldco has a stated target to grow its annual dividend in the upper range of a 5% to 8% target growth range. Fiscal 2023 first-quarter revenue came in at $288 million, an increase of 34.6% over the year-ago quarter and a beat by $7.77 million on consensus estimates. The yieldco generated and sold around 9% more renewable energy during the first quarter due to the contribution of its newer growth investments. However, a planned spring outage of its El Segundo Energy Center gas-fired power plant caused its conventional equivalent availability factor to drop to 74.4% from 95.3% in the year-ago comp.

Clearway Energy

Clearway is one of the largest developers and owners of utility-scale renewable energy projects in the US. And this continued investment in growth forms a core part of its investment pitch, with the yieldco announcing a new investment during its first quarter earnings call. The Cedro Hill repowering project will see Clearway invest $63 million at a 9% incremental asset CAFD yield. It will see Cedro Hill realize a 10 MW uplift and an extension of its PPA duration to 2045. The project is expected to reach repowering commercial operation in the second half of 2024 with the capital commitment funded from excess cash generated by Clearway.

Clearway Energy

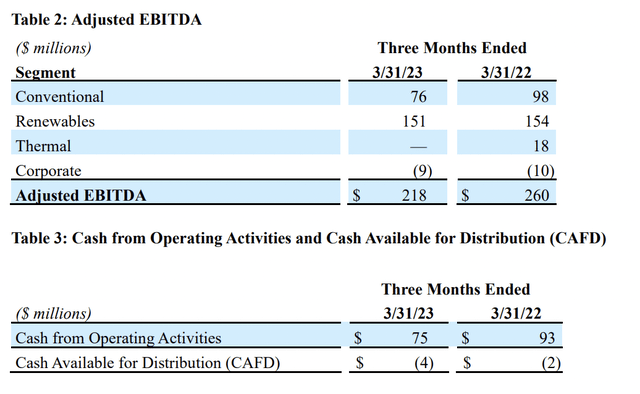

Clearway generated positive adjusted EBITDA of $218 million during the first quarter, this was down around 16.15% versus the year-ago comp on the back of the El Segundo outage and weak renewable energy generation due to heavy rainfall in California and the West Coast. CAFD was negative $4 million during the first quarter. This came as the yieldco reaffirmed their 2023 CAFD guidance of $410 million, around $2.03 per share. This is against an annualized forward dividend payout of $1.5272 per share.

More Dividend Raises, The Year Ahead

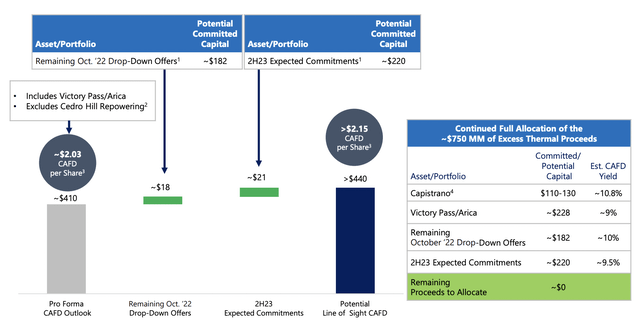

The yieldco’s CAFD outlook for 2023 is set to be potentially boosted to around $2.15 per share on the back of returns from an additional $180 million dropdown from its sponsor. This would then be followed by another $220 million dropdown opportunity in the second half of 2023. Critically, these are expected to have CAFD yields of around 9.5% to 10% respectively.

Clearway Energy

Hence, Clearway’s investment case is clear and is formed from what’s set to be a well-covered dividend and a path to hit the upper end of its dividend growth target. For many other income securities, the current Fed funds rate environment has heavily pressured earnings and led to broad dividend cuts that have left shareholders reeling. Clearway’s $750 million in excess proceeds from the sale of its thermal business has been instrumental for the yieldco to maintain investments against the current macroeconomic environment. I remain enthusiastic about the company’s growth, and I rate shares as a buy. The secular growth of renewables continues unabated, and Clearway occupies a healthy position within the US renewables ecosystem.

Read the full article here