Rapid Recap

In my previous analysis, I said,

To summarise the bull case for Cleveland-Cliffs (NYSE:CLF), it would be this: Steel prospects are likely to be quite strong in 2023 and 2024. And this will allow Cleveland-Cliffs to pay down its overleveraged balance sheet.

However, I don’t believe that its stock is particularly cheap, particularly when compared with other steel companies. Therefore, I’m only tepidly bullish on Cleveland-Cliffs’ prospects.

Today, with more visibility in 2023, I stand by those statements. The bull case for steel demand is very much alive and well.

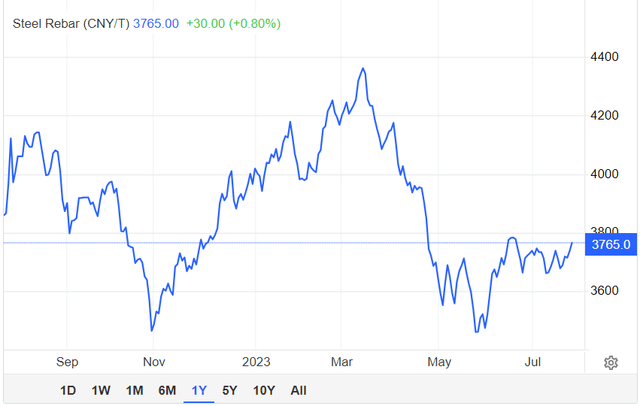

Trading Economics

We can see that steel prices are showing no interest in staying around the lows set back in June of this year and November 2022. However, I estimate CLF is priced at around 9x 2023 EPS, a multiple that is fair considering the debt on its balance sheet.

So I’m bullish on CLF, but I’m also quick to note that there are perhaps even better opportunities in other steel companies.

Steel is the Backbone of the Energy Transition

Everyone is talking about the green energy transition but few investors realize that steel will form the critical foundation of the energy transition. I’ll highlight a brief quote from Vaclav Smil below.

For a 5-megawatt turbine, the steel alone averages 150 metric tons for the reinforced concrete foundations, 250 metric tons for the rotor hubs and nacelles (which house the gearbox and generator), and 500 metric tons for the towers.

Think about these figures for a moment. We are talking about massive amounts of steel required for the energy transition.

From making solar panels to wind turbines to building gigantic AI warehouses to accommodate all the servers needed for the AI infrastructure, every step of the modern world requires more steel.

What about EVs? Did you know that EVs require more steel to house their substantially heavier batteries than traditional internal combustion engines?

Demand for steel is going nowhere but up over the next several years. And to top it off, consider the 3 different federal initiatives below.

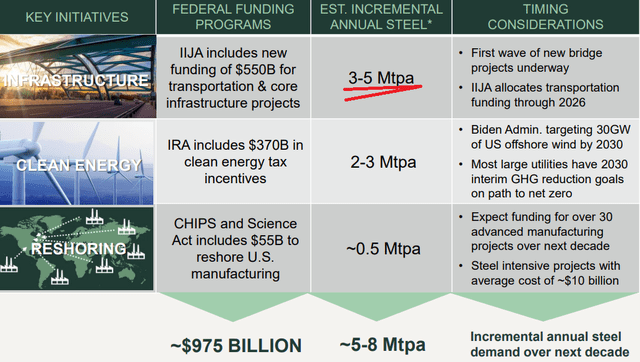

NUE Q2 2023

There is a tremendous stimulus for millions of tons per year of additional steel. Even though the Infrastructure Reduction Act gets the most headlines, in actuality, the IIJA (Infrastructure Act) is a more significant needle mover for steel demand.

Revenue Growth Rates Will Ease Up

CLF revenue growth rates

Cleveland-Cliffs was always going to struggle in Q2 to put up strong growth rates, given that the hurdle against Q2 of last year was so high at 26% y/y revenue growth rates.

What is more important now is to start to think about the exit rate from Q4. What sort of revenue growth rates can Cleveland-Cliffs enter 2024 with?

Can the argument be made that over the next several quarters, as the quarterly comparables become easier, Cleveland-Cliffs will be able to post several back-to-back quarters of positive revenue growth rates? I believe that this possibility is very much on the cards.

And if over time investors can get behind this idea, then in a few months’ time, investors looking at Cleveland-Cliffs will be looking at a very different company, with different prospects.

Rather than eyeing up a company that’s reporting several consecutive quarters of back-to-back negative revenue growth rates, investors will be eyeing up a company that has to its back to quarterly results of negative revenue growth rates and is now “seemingly” to have turned a corner and is on the front foot once more.

With that in mind, let’s press ahead and discuss other important considerations

Debt Profile Hanging Over Cleveland-Cliffs

Back in Q1 2023, Cleveland-Cliffs’ free cash flow was negative $240 million, and Cliffs’ Chairman, President, and CEO Lourenco Goncalves made the declaration that Q2 would see significantly more free cash flow than Q1.

Well, when the results came out, Q2 2023 saw Cliffs’ free cash flow at a positive $756 million. Clearly, Goncalves and his team delivered what they set out to do.

That being said, the argument that overhangs Cliffs continues to be the case that the business holds more than $4 billion of debt and pension liabilities combined.

To put this figure in perspective, approximately half of Cliffs’ market cap figure of $8 billion is made up of debt and pension liabilities. This means that even if we can safely presume that steel demand in H2 2023 picks up and that the outlook for the steel industry in 2024 looks enticing, Cliffs will still not be in a position to see the majority of its free cash flow returning to shareholders any time soon.

The Bottom Line

In my previous analysis, I highlighted the bull case for Cleveland-Cliffs based on strong prospects for the steel industry in 2023 and 2024, which could help the company reduce its overleveraged balance sheet. However, I remained cautious about the stock’s valuation compared to other steel companies.

With the steel industry’s pivotal role in the energy transition and increasing demand for steel in various sectors like renewables and electric vehicles, CLF’s outlook is positive.

Although Q2 revenue growth rates were expected to be lower due to tough comparables, there is clear potential for improved performance in the future.

Nonetheless, the company’s substantial debt profile remained a concerning factor, affecting the likely timing for a notable increase in shareholder returns.

Read the full article here