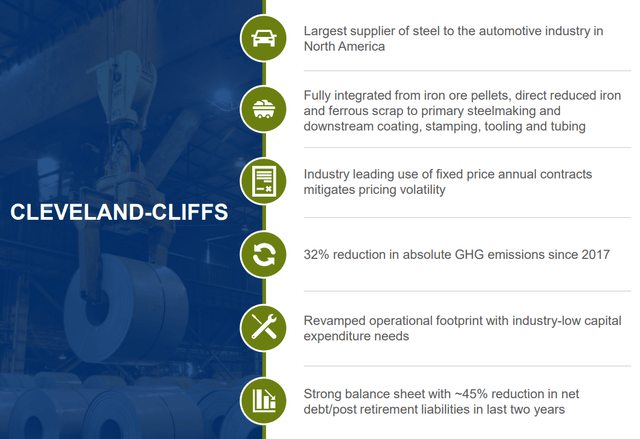

I last wrote on Cleveland-Cliffs (NYSE:CLF) during December here, with a Sell/Avoid rating on the stock, as a recession looked imminent during 2023. The company is one of the largest steel and iron ore producers in the U.S., with most of its revenues derived from sales inside America. For me, this focus on production and sales here at home could be a huge advantage if Chinese/Asian supplies become less desirable in today’s China vs. U.S. confrontation-heavy political environment.

Founded in 1847, the company operates 56 facilities, has 27,000 employees, and is one of only a few fully integrated steel producers in the U.S.

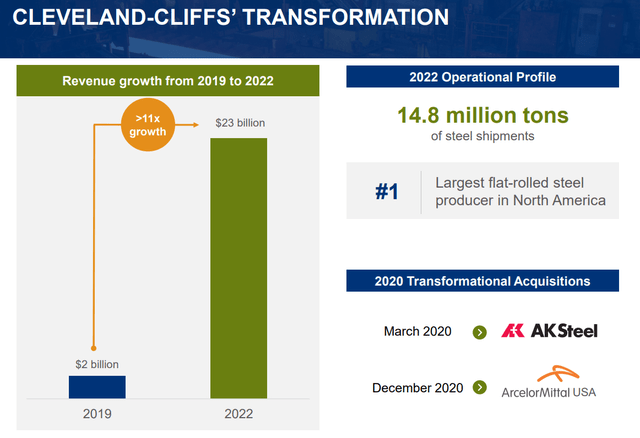

Company June 2023 Investor Presentation Company June 2023 Investor Presentation

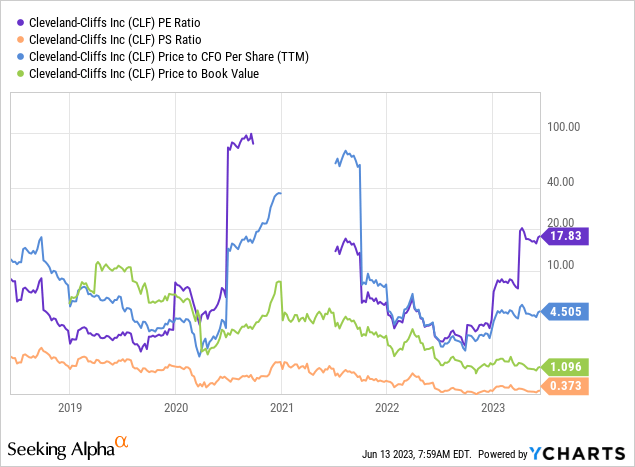

While Cleveland-Cliffs would definitely suffer a major drop in revenue and earnings during a recession later this year, improving technical momentum since my last article (including a higher share price generally), and a string of insider buys during late April and early May could be hinting at a better long-term outlook for the stock. Cleveland-Cliffs also has a recent history of performing well for investors during June-July.

Finally, the company continues on a conservative path of increasing tangible book value and reducing net leverage on its balance sheet. Consequently, I decided to purchase shares last week under $16 for a short-term trade into July or August. In addition, I am raising my 12-month rating officially to Hold. Statistically speaking, the next $10 move will almost surely be on the upside, not the downside from today.

Improving Technical Momentum

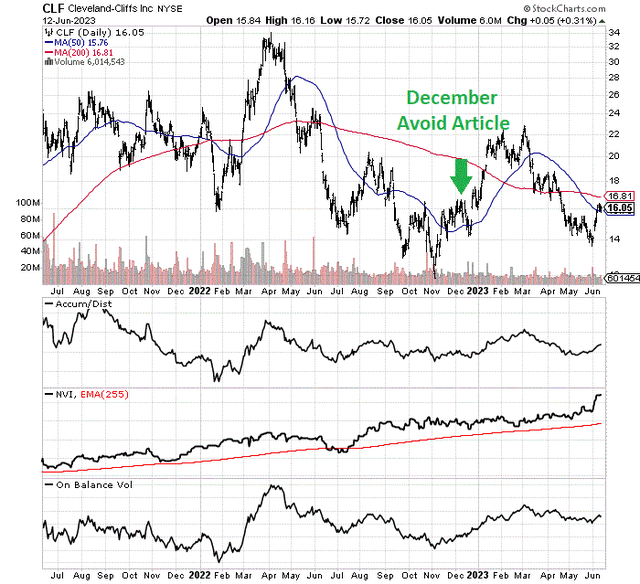

When price was $15 in December, my thinking was a move to $10 would come in the first half of 2023 on weaker recessionary-induced demand for steel, followed by a sizable share quote rebound in the second half. Of course, what we experienced was a rapid rise over $22 into March, followed by an equally fast drop back to $14 in May.

Underneath these wild swings, however, my favorite momentum indicators have survived far better than I anticipated. You can review strength in the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume calculations since my December article. All 3 indicators are materially higher than 6 months ago, despite a flat price result. My readout of the situation is any soft landing or mild recession scenario for the second half could already be discounted in the share quote.

StockCharts.com – Cleveland-Cliffs, 24 Months of Daily Price & Volume Changes, Author Reference Point

June-July Seasonal Strength

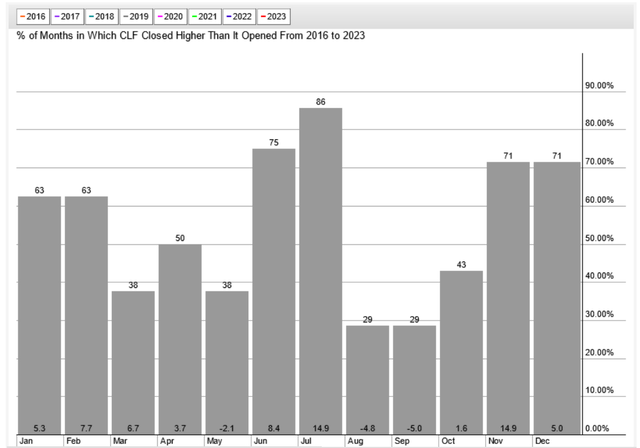

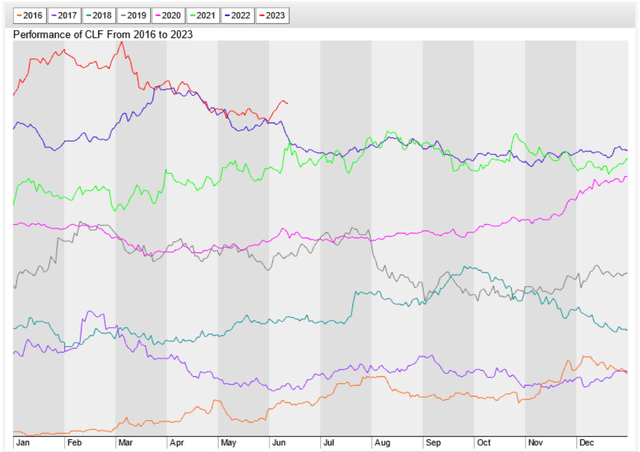

Another data point to contemplate is June-July have typically been the most profitable part of the trading calendar to own shares during the last eight years. 7 out of 8 instances (including 2023 so far) have outlined a solid advance over this 9-week span. Taken together, bullish underlying momentum and seasonal patterns seem to argue in favor of holding a position, if not adding to them for a quick trade.

StockCharts.com – Cleveland-Cliffs, Average Monthly Price Performance, 2016-Present StockCharts.com – Cleveland-Cliffs, Calendar Price Performance, 2016-Present

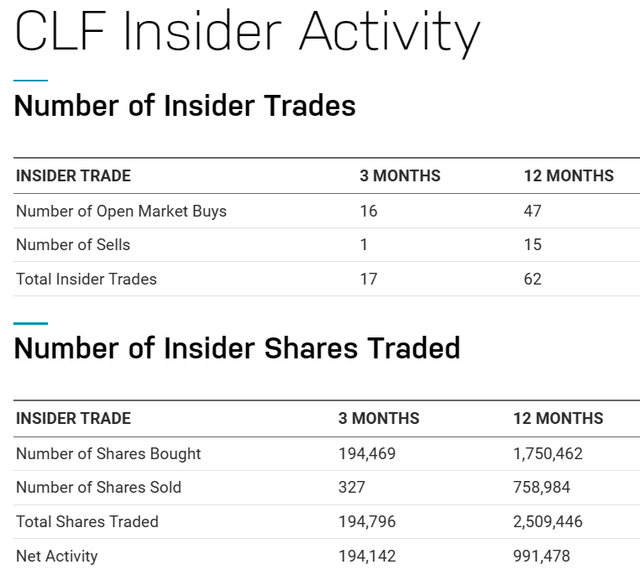

Insider Buying

If insiders were seeing a significant drop in orders for steel and iron ore, they would be net sellers of the stock, not buyers. Yet, buying is increasingly the action management and major existing holders are doing since $15 was breached in late April. Below is a listing of insider buys far outpacing sells over the past 12 months, specifically over the latest six weeks.

Nasdaq.com – Cleveland-Cliffs, Insider Trading Action, Past 12 Months Nasdaq.com – Cleveland-Cliffs, Insider Trading Action, Past 6 Weeks

Valuation Story

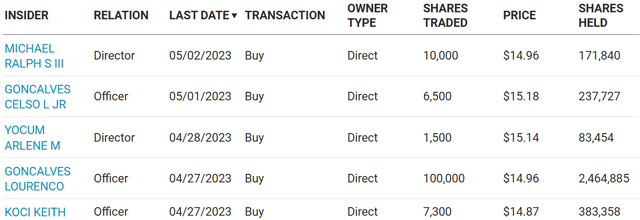

Part of the enthusiasm from insiders could be tied to a more conservative balance sheet, alongside continuing high levels of cash flow vs. previous industry downturns. Cleveland-Cliffs is a much different company than a decade or even five years ago, from the acquisition of new steel-producing assets, plus record income and cash flow since 2020-21.

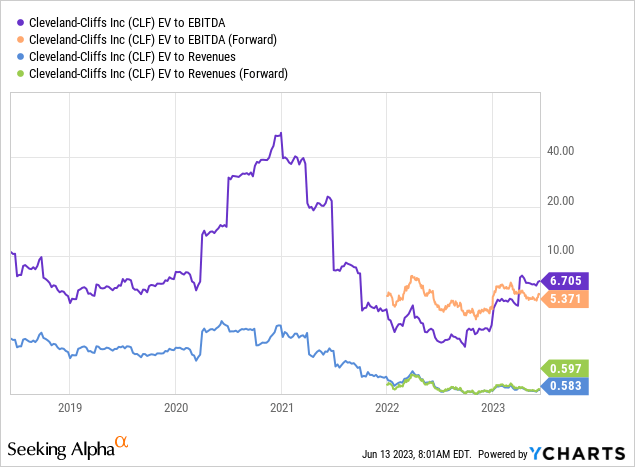

Below is a graph of price relative to CLF’s basic fundamental operating results since 2018. Using ratio analysis in combination, the company is the cheapest today since at least 2014. Notably, on price to book value and trailing cash flow, shares are valued at a 50% discount to 5-year averages.

YCharts – Cleveland-Cliffs, Price to Basic Fundamental Operating Results, 5 Years

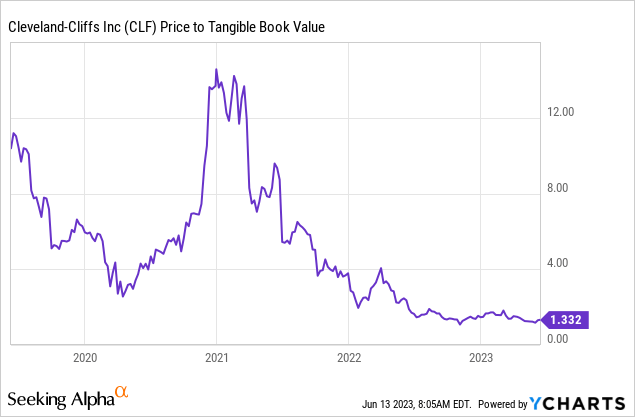

For me, the best buy argument on fundamentals is the price to tangible book value setting. At just 1.3x today, investors can purchase a stake near the net cost-accounting (depreciated) value of buildings and steel mills, cash, inventory, receivables, plus iron ore assets minus all liabilities. This setup is completely different than the 12x ratio of early 2021.

YCharts – Cleveland-Cliffs, Price to Tangible Book Value, 4 Years

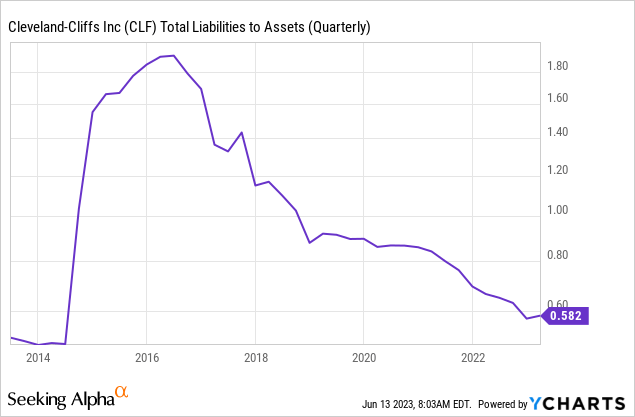

Management has aggressively used record profits after the pandemic to pay down debt and leverage. Today’s ratio of total liabilities to assets is the lowest since 2014, meaning the company is well prepared for a recession.

YCharts – Cleveland-Cliffs, Total Liabilities vs. Assets, 10 Years

When we include total debt with the equity capitalization and subtract cash held, enterprise values vs. EBITDA and revenues are equally inexpensive. Using forward estimated results for 2023-24 by Wall Street analysts, shares appear to be closer to a long-term bottom than top.

YCharts – Cleveland-Cliffs, Enterprise Valuations on EBITDA & Revenue, 5 Years

Final Thoughts

I am projecting a $17 to $19 price is likely by the end of July. After that, share movements will depend to a greater degree on the outlook for the general U.S. economy. If we get a soft landing, it is entirely possible the stock quote will remain in an uptrend. If a recession becomes reality in the second half (still my base forecast), prices under $15 will likely appear into yearend.

For now I have a Hold rating on Cleveland-Cliffs, with prices under $15 representing Buy territory for long-term investors. As of this writing, reviewing the valuation picture, I would rate prices under $12 as a Strong Buy. At $20, I would be less optimistic for sure. $22 would be Sell territory, with $25 as Strong Sell. I am using price to tangible book value and projected sales as my primary valuation data points.

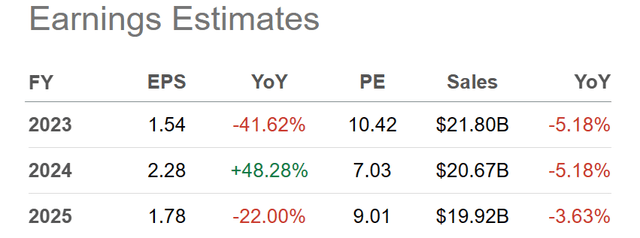

Seeking Alpha Table – Cleveland-Cliffs, Analyst Estimates for 2023-25, Made on June 13th, 2023

Current Wall Street analyst forecasts for EPS and revenue during 2023-25 are in a range expecting a slow-growth economy to be our near-term future. So, any position held past July looks to be a bet on your own feelings regarding the economy. The good news is Cleveland-Cliffs may survive any economic contraction better than I thought possible, when I wrote my December article. And, the stock quote should hold up during a market crash or bear move at percentage rates closer to the S&P 500, versus my original “underperform” forecast.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here