Instead Of An Investment Thesis

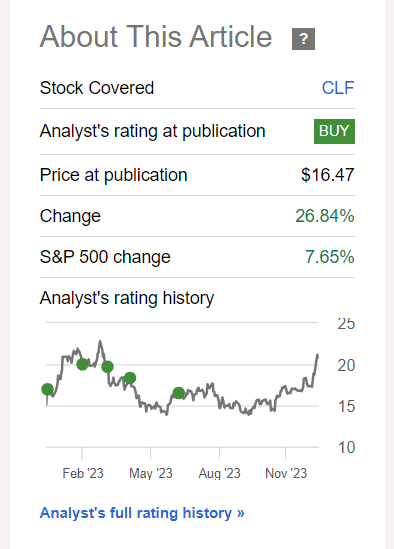

I’ve been covering Cleveland-Cliffs Inc. (NYSE:CLF) stock since June 2021, and all along I’ve been bullish on the stock for many reasons. The last time – in June 2023 – I argued for a serious undervaluation of the company in light of its superior projected growth rates in FY2024-25 and implied multiples that are well below those of its peer group. Since then, CLF has managed to significantly outperform the broad market, showing ~27% in return:

Seeking Alpha, Oakoff’s previous article on CLF

And based on what I see today, my thesis hasn’t changed: I still see a higher share price for CLF over the next few years, making it a great long-term ‘Buy’ today.

My Reasoning

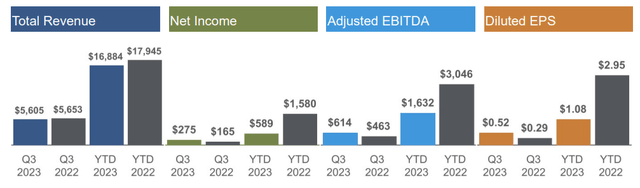

In Q3 FY2023, Cleveland-Cliffs reported revenues of $5.6 billion, with adjusted EBITDA of $614 million and GAAP EPS of $0.52. Despite the UAW strike affecting 3 automotive clients, total shipments reached 4.1 million net tons, setting a quarterly record for steel shipments to the automotive sector. At the same time, CLF’s cost reduction performance was strong, improving by $31 per net ton in Q3. So although the YoY dynamics in sales were flat, the margins went up significantly during the period:

CLF’s 10-Q

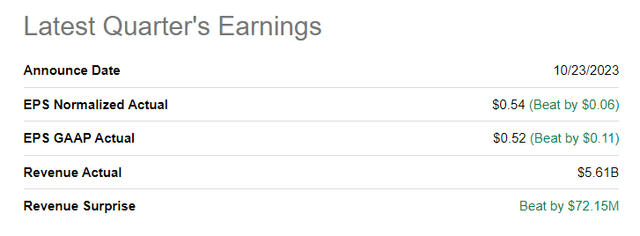

As a result, CLF beat the bottom-line consensus forecast:

Seeking Alpha

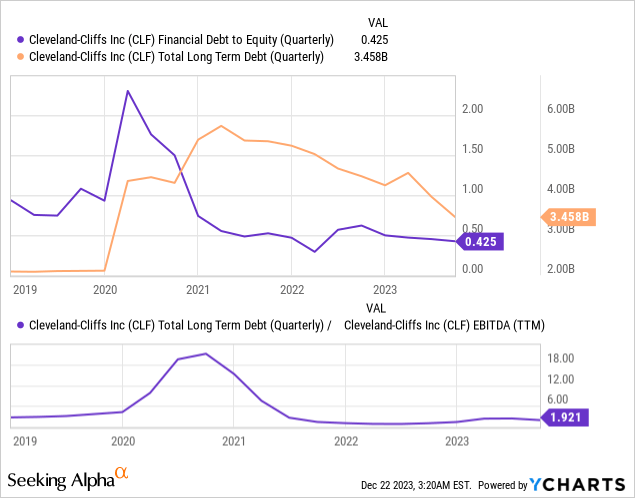

The firm’s free cash flow for the quarter amounted to $605 million, mainly used to pay down the ABL, reducing net debt to $3.4 billion and increasing total liquidity to $4.4 billion. So CLF’s debt-to-equity decreased further in Q3, and the debt-to-EBITDA got below 2x:

The company’s capital structure is now primarily comprised of low-cost fixed coupon debt instruments, with no upcoming maturities until 2026. Since acquiring ArcelorMittal USA in December 2020, CLF has reduced net debt by nearly $2 billion and eliminated $3.5 billion in pension and OPEB liabilities.

Aside from the debt reduction, CLF bought back 3.9 million shares, returning ~$60 million to shareholders. That’s ~0.56% of today’s market capitalization, but I believe it’s a temporary number as the company becomes more flexible on share buybacks as it reduces its debt load.

During Q3 FY2023 Cleveland-Cliffs was able to maintain strong average selling prices above $1,200 per net ton. Now cost reduction is expected to continue, according to the management’s comments during the latest earnings call, with an additional $15 per net ton reduction forecasted for Q4.

CLF also highlighted its position in the automotive market, emphasizing excellence in meeting customer needs. They expect total shipments in Q4 to remain at ~4 million net tons, even if the UAW strike persists. The impact of the strike on CLF seems to be less significant than previous challenges such as the microchip shortage and other supply chain issues.

The company’s commitment to buying a significant portion of the output from a clean hydrogen hub in northwest Indiana helped secure the location in October 2023.

As for the failed purchase of United States Steel (X), which is eventually going to be sold to the Japanese company Nippon Steel (OTCPK:NPSCY), CLF shareholders have actually benefited from that outcome: The company will not have to take on more debt, which would further diminish the prospects of increasing shareholder returns indefinitely. Call me short-sighted, but as a shareholder of the company, I want it to get rid of the debt as soon as possible, while it is possible due to the still strong economy. The merger with X may have come at the wrong time, destroying value for shareholders and making CLF more vulnerable in a possible turbulent economic period (that would be a consequence of the high stakes anyway; it’s a matter of timing, in my opinion).

Now the company can continue to raise steel prices without any additional burden, as it did again recently, thus maintaining margins and benefiting from the still low car inventories in the US, which will have to be replenished in any case.

TradingEconomics, Domestic Car Inventories

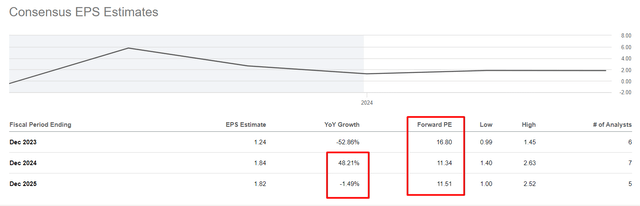

CLF, which has one of the dominant roles in the steel industry with a focus on automakers, is still almost as cheap as when I looked at it in June 2023. Yes, the P/E ratio for FY2025 looks higher than before, but the EPS growth forecasts for that year predict stagnation.

Seeking Alpha, author’s notes

I can’t agree with that consensus, as the firm’s debt should continue to fall and buybacks should increase by then – both of which have a positive impact on EPS on a YoY basis.

Risks To Consider

I want everyone reading this article to keep in mind that investing in CLF shares carries several risks that need to be carefully weighed. First, market risk is ever-present, as the value of the stock depends on general market conditions and geopolitical events. As CLF is linked to the steel and iron ore industry, investors are exposed to industry-specific challenges such as demand fluctuations, iron ore price volatility, and competitive pressures. Financial stability and management effectiveness also contribute to the risk profile, with factors such as debt and operational challenges potentially impacting share performance. Commodity price risk is a key factor as CLF is active in mining and steel production. Fluctuations in global commodity prices can therefore have a significant impact on the company’s revenues and profitability, which represents an additional uncertainty for the investment. Regulatory and political risks, both at national and international levels, may also have a negative impact on CLF’s business activities.

Your Takeaway

Despite all the risks, CLF stock is still one of my favorite companies in the industry. The company is recovering in seemingly tough times and with a lot of headwinds. So just think about what potential the company might have in calm times.

I also think the share price is still cheap. It’s still a ‘bargain’ as investors say, and don’t be put off by some high TTM multiples as the FWD multiples show a very different picture. From all this, I conclude that it still makes sense to hold CLF in a long-term portfolio and to continue buying at the current price level, even though it’s up +24.5 % year-to-date.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here