Cloudflare (NYSE:NET) stock has finally met gravity. NET has typically traded at a rich premium relative to peers on account of both its strong financial profile but mostly due to high investor confidence in the medium-term growth rates. With the company finally lowering full-year revenue guidance, that thesis has been shattered, and analysts are now even wondering if the newly lowered guidance has been “de-risked” enough. I continue to view NET as being a secular growth story on a faster and more secure internet. While I remain confident in the long-term thesis, it is very difficult to recommend buying NET over the simple market index fund.

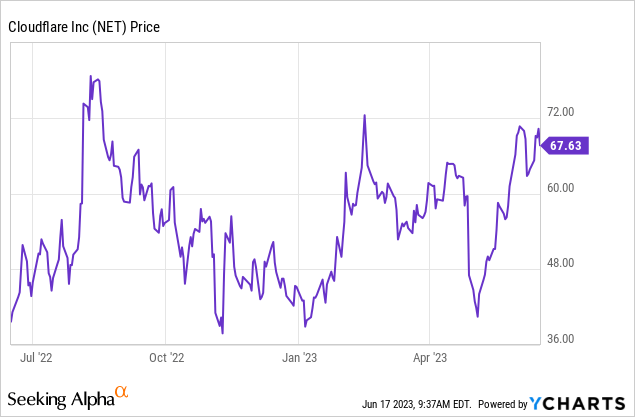

NET Stock Price

After a complete and thorough beating from all-time highs, NET stock is now trading at where it did in mid-2020. Compared to some peers which are trading at 2018 levels, that still represents some relative outperformance.

I last covered NET in April where I rated the stock a buy but noted my preference for cheaper peers. The stock is up slightly since then in spite offering investors a short-lived buying opportunity following its earnings report.

NET Stock Key Metrics

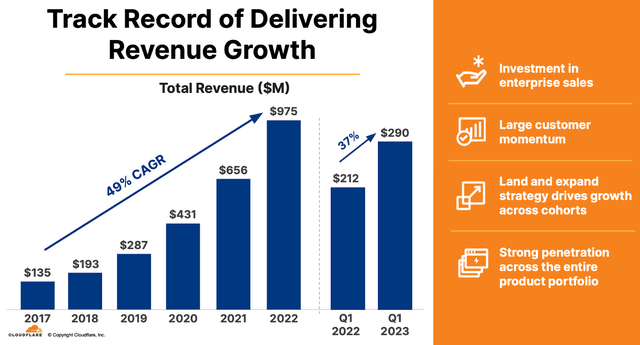

In the most recent quarter, NET delivered 37% YOY revenue growth to $290 million. For most tech companies, such a result would be cheered considering the tough macro environment. The problem is that good is not enough for the richly valued NET stock, and management did guide for $291 million. This is a company that traditionally “beats and raises” on guidance every quarter, making the revenue miss potentially concerning.

2023 Q1 Slides

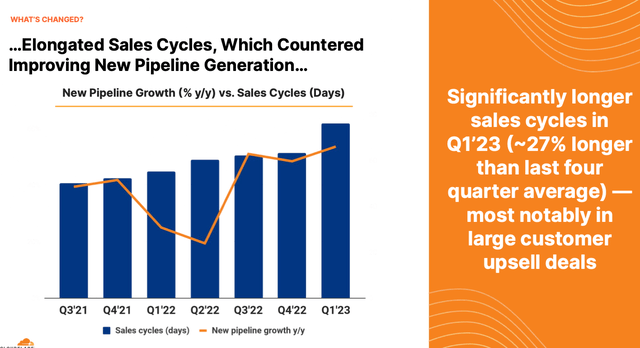

On the conference call, management cited elongated sales cycles, noting that “almost half of the new business closed in the last 2 weeks of the quarter.” At its investor day in May, management quantified the elongation as being 27% higher than average.

2023 Q1 Slides

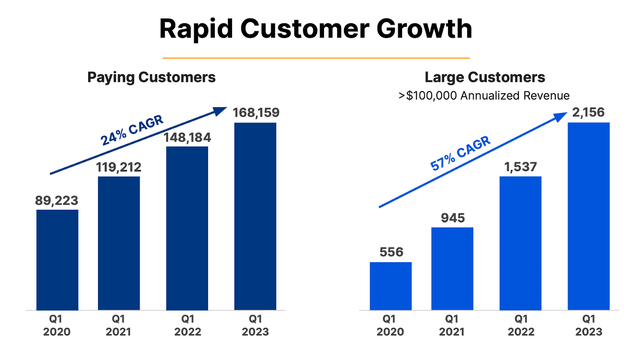

NET has continued to grow its customer base rapidly, including its largest customers.

2023 Q1 Slides

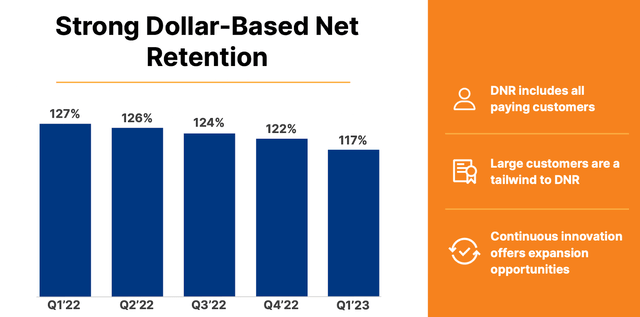

The issue is instead primarily cautiousness from existing customers to increase spending. The dollar-based net retention rate stood at 117%, marking yet another quarter of sequential deceleration.

2023 Q1 Slides

Management has often noted their determination to bring that metric above 130% over the long term, but investors may be growing impatient in the meantime.

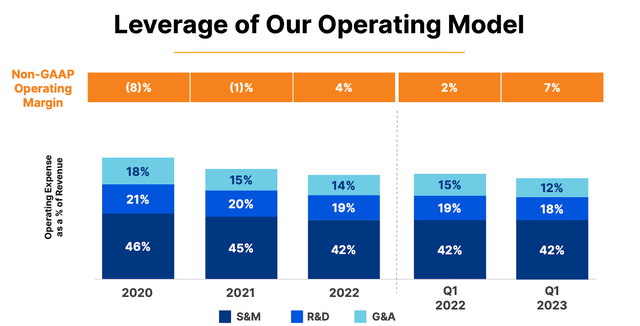

NET did deliver some operating margin expansion, but not nearly enough to offset the disappointment on the top-line.

2023 Q1 Slides

NET ended the quarter with $1.7 billion of cash versus $1.4 billion of debt. Given management’s reassurance for positive cash flow generation this year, I view their balance sheet position as being sufficiently safe.

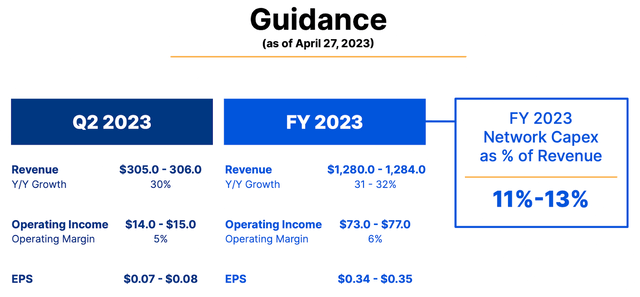

Management lowered the full year guidance to see only 32% growth to $1.284 billion – down significantly from prior guidance of $1.34 billion. As discussed earlier, this is a company which has historically raised guidance throughout the year, making this reduction in guidance notably significant.

2023 Q1 Slides

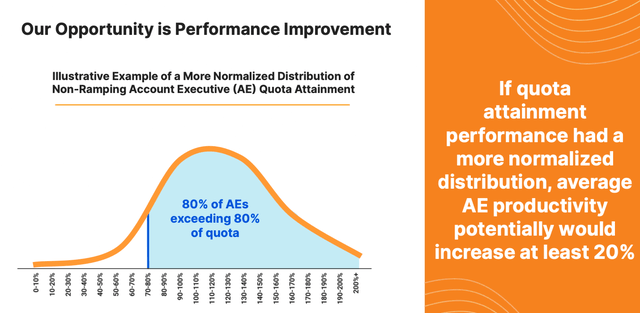

Does management have a plan to fix these execution issues? Management noted that they would undergo a revamp of their sales teams, saying that over the past several years their products were so good that some on their sales teams were able to “succeed largely by just taking orders.”

Management identified more than 100 people who have consistently missed expectations. They expect that by replacing these employees (which accounted for 4% of overall sales), they’ll be able to boost productivity by at least 20%.

2023 Investor Day

Management emphasizes that they are not experiencing elevated churn but that their deteriorating view of macro led to the reduction in full year guidance. Management did not exactly reiterate guidance to reach $5 billion in run-rate revenue within 5 years but seems convinced that these headwinds are near term in nature. Like many other tech stocks, investors have to make the determination of whether they believe growth will eventually accelerate and if the stock price has already priced in any potential disappointment.

Is NET Stock A Buy, Sell, Or Hold?

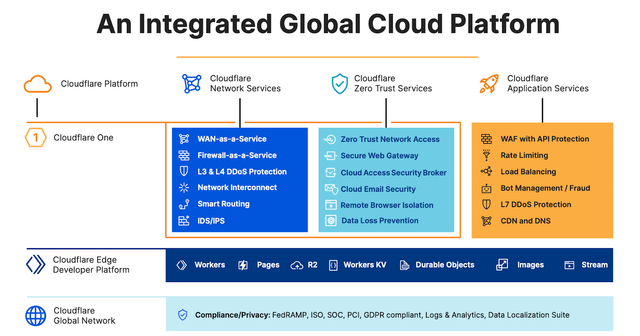

NET is mostly known for being a content distribution network (‘CDN’), but it is positioning itself to be an integrated platform for a faster and safer internet.

2023 Q1 Slides

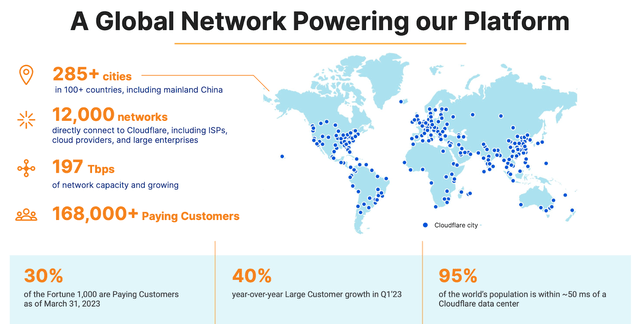

NET benefits from having a wide global network.

2023 Q1 Slides

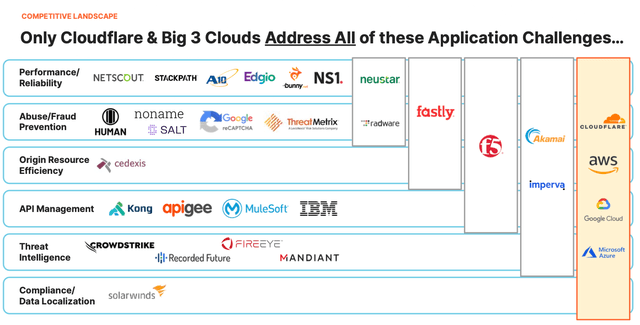

NET views itself as being a disruptor in the sector, with its primary competitors being not legacy vendors like Akamai (AKAM) but instead the big 3 cloud vendors. NET believes it offers a more complete offering than these vendors without “lock-in” risk.

2023 Investor Day

NET stock still trades richly relative to peers, though based on consensus estimates the valuation is expected to get more reasonable after several years of hyper-growth.

Seeking Alpha

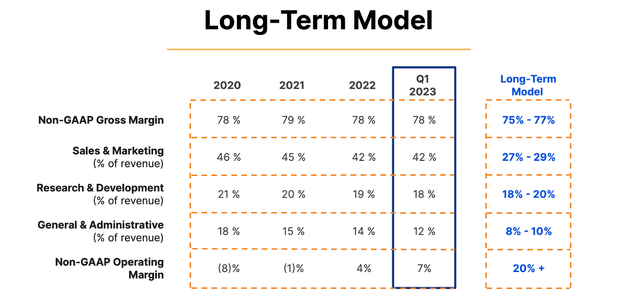

Management has guided for at least 20% operating margins over the long term.

2023 Q1 Slides

I view that guidance as being conservative as 25% to 30% appears achievable but I’ll use that 20% target in my valuation model. Based on 30% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I can see fair value hovering around 9x sales. Given that the stock currently trades at a material premium of that, it is clear that the stock is pricing in many years of growth. There are still many other stocks in the tech sector that are trading at a discounted valuation relative to this year’s estimates, so investors interested in NET should understand what they are paying for. If the stock traded at a 9x multiple in 2027 then that would imply around 12% annual returns over the next 4.5 years. I view that potential return as being insufficient relative to the broader market index fund and note that the above model is using consensus estimates which look aggressive and there is also a low likelihood that NET can sustain a 30% growth rate exiting 2027.

What are the key risks to the bullish thesis? At this point, the main risk is valuation. NET is subject to the same macro difficulties faced by other tech companies. It is possible that the new guidance is still too optimistic and a future reduction in guidance is likely to come with another round of multiple compression. I can see NET trading down at least 50% if growth were to decelerate to the 15% to 20% range and if the stock were to trade in-line with peers. Compared to many other tech companies, NET has less net cash on its balance sheet. If the business were to turn south, then the downside would be more pronounced due to the potential for greater financial risk. Finally, there remains the risk that this tough macro environment makes customers inclined to work with more well-known operators like the mega-cap cloud titans, which may have a detrimental impact on the stock’s long term growth outlook. I am of the view that barring a huge beat to consensus estimates, NET is not offering sufficient risk-reward, especially relative to both tech peers as well as the simple S&P 500 market index.

Read the full article here