Following the positive news of S&P Global Ratings, we are back to comment on CNH Industrial N.V. today (NYSE: NYSE:CNHI). Here at the Lab, we have a deep coverage of the Exor investments, and after the Q3 results, we decided to reduce our target price and estimates for the truck manufacturer. Even if we now anticipate a softer 2024 with a downcycle underway, we still expect CNH to achieve cost takeouts, so we are still overweight the company.

Starting the S&P Global announcement, CNH Industrial’s rating was raised from ‘BBB’ to ‘BBB+.’ S&P Global also confirmed the short-term debt rating at A-2. Following that, the rating agency now classified the industrial group among the non-speculative issuers.

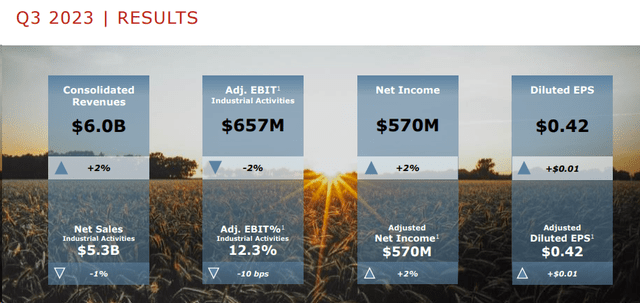

While the company is ready to be delisted from the Italian stock exchange (this will happen on January 2nd), in early November, CNH presented its Q3 results, recording a net profit of $570 million and a diluted EPS of $0.42, above analysts’ consensus estimates of $0.41. CHN top-line sales reached $5.99 billion with a plus 2% vs. Q3 2022 and a miss on Wall Street numbers ($6.06 billion). Looking at the divisional level, the agriculture segment’s net sales revenue decreased by 2.6% to $4.38 billion, primarily due to lower volume, particularly in EMEA and South America. These results were partially offset by a good product mix in North America and price increases. The cash flow from operating activities recorded a plus of $232 million, but the free cash flow from industrial activities was unfavorable by $127 million.

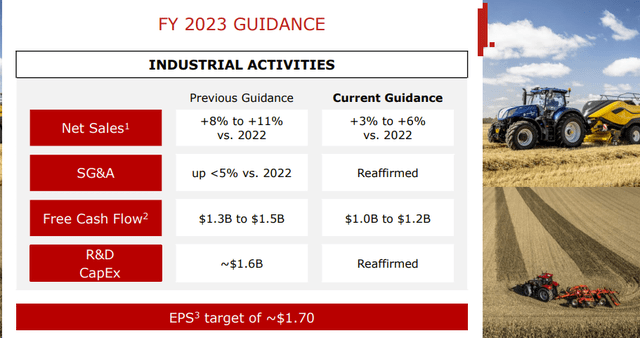

In the Q3 results presentation, the company also announced a guidance cut, with sales from industrial activities now expected to grow by 3%-6% in 2023 compared to a previous estimate of between +8% and +11%. FCF was negatively re-forecasted to $1/$1.2 billion from $1.3/$1.5 billion. In the Q&A call, the CEO reported an industrial slowdown, especially in South America.

CNH Industrial Q3 Financials in a Snap

Source: CNH Industrial Q3 results presentation – Fig 1

CNH Industrial guidance

Fig 2

Changes to our forecast

Here at the Lab, we believe that CNH Industrial Is Set For Long-Term Growth. This is supported by 1) population growth (we also backed this analysis up with our fertilizer coverage: LSB Industries, Corteva, and Yara International), 2) land scarcity, and 3) product automation with higher productivity (this helps farmers to benefit in their day-to-day work and produce more outputs). In addition, we suggest our readers check our publication on the company’s M&A Optionality. Despite that and after listening to Deere’s latest call (DE is guiding a machinery market demand down by approximately 10% for 2024), we decided to lower our 2024-2025 numbers. Before going into the details, it is also important to recap the 9M aggregate results.

In 9M, CNH revenues increased by 8% to $17.89 billion, with industrial activity sales growing by 6% to $16.06 billion. Net income also increased by 22% to $1.766 billion, with an EPS of $1.30. In the Q3 results, the company announced a restructuring plan, followed by a complete review of its corporate, administrative, and sales cost structure. The plan aims to reduce the CNH workforce by 5%, but this process will be carried out with a full review of the company’s expenses. In 2024, CNH expects a cost reduction of 10-15% of its total corporate costs and plans to incur a sunk cost of $200 million. Therefore, there are mitigating factors in our forward CNH estimates. We now expect and guide the following:

- Decline in sales by mid-single digits in 2024, with construction top-line sales estimates to minus 5%. This is based on a softer global construction demand and tougher comps in the US. For the above reason, our sales 2024 and 2025 sales projections are at $21.16 and $20.4 billion;

- As noted, the company forecasts a 2024 cost reduction/efficiency goal. CNH remarked that it will be on track to achieve $550 million in operational efficiency. Here at the Lab, we forecast that 30% efficiency will be realized in 2023, with the remaining in 2024. Therefore 2024, despite lower sales, we anticipate a 40 basis points margin expansion. In our estimates, we project an EBIT margin of 12.6% in 2024 (from a core operating profit of 12.2% in 2023).

- With our changes, we arrived at EPS of $1.67 and $1.6 in 2024 and 2025 respectively. We are reducing the CNH deleveraging process on the debt side following a lower FCF development. Our DPS estimate is unchanged at $0.4 per share. Just to remind you, CNH recently announced a $1 billion buyback program, which we believe will be helpful to current shareholders.

Conclusion and Valuation

CNH stock trades at a 6x P/E on our 2024 EPS, and we believe this multiple is not justified given that CNH demonstrated earnings resiliency. In addition, even if we project a slowdown in sales, with a delisting process and cost optimization target, CNH will likely benefit from its operating leverage (EPS target is set at $1.7). To reflect an industrial slowdown and upon execution of CNH’s cost reduction strategy, we lowered our P/E multiple to 9.5x from 11x (this was the company’s historical P/E valuation), and we arrived at a valuation of $15.86 per share (from $18.7). This target price still implied a potential upside of 44%. Our buy rating is then confirmed. Downside risks are included in our analysis called Structural Growth To Be Priced In (Rating Upgrade).

Read the full article here