The Coca-Cola Quality Effect …

Coca-Cola (NYSE:KO) has long been considered a fantastic company, appreciated for exceptional consumer brand love and global scale. On the stock market, investors have bet on Coca-Cola stock for steady revenue growth and value accumulation. To give context about Coca-Cola’s long-dated love relationship with value investors, I point out that Warren Buffett bought Cola stock back in 1988 for $1 billion worth of shares, which accounted for a 6.2% stake in the company and Berkshire Hathaway’s largest portfolio holding at the time. Today, Coca-Cola’s stock still maintains a prominent position in Berkshire Hathaway’s holdings, with Buffett’s stake having increased to about 9.2%.

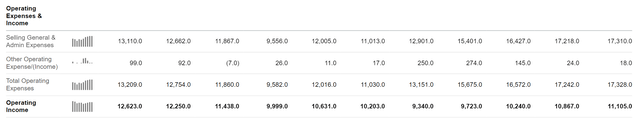

Coca-Cola is not the typical value investor’s darling, with depressed price multiples. In fact, Cola trades at a high 24x price-to-earnings ratio. The reason why investors are comfortable giving such a high multiple for Coca-Cola stock is anchored on investor’s trust in the company’s stable earnings power, which is supported by the company’s historic financials. From 2013 to 2023 TTM, Coca-Cola has consistently generated about $11 billion of operating earnings, with about +/- $1 billion of annual earnings volatility. Accordingly, investors are not paying for alpha-rich earnings ($11 billion operating income/ $258 billion market cap, is below 2 year treasury yield), and neither for earnings growth (2013-2023 earnings CAGR <2%); investors are paying for earnings predictability and stability.

Seeking Alpha

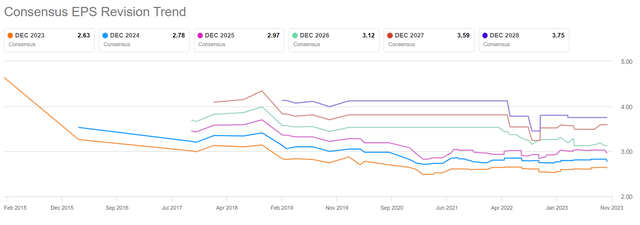

A look at analyst revisions for Coca-Cola’s EPS estimates underscores the thesis further. For the past 5 years, EPS estimates have shown little earnings volatility, despite the aggressive bearish and bullish sentiment swings in the macro environment.

Seeking Alpha

… Is Under Attack From Pharma

But I see this changing: After decades of earnings stability, Coca-Cola’s business is under attack from pharma’s new weight loss drugs, such as Novo Nordisk’s (NVO) Ozempic and Wegovy and Eli Lilly’s (LLY) mounjaro. These drugs are leveraging the effects of semaglutide, which mimics the action of a natural hormone in the body called GLP-1. This hormone is involved in regulating appetite and food intake through increasing the sensation of fullness or satiety after eating, and slowing down the emptying of the stomach. Ultimately, semaglutide is designed to help in reducing cravings for high-calorie or unhealthy foods, pressuring consumers’ demand for products offered by Coca-Cola.

In a previous article, I covered the business outlook for Novo Nordisk, predicting that the obesity drug market may be valued at $350-450 billion annually by 2030. While this is good for pharma, notably Novo Nordisk and Eli Lilly, it is very bad for many food and beverage companies. And the argument should be straightforward.

According to Novo Nordisk estimates, there are currently 764 million people diagnosed with obesity health issues, of which only 2% are currently medically treated. In line with this, there is only minimal effect on Coca-Cola’s business; and through the next 3-5 years, the market penetration of weight loss medications is expected to progress at a gradual pace. Because these drugs are relatively costly and necessitate prescription, which can limit their immediate adoption. However, it’s worth noting that the projected patient base for these drugs is anticipated to increase broadly and consistently, capturing an ever larger share of the 40-45 percent of the U.S. adult population that is obese, according to the US Centers for Disease Control and Prevention.

Weight loss drugs sting Coca-Cola by addressing an audience whose consumption adjustment hurts Coca-Cola the most. Or in other words, Coca-Cola may be poised to lose some, or many, of its highest-valued customers.

Valuation Rerating Necessary

I am not saying that Coca-Cola is poised to lose its appeal. Overall, the company will highly likely continue to command a strong position with consumers, as well as attractive price leverage. And the precise impact of weight loss drugs on consumption of high-caloric food and beverages must yet be determined. However, what I am convinced of it that Coca-Cola’s time of predictable earnings streams is likely over, as GLP-1 brings lots of uncertainty. This means that Coca-Cola’s implied P/E premium should be no more justifiable; and a rerating towards 12-15x P/E should be reasonable and prudent. This would suggest about 35% downside for Coca-Cola stock.

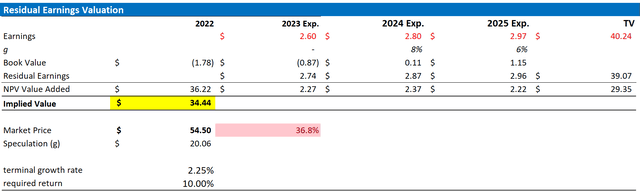

This valuation estimate would be in line with a residual earnings model based on analyst consensus estimates through 2025, charging earnings against a reasonable 10% implied required return (excl. the previously discussed quality premium, which I estimate at 200 basis points).

For context, the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

For context, I charge Cola’s earnings against tangible book value, excluding intangible assets like goodwill, which can be subjective and can fluctuate in value over time.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Upside Risk

Although valuation and GLP-1 trend point to downside for Coca-Cola, investors should not forget that the company still enjoys one of the best brand images, and commercial strengths such as distribution channels, in the world. Strong companies like Coca-Cola are notoriously difficult to short. Moreover, it is important to point out that GLP-1 medication may gain traction at a much lower pace than projected, especially as pharma companies are still constricted by their supply chain capacity.

Investor Takeaway

Coca-Cola has long been a favorite among value investors, cherished for its substantial moat built on brand appeal and global reach. This, combined with exceptionally low earnings volatility through the past few decades, caused Coca-Cola stock to trade at an implied premium price to earnings multiple. However, I see a major headwind attacking Coca-Cola earnings predictability, as the pharma industry introduces weight loss drugs that harness the effects of semaglutide, reducing cravings for high-calorie foods and beverages. While the impact on Coca-Cola is currently limited, the slow-grinding, but surely growing, market for weight loss medications may eventually pose a significant threat, especially considering the rising prevalence of obesity. This shift towards uncertainty may suggest that Coca-Cola’s current P/E premium may need re-evaluation, with a potential rerating towards a more conservative 12-15x P/E being reasonable and prudent, as suggested by the residual earnings model on a 10% implied equity charge. Accordingly, I advise to sell Coca-Cola stock while the price is rich (currently 24x P/E).

Read the full article here