The Q3 earnings season for the restaurant industry is finally over and we saw mixed results overall. Evidence of this came from another weak report from Dine Brands (DIN) and significant traffic declines at Cracker Barrel (NASDAQ:CBRL), and we haven’t seen much improvement in industry-wide traffic since October. On a positive note, quick-service and fast-casual brands have continued to beat estimates like Restaurant Brands International (QSR) and Chipotle (CMG). Fortunately, Cracker Barrel noted that traffic has improved sequentially since August, its new loyalty program enrollments have “exceeded expectations”, and it has strong leadership in place to sustain this growth. In this update, we’ll look at the updated valuation, the recent fiscal Q1 results (CY-Q3), and whether this rally in the stock is worth chasing with the stock still sporting a 6.5% yield.

Cracker Barrel Breakfast Offerings – Company Presentation

Q1 Results

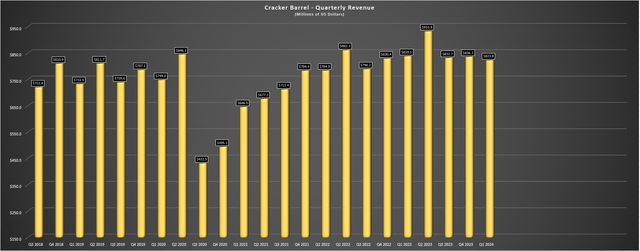

Cracker Barrel released its fiscal Q1 2024 results ended October 27, 2023 last month, reporting quarterly revenue of $823.8 million, a 2% decline from the year-ago period. The disappointing sales figures were despite 6.8% menu pricing in the period, with the company reporting –0.5% comparable restaurant growth, -8.1% comparable retail growth, a 7.1% decline in comparable traffic and 0.2% negative mix. Cracker Barrel noted these results were in line with its expectations, with the bar clearly set quite low, especially with other brands like First Watch (FWRG) reporting positive dining room traffic in the period. Meanwhile, the company noted that operating margin was at the low end of internal expectations, with a sharp decline to just 1.4% operating margins and with its margins down over 80% from pre-pandemic levels (Q1 2019: 8.4%).

Cracker Barrel Quarterly Revenue – Company Filings, Author’s Chart

Digging into the results a little closer, Cracker Barrel’s cost of goods sold benefited from commodity deflation with softness in poultry/pork prices, declining from 33.5% to 31.0% year-over-year (albeit still up significantly from pre-pandemic levels despite the benefit of menu pricing). Unfortunately, labor costs jumped 220 basis points to 37.0% with increased labor hours to support its guest experience, with the company noting this appears to have paid off with improvements in key guest metrics. Finally, other operating expenses also jumped meaningfully to 24.7%, with higher advertising expenses (increased median spending) and the launch of its Cracker Barrel Rewards program, plus a shift in timing of ad spend for the holidays. The company noted that it has refined its messaging to focus on core guests and leaned into linear TV, and the results appear to be paying off with continued sequential improvements in store traffic extending into fiscal Q2 2024.

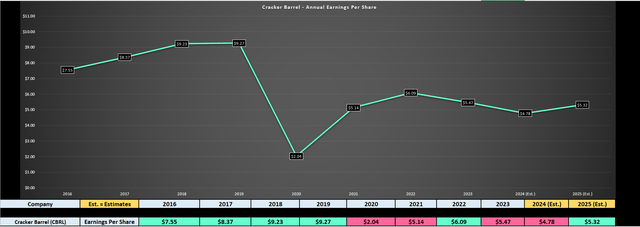

Cracker Barrel Annual Earnings Per Share – TIKR.com, Author’s Chart

Although it’s encouraging to see that enrollments in the Cracker Barrel Rewards program were better than expectations and that traffic is improving, traffic has improved off of relatively low levels (significant traffic declines in the quarter) and with elevated marketing required to drive these sales. The result is that annual earnings per share [EPS] have taken a beating with the combination of higher labor and advertising expenses, with quarterly earnings per share sinking to $0.51 (Q1 2023: $0.99), and the company on track to report another significant decline in annual EPS based on current estimates ($4.78). And despite the higher planned marketing spending and continued menu price increases, the company has guided for relatively muted sales growth, calling for revenue of $3.4-$3.5 billion in FY2024.

Overall, the results were mixed at best, with planned unit growth at Maple Street Biscuit and improving traffic offset by disappointing traffic at Cracker Barrel and a significant decline in retail spending as some guests appear to be managing total spending per visit at Cracker Barrel by passing on its gift shop (combined with already weak restaurant traffic numbers). Let’s look at recent developments and industry-wide trends to see how fiscal Q2 is trending so far.

Recent Developments & Industry-Wide Trends

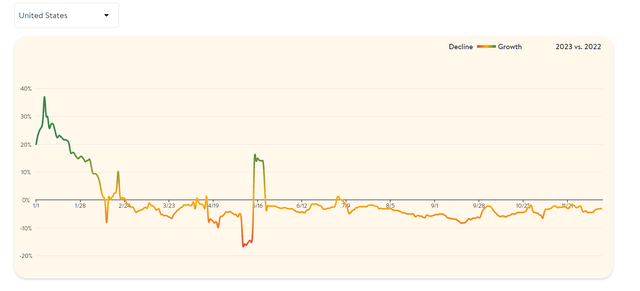

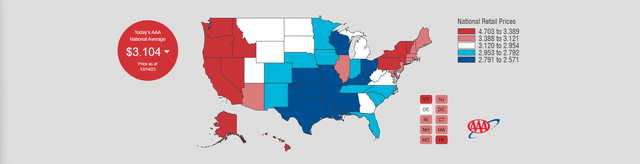

Beginning with the negatives, seated diner growth remains stuck in negative territory on a year-over-year basis (according to OpenTable data), and this marks five months spent in negative territory. This is certainly a change of character from the February to June period where traffic was volatile but saw temporary pushes into positive territory, and the alarming part about this traffic is that we’ve seen minimal recovery despite a significant and persistent decline in gas prices which are often a tailwind for the industry as wallets feel a little more full. This could be because of a number of factors like excess savings being depleted, and it doesn’t help that while gas prices may be lower year-over-year, menu prices when dining out are still up meaningfully, potentially pricing some less affluent customers out of casual dining.

Seated Diners Growth – OpenTable

National Average Gas Prices – GasPrices.AAA.com

As for the company’s outlook, Cracker Barrel was upbeat on the success of progress to date, but a little cautious overall, stating that it plans to be more conservative with pricing in FY2024 because of promotional activities being elevated and consumers being “generally pressured”. Meanwhile, although it benefited from commodity deflation in fiscal Q1 2024 and still reporting sub 3.0% operating margins, it is guiding for low single digit commodity inflation for the year and mid-single-digit wage inflation, a tough combination when the company is having to be more careful with additional menu price increases.

So, what’s the good news?

Despite minimal improvement in industry-wide traffic in the September through late October period, Cracker Barrel shared it has sustained momentum regarding recovering traffic, suggesting that more effective marketing, highlighting its 20 options under $12, $8.99 breakfast, and focusing on core guests is paying off. That said, while it seems to be winning back some traffic with increased messaging and highlighting its value proposition across dayparts, the environment remains quite promotional, restaurants appear to be chasing fewer dollars as traffic is lower overall (suggesting reduced frequency or some consumers simply being tapped out), and previous drivers of incremental industry-wide traffic improvement don’t appear to be helping as much as in the past (lower gas prices). Hence, I think it’s tough to be optimistic about FY2024, and the stock isn’t particularly cheap for a turnaround story at ~16.2x FY2024 earnings estimates and over 10x EV/EBITDA.

Valuation

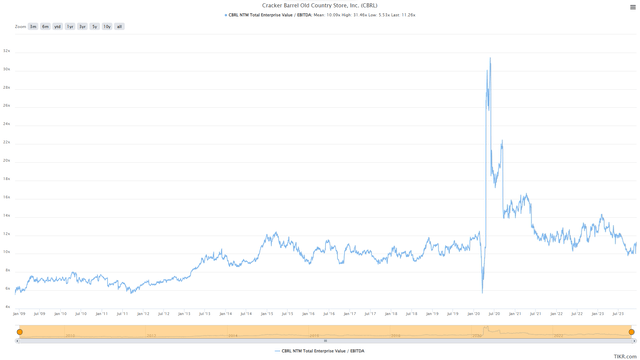

Based on ~22.2 million shares and a share price of $77.40, Cracker Barrel trades at a market cap of ~$1.76 billion and an enterprise value of ~$2.92 billion. This figure is a massive decline from its more recent peak market cap of ~$4.3 billion in 2021, but we haven’t seen a significant improvement in the valuation despite the magnitude of this drop. This is because annual earnings per share have fallen off a cliff given the margin compression we’ve seen, and Cracker Barrel is still trading in line with its historical EV/EBITDA multiple despite hanging out only 20% off its multi-year lows. So, while the turnaround plans could have legs with a new COO at Maple Street Biscuit (former COO of Panera Bread) and a new CEO (former President, International of Taco Bell), it’s hard to argue that there’s enough margin of safety to justify owning the stock after the recent rally.

Cracker Barrel – Historical EV/EBITDA Multiple & Current Multiple – TIKR.com

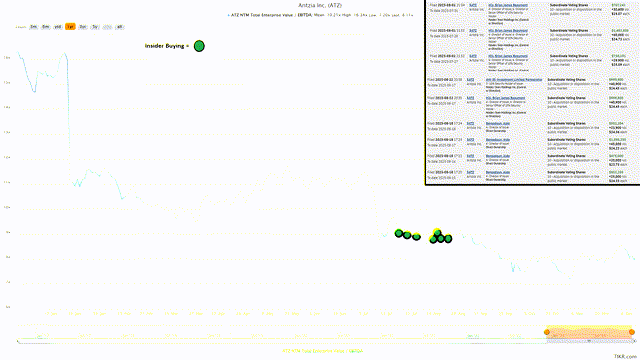

Using what I believe to be a fair multiple of 10.5x EV/EBITDA and FY2025 estimates to be generous ($265 million) and allow time for a potential turnaround, I see a fair value for Cracker Barrel of $73.10, translating to no upside from current levels. And even if we include $5.20 for the annualized dividend, this still points to no upside return based on what I believe to be a fair multiple for this business of 10.5x. Clearly, this isn’t nearly enough reward to justify taking on the risk of owning a laggard, and especially not when consumers are being far more judicious with their spending and Cracker Barrel has some of the weakest margins industry wide. Hence, if I were looking to put capital to work in the Retail Sector (XRT), I think there is far more value in names like Aritzia (ATZ:CA) that have tripled revenues over the past five years at a lower EV/EBITDA multiple, and with significant insider buying.

Aritzia EV/EBITDA Multiple & Insider Buying – TIKR.com, SEDI Insider Filings

Summary

Cracker Barrel reported another disappointing quarter in fiscal Q1 2024 with significant traffic declines, underwhelming comp sales growth, and significantly lower margins year-over-year. Meanwhile, commodity deflation that benefited the most recent period is expected to flip back to single-digit inflation in fiscal 2024, with beef costs remaining elevated and a tick-up in bacon prices, with beef alone making up over 11% of food purchases in 2023. This isn’t a massive issue and Cracker Barrel is certainly better positioned than steakhouses, but with choppy traffic, razor-thin margins and little room for error, I still don’t see a compelling enough setup to go long the stock here at $79.50.

Obviously, I could be wrong, and if the Cracker Barrel turnaround is successful with the help of a solid management team at the helm, investors waiting for $60.60 where the new low-risk buy zone lies may miss out on locking in a high single-digit dividend yield. However, I prefer to buy at the right price or pass entirely, and while there are examples of successful turnarounds, I would rather bet on a proven management team that has consistently grown per share metrics at ~12x forward earnings than a brand that looks to have lost some market share and is playing catch-up relative to peers with significant traffic declines vs. more iconic brands. In summary, I continue to favor names like Aritzia in Retail and B2Gold (BTG) in Materials, and I would view any rallies above $86.00 before February in CBRL as an opportunity to book some profits.

Read the full article here