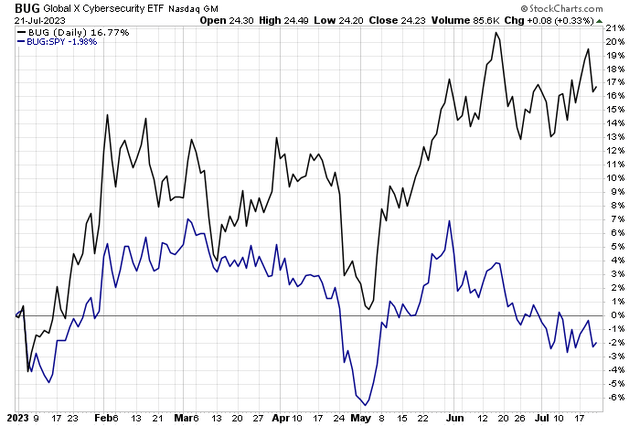

Cybersecurity stocks are up solidly on the year, but the industry has modestly underperformed the broad market. The Global X Cybersecurity ETF (BUG), through July 21, is up 17% total return in 2023, but it has been a choppy ride over the past two months. Will earnings season change that?

I am initiating coverage on CrowdStrike (NASDAQ:CRWD) with a buy rating for its robust growth outlook, improving free cash flow, and appealing valuation relative to some of its peers.

BUG Cybersecurity ETF Holding YTD Gains, Underperforming SPX Lately

Stockcharts.com

According to Bank of America Global Research, CRWD is a leader in the Endpoint Protection Platform (EPP) market. EPP solutions help protect enterprises’ internet-connected devices from cyber attacks, and there is a market shift from signature-based on-prem solutions to cloud-based platforms using AI and machine learning. CrowdStrike’s platform is one of the few 100% cloud-based architectures and is uniquely positioned to displace incumbents with its platform breadth, including advanced detection and remediation capabilities.

The Austin-based $35 billion market cap Systems Software industry company within the Information Technology sector has negative trailing 12-month GAAP earnings and does not pay a dividend. Ahead of earnings next month, the stock has a somewhat high 39% implied volatility percentage along with a modest 2.9% short interest.

Back in May, CrowdStrike reported a solid operating earnings beat along with a FY 2024 guidance raise. $0.57 of per-share profits topped analysts’ expectations of just $0.50 while revenue also bettered the consensus forecast. Net sales grew 42% from a year earlier. The results were fine, but the stock price reaction was something to behold. I like to see how accumulation and distribution appear around key news events on growth stocks. In this case, CRWD opened sharply lower on June 1, but then the bears stepped up to the plate intraday. After notching a low of $142.49, CRWD settled just shy of $160, establishing a key trading range. It has been a bullish consolidation pattern since then. But let’s home in on the fundamentals here.

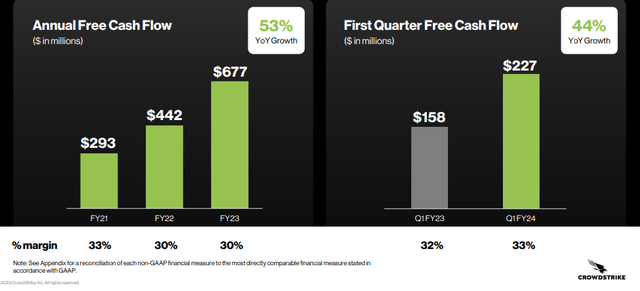

While net new ARR came in light for its Q1, perhaps causing the initial bearish reaction, the broader report was robust. Importantly, the cybersecurity player posted record a record free cash flow figure of $227 million in its Q1. Its gross and operating margins of 78% and 17%, respectively, beat street expectations, and strong demand trends were seen across segments, leading to the guidance raise.

Strong Free Cash Flow Growth Sequentially and YoY

CrowdStrike IR

Key risks include possible investor sensitivity to the growth multiple should a shift to value take place in the second half, softer adoption rates for CrowdStrike’s new service offerings, and competition from strong competitors.

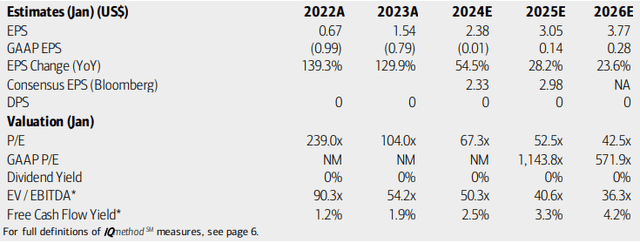

On valuation, analysts at BofA see earnings rising sharply this year (CRWD finishes Q2 of its FY 2024 at the end of July) while EPS is expected to rise a slower, though still robust, clip through 2026. GAAP per-share profits are expected to be significantly less, though. Still, the Bloomberg consensus profitability outlook is about on par with what BofA projects. With an operating P/E currently north of 60, shares are not cheap on the surface. Still, CrowdStrike is free cash flow positive and its FCF is seen as climbing steadily over the coming quarters.

CrowdStrike: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

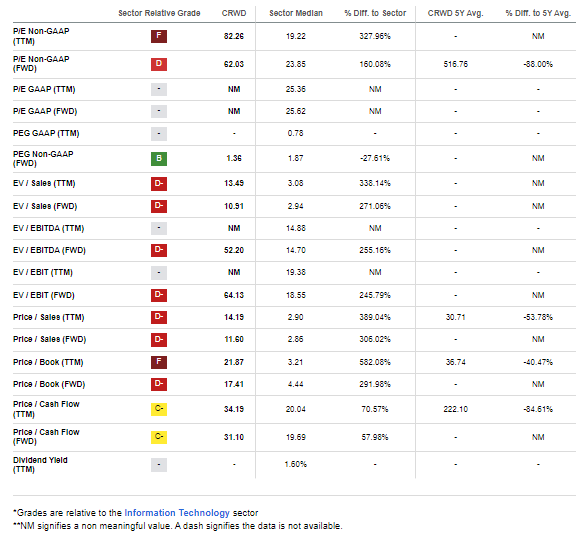

Given that the company is still in somewhat early growth stages today, a high valuation is warranted. What is encouraging is that its forward price-to-sales ratio is now just half of its 5-year average. That makes sense given a much higher cost of capital today. Let’s look at the valuation another way, though.

If we assume normalized non-GAAP EPS of $3 over the coming 12 months, that is a P/E ratio near 50. Now, pair that P/E with a growth rate of 25%. We arrive at a normalized forward operating PEG ratio of just 2. That’s not all that expensive in my view. That is cheaper than Check Point’s (CHKP) 2.42 ratio and Fortinet’s (FTNT) PEG 2.83 multiple. So, I see shares near to slightly under fair value on this growth stock.

CRWD: Lofty Valuations, But Not Too Pricey Considering The Strong Growth Profile

Seeking Alpha

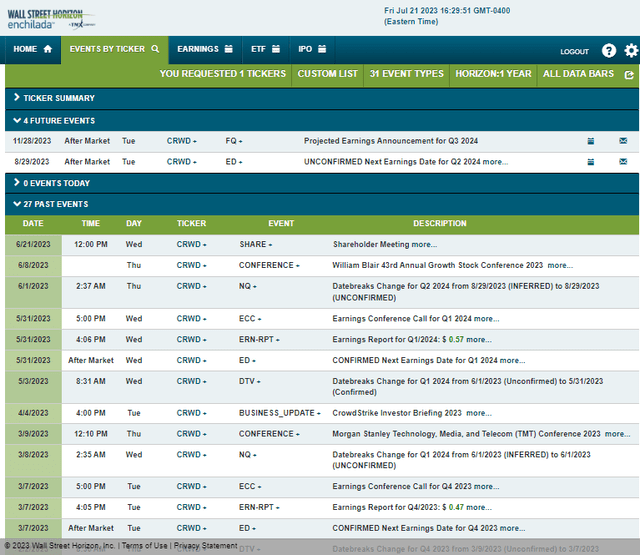

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2024 earnings date of Tuesday, August 29 AMC. No other volatility catalysts are seen on the corporate event calendar.

Corporate Event Risk Calendar

Wall Street Horizon

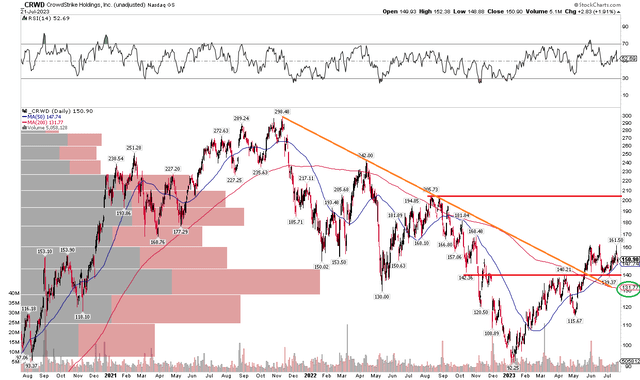

The Technical Take

Some macro risks but ample room for growth, along with a decent valuation, the chart has encouraging signs. Notice in the graph below that shares broke out from a downtrend resistance line that began at its late 2021 all-time high near $300. After a 70% drawdown ending this past January, shares climbed to $140 resistance, then pulled back in April to notch a higher low in May. The stock then jumped above $140 and successfully retested that level earlier this month.

So, we have established support and resistance levels to watch. On the upside, $206 is a possible point of selling, but long today with a stop under the flattening 200-day moving average looks like a favorable risk/reward play. In the very short run, $160 appears to be a point of possible selling pressure, as well.

Overall, it appears a bearish to bullish reversal pattern continues to take shape.

CRWD: $140 Key Support, Downtrend Broken As 200DMA Inflects

Stockcharts.com

The Bottom Line

I have a buy rating on CrowdStrike. I see the valuation as attractive relative to some of its peers, while its growth outlook appears robust with secular tailwinds. Finally, the chart has reversed higher after a major drawdown.

Read the full article here