CrowdStrike (NASDAQ:CRWD) reported its 3Q24 results and overall, I continue to be impressed by the company and this remains one of the highest conviction stocks in the portfolio.

I have covered CrowdStrike extensively (which can be found here), having been rating the company a Buy and even bought the company for the barbell portfolio when valuations were attractive.

That said, I would not be recommending to buy at current valuation levels as much has been priced in despite still being constructive about the long-term opportunity for CrowdStrike and the strong recent results. Therefore, I am turning neutral on the grounds of rich valuations.

3Q24

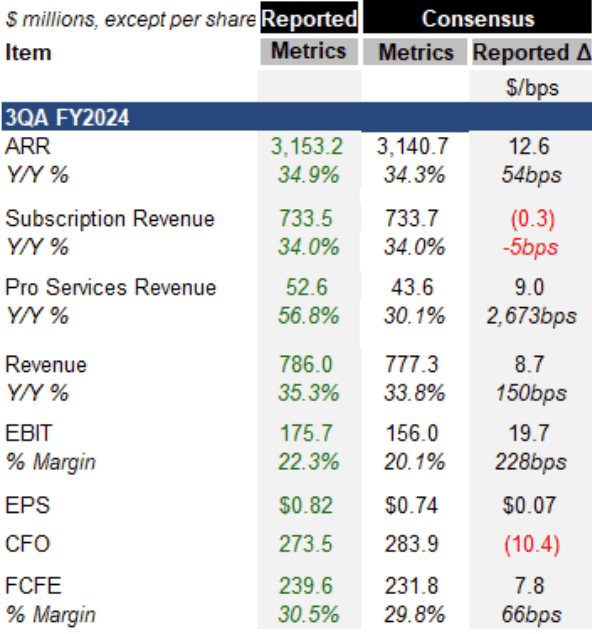

Despite a challenging macro backdrop, as can be seen below, CrowdStrike beat consensus expectations across growth and profitability metrics.

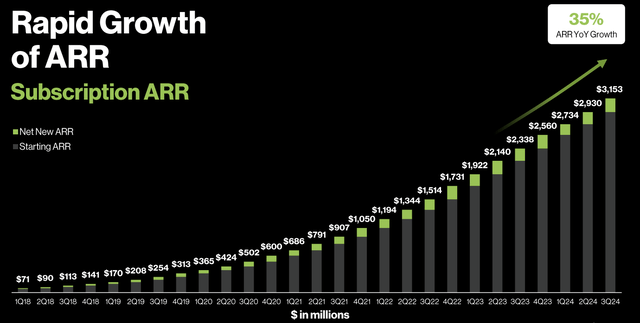

ARR grew 34.9% to $3,153 million, beating consensus expectations by 54 basis points.

This is the first time CrowdStrike surpassed the $3 billion ARR milestone. With this milestone achieved, CrowdStrike is the fastest and the only pure-play cyber security software vendor in history to achieve this milestone.

In 3Q24, CrowdStrike achieved a record net new ARR of $223 million, reaccelerating to 13% growth, up from the 1H24 negative 9% net new ARR performance, even when compared to a 17% compare from the prior year.

The demand in the quarter was broad-based, across large enterprises and small businesses. The acceleration of net new ARR growth was brought about by new customer acquisition, strong expansion with existing customers and a record quarter with the US federal government. The rising win rate against competitors and an acceleration in its emerging businesses also contributed to this re-acceleration.

In the current environment, the double digit net new ARR growth is very impressive.

Subscription ARR (CrowdStrike)

Revenues came in at $786 million, beating consensus expectations by 150 basis points, growing 35% from the prior year.

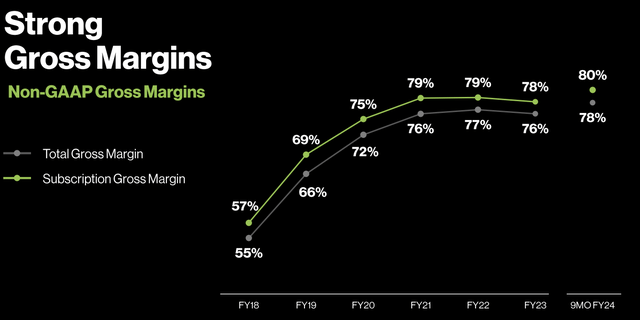

The strong top-line performance was accompanied by cost discipline as the company’s profitability reached new records, with record non-GAAP subscription gross margin, record GAAP and non-GAAP operating profitability, and record free cash flow.

Subscription gross margins reached a new record, coming in above 80% for the quarter, as the investments in data center and workload optimization are showing their results.

Gross margins (CrowdStrike)

EBIT came in at $176 million, with EBIT margin of 22.3%. This was 228 basis points ahead of consensus expectations of 20.1%.

Operating expenses in 3Q24 came in at $436 million, up 25% from the prior year, with sales and marketing and R&D expenses growing 23% and 31% respectively.

The operating expenses growth of 25% was smaller than that compared to the revenue growth of 35%, thereby leading to margin expansion in the quarter.

EPS came in at $0.82, beating expectations by 11 percentage points, while FCF to equity came in at $240 million or 30.5% margin, beating consensus expectations by 66 basis points.

As a result, CrowdStrike achieved a free cash flow Rule of 66, up from 63 last quarter.

The company also has a very strong balance sheet, with $3.2 billion in cash position, and in 3Q24, generated $274 million and $239 million in cash flow from operations and free cash flows.

Summary of CrowdStrike 3Q24 results (Author generated)

Based on current quarter, management believes that it is on track to reached $10 billion in ARR given its strong setup for 4Q24, a record pipeline and continued widening of the competitive gap between CrowdStrike and competitors.

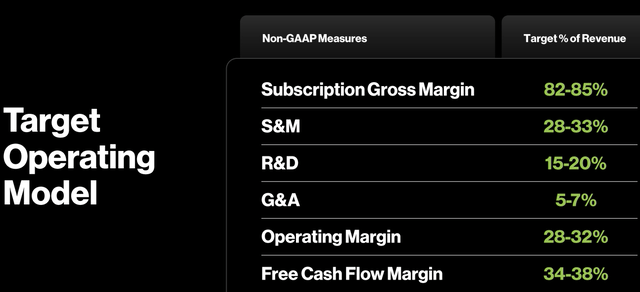

I have shared this earlier in another article, but to emphasize CrowdStrike’s medium-term goals, it expects to reach $10 billion ARR in the next five to seven years, and it expects to reach its target operating model, including subscription gross margins between 82% to 85%, operating margin between 28% to 32%, and free cash flow margin between 34% to 38%, in the next three to five years.

Target operating model (CrowdStrike)

Another thing I will highlight is that while other companies are dialing back on their investments into innovation, CrowdStrike continues to invest aggressively while still meeting its profitability targets. We saw R&D expenses grow 31% in the quarter as evidence that CrowdStrike remains in growth mode and is able to invest aggressively as a result of its competitive position and balance sheet.

Outlook

CrowdStrike did mention that the macro environment remains challenging, with companies increasing scrutinizing budgets.

While there is strong demand for the Falcon platform and thus a record pipeline, management is not expecting the usual 4Q budget flush.

Thus, management is reiterating its net new ARR assumptions, which assumes that net new ARR for the full year of 2024 to be in-line or modestly up, and that implies a double digit growth in net new ARR growth in the second half of 2024.

CrowdStrike is raising its full year revenue and profitability guidance, with an expectation of revenues between $3,047 million to $3,050 million, growing 36% from the prior year, non-GAAP income from operations between $634 million and $636 million, non-GAAP net income between $715 million and $718 million, and non-GAAP net income per share between $2.95 to $2.96.

In addition, CrowdStrike is maintaining its free cash flow margin of 30% for the full fiscal year of 2024.

The assumption of guidance for net new ARR growth of in-line to modest growth for the full fiscal year of 2024 looks to be conservative given that management is not incorporating any budget flush the final quarter of FY2024.

Key beneficiary of consolidation

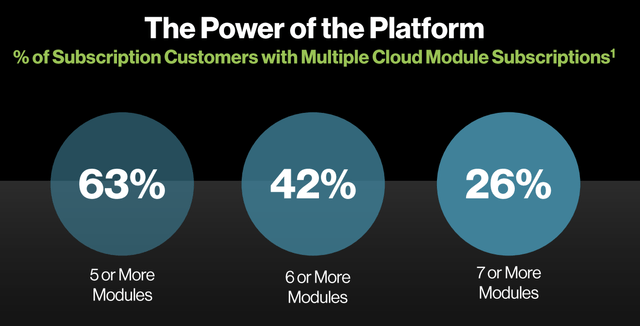

As can be seen below, 26%, 42% and 63% of its customers use seven or more, six or more, and five or more modules respectively.

CrowdStrike also mentioned in the 3Q24 earnings call that deals with eight or more modules increased by 78% from the prior year in the quarter, further highlighting that large deals are consolidating with CrowdStrike.

Number of customers with 5 modules or more (CrowdStrike)

This consolidation by CrowdStrike is contributed by the strong industry recognition and this was also the case in 3Q24. CrowdStrike continues to be ranked amongst the best cybersecurity companies in its segments, as it was one of the highest-rated in Gartner’s latest Peer Insights Voice of the Customer for EPP report, it was named a Leader in the Forrester Wave for Endpoint Security, and it was also named as a leader in the IDC Vulnerability Management MarketScape. In MITRE’s latest ATT&CK testing CrowdStrike was awarded a perfect 100% across protection, visibility and analytics detections.

CrowdStrike’s gross retention rate continued to stay high and its dollar-based net retention rate was slightly below its benchmark in 3Q24. The mix of net new ARR from new customers has continued to be ahead of the company’s expectations and the company continues to land larger deals today than before.

Platform opportunities

Within cloud security, growth accelerated in 3Q24 and the company is entering 4Q24 with a record pipeline. Management shared that there was an eight-figure deal with a new Falcon customer in the hospitality vertical where CrowdStrike was also to replace Microsoft. In another seven-figure deal for cloud security expansion with one of the largest enterprise SaaS providers, CrowdStrike’s Falcon Cloud Security replaced multiple existing point products. And within cloud security, there was another seven-figure cloud security expansion with a major apparel brand, where CrowdStrike replaced a firewall hardware vendor’s cloud security.

With the number of customers CrowdStrike protecting in the public cloud growing 45% from the prior year, its cloud security solution is quickly replacing other cloud security vendors, and it is one of the largest and fastest-growing cloud security businesses by ARR and customer count.

Within its Identity Threat Protection business, CrowdStrike delivered a record quarter, and highlighted several notable wins.

In particular, management noted that there was an eight-figure deal win with the federal government. The federal government chose Falcon Identity as the identity security solution of choice. There were also multiple seven-figure wins, which are across diverse verticals like financial services, consumer packaged goods and manufacturing, amongst others.

CrowdStrike’s LogScale next-gen SIEM business reached a record in 3Q24, exceeding the $100 million ARR milestone. The growth has been fueled by the discontentment with legacy SIEMs, and CrowdStrike’s LogScale, which is integrated within the Falcon platform and brings cost efficiencies, search speeds and data gravity that led to significant increase in interest from customers in the offering.

Within LogScale, some of the notable wins include a seven-figure expansion with a major consumer staples company, a second seven-figure deal with a financial services company, where Microsoft was replaced, and lastly, another seven-figure deal with a business process outsourcing firm that replaced a legacy SIEM with CrowdStrike’s LogScale.

I think we are seeing good traction in cloud security, identity threat protection, and LogScale. In particular, given that we are seeing CrowdStrike replace multiple leaders and legacy players in the respective segments is very encouraging.

Partnerships

We are starting to see partnerships contribute to CrowdStrike.

In particular, we saw that CrowdStrike commented that they saw a very strong SMB segment this 3Q24 quarter.

The company specifically highlighted partnerships as a key driver for the current quarter’s results.

These partnerships include those with Dell, Pax8 and AWS marketplace, all of which represent diversification of go-to-market approaches.

The company highlighted that 62% of its new logo wins were partner-sourced year-to-date. As a result, the partners ecosystem fueled CrowdStrike’s go-to-market.

Valuation

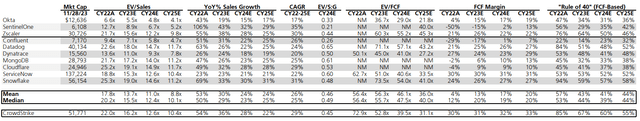

As can be seen below based on consensus data, CrowdStrike is expected to operate at higher FCF margins of 33% compared to the average in the comp group of 20%, grow faster at a CAGR of 29% compared to the average in the comp group of 26% and operate at a rule of 40 of 61 compared to the peer average in the comp group of 43.

Despite all that, it is trading at an EV/S/Growth of 0.45x, in-line or just slightly below the average in the comp group of 0.46x.

CrowdStrike comp group (Visible Alpha consensus)

I revised my financial forecasts for CrowdStrike higher after this solid print.

To determine the 1-year price target for CrowdStrike, the peer group trades between 35x to 60x EV/FCF and I applied a 40x FY2025 EV/FCF to derive the 1-year price target.

Thus, my 1-year price target for CrowdStrike is $230.

Conclusion

While I would love to buy CrowdStrike today, the valuation of the company is too rich for my liking, hence I am turning neutral on the name. That said, I am a happy buyer on weakness when valuation becomes more attractive and I continue to see CrowdStrike as a long-term winner in the space.

The 3Q24 quarter showed that CrowdStrike is differentiating itself from the rest as it continued to execute well and show strength in a difficult macro environment.

In particular, its win rate amongst competitors continues to impress me as it is winning not just legacy players, but also market leaders like Microsoft.

While the growth is accelerated by increasing consolidation, CrowdStrike is also growing increasingly profitably and cash flow generative. The company is able to have the privilege of investing aggressively in innovation and growth while doing so profitably and operating efficiently.

With the execution management has shown thus far, it is no wonder that the market has very high confidence in the company’s ability to reach its medium-term goals.

In an environment like this, CrowdStrike is benefiting from an environment in which others are facing challenges in, and thus therefore likely to continue to generate alpha as it continues to grow its market leadership.

Read the full article here