Introduction

It’s time to talk about Cummins Inc. (NYSE:CMI), the machinery producer I’ve been covering for many years. The only reason I don’t own it is because I own highly correlated Caterpillar (CAT) and Deere & Company (DE).

In August, I wrote an article discussing the company’s tremendous resilience in light of mounting economic challenges.

Despite global challenges, Cummins achieved record revenues, boosted its dividend, and stuck to its guidance.

However, the company subtly hinted at potential headwinds ahead, causing a recent stock dip.

Despite changes in economic indicators, Cummins is well-positioned for growth, innovation, and creating value for shareholders.

Three months later, we get to discuss stellar third-quarter earnings, a guidance hike, and a valuation that indicates a great long-term risk/reward – despite ongoing manufacturing weakness.

We’ll also discuss the company’s qualities as an income growth stock, as it has a top-tier dividend scorecard backed by a decent yield, a low payout ratio, and consistent dividend growth despite its cyclical nature.

So, let’s get to it!

An A-Rated Dividend Scorecard

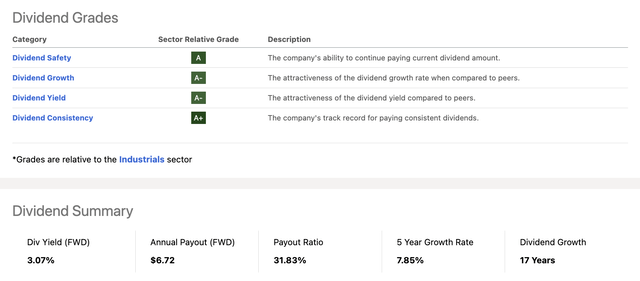

Cummins is one of the few companies in its industry that scores high in all dividend categories.

Using the Seeking Alpha dividend scorecard below, we see that CMI doesn’t score lower than A- in any of the dividend categories.

Seeking Alpha

As we can see in the overview above:

- Cummins is yielding 3.1%.

- It has a healthy dividend payout ratio of 32%.

- Its five-year dividend CAGR is 7.9%.

- CMI has hiked its dividend for 14 consecutive years. The image above says 17, but it kept dividends stable during the Great Financial Crisis.

- In July, it hiked by 7%, which was the 14th consecutive hike.

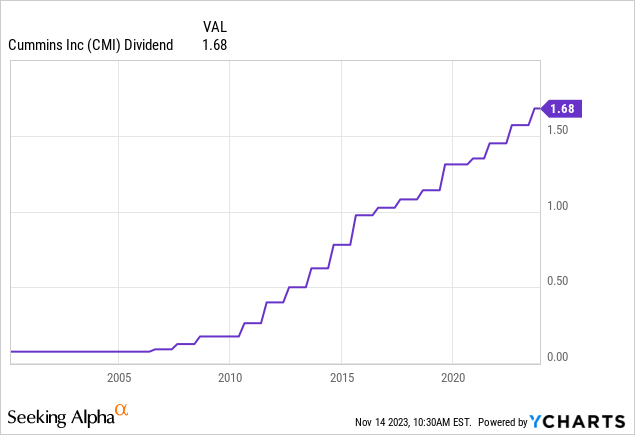

On top of that, the company has consistently bought back stock.

Since 3Q13, the company has repurchased roughly a quarter of its shares.

These buybacks have added significantly to its stock price performance. After all, a lower share count artificially boosts the per-share value of a company.

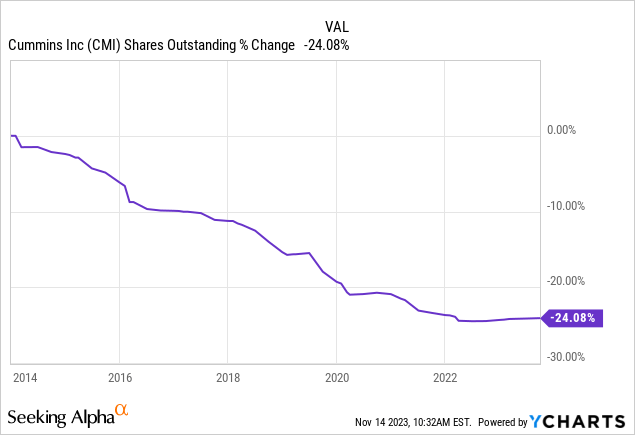

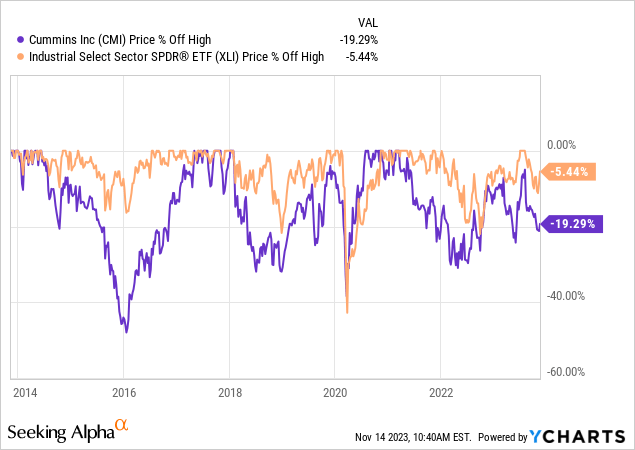

Unfortunately, the company failed to outperform the S&P 500 over the past ten years. It also failed to outperform the industrial ETF (XLI).

The main reason for underperformance is its cyclical behavior.

Because CMI sells engines, components, and related services, it tends to sell off during recessions. In 2016, 2018, and 2022, CMI shares sold off more than the XLI ETF.

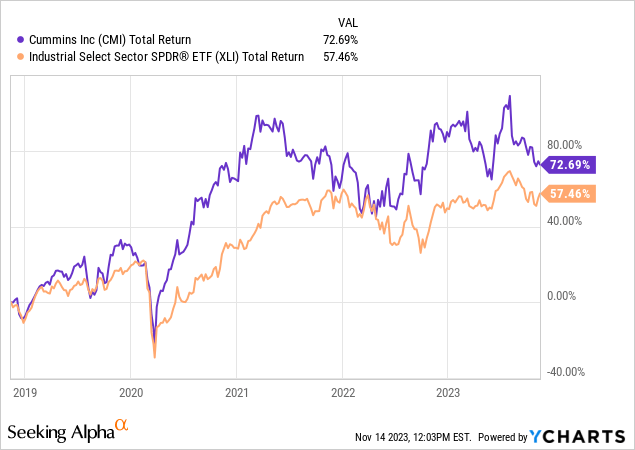

It has outperformed its peers over the past five years.

Generally speaking, I prefer to invest in companies with more favorable volatility.

However, I do own machinery stocks for a number of reasons. Consistently rising dividends and buybacks are two reasons. The fact that sell-offs come with attractive valuations is another reason.

Getting the timing just halfway right when investing in CMI for the long term comes with significant benefits.

Unfortunately, timing CMI is tough.

CMI’s Resilience In A Tough Economy

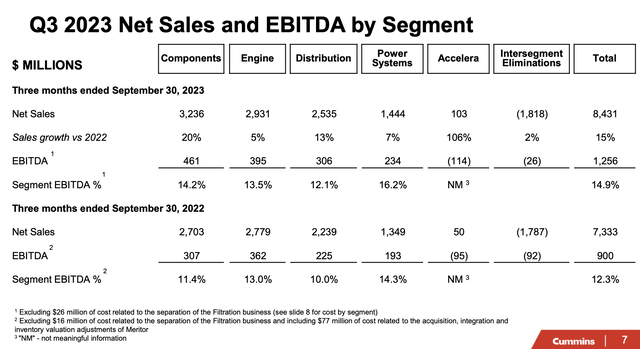

Earlier this month, CMI reported its third-quarter earnings, which showed tremendous resilience.

Cummins’ revenues in 3Q23 were $8.4 billion, a 15% increase compared to the third quarter of 2022, driven by the addition of Meritor and strong global demand.

Cummins Inc.

Furthermore, in addition to the Meritor acquisition, this growth rate was attributed to a 16% increase in North American sales and a 13% increase in international revenues.

Even without M&A benefits, organic sales growth stood at 10%, driven by improved pricing and strong demand for On-Highway and power generation products.

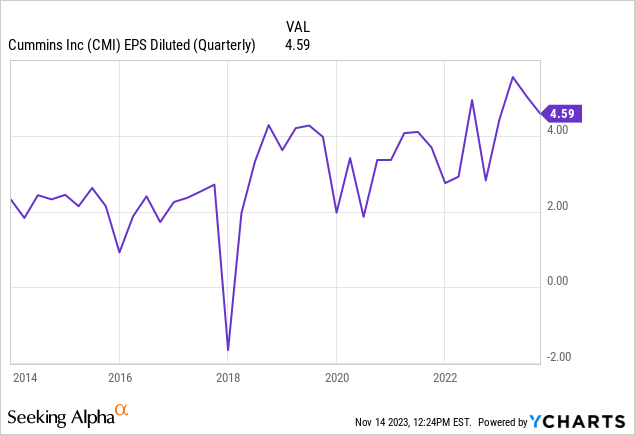

As a result, all-in net earnings for the quarter were $656 million or $4.59 per diluted share.

Operating cash flow was a record quarterly inflow of $1.5 billion, a substantial increase from the previous year, driven by solid earnings and continued focus on working capital management.

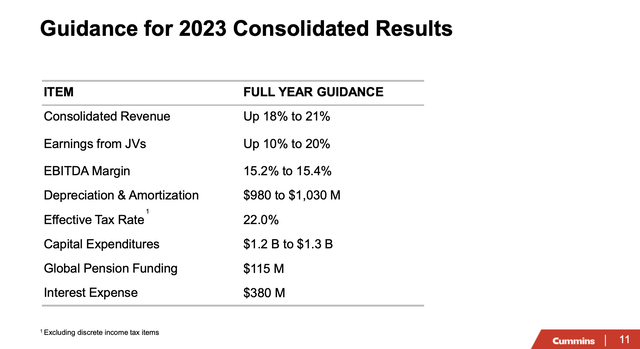

Thanks to a stellar quarter, the company hiked its guidance.

Cummins raises its full-year 2023 revenue guidance to 18%-21% growth, narrowing EBITDA guidance to 15.2-15.4%.

Cummins Inc.

Expectations include higher revenues in the Components segment and increased profitability in Power Systems, offset by decreased profitability in the engine business.

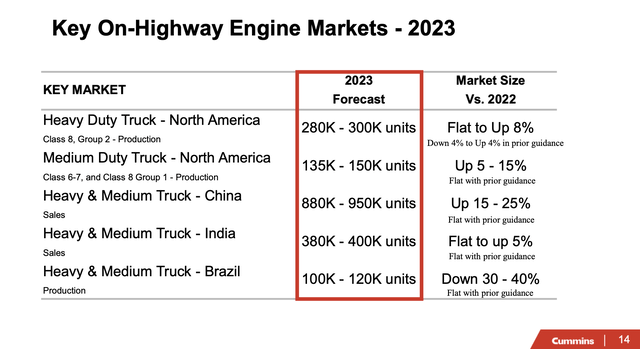

Furthermore, projections include increased heavy-duty truck demand in North America and growth in the China truck market. China’s construction volume is expected to be flat to down 10%, while India’s total revenue, including joint ventures, is projected to increase by 6%.

Cummins Inc.

Nonetheless, Cummins has initiated cost-reduction actions, including voluntary retirement and separation programs.

The company aims to monitor end markets closely and assess the need for further action while focusing on future investments, as the macro environment remains uncertain.

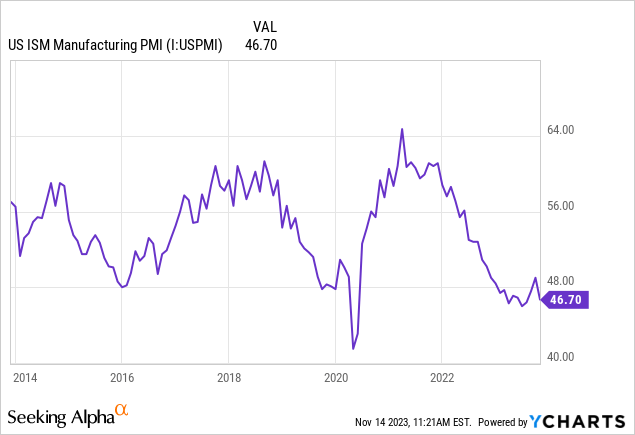

I cannot blame them, as this is what the ISM Manufacturing Index looks like:

On top of that, CMI is expanding its footprint in key areas.

During its 3Q23 earnings call, the company highlighted key strategic events in the third quarter, showing its commitment to its long-term strategy.

- The collaboration with Accelerate by Cummins, Daimler Truck and Bus, and PACCAR to accelerate battery cell production in the U.S. underscores the company’s focus on advancing clean technology. It’s still a small segment, but growth is fast in clean technology.

- The acquisition of Faurecia commercial vehicle manufacturing plants aligns with Cummins’ strategy to meet current and future demand for low-emission products, while the collaborations for the X15 natural gas engine demonstrate the company’s dedication to offering sustainable solutions.

Total investment by the partners is expected to be in the range of $2 billion to $3 billion for the 21 gigawatt hour factory with production expected to begin in 2027. We see this partnership as an opportunity to share investment with two long-standing partners while advancing a key technology solution for our customers and industry and collectively to accelerate the energy transition in the United States.

In October, Cummins completed its acquisition of two Faurecia commercial vehicle manufacturing plants and their related activities, one in Columbus, Indiana and one in Roman Netherlands. This acquisition is a natural addition to the Cummins Emission Solutions business and will help ensure we meet current and future demand for low emission products. – CMI 3Q23 Earnings Call

I believe these deals are no-brainers. While CMI won’t suddenly turn into a renewable energy machinery company, it will grow with the market and offer enough solutions and products for it to capture market share in what is still a very young market.

For example, in China, the company has expectations for a 20% market share for natural gas-powered heavy-duty trucks by the end of this year.

Cummins also reduced debt.

The company successfully reduced debt by $390 million. In October, Cummins took additional steps to reduce debt by $650 million.

As a result, the company is expected to end this year with $4.1 billion in net debt, which would translate to 0.8x EBITDA.

The company has an A+ credit rating, which is one of the best ratings on the market – especially among cyclical companies!

Valuation

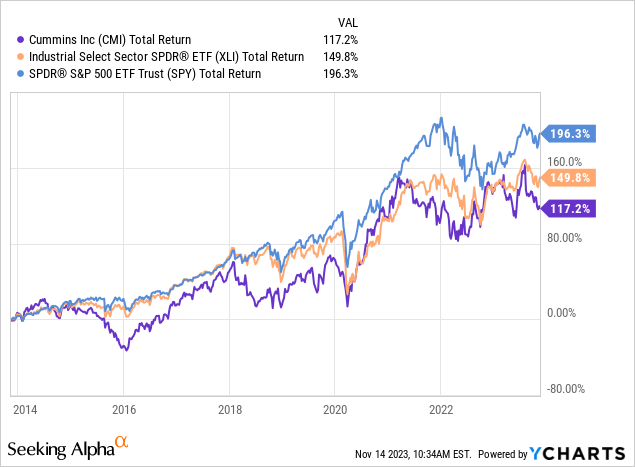

As we discussed, this year, Cummins is expected to do very well.

- As seen in the chart below, analysts expect the company to grow EPS by 27%. This includes both organic and inorganic growth.

- Next year, EPS is expected to contract by 2%, followed by an 11% surge in 2025.

- While these numbers are obviously subject to change, they show that CMI is expected to have the best performance of any manufacturing recession in recent history.

- The company is now trading at a blended P/E ratio of 11.3x.

- Going back to 2002, the normalized P/E ratio is 15.4x.

- A return to its normalized valuation by incorporating expected growth rates could result in a price target of $331 by the end of 2025.

FAST Graphs

This price target is roughly 50% above the current price.

Although I believe that this is possible, I can by no means promise a return like this. We could easily see a prolonged manufacturing recession, which would require EPS expectations downgrades.

Hence, while I like the long-term risk/reward, investors need to be very careful, as we could see 10% to 20% more downside if the ISM index does not bottom in the next two quarters. So, please take that into account when researching CMI.

Takeaway

Cummins stands out as a resilient dividend growth stock. Despite facing cyclical challenges, Cummins boasts a top-tier A-rated dividend scorecard backed by a 3.1% yield, a healthy 32% payout ratio, and a 7.9% five-year dividend CAGR.

The recent stellar third-quarter earnings, robust revenue growth, and strategic initiatives in clean technology confirm Cummins’ ability to navigate economic uncertainties.

While its valuation presents a compelling long-term risk/reward, cautious optimism is advised, given the potential impact of manufacturing recessions on earnings expectations.

Read the full article here