Curaleaf (OTCPK:CURLF) is currently the largest US multi-state operator by quarterly sales. The Wakefield, Massachusetts-based company realized revenue of $336.5 million for its fiscal 2023 first quarter, a 7.5% increase from its year-ago comp and a beat by $4.6 million on consensus estimates. This growth was positive against competitors who either saw anemic or negative revenue growth over the same comp. For example, the second largest MSO Trulieve (OTCQX:TCNNF) realized a 9% revenue decline year-over-year with the third largest Green Thumb Industries (OTCQX:GTBIF) seeing revenue grow by only 2% over its year-ago quarter.

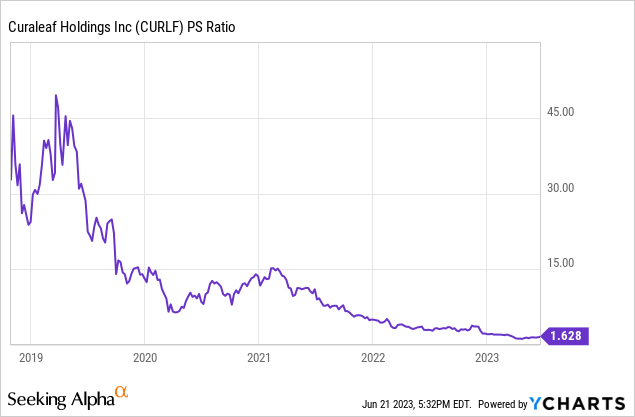

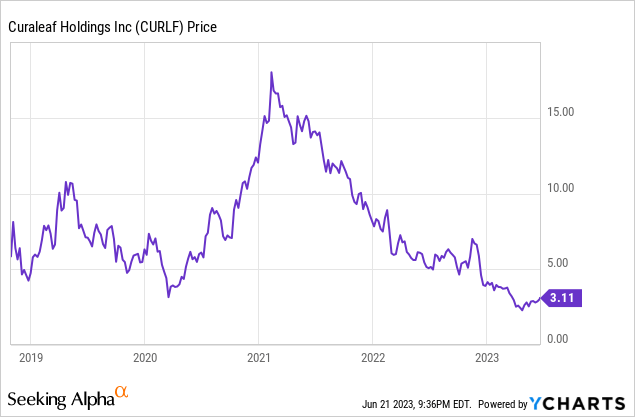

The bull case has become more potent against commons that have declined by 39% over the last 1-year. To be clear, Curaleaf’s price to trailing 12-month multiple now stands at 1.6x, a roughly 90% decline from its 5-year average. Whilst this is significantly higher than Trulieve’s price multiple of 0.62x, Curaleaf faces the same pertinent headwinds but with a cash generation profile that is somewhat better against the broader pullback of the industry. Curaleaf’s multiple stands to recover as revenue continues its growth and as future FOMC rate pauses give way to an eventual cut and a broad improvement in market appetite for tickers that currently form the heavily sold “risk-off” industries.

The company held cash and equivalents of $115.8 million, a $47.4 million sequential decline over its fourth quarter with positive cash flow from operations of $14.2 million. This has placed Curaleaf as one of the few companies in the space entire North American cannabis space generating positive operating cash flows. Moving on from MSOs, the bulk of the Canadian cannabis companies from Aurora Cannabis (ACB) to Canopy Growth (CGC) all sport deep and consistent cash burn from operations.

When Are The Common Shares A Buy?

Whilst the Fed has said that more rate hikes are coming this year, I think this will be unlikely if the data points to continued headway being made with the headline rate of inflation inching closer to the Fed’s 2% target. The partial recovery of Curaleaf’s price multiple, a core measure of market sentiment, is in view here on the back of the normalization of current macroeconomic conditions. Indeed, the US cannabis market is forecasted to grow sales to $71 billion by 2030 without any legalization at the federal level. There are some reasons to be bullish about the wider industry. Firstly, more states continue on the path of legalization with Minnesota becoming the 23rd state to legalize adult-use cannabis.

There is also high confidence that the current session of Congress will be able to pass the Secure and Fair Enforcement (“SAFE”) Banking Act. This would form a watershed moment for the industry as it would allow MSOs to access traditional US banking services. The impact would be a cheaper cost of capital from a dramatic increase in current sources of capital. However, bears would be right to state that this does not address the two fundamental problems MSOs are facing. Firstly, the taxes are too burdensome with Curaleaf facing $202.3 million in income taxes as of the end of its first quarter despite trailing 12-month net losses of $388 million. US cannabis taxes are mostly levied on the retail sales price of cannabis products and not on net income. This has left MSOs with large tax bills against consistent net losses and a dwindling liquidity position.

Keeping The Cannabis Dream Alive

Further, these taxes have inflated the prices of legal recreational cannabis to render them more structurally uncompetitive with the black market. In California, there is a 15% excise tax on cannabis which is aggregated with the state’s 7.25% general sales tax and a 3% local government tax. Critically, these taxes have likely helped protect illicit cannabis sales. So whilst the SAFE banking act addresses some headwinds and its passage could see positive sentiment return, the long-term health of the industry and its competitiveness is still uncertain.

Hence, Curaleaf has had to retreat from not just California but Colorado and Oregon with the company set to close its dispensaries in these states. The current decline has been the most protracted since it went public to highlight the extent of the headwinds facing the industry and the potential baseline for a recovery. The continued argument from bulls here is that expectations are so low that any near-term catalyst would likely cause a more violent upward move. I believe them.

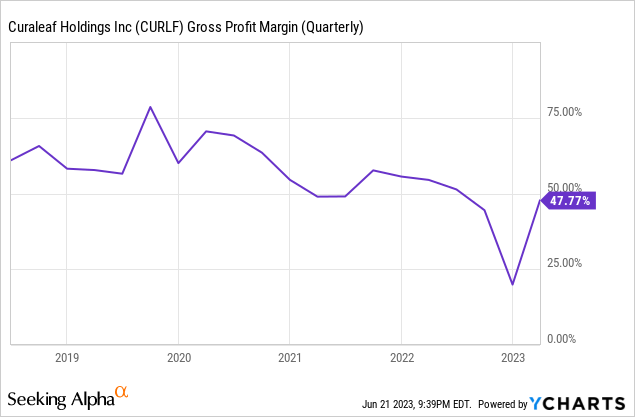

Curaleaf recorded a gross profit of $160.8 million during its first quarter with a gross margin of 48%, a strong recovery from the prior fourth quarter but still below its longer-term average. Further, with the exit from what management flagged as highly unprofitable markets during their first-quarter earnings call, the company’s gross profit margins and cash flow profile are likely set to improve. Indeed, Curaleaf’s operating cash flow from continuing operations was higher at $30.6 million. Hence, the company intends to keep the cannabis dream alive as best it can against a brutally Darwinisitc cannabis market where initially euphoric dreams of wealth creation from an industry finally let out from the dark have turned into nightmares. This is a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here