Shares of D.R. Horton (NYSE:DHI) have been a tremendous performer over the past year, rising by nearly two-thirds. The company recently reported another excellent quarter, despite concerns about the housing market. With its strong cash flow, solid operations, and excellent balance sheet, I see ongoing upside, given my view the housing market can continue to prove the skeptics wrong. DR Horton has a strong balance sheet, disciplined capital allocation, and over $14 in earnings power given my view the housing market will stay resilient, which is why I view shares as a buy.

Seeking Alpha

In the company’s fiscal fourth quarter, DHI earned $4.45, blowing past consensus by $0.52. Revenue rose by 19% to $10.5 billion, defying fears of a downturn in housing. For the full year, it earned $13.82, the second highest in history and triple 2019 levels. Next year, it expects $36-37 billion in revenue as it sells 86,000-89,000 homes, up from $35.5 billion and 82,917, respectively. This should result in $3 billion in homebuilding cash flow in 2024.

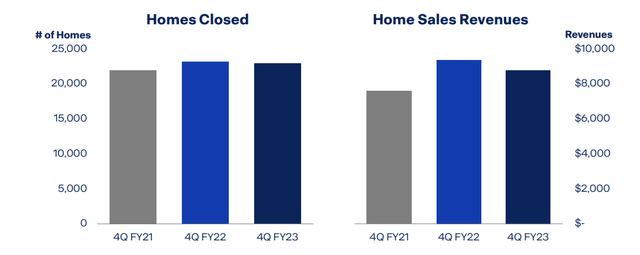

During the quarter, the number of homes closed was comparable to last year and up from 2021, as you can see below, as the company has continue to grow market share. Revenue was off modestly from last year as home prices were lower, largely due to geography and mix. While gross margins did decline from last year’s 28%, it was encouraging to see them expand 180bp sequentially to 25.1%. While the market may have softened a bit, input price pressures have also fallen for products like lumber as supply chains normalize, helping to cushion margins.

D.R. Horton

For the full year, DHI generated $4.1 billion in free cash flow even as it spent $360 million on net deepening its inventory via increased lots. In 2022, DHI spent a net $3.5 billion on inventory increases, so this was a dramatic slowdown, again consistent with the cautious capital management approach management has in times of uncertainty. Homebuilding revenue was down about 0.5% for the full-year at $31.7 billion. It sold about 0.2% more homes, at 82,917. So, the average sales price was within 1% of last year.

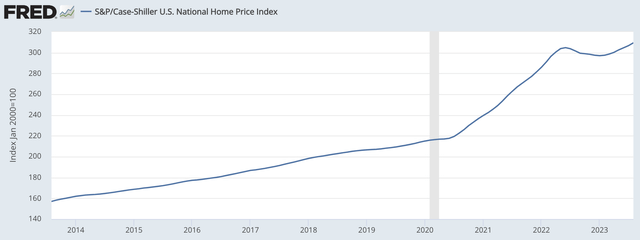

This price performance is consistent with national home price trends, which dipped in the latter half of last year and then recovered in recent months. Over the past twelve months, new home sales fallen by about 2% to 663,000 units. Here, DHI was an outperformer, with sales growth, pointing to ongoing market share gains. Importantly, this is not coming through pricing (which has held firm), but rather by delivering quality product with geographic diversity. 2023 was a strong year for the company.

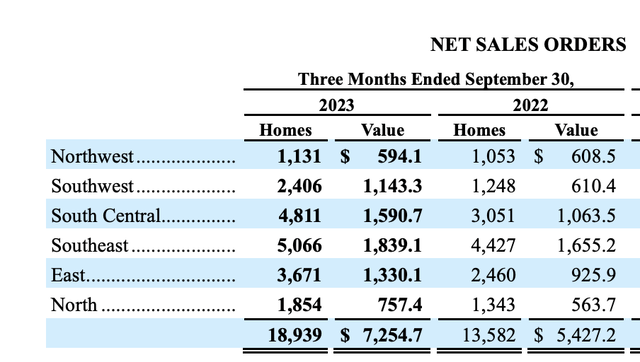

Critically, the company actually saw an acceleration in buyers’ interest during the quarter, even with higher interest rates. Net orders rose 39% from last year to 18,900 homes, and the value of its orders are up 34% to $7.3 billion. The cancellation rate has also declined from 32% to 21%. As you can see below, order activity increased across every region, pointing to a widespread recovery. Last year, as rates first rose, buyers stepped back, but after perhaps accepting higher rates could be a new normal, they are coming back into the market.

D.R. Horton

This shift is evident in national statistics. Most notably, home prices have hit a new all-time high, even with mortgage rates of 8%. Last year as the Federal Reserve began aggressively raising rates, prices fell modestly, but they have since recovered. Ultimately, many homebuyers can only delay buying so long. Moreover, as discussed further below, the housing market is structurally under-supplied, which will support prices in my view.

St. Louis Federal Reserve

Now because orders were weaker earlier this year, the company’s backlog has fallen. It stands at 15,197 with a value of $5.9 billion, down 26% from last year. This backlog has done exactly what it was supposed to—smooth DHI’s revenue and act like a “shock absorber” during periods of stress. When orders slow, it can deliver out of its backlog, keeping production rates similar, and now that orders are coming back, I expect to see the backlog stabilize.

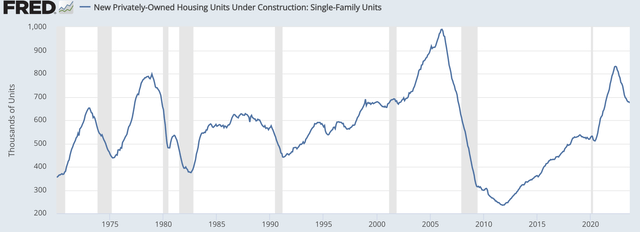

DHI has also been sure not to overbuild into a weakening market. Its inventory of homes is 42,000, down from 46,500 a year ago. 27,000 are sold, and just 7,000 of the unsold homes are completed. This discipline has been shared across the industry. While construction took off after COVID as homebuying surged, the number of houses under construction has been falling sharply since the Fed began raising rates as builders prepped for a possible downturn.

St. Louis Federal Reserve

Of course, by building less, the homebuilders may be helping to support prices, by reducing supply. It is essential to emphasize how the industry has become fundamentally more conservative, still having scar tissue from the collapse seen in the financial crisis. This comment from CEO Steve Auld is critical to consider when thinking about the homebuilders: “And the awakening of 2008, 2009 and 2010, I think, created a discipline in operations that made the transition from margin to return pretty much an industry standard today. You listen to other builder calls and everybody is talking about returns, cash flow, deleveraging and derisking their land pipeline. I don’t see that changing.”

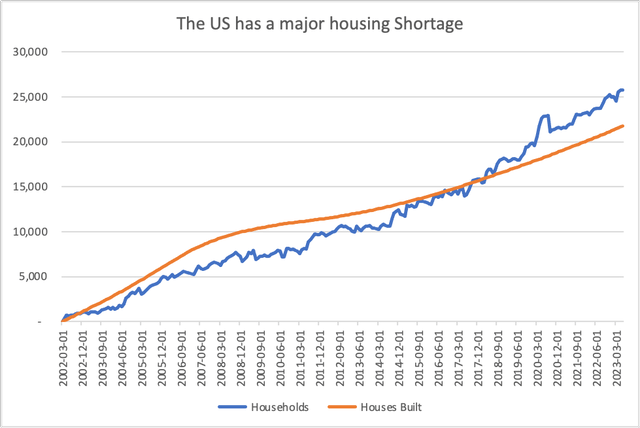

Similar in many ways to the oil companies today, homebuilders are not focused on growth at any cost, but on delivering strong cash returns to shareholders. This mindset has led to less home construction, which is contributing to today’s strong market, in my view. As you can see below, over the past 20 years, we have built 4 million fewer homes than we have created households. Whereas homebuilders overbuilt vs household formations in the 2000s, contributing to the crash, they have been so cautious about building that there now is a major shortfall.

Census Bureau, my own calculation

Supply constrained markets tend to have higher prices and wider margins. That is exactly how the US housing market is operating, which is why builders are so profitable. Yet, having been hurt so badly by 2008, caution rules their actions today, as seen by them curtailing construction last year just at the hint of slowing. I do not see evidence that this mindset is shifting. As such, I view the US housing market as likely to stay structurally undersupplied, keeping prices up and builders solidly profitable.

Speaking further to the company’s conservatism, D.R. Horton paid down $700 million of debt in 2023, and it now has no maturities until 2025. It has just $2.3 billion of homebuilding debt, giving it a pristine balance sheet. Further, it only owns only 25% of its lots, with options for the other 75%. This mix makes it less capital intensive, and if land prices fall, it will not have overpaid for lots; rather, it can just not exercise options.

While DHI is largely a homebuilder, its business has some diversification. It has a 64% stake in Forestar (FOR), worth about $1 billion. It also has a rental unit, which generated $2.6 billion in revenue last year, up five-fold, while generating $524 million of pre-tax income. This unit has $1.3 billion of single-family properties (2/3 completed) and $1.4 billion of multi-family property (25% completed), which it continues to grow.

Last year, DHI bought back $1.2 billion in stock, reducing the share count by 3%. In October the board authorized $1.5 billion, which it expects to complete in 2024. I view management’s guidance for modest revenue growth to be reasonable, as I expect the housing market to hold firm around current levels while the rental unit should show growth as more multifamily units are completed. Rising orders are consistent with this view.

As we think about next year, management is guiding to about 3% revenue growth and a 4-5% increase in home sales. With cost pressures moderating, the company should be able to sustain margins in the current 25% area, even with this implied 1-2% drop in home prices. As discussed above, given the macro factors driving the housing market, I do believe there is adequate structural demand to support this outlook. Additionally, existing home sales inventory remains quite low as those with low mortgages do not want to sell, which will push buyers toward new homes. Construction times have also been shortening, which should enable some volume growth.

All else equal, I see risks skewed towards slightly fewer sales at a somewhat better price. I say this because the company’s inventory of homes under construction is down by 10%. That lower inventory level has the potential to slow, or at least delay closings, but because it has few unsold, completed homes, DHI has little need to offer pricing concessions to free up capital. Ultimately, these two forces may cancel out to some degree and still leave the company with about $36-37 billion in revenue. I also would expect to see material growth from its multifamily rental unit. While rent growth has slowed, with only 25% of its projects complete, that completion rate should improve materially in 2024, driving incremental revenue for the business.

Thanks to ongoing share count reduction from its buyback, EPS should rise about 0-5%, or about $14.10 over the next year. Given its balance sheet and industry leading scale, I view 8.6x forward earnings as quite attractive. While I view the level of housing market activity as durable, I do think ongoing concerns about the rate environment will cap multiples in the sector at 10x. Still, that leaves about 16% upside past $140 and the lower multiple makes the share repurchase program more powerful.

Now, every investment has risk. For DR Horton, I am worried less about idiosyncratic risk than macro risk. It sells houses across every geography and multiple price points, providing some insulation from mix shifts in the market. It is the largest builder, providing pricing power with suppliers. However, if I am wrong about the housing market and it does roll over due to buyer exhaustion from higher rates, that will reduce DHI’s profits.

Now given its stellar balance sheet and capital-light land position, DHI can weather a downturn, but profits will come down. I would closely watch DHI’s backlog and order cancellations. If cancellations start to rise again and it begins eating into backlog meaningfully, this would point to a weakening of demand that would lead to lower earnings. Right now, we are seeing the opposite, but these would be early warning signs.

The second leg of my thesis is the tight supply in the housing market. As such I would watch permits for new homes. If these begin to rise even amidst this uncertainty, that would suggest the discipline the builders have shown is reversing, which could lead to excess supply and reduce pricing power.

Overall though, yes, shares have run a lot. And the next 12 months are unlikely to be as great for investors as the past 12 months, but there is still substantial upside, thanks to what is a secularly favorable environment for builders. I view DHI as a buy

Read the full article here