Datadog (NASDAQ:DDOG) has emerged as the clear leader in the fast-growing cloud monitoring and observability market. The company’s SaaS platform integrates infrastructure metrics, application tracing, log analysis, and more to give engineering teams end-to-end visibility into dynamic cloud environments. This consolidated data is transforming monitoring from reactive firefighting into proactive optimization.

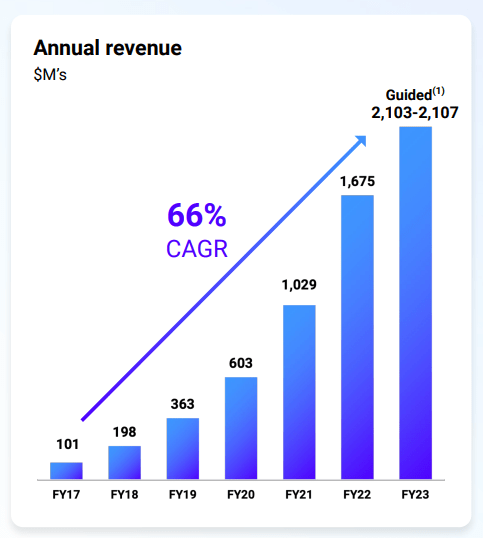

Over the past six years, Datadog has achieved tremendous growth, with revenue expanding at a 66% CAGR as the company has signed major customers like DoorDash, Peloton, and Netflix. Trailing twelve month revenue now exceeds $2 billion, up 66% year-over-year. Powering this growth is the secular tailwind of cloud adoption, expected to drive over $500 billion in public cloud spend by 2023 per Gartner.

Secular Growth and Platform Expansion

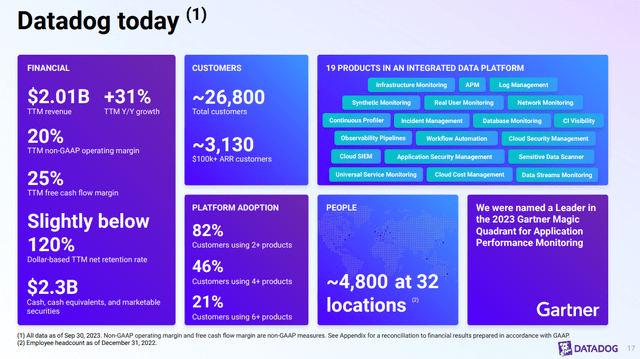

The core bull case for Datadog is straightforward – the company’s product is mission-critical for organizations adopting cloud, and those customers demonstrate impressive retention and expansion. Datadog’s revenue growth is impressive and its dollar-based net retention rate stands at over 120%, indicating strong upsell into existing accounts.

Datadog company presentation

As customers deepen their cloud usage, Datadog has significant room to expand spend through additional products and support more infrastructure. Beyond core infrastructure monitoring, Datadog is broadening its platform into security, business analytics, and customer experience monitoring.

While competition is fierce with challengers like Dynatrace, New Relic, and Splunk, Datadog’s bottom-up developer-focused strategy and robust partner ecosystem with cloud providers offer a sustainable competitive advantage as the market consolidates.

Best In Class Financials

More broadly, Datadog exhibits a number of best-in-class financials that any investor or company executive would be excited by.

Datadog company presentation

The balance sheet is a fortress. Cash and short-term investments have piled up from $1.5 billion in 2020 to over $2.3 billion today. Software gross margins near 80% allow Datadog to drive significant operating leverage. Most incremental revenue flows through to profit, as cloud delivery costs are relatively fixed. 25% FCF Margins result in substantial free cash flow. This not only bolsters the balance sheet, it funds growth initiatives that suggest greater profitability in the future.

In aggregate, metrics across user adoption, retention, margin profile, and cash generation are not just excellent compared to competitors, they also stand up to high-growth SaaS peers. Sustaining these metrics is key for the bull thesis as growth and scale progress. But the indicators reflect winning product-market fit so far.

An Early Pioneer

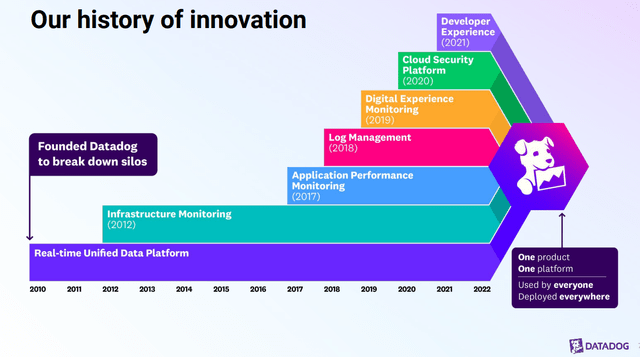

One underappreciated element of Datadog’s strategy is the company’s early prioritization of embedding into engineering workflows. Unlike many monitoring tools that started as top-down IT purchasers, Datadog designed its platform around developers first. This has driven rapid bottoms-up adoption as engineers directly integrate Datadog into their toolchain. And once embedded, it becomes exponentially harder for customers to displace Datadog.

The company understood early that aggregating data is not enough – turning that data into insights requires tailored visualization. Datadog now handles over 1 trillion signal flashes per day across its customer base. Translating signals into readable graphs and alerts is a data science challenge that Datadog’s algorithms solve every second. The result is actionable insights delivered proactively to engineering teams without added overhead.

Datadog company presentation

A Key Risk

While observability is red-hot, the broader IT operations management software market represents a $30B+ opportunity for Datadog. By providing solutions for incident and alert management, on-call scheduling, and IT service management, Datadog can become a one-stop-shop monitoring broader IT environments.

Datadog already supports some application performance monitoring capabilities. Expanding up the stack into digital experience management and providing business KPI dashboards extends the company’s reach from tech teams to the C-suite. Partnerships with best-of-breed analytics tools are possible here.

However, broadening into adjacent or vertical segments always presents risk to any firm. Navigating category expansions requires careful balancing of focus and resources to minimize distraction from the core business. If not managed well, over-diversification could erode the winning formula propelling Datadog’s rise.

Decelerating Growth and Formidable Competitors

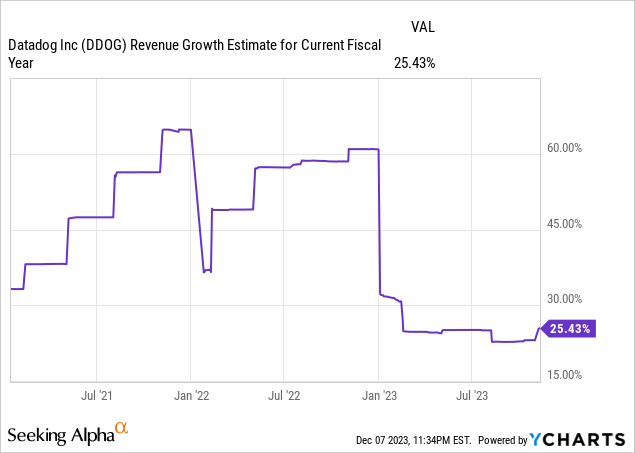

Datadog may have best-in-class metrics, and it may have the foundations of a truly great company. But sustaining that advantage is crucial and risks remain around growth, competition, and valuation. In Q2, 2023, the company trimmed full-year guidance based on potential economic impacts on cloud spending. This spooked investors accustomed to flawless execution. This is significant because it shows what can happen if Datadog misses investor expectation by just a small amount:

source: finviz.com

Meanwhile, Datadog faces an increasing number of deep-pocketed competitors. Legacy on-premises vendors like Splunk are adapting to cloud, while the hyperscale cloud platforms themselves – AWS, Microsoft, and Google – have introduced their own observability tools often bundled with infrastructure. If Amazon and Microsoft choose to focus more aggressively on monitoring, Datadog’s specialty positioning gets more tenuous. Meanwhile, Cisco’s acquisition of Splunk could give the rival a stronger position.

And with shares trading at 67x earnings and 19x forward revenue, Datadog has essentially zero margin for error. The company must rapidly gain share and demonstrate operating leverage for the stock to outperform from here. Any blips in the growth narrative could mean more painful valuation compression from today’s nosebleed levels. Meanwhile, revenue growth is expected to soften, which is more than reasonable in today’s economic climate:

Back of Envelope Valuation

A simple back of envelope valuation reveals just how much growth is already priced into the Datadog stock price. Assume the company grows its top line revenue at a continued rate of 20% per annum for the next 5 years, then manages to operate at a net income margin similar to the current free cash flow margin of 25%. In that scenario, the company would be producing $5 billion of revenue and roughly $1.24 billion of net income in 5 years’ time. The stock would then need a PE multiple of 50 to generate an investment return of just 10.5% per year.

| CURRENT MARKET CAP | 37.8B |

| EARNINGS IN 5 YRS | 1.24B |

| MULTIPLE IN 5 YRS | 50.00 |

| MARKET CAP C IN 5 YRS | 62.21B |

| CAGR | 10.48% |

Leader in a Massive Market but Risks Remain

In summary, Datadog sits at the intersection of two hugely important megatrends – digital transformation and cloud migration. The company’s impressive product-market fit and platform strategy give it a strong position in the exploding observability software market with plenty of room for continued growth.

In comparison to rival Splunk, Datadog shows significantly better financial metrics, in particular with regard to revenue growth and free cash flow margin. But capitalism is brutal, and Cisco’s acquisition of Splunk will no doubt provide the rival with greater resources to compete.

Such risks around competition, cloud spending headwinds, and steep valuation tempers the bull case. Investors should monitor leading growth indicators like new customer adds, net retention rates, and gross margins closely while awaiting progress towards profitability.

If Datadog’s execution remains best-in-class, today’s lofty valuation may prove justified over a long enough horizon. But with little room for error, there is too much risk for an investor at the current price level.

Read the full article here