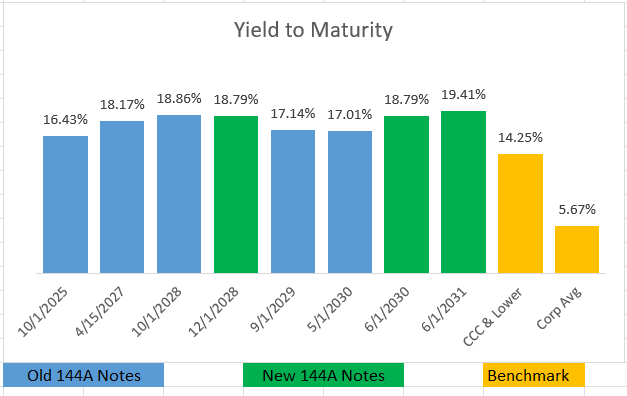

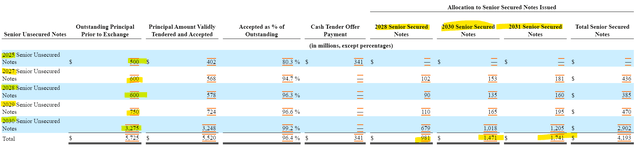

Carvana (NYSE:CVNA) was once a giant in the automotive retail space, with a $70 billion market cap. This year, the company found itself in a challenging position, with quarterly losses and heavy share price volatility. With bond prices depressed and a 2025 maturity looming, the company engaged in a debt exchange involving all its unsecured notes. The exchange, which was successfully completed in September, refinanced 96% of the unsecured notes into longer-dated secured notes with higher interest rates. Despite the successful exchange, the new bonds are trading at rates comparable to the old bonds, and combined with recent operating results, I doubt that the company will avoid a restructuring.

FINRA

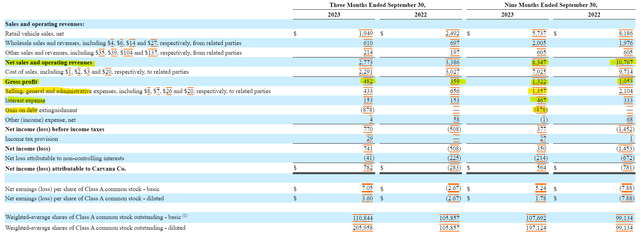

Carvana is facing heavy revenue headwinds in 2023 with year-to-date net sales nearly $2.5 billion below where they were a year ago. Fortunately, the company has cut its cost of sales further than the revenue decline, and this has led to a $300 million increase in gross profit to $1.3 billion. Unfortunately, the improvements in gross profit are far from sufficient as selling, general, and administrative expenses consumed all the gross profit thus far in 2023. The company’s gains on its debt exchange are the only item keeping Carvana from an operating loss year to date.

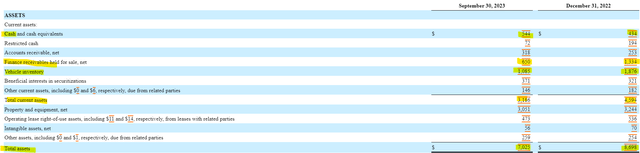

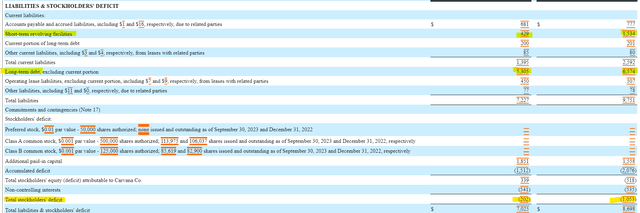

SEC 10-Q

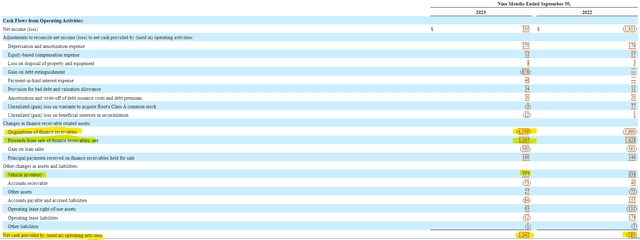

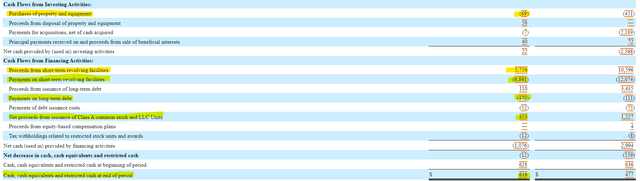

Carvana’s cash flow situation saw the most robust improvement in 2023, but when investors examine the details, they can see that the causes are short term in nature. Operating cash flow increased by more than $1.6 billion to over $1 billion, but this was due to the sale of financing receivables and decreases in vehicle inventory. If changes in working capital were removed, Carvana’s operating cash flow would have been negative for the first three quarters of 2023. Carvana did use its cash generated from working capital declines, combined with a share issuance, to pay down debt.

SEC 10-Q SEC 10-Q

Carvana’s balance sheet shows the big changes from the reduction in working capital to the paydown and exchange of long-term debt. Assets were down by $1.6 billion, led by the declines in working capital. The short-term revolving facilities were paid down with cash raised by declines in working capital and long-term debt declined due to the debt exchange. Ultimately, Carvana’s shareholder deficit closed to $200 million from over $1 billion at the beginning of the year.

SEC 10-Q SEC 10-Q

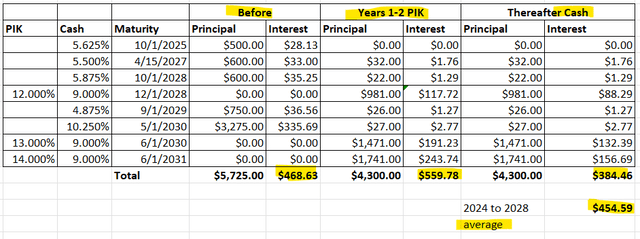

Carvana’s debt exchange did buy the company more time to turn around operations. The new debt structure moves the next note maturity from 2025 to 2028. While management noted that the exchange lowered short-term debt servicing pressures, it’s important to note that this is due to a two-year payment in kind provision on the new secured notes. After two years, the new notes will be required to pay 9% cash interest. When analyzing all variables related to the exchange, cash interest costs will resume in late 2025 and be comparable to current interest expenses.

SEC 10-Q Debt Exchange Data Entered into Spreadsheet

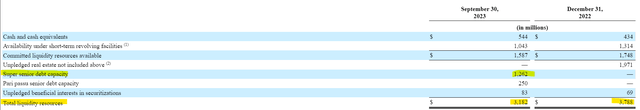

Despite the debt exchange and the paying down of revolving credit facilities, Carvana’s liquidity has declined from $3.8 billion to $3.1 billion. This is because of the creation of a super senior credit class that has the capacity to lend $1.2 billion to the company against a formerly unpledged real estate group valued at just under $2 billion. Liquidity is going to be necessary to manage increased sales (through the ability to finance receivables) and increased inventory.

SEC 10-Q

Despite my unwillingness to take a long position in Carvana, investors should also be cautious of the risks associated with a short position. Carvana has had heavy share price volatility this year and could find itself at the center of another meme trade, which would squeeze short sellers.

While Carvana has succeeded in extending its debt maturities through debt exchange, I’m having a tough time seeing a path to profitability and positive free cash flow. Without positive free cash flow, Carvana would need to rely on additional financing to continue operations, and that would not sit as well with three different classes of debt holders. The erosion in value of the new bonds in the backdrop of rallying share prices is further evidence that the shares are overvalued.

Read the full article here