Introduction

As an investor in dividend growth stocks for the past nine years, I seek new opportunities to invest in income-producing assets, mainly stocks. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The industrial sector is attractive, and UPS (NYSE:UPS) in particular. Industrial companies tend to be more volatile than others, as they are often part of a more cyclical business. Therefore, when investors seek opportunities, sometimes they can find industrial companies attractively valued as investors fear short-term cyclicality and ignore long-term rewards. UPS is an example of a well-known brand with a significant scale.

I will analyze UPS using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

United Parcel Service, a package delivery company, provides transportation, delivery, distribution, contract logistics, ocean freight, air freight, customs brokerage, and insurance services. It operates through two segments, U.S. Domestic Package and International Package. The U.S. Domestic Package segment offers time-definite delivery of letters, documents, small packages, and palletized freight through air and ground services in the United States. The International Package segment provides guaranteed day and time-definite international shipping services comprising guaranteed time-definite express options.

Fundamentals

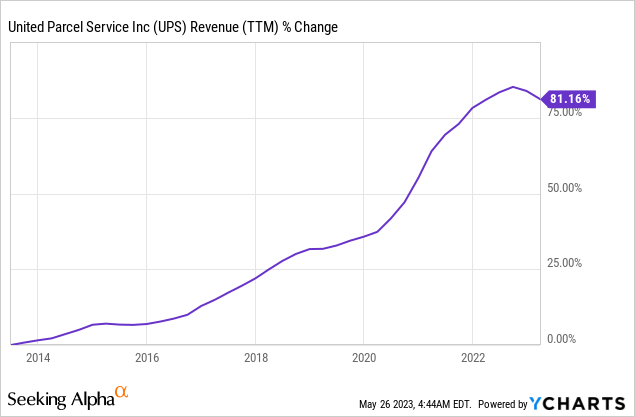

Revenues of UPS are up 81% over the last decade. UPS has been growing steadily during that decade with two main catalysts: Higher volumes of shipments and higher shipping prices as demand has been climbing. The company grows mainly organically as it invests in its fleets of airplanes and trucks to reach more destinations quicker. In the future, as seen on Seeking Alpha, the analyst consensus expects UPS to keep growing sales at an annual rate of ~1.5% in the medium term.

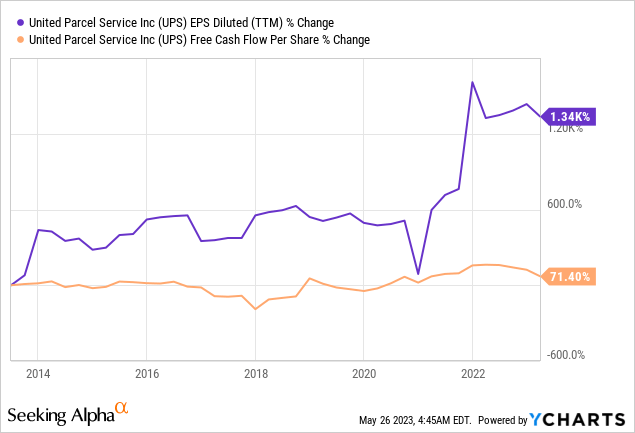

The EPS (earnings per share) has grown much faster during that period. However, the 1340% may be misleading as it is a GAAP figure impacted by non-cash expenses. The non-GAAP EPS is up 180% during the period, and the company has increased the free cash flow per share by 71%. The reasons for the EPS growth are higher sales, some buybacks, and cost-cutting that improved margins. In the future, as seen on Seeking Alpha, the analyst consensus expects UPS to keep growing EPS at an annual rate of ~8% in the medium term following the 17% decline from 2022 all-time high EPS.

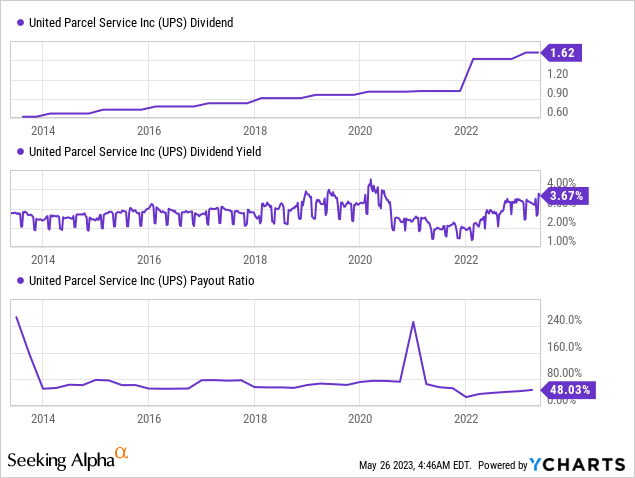

The dividend is one of UPS’s best traits. The company is paying a decent 3.67% dividend yield which seems safe with a payout ratio below 50%. The company has increased the dividend significantly in 2022 and again in 2023. The company has a record of 13 years in a row with dividend increases, and it hasn’t reduced the dividend for almost a quarter of a decade. Investors should expect mid-single digits increases in the medium term, which is in line with the company’s EPS growth.

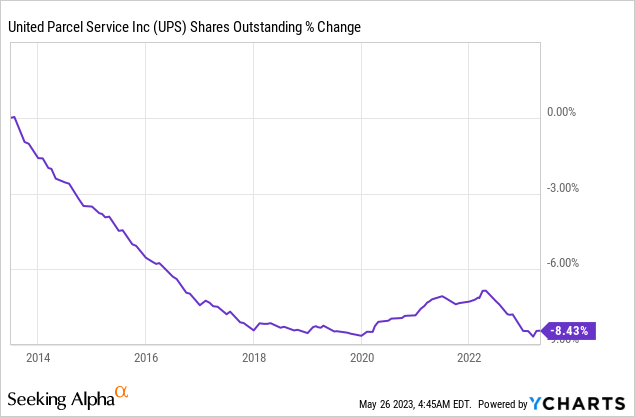

In addition to dividends, companies, and UPS included return capital to shareholders via share repurchases plans. These plans reduce the number of shares outstanding. In UPS’s case, the number of shares decreased by 8% over the past decade. Buybacks support EPS growth as the same net income is now divided between fewer shares. When the share price is attractive, buybacks are highly efficient as every dollar buys more shares.

Valuation

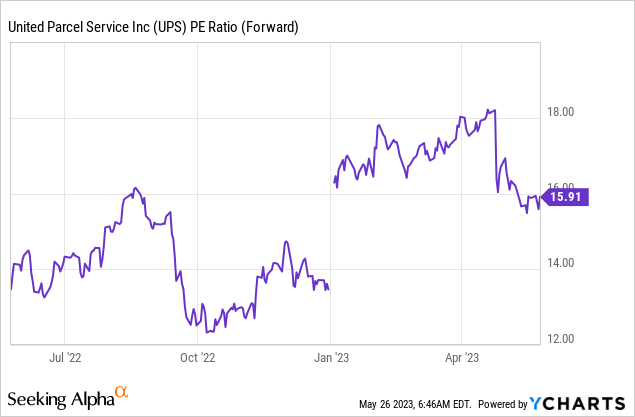

UPS’s P/E (price to earnings) stands at 16 when using the forecasted EPS for 2023. The P/E ratio declined following the release of the company’s Q1 results which disappointed investors. Therefore, we now see the lowest valuation in 2023. The valuation increased in January as the forecasts for 2023 are for an EPS decline. Still, paying 16 times earnings for a growing company with a positive medium-term outlook makes sense.

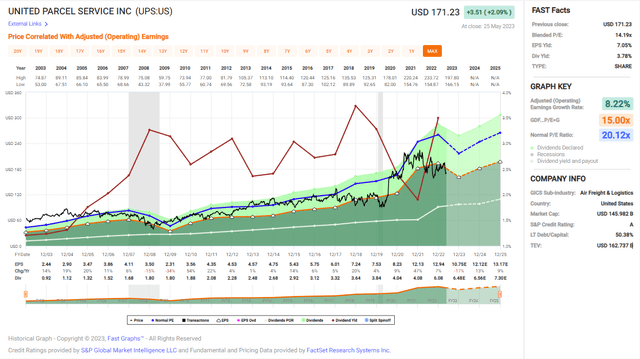

The graph below from Fast Graphs emphasizes that the company is trading for a decent valuation. The average valuation of UPS over the last two decades is a P/E of 20. The current P/E ratio is 20% lower. In the same period, the company has shown annual growth of 8.2%, which aligns with the forecasted EPS growth following the decline in 2023. Therefore, forward-looking investors see a growing company with a decent valuation that offers some margin of safety if the execution isn’t perfect.

Fast Graphs

Opportunities

The first opportunity for UPS is the adoption of technology in its business. The logistics business requires a significant workforce and investments. The ability to offer consumers more services with self-serve kiosks to require fewer employees in a store and to adopt electric trucks to save fuel money will support margins and EPS growth in the medium and long term.

Moreover, the company is shifting its focus towards more lucrative goods to ship. The company relies on Amazon for 11% of its shipments while Amazon is building its own logistics business. To avoid the risk and increase profitability, UPS is focusing on healthcare logistics. It has opened around 1M sqft of dedicated healthcare logistics space in Q1, and it is on target to generate more than $10B in healthcare revenue in 2023.

Another opportunity and advantage that UPS has over its peers is its scale. The company owns 24% of the market for shipping inside the United States. It is higher than Amazon (22%) and FedEx (19%). Despite the supply chain challenges, the scale allows UPS to trim costs and become more efficient. The ability to leverage its scale is even more important than smaller peers that cannot compete with UPS’s ability to price due to its massive scale in terms of volumes.

Risks

The reopening of China for tourists, goods, and business is an essential catalyst for UPS. However, China’s reopening has been going slower than first anticipated. It is not just the fear of deglobalization that scares investors, but it’s the simple fact that China takes longer. It takes longer for companies working in China, and for the same reason will take longer for companies producing in China. It may mean that UPS will enjoy that dividend of more shipments later.

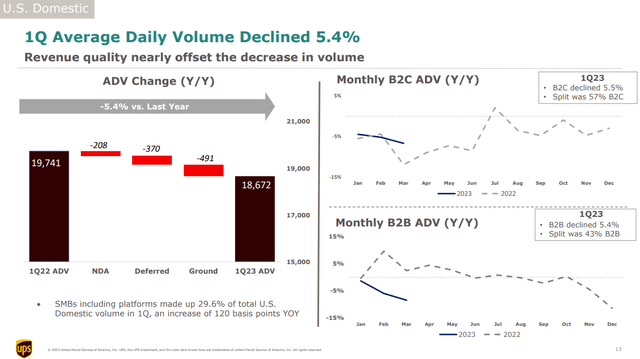

UPS is also suffering from the Federal Reserve raising the interest rates. The company relies on consumers purchasing goods, and UPS delivers them. With higher interest rates, the budget has less room to acquire goods with credit. Therefore, it makes sense that we see a decline in average volumes during Q1 2023. A possible recession may increase the trend even more, hurting UPS’s volumes further.

UPS Q1 Results

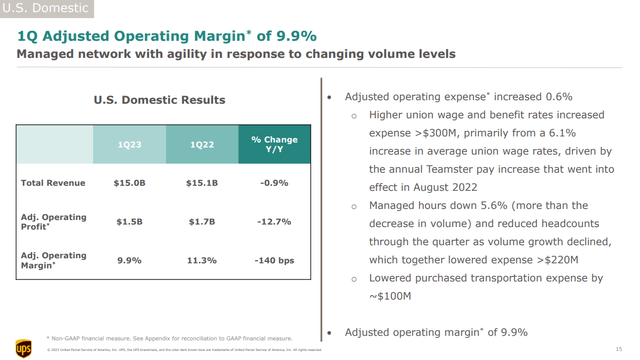

Another risk for UPS is inflation. Inflation is pressuring the company in the short and medium term and is one of the main reasons for the lower EPS forecasted for 2023. The higher expenses due to higher wages and costs have lowered the margins significantly. Operating margins dropped from 11.3% a year ago to 9.9% in Q1 2023. The higher inflation will continue to pressure UPS in the short term.

UPS Q1 Results

Conclusions

To conclude, UPS is an excellent business with a long track record. The company has been growing for decades and offers investors solid fundamentals. Top and bottom-line growth lead to dividend growth and more capital returned to shareholders. Several business opportunities will allow the company to grow more in the medium and long term as it adapts to the changes in the world.

The company trades for a decent valuation, and the risks are manageable. Therefore, investors should think about buying shares in UPS slowly and gradually. There are some possible short-term headwinds and no significant margin of safety, but there is enough margin to justify the slow accumulation of this blue chip.

Read the full article here