In this article, I take another look at Deutsche Post (OTCPK:DPSTF; OTCPK:DPSGY). While I won’t delve into the operational parts of the organization here, my prior post addresses many things that are still relevant. Please refer to it here, if you want to take a deeper look. Here I summarized the most important aspects in a SWOT-Analysis. In addition, I intend to go deeper into the company’s current valuation, taking both management forecasts and analyst projections into account.

SWOT Analysis

To recapitalize the major points that currently influence DHL’s business, I conducted the following SWOT Analysis:

Strengths

-

Market Position and Size: With operations in over 220 nations, DHL is one of the biggest courier services in the world. Due to its extensive footprint, it has access to a wide range of markets, clients, and revenue sources.

-

Financial Stability: Due to the German government’s sizeable ownership of DHL, there is a certain degree of both financial stability and security.

-

Diversification: DHL offers a wide range of logistical services in its varied offering. Along with increasing revenue diversification over time, they have lessened their dependency on the German market.

-

Profitability: The business has consistently grown its revenue, EBIT, and EPS, displaying great financial performance. They have a substantial operating margin as well.

-

Commitment to Sustainability: DHL has a solid plan to attain net-zero emissions by 2050, demonstrating commitment to social responsibility and satisfying the growing need for environmentally friendly business methods.

-

High ROCE: DHL showed effective capital management by increasing their ROCE from 9% in 2018 to 18% in 2022.

Weaknesses

-

Cyclical Industry: DHL works in a sector that is quite cyclical and dependent on the state of the economy. The demand for shipping and delivery services may decline during an economic downturn, which would have an effect on their revenue.

-

Geographic Dependence: Despite diversification initiatives, DHL still relies heavily on the German market, which could leave it open to hazards that are unique to that nation.

-

Projected Decline in Performance: Due to macroeconomic difficulties, DHL is anticipated to have a decline in projected revenue and operating profit for 2023 and 2024.

Opportunities

-

E-commerce Growth: Growth of e-commerce: As the need for delivery and logistics services rises, DHL is presented with a tremendous opportunity.

-

Investments in Technology and Sustainability: DHL’s dedication to environmentally friendly procedures and technological advancements like electric vehicles may give it a competitive edge and spur growth.

-

Economic Recovery: DHL could profit from greater trade and a rise in demand for logistics services as the European economy bounces back from the effects of the Russia-Ukraine war and inflation.

Threats

-

Intense Competition: Competition is fierce in the logistics sector, where big competitors like FedEx, UPS, and Amazon are battling for market dominance.

-

Rising Costs: The logistics industry has been impacted by the COVID-19 pandemic’s global disruptions, which have driven up shipping costs and reduced labor availability.

-

Amazon’s In-house Logistics: If Amazon chooses to handle its own package delivery, it could result in less revenue for DHL as it develops its own logistics network.

-

Geopolitical Risks: Given that DHL conducts business in more than 220 nations, unanticipated geopolitical risks like conflicts or trade disputes could impair the company’s operations.

Valuation

After summarizing the most important aspects of DHL, we can now take a deep dive into the valuation of the company.

Like mentioned above and in my latest article, challenges are expected for Deutsche Post in the years to come. In light of the company’s uncertain future and the anticipated decline in both top and bottom lines in 2023 and 2024, the stock price should therefore in my opinion reflect these factors.

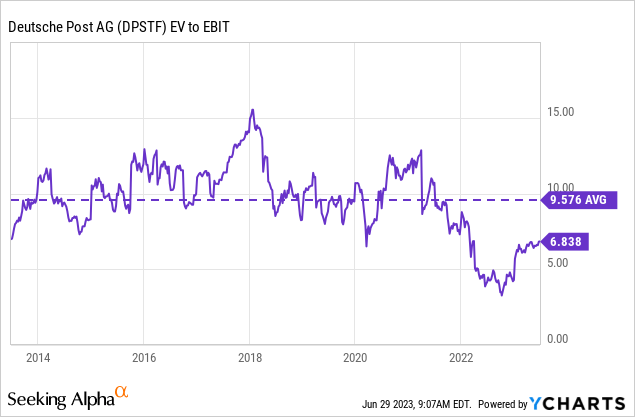

In their latest earnings call DHL’s management confirmed an EBIT target of €8 billion for 2025. Considering the current market cap of €53 billion, the company currently trades at an EV/EBIT of 6.6.

Comparing this to the 10 year average EV/EBIT ratio of 9.5, the company looks attractively valued at an discount of ~30%.

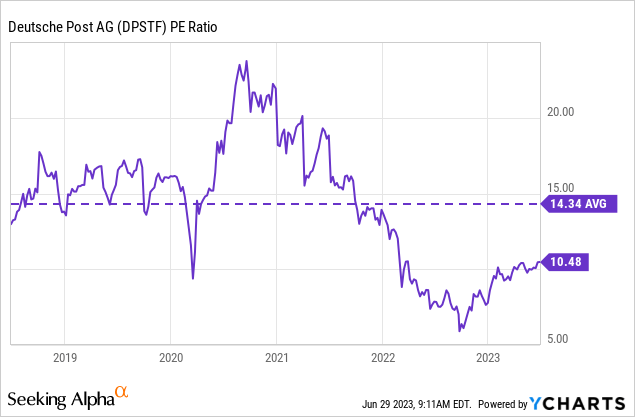

When taking a look at the P/E ratio, this trend is further solidified: Deutsche Post is currently trading at a forward P/E of 13.3, while the average P/E-ratio over the last 5 years is at 14.3.

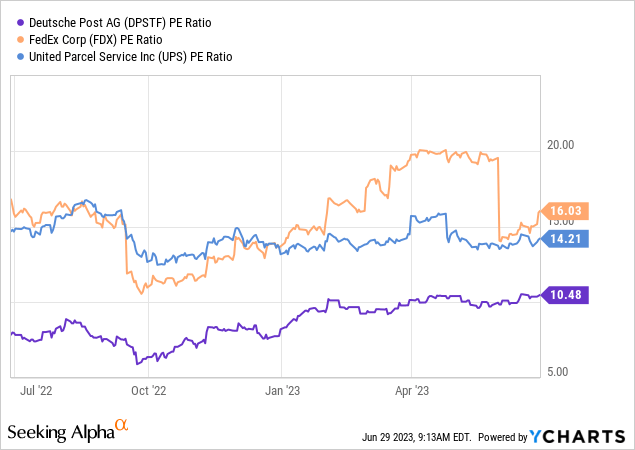

Even when comparing DHL within its peer group, the company seems to be attractively valued. With both FedEx (FDX) and United Parcel Services (UPS) trading at way higher P/E-ratios right now.

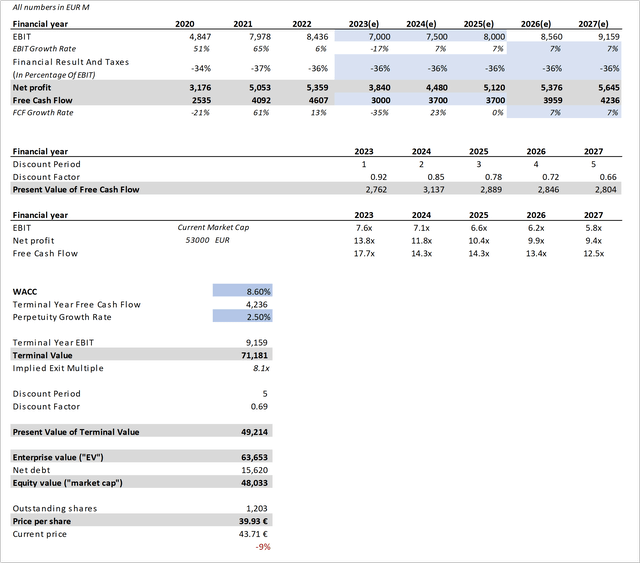

The best way to valuate stock however, in my opinion, is a Discounted Cash Flow Analysis, as here the future and the expectations for the business is included.

To get a more sophisticated view at the valuation of DHL, I separated the DCF into two different scenarios. One is based on management’s expectations and the other is based on analysts’ expectations on the company.

Management’s Expectations

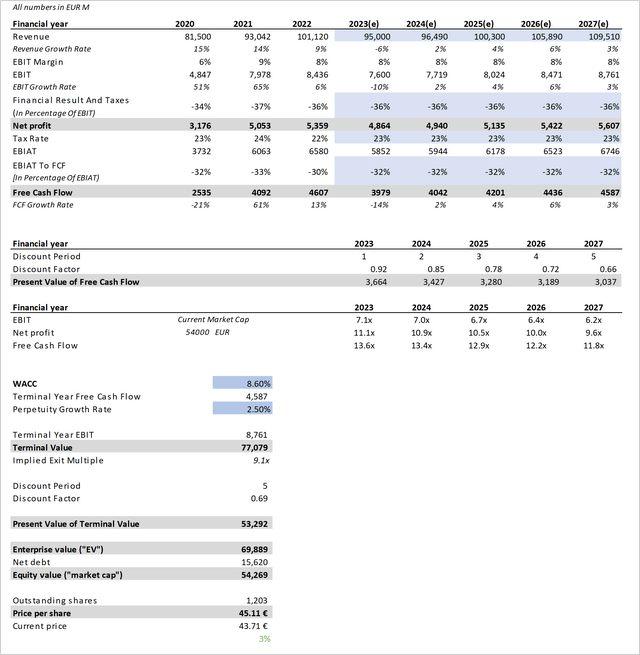

In this segment, I anticipated that the expectations and guidance of DHL’s management from their latest earnings call will come to fruition. The blue cells in the analysis represent the assumptions made to evaluate DHL. Some points here are the same compared to my last article but I made some metrics more optimistic. Here is a brief overview of how I calculated and predicted the future prospects of Deutsche Post:

- EBIT:

- 2023: This time I based my EBIT prediction for 2023 on the most bullish scenario, €7.0 billion, given by Deutsche Post’s management in their latest investor presentation.

- For 2024 to 2025 I anticipated that the high end of management’s mid-term guidance for 2025 of €6.0 to €8.0 billion comes to fruition.

- From here on I assumed a 7% EBIT-CAGR for the remaining period, because DHL’s EBIT before Covid-19 grew an average of 7%.

- Financial Result And Taxes: I averaged the values of the last three years and therefore used 36% to predict the net profit for the years 2023 to 2027.

- Free Cash Flow:

- 2023: Here the management currently predicts a FCF of €3.0 billion

- 2024 – 2025: For the years 2023 to 2025 the management expects a cumulative Cash Flow of €9.0 to €11.0 billion. Once again I estimated the high end and used € 11.0 billion, so €3.7 billion p.a..

- 2026 – 2027: For this period I predict a CAGR of around 7%, which is right at their 10y CAGR of 7,6%.

- WACC: As per Gurufocus, DHL’s WACC is currently at 8.6%.

- Perpetuity Growth Rate: The perpetuity growth rate assumed for the analysis is 2.5%.

seekingalpha.com; dpdhl.com

Based on this Discounted Cash Flow analysis, the calculated share price for DHL is €43,71 or currently $47,70. This suggests that DHL is trading around 10% above its fair value at the moment.

Keep in mind that this DCF is taking the high end and therefore the most optimistic expectations of DHL’s management into account.

Analyst’s Expectations

In this scenario, I conducted a DCF based on the current analyst revenue expectations. For simplicity purpose, I tried to keep margins and other metrics the same.

- Revenue: Analysts expect the revenue of DHL to develop as follows:

| 2023(e) | 2024(e) | 2025(e) | 2026(e) | 2027(e) |

| 95.00 billion | 96.49 billion | 100.30 billion | 105.89 billion | 109.5 billion |

- EBIT: From here on I tried to calculated a suitable EBIT-Margin for DHL over the next years. I averaged out the last three years and arrived at a margin of 8%. This metric was used to calculate the EBIT for the remaining years.

- The other metrics stayed the same

seekingalpha.com; dpdhl.com

When looking at the current Analyst expectations we get a slightly improved price target of €45,11 or $49,23. This suggests that DHL is currently trading pretty much at fair value.

Conclusion

To summarize, Deutsche Post is a well-managed firm with good financial standing and a leading position in the logistics sector. From 2019 to 2022, the corporation had exceptional growth, but it is currently dealing with challenges connected to continued expansion.

Even when factoring in the most optimistic expectations of management the company seems to be slightly overvalued. When considering the expectations of analysts, the company seems to be trading right around fair value.

Keeping both scenarios in mind, I currently rate the company as a ‘Hold’.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here