Direxion Daily Small Cap Bear 3X Shares ETF (NYSEARCA:TZA), a leveraged ETF, was launched in 2008 to inverse the performance of the small cap Russell 2000 index. The “3X” refers to the fact that these funds use leverage to gain three times the (inverse) returns of Russell 2000 index.

I can understand why inverse funds became popular, especially around 2008/2009 when the financial crisis took center stage. Search for “Is the stock market over-valued” and you will find articles dating back to at least 1990s. It is undeniable that using common metrics like PE ratio or Price-Sales ratio, most stocks and even the market in general have been overvalued compared to historical average. But the fall in interest rates and general lack of alternatives compared to the mid 20th century make these comparisons uneven to put it mildly. That said, it is still reasonable for those who believe the market to be overvalued to look for ways to profit by other means.

The dangers of shorting an individual stock are well documented, especially the adage “The market can stay irrational than you can remain solvent”, meaning you are likely to run out of cash to cover your short position before the market acts on an over-valued stock. Hence, bear funds like TZA appear like a good bet on surface to bet against an inflated market. However, TZA has recorded 6 reverse splits since initiation in 2008:

- 1:5 reverse split in July 2010.

- 1:3 reverse split in February 2011.

- 1:4 reverse split in April 2013.

- 1:4 reverse split in October 2015.

- 1:5 reverse split in June 2019.

- 1:8 reverse split in March 2021.

No wonder, TZA’s chart looks like the absolute nightmare anyone could imagine for any stock or fund they buy.

TZA Chart (Google Finance)

Before readers think I am simply preaching here, I will admit that I lost my shirt on TZA a couple of times, losing pretty much everything I had put into the name on two separate occasions. I can also envision some advanced traders thinking “Well, TZA and the likes were never meant to be an investment but a tactical short-term positioning against risk”. But what is short-term for one may be eternity for someone else.

I am presenting a few reasons below why I’ve been avoiding TZA since my debacles and suggest most of the readers to do so. Let us get into the details.

- There are several risks associated with inverse ETFs that an average investor may not know or even fully understand. These risks are not as simple as saying “But then, any stock you invest in may go to $0”. I admit that while I’ve always considered myself an above-average investor (not in terms of returns per se but my understanding of the market in general), I did not fully pay attention to the intricate risks involved here. This article explains these risks well. The main risk I’d like to highlight here is the Compounding Risk. By definition, TZA and the likes are not built for long holding periods as their objective is to inverse the single day performance of the underlying index, which is the Russell 2000 in case of TZA. This means, the longer you hold an inverse ETF, the greater the compounded risk. Now, you may think you will get out by the end of the day. Not so fast.

- They move too quick when they move, as evidenced by a beta of 3 in line with the 3 times leverage. You may think you have quick hands and can trade these out profitably but it is like playing the lottery. The few winners come out alright but a vast majority of the players end up poorer than when they got into the game.

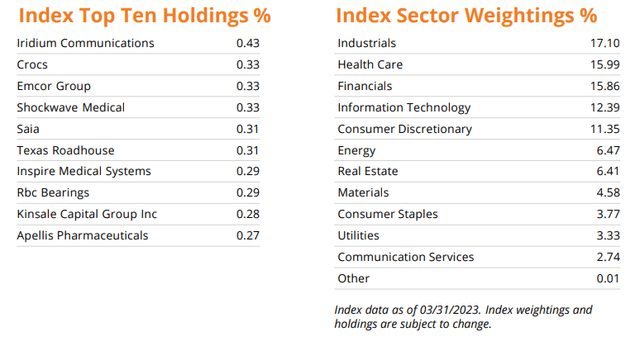

- An expense ratio of ~1% is way too high in this day and age but then their way of justifying this might be the fact that they need to rebalance daily. It seems counter intuitive to me to pay a higher than normal fee to rebalance every day to 3 times reverse imitate the performance of an ETF that has strong exposure to the sectors that make up and run the economy: Health Care, Financials, Information Technology, and Energy to name a few. Please see the full sector weightings below.

- In general, leveraged ETFs are risky enough that the Securities & Exchange Commission (SEC) has a separate section on their specific risks.

- Finally, betting against small caps is like betting against the future. Granted, there will be many that companies that don’t deserve their individual over-valuation but as a group, small caps are extremely vital for the economy to adjust to its previous excesses while also ensuring the strong don’t keep getting stronger at the expense of the new.

TZA Holdings (direxion.com)

Conclusion

A complete understanding of risks, quick-hands, the willingness and affordability to let go of the entire position are all equally vital elements before you consider putting any money into TZA and the likes. If you are still not convinced by the reasons above to not touch TZA here or ever, take a look at the chart below of the index TZA has mimicked. Quite an inverse actually, which once again conveys the risks involved with leveraged reverse ETFs like TZA for the average investor.

Additional Disclaimer: I did not select a “Sell” rating on TZA to avoid being misinterpreted for being bullish on Small Caps right now. Hence, this article has a “Hold” rating on TZA but please note I recommend a vast majority of investors to stay away from this name.

Russell 2000 (Google Finance)

Read the full article here