Investment Overview – Disc Medicine Stock Rises Nearly 250% Since Dec 2022 Nasdaq Listing

Disc Medicine Opco Inc (NASDAQ:IRON) shares are having a fantastic year so far. The stock has risen in value by >165%, and is currently priced at $47, valuing the company at $934m at the time of writing.

The hematologic disease specialist obtained its Nasdaq listing via a reverse-merger with Gemini Therapeutics, a failing, SPAC-listed biotech in the midst of a strategic review, beginning trading on a 1-10 reverse split basis on 30th December 2022. Disc was able to raise $53.5 from numerous biotech venture capital firms including OrbiMed, Atlas Ventures, 5AM Ventures, Novo Holdings, Arix Bioscience, Rock Springs Capital, and Janus Henderson.

According to a press release at the time, funds were to be allocated on “advancing its development pipeline of investigational product candidates,” including:

- The ongoing phase 2 BEACON and AURORA clinical trials of Bitopertin, an investigational, orally administered inhibitor of glycine transporter 1 (GlyT1) that modulates heme biosynthesis, in patients with erythropoietic protoporphyria (“EPP”)

- The ongoing phase 1b/2 clinical trial of DISC-0974, a monoclonal antibody designed to suppress hepcidin by inhibiting the hemojuvelin (HJV) co-receptor, in myelofibrosis patients with anemia

- A planned phase 1b/2 clinical trial of DISC-0974 in patients with anemia of chronic kidney disease (CKD) who are non-dialysis dependent

- Preclinical studies of Bitopertin and DISC-0974 to additional indications of interest and advancing several preclinical-stage programs in development designed to address hematologic diseases

Almost as soon as the merger was complete, Disc stock began to rise – from ~$13.5 on 29th December, to $46.6 – a rise of 245%.

What Is The Story behind Disc Medicine’s Rapid Share Price Gains?

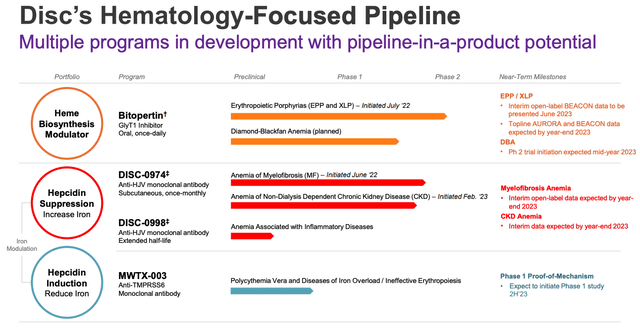

Disc Medicine’s pipeline is comprised of 2 clinical stage assets, and one preclinical, as shown below:

Disc Medicine pipeline (Corporate Presentation)

The asset that is arguably chiefly responsible for Disc’s excellent trading debut is Bitopertin, an asset acquired from Swiss Pharma giant Roche (OTCQX:RHHBY) in March 2021 in exchange for an upfront payment of $0.5m, followed by a further payment of $4m in May, according to the company’s Q321 10Q submission, which also states that:

The Company is obligated to make contingent payments to Roche totaling up to $205.0 million upon achievement of certain development, regulatory and commercial milestones. Roche is also eligible to receive tiered royalties on net sales of commercialized products, at rates ranging from high single-digits to high teens.

Disc also issued ~2.85% of its stock over to Roche, or ~482k shares to gain access to Bitopertin, a drug which Roche had evaluated in >4,000 patients across several neurological indications. According to Disc’s 2022 10K submission (annual report):

The data generated in these clinical trials failed to establish the efficacy of bitopertin in neurologic disorders. However, the data did demonstrate that, by limiting glycine uptake in newly forming red blood cells, bitopertin reduced the activity of the heme biosynthesis pathway, and we believe that this effect has the potential to treat many hematologic disorders. In addition, bitopertin was observed to be well tolerated in humans, with adverse events reported to be generally mild and infrequent across all trials

Buoyed by Bitopertin’s effect on the heme biosynthesis pathway, and confident in the drug’s safety profile, Disc was able to initiate a Phase 2 study in Erythropoietic Porphyria (“EPP”) and X-linked protoporphyria (“XLP”) in July Last year. The study is a randomized, open-label, parallel-arm trial enrolling up to 22 patients at trial sites in Australia.

EPP is a lifelong condition characterized by painful skin when exposed to bright sunlight, whilst XLP is an extremely rare genetic disorder characterized by an abnormal sensitivity to the sun.

Phase 2 Data Sends Stock Surging Again Today

Disc had promised data from its Phase 2 BEACON study today, and it has duly arrived, sending the stock price up a further 16% today, to its all-time high price. The company describes the mechanism of action of its drug in its Q123 earnings release as follows:

Bitopertin is an investigational, clinical-stage, orally-administered inhibitor of glycine transporter 1 (GlyT1) that is designed to modulate heme biosynthesis. GlyT1 is a membrane transporter expressed on developing red blood cells and is required to supply sufficient glycine for heme biosynthesis and support erythropoiesis.

Presenting preliminary findings from the BEACON study today, at the European Hematology Association (“EHA”) 2023 Congress in Frankfurt, Germany, Disc revealed in a press release that:

The initial trial data demonstrated consistent decreases in PPIX, significant increases in reported sunlight tolerance and improvements in measures of patient quality of life.

Will Savage, M.D., Ph.D., Chief Medical Officer at Disc Medicine, commented:

Importantly, this reduction translated into significant improvements in the time that patients can spend in sunlight without reporting pain or symptoms related to their disease. We’re encouraged by the data and plan to present additional data at the end of the year.

Apparently, the mean reduction in Protoporphyrin IX (“PPIX”) levels was >40% when compared to baseline. 1 patient on the 20 mg dose reported an 80-fold increase in sunlight tolerance, increasing from 4.5 minutes baseline to over 6 hours, with no reports of a prodrome (early symptom), and collectively, the average weekly total time spent in sunlight: increased from 344 minutes, to 1,200 minutes at Week 24, and the time to prodrome during the sunlight challenge increased 7-fold, from 25 minutes, to 182 minutes at Week 24.

In other words, the news appears to have been overwhelmingly positive.

What Is The Market Opportunity In Play For Bitopertin?

EPP is an unpleasant disease, caused by, according to Disc:

a deficiency of the FECH enzyme. FECH is responsible for the last step in heme biosynthesis and catalyzes the insertion of iron into PPIX to create the final heme moiety.

Exposure to sunlight causes patients to experience itchy, inflamed skin and a burning sensation that can last for days, and also causes gallstones in ~25% of patients and liver damage that requires a transplant in 2-5% of cases. Disc’s research suggests:

EPP has been reported worldwide, with prevalence between 1 in 75,000 to 1 in 200,000, but a recent genetic study suggests that the genetic prevalence may be higher at approximately 1 in 17,000

That implies the number of patients with EPP could be anything from ~7.5k (the midpoint of reported prevalence and an addressable population of ~1bn based on age range and diagnosis), to nearly 60k patients, if Disc’s assumptions are correct.

Apparently, the global prevalence of XLP is estimated to be one tenth that of EPP, meaning that I would estimate the market opportunity in play to be not much more than $500m, in an optimistic scenario. In reality, Disc may struggle to turn this into a >$100m peak sales opportunity. Furthermore, although there are few available treatments for EPP and XLP at present, Disc acknowledges some significant competition in its 10K.

If approved, bitopertin will face competition from melanocortin-1 receptor agonists, including afamelanotide, a subcutaneously implanted therapy that is approved in the U.S. and other territories and marketed as Scenesse by Clinuvel, and dersimelagon, an oral therapy in Phase 3 development by Mitsubishi Tanabe Pharma Corporation. In addition, there are other potential treatments currently in the discovery stages of development that may become competitors in the future. These therapies include, but are not limited to, gene therapies, heme biosynthesis modulators that target GlyT1 or other enzymes in the heme biosynthesis pathway, and molecules that target porphyrin export.

What Else Is In The Pipeline For Disc Medicine?

Disc has already begun to target other rare blood disorders with Bitopertin, initiating a Phase 1 study in Diamond Blackfan Anemia this year, and planning to move to a Phase 2 later this year, but the company’s larger market opportunity may rest with its other clinical stage drug, DISC-0974.

This drug has been entered into a Phase 1 study in anemia of myelofibrosis (“MF”), and anemia of non-dialysis dependent Chronic Kidney Disease (“CKD”), with interim data from both studies due before the end of the year.

Both of these diseases have a high unmet need for new and better therapies, but it should be noted that these are tricky targets for drug developers, albeit popular ones for biotechs.

For example, in MF, although there are no approved therapies, Erythropoietin stimulating agents (ESAs) such as Johnson & Johnson’s (JNJ) Procrit, Amgen’s (AMGN) Epogen and Aranesp, and Roche’s Mircera, are often prescribed off-label, whilst several biotechs have drug candidates in more advanced stages of development. According to Disc:

multiple erythroid maturation agents are in development, such as luspatercept, which is in a Phase 3 trial by Bristol-Myers Squibb, and KER-050, which is in a Phase 2 trial by Keros, Inc. In addition, multiple ALK2 inhibitors, which work by a hepcidin-lowering mechanism similar to, but less specific than that of DISC-0974, are in Phase 1/2 development, including KER-047 by Keros, Inc. and INCB00928 by Incyte Corporation. Sierra Oncology, Inc. (recently acquired by GlaxoSmithKline) is developing a JAK2 kinase inhibitor, momelotinib, which has completed a Phase 3 trial and has a New Drug Application, or NDA, under review by the FDA.

The news does not get much better in Chronic Kidney Disease – there may be fewer competing biotechs, but CKD is synonymous with failed drug candidates, e.g., Akebia Pharmaceuticals (AKBA) Vadadustat, Fibrogen’s Roxadustat, and Protagonist Therapeutics (PTGX) Rusfertide (although approvals have been easier to come by ex-U.S.).

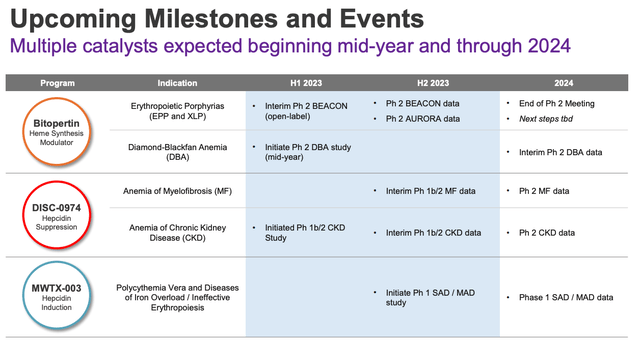

In fairness to Disc, the company has multiple data readouts upcoming across all of its pipeline, including the hepcidin induction candidate MWTX-003, as shown below.

Disc medicine upcoming milestones (corporate presentation)

Concluding Thoughts – Should Investors Consider Buying IRON Stock At Current Prices?

Drug development is a tough business – even the Big Pharma sector, pouring billions upon billions of dollars into R&D, has a hit rate not much better than 1 in 5, and that is with clinical candidates, plus the costs of successfully developing a drug are estimated to be ~$2bn.

As such, Disc has a long road ahead of it, but that does not mean the company does not deserve praise for repurposing a Roche cast-off in Bitopertin and obtaining some very strong early data.

Analysts have been supportive of Disc’s efforts, with Morgan Stanley (MS) setting a price of target of $37 per share in April – a target that has already been exceeded – and today, Raymond James responding to the Bitopertin data, upgrading its target to $75 per share, implying an upside opportunity of nearly 60%.

Often, however, analysts price targets should be taken with a pinch of salt – they may have a working relationship with the company, for one thing – and the risks associated with Disc’s MF anemia and CKD approval shots strike me as high – in my (limited experience), kidney disease is an area where biotechs can burn through hundreds of millions of dollars very quickly, only to fail at the final hurdle, whilst in MF, there are several biotechs that appear to be substantially further ahead in the race to approval than Disc is presently.

Disc could have a commercial candidate approved within the next few years if early Bitopertin data is borne out in a pivotal trial, and that is an achievement worth celebrating. The company is in a reasonably sound position financially also, with $236m of cash reported as of Q123, and a cash burn of only $22.7m.

Would I recommend Disc Medicine Opco Inc stock today at current price? Personally, I’ll remain on the sidelines for this one as I don’t think the commercial opportunity for Bitopertin – $100m at best, I would estimate, supports a market cap 9x larger than that, whilst the company may need hundreds of millions more funding to complete studies in its other indications, where the risk of a study setback is high.

Read the full article here