After a dismal 2023, Disney (NYSE:DIS) appears to have not learned anything from the failures of the past few years. The media company has made a lot of noise regarding the Board of Directors alignment, but the company appears to have not fixed the film studio. My investment thesis remains Neutral on the stock, with no apparent changes being implemented at the media giant.

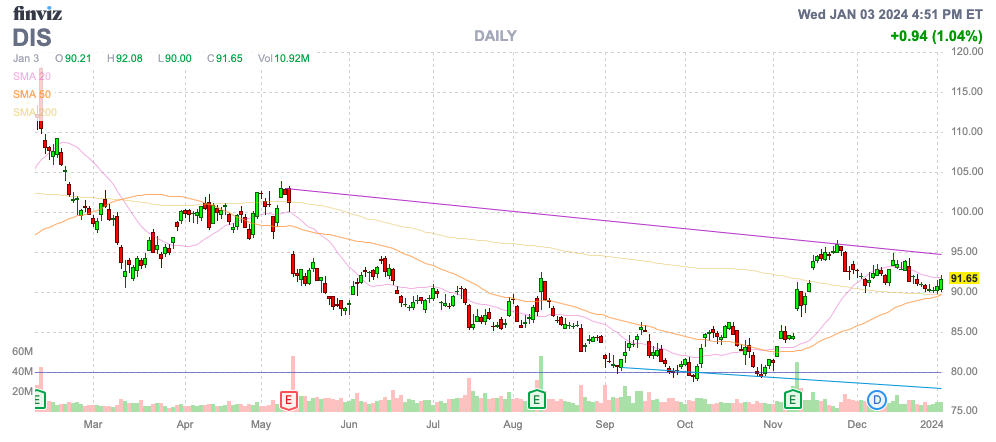

Source: Finviz

Dismal 2023

Disney had such a bad year that Universal overtook Disney for the top grossing movie studio in 2023. The NBCUniversal (CMCSA) Studio Group edged out Disney with total global box office gross of $4.91 billion, compared to an estimate of $4.83 billion for Disney.

Disney has had the top global grossing box office since 2016 and only lost the domestic box office during the 2020 Covid victory by Sony. Universal hasn’t ranked No.1 since hauling in $6.9 billion in studio revenues back in 2015.

The news gets even worse with the projections for 2024 not shaping up very well due to the Hollywood strikes. The domestic box office topped $9 billion in 2023, but the projections have box office sales dipping to $8 billion in 2024.

While returning CEO Bob Iger suggests the company lost focus, new signs continue to emerge that Disney is set to continue repeating the political issues leading to the box office failures of 2023. The new Director of the Star Wars franchise stated she wants to accomplish the following:

We’re in 2024 now, and it’s about time that we had a woman come forward to shape a story in a galaxy far, far away.

The Canadian-Pakistani woman in charge of directing the new franchise focused on Rey Skywalker appears headed down the path of running off movie goers only looking to be entertained. According to data, the Star Wars franchise viewer is shifted towards the male viewer. A survey in 2019 showed 70% of males are a fan and nearly half of women aren’t fans.

Disney appears headed down the path similar to the Snow White movie recently delayed until March 2025. Star Rachel Zegler constantly promoted the historical concept of the movie franchise as flawed and even involved a “stalker”.

The Marvels recently scored the weakest opening ever for the Marvel franchise. The movie now has barely passed the $205 million mark globally after nearly two months in theaters. The Marvel movie is set to be the worst performing movie from the franchise since Disney acquired the studio in 2009.

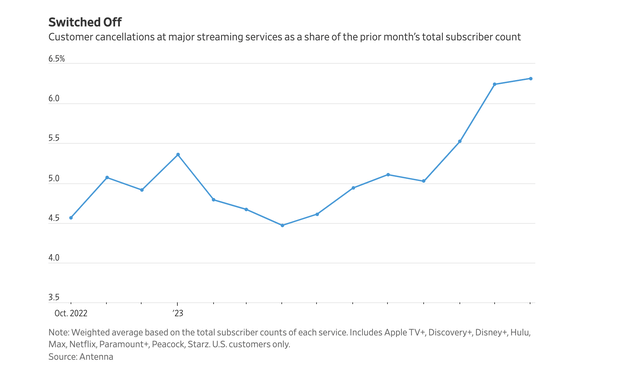

While Disney is having huge problems at the box office, the video streaming market is under major pressure. Nearly 6.5% of all subscribers now cancel services on a monthly basis.

Source: WSJ

The streaming services convinced people to cord cut with lowball prices and suddenly the subscription price hikes are leading to much higher cancellations. Not surprisingly, video streaming services were built on courting the cable subscribers looking for better value and the large rate hikes are pushing more people to cancel services.

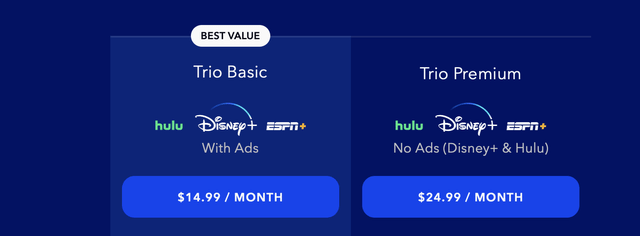

Disney+ now charges $24.99 for the Hulu/ESPN+ bundle after the service originally started for only $12.99 in late 2019. The subscription has soared nearly 100% during the 4 year period and the Disney+ trio is actually up $2/month with the inclusion of requiring users to view ads.

Source: Disney+

Investors need to remember that Bog Iger was the CEO when Disney+ was launched at $6.99/month price with no ads.

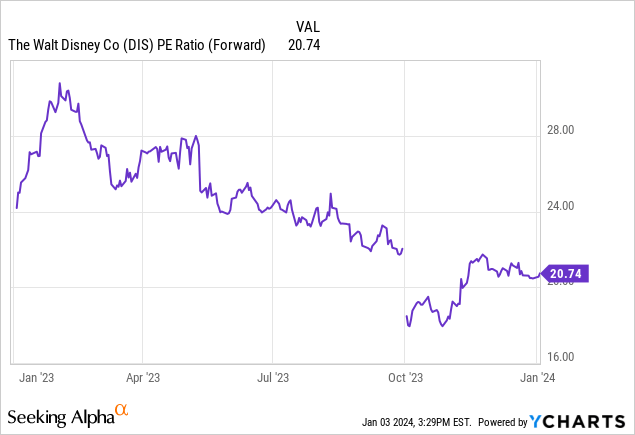

Complicated Value

Disney is a complicated investment to own right now. The stock only trades at 21x forward EPS targets, but the media company has to grow earnings by 17% to reach the analyst target for FY24.

The company has reported 2 consecutive quarters of missing revenue targets questioning how Disney is able to grow earnings so dramatically over the next year. Nothing about the business direction is supportive of the media giant turning the quarter outside of charging aggressively on the Disney+ subscription service to outrun the ongoing cancellations.

Disney just worked out an agreement with activists from ValueAct to support Disney’s slate of board members while Blackwells Capital is promoting their own board members, though ones supportive of CEO Bog Iger. The Trian Fund, run by Nelson Peltz, is still seeking their board members, which remain critical of Disney.

The company wouldn’t have so many activists circling the business, if Disney was on the path to the nearly 20% EPS growth rates of the next 3 years. EPS estimates continue to slide making our view on the stock Neutral.

Takeaway

The key investor takeaway is that Disney still appears more focused on the activists circling the business than on fixing the issue impacting studio box office sales. The company requires far too much EPS growth during 2024 to make the stock appealing around $90.

Read the full article here