Background

For a long time, even work became increasingly efficient (through digitization, the ability to work from anywhere, and so on), one problem seemed to be continually un-solvable: the problem of having to secure physical signatures for legal and business documents. DocuSign (NASDAQ:DOCU), of course, changed all that, by pioneering e-sign documents and the technology needed to treat a digital signature as legally valid and binding.

The value proposition of the business is at once immediately apparent. Instead of needing to overnight documents for signature, business deals, home purchases, and many other myriad complex transactions can be completed from a mobile device.

And yet, for all the convenience and ease of its service, DocuSign has yet to turn a profit (on an annual basis, for the fourth quarter of 2022 the company squeezed out a net profit of $4.9 million).

The stock, also, has felt the pain of rising interest rates, with prices falling from whipsawing over the past three years.

Koyfin

From having appreciated nearly 200% from mid-2020, the stock has fallen to deliver a negative 52% total return. Such volatility over relatively short time horizon begs the question: what comes next? Let’s dive in.

Board Room Drama

One of the first things investors should be aware of if they are approaching the DocuSign narrative for the first time is that the company has recently undergone a bit of executive turnover. The company’s CFO, for one, announced that she would be leaving the company on the full-year 2022 results conference call. The company’s CEO, Allan Thygesen, just completed his first full quarter as the company’s top executive. To say that the process of his arriving at the helm of the company was dramatic is… not an overstatement.

Until mid-2022, DocuSign was helmed by Dan Springer until he suddenly stepped down (the stock’s price had been halved at this point), and Maggie Wilderotter stepped in as interim CEO (she currently serves as Chairman of the Board).

Then, in a dramatic twist, in an 8K filed in October 2022 the company simultaneously announced that Allan Thygesen would become CEO and have a place on the board of directors, while at the same time Dan Springer would be stepping down.

Everyone seemed to be ok with this–except Dan Springer.

Dan Springer rapidly filed a lawsuit against DocuSign in Delaware alleging that he had not, in fact, resigned. He claimed, in effect, that the DocuSign announcement of his resignation was fabricated in an attempt to remove him from his board seat.

Then, in January 2023, DocuSign filed a new 8K, which reads as follows:

As previously reported, DocuSign, Inc. (the “Company”) is party to litigation in the Court of Chancery of the State of Delaware (the “Chancery Court”) brought by Daniel D. Springer. To avoid the cost and distraction of further litigation with Mr. Springer, the Company offered to stipulate to entry of judgment in favor of Mr. Springer as to his disputed resignation and his status as a director of the Company. Following the Company’s offer, on January 11, 2023, the Chancery Court issued an order declaring and confirming that (i) Mr. Springer has not resigned from the Board of Directors (the “Board”) of the Company and (ii) Mr. Springer is currently a member of the Board.

To recap, the old CEO had stepped down but remained on the board. Upon finding a new CEO, the company claimed the old CEO had stepped down from the board. The old CEO claimed this was fraudulent, and DocuSign pretty quickly backed down and allowed him to remain on the board.

This is… important. Investors might think that drama within boards is something distant and remote, but a contentious boardroom atmosphere can have effects that reverberate throughout the company. It also seems odd that if Springer had “previously tendered his resignation to the Board in accordance with Section 1.12 of the Company’s Corporate Governance Guidelines,” the company wouldn’t simply produce the documentation required by those guidelines to substantiate the resignation. While we are not lawyers, it also seems odd that a $10 billion company would cite “cost” as a reason to not enter into litigation with a single individual over what appears to be a relatively simple (likely administrative) question.

The end result, however, is less than ideal for Mr. Thygesen, since the former CEO now sits on the board until at least 2025.

Restructuring & Costs

As uncomfortable as it may be to have the guy who used to have your job listen to every board room strategy pitch you make, Thygesen and his team have pressed forward. In February the company announced that it was implement a restructuring plan which would cost the company between $25-$35 million to execute but would reduce headcount by 10% overall.

Thygesen highlighted this on the March 9th conference call, stating that “95%” of the restructuring would affect the company’s sales force. This is critical, in our view, since DocuSign has historically spent a significant amount of resources on its sales teams, which has contributed to bloated customer acquisition costs.

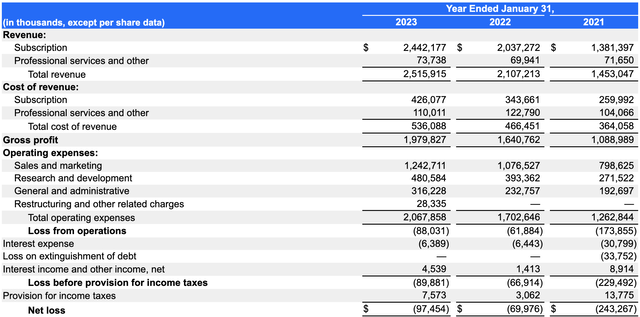

Company Filings

For example, in 2022 DocuSign incurred Sales & Marketing costs of $1.24 billion, 49% of total revenues (down from 51% the prior year). Compare this to rival Adobe’s (ADBE) 30% expenditure on sales against revenue, and the bloat is clear (Adobe offers the strongest competition to DocuSign with its Acrobat Sign product).

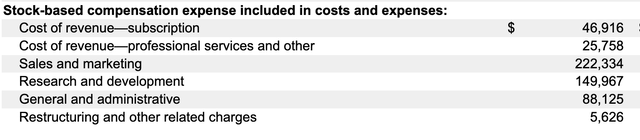

Shareholders are likely to greet the restructuring news with excitement since not only does DocuSign incur heavy Sales & Marketing expenses, but the line-item’s portion of share-based compensation is quite high (we must also point out that stock-based compensation growth outpaced revenue growth, coming in at 30% and 19%, respectively).

DocuSign 10K, 2022 Share Based Comp

To combat this spending, Thygesen said on the call that the company would look to prioritize “self-serve” options for customers, rather than having them interface with sales personnel. He also stated that “we may also see modest near-term disruption as we realign our sales force and shift to more of a self-serve motion.”

Our interpretation of this statement is that DocuSign relies heavily on its sales force to actively generate sales, rather than expecting customers to passively enter the DocuSign sales funnel. Management also expects that the company will experience near-term headwinds as the strategy is executed.

Bulls Say…

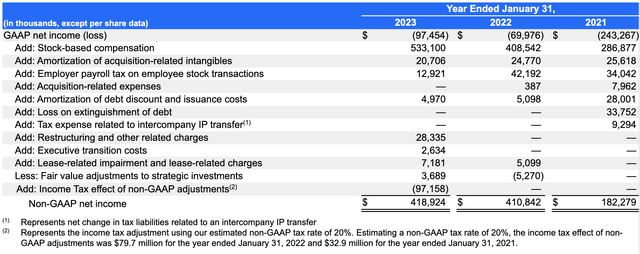

DocuSign bulls will likely point to the fact that losses are narrowing, and that the company posted a positive Q4. We point out that the net loss figures provided above only give investors a portion of the picture. The company’s comprehensive loss (which appears just beneath the company’s net loss figures) grew a whopping 45% last year.

DocuSign 2022 10K

We also point out that company’s reconciliation of net income from a negative $97 million net loss to an adjusted net income of $418 million requires more mental gymnastics than we are willing to perform.

Company Filings

While companies love to add back stock-based compensation, we are firmly of the belief that the practice is misleading. While it may be true that it is not a cash expense to the company, it certainly is an expense that shareholders must bear via the dilution it creates.

It is also unclear to us why any company should be given a pass–even for internal metrics–to add back restructuring charges, lease related charges, or payroll tax charges on stock based compensation to its net income figures. These are legitimate expenses paid by the company, and investors should not take seriously such measures to turn a loss into a profit.

Bulls are also likely to counter that the company has a new CEO–why not give him a chance?

We respond to this by saying that even in a perfect world, turnarounds (or pivots to profitability) are exceptionally difficult. Doing so while the predecessor CEO remains on the board, fresh out of a legal dispute with the company, is a whole other kettle of fish. Further, even the perception of crooked dealings (such as fabricating a resignation) among board members should be met with extreme caution by investors. In this matter we point out that the company and board have been silent on these issues with the exception of the 8Ks the company is required to file, and the reasoning presented within those filings seemed exceptionally weak.

Bulls have often pointed out that DocuSign is a market leader, and that their status as a first mover in the e-sign space have given it a head start that is unlikely to be lost any time soon.

While we concede that DocuSign is currently the leader in the e-sign space, we point out two things in response:

- DocuSign has attained its market position with an active, well-compensated sales force.

- DocuSign is now materially abandoning that strategy.

DocuSign has been reliant on its sales force almost by necessity–after all, it doesn’t have a built-in platform (like Adobe does with its PDF-reading software) through which to integrate and sell its product. We think it is fair to say, then, that DocuSign has been more reliant on its sales force to drive enterprise-level adoption than investors may believe. It is entirely unclear that an expansion of self-serve options and a reduction of headcount in sales will produce existing account growth and new customer acquisition at a level close to what the company has experienced in the past.

Further, we note that DocuSign is swimming in the deep end, so to speak, with Adobe, whose market capitalization is 17x that of DocuSign’s. It does not take a huge leap of the imagination to envision Adobe leveraging its existing enterprise relationships and ubiquitous software presence to diminish DocuSign’s role in the competitive landscape should Adobe sense weakness at its smaller rival.

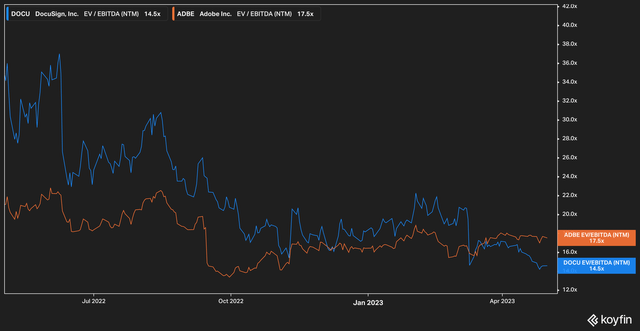

Further, DocuSign doesn’t even possess a highly attractive valuation when compared to Adobe.

Koyfin

On a forward EV/EBITDA basis, DocuSign (the blue line), has certainly fallen quite a ways, trading today at 14.5x from close to 40x a year ago, but we believe that even this valuation with its slight discount to Adobe is too expensive for a single product, unprofitable company.

The Bottom Line

Investments are tricky things–companies can, for example, have a great product and still falter. We believe that is the case with DocuSign. Between board room drama that isn’t likely to go away any time soon, gimmicky accounting, a conspicuous lack of profits, and the fact that stock-based compensation growth outpaces revenue growth by a not-insignificant amount, we think investor’s time would be best served looking elsewhere.

Read the full article here