This article series aims at evaluating ETFs (exchange-traded funds) regarding past performance and portfolio metrics. Reviews with updated data are posted when necessary.

DOL strategy and portfolio

WisdomTree International LargeCap Dividend Fund ETF (NYSEARCA:DOL) started investing operations on 06/16/2006 and tracks the WisdomTree International LargeCap Dividend Index. It has 261 holdings, a 12-month distribution yield of 4.13% and a total expense ratio of 0.48%. Distributions are paid quarterly.

As described by WisdomTree,

the Index is comprised of the 300 largest companies ranked by market capitalization from the WisdomTree International Equity Index. Companies are weighted in the Index based on annual cash dividends paid.

It includes developed countries except the U.S. and Canada. As it is weighted based on paid dividends (not yield), it favors large and mega-cap companies, which represent about 85% of asset value.

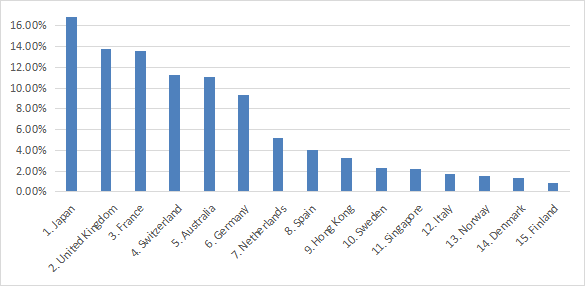

European companies have an aggregate weight over 60% in the portfolio, but the heaviest country is Japan with 16.9% of assets. Hong Kong weighs 3.25%, so direct exposure to geopolitical risks related to China is low. The next chart plots the top 15 countries, representing 98.2% of the fund’s asset value.

Country allocation (chart: author; data: WisdomTree)

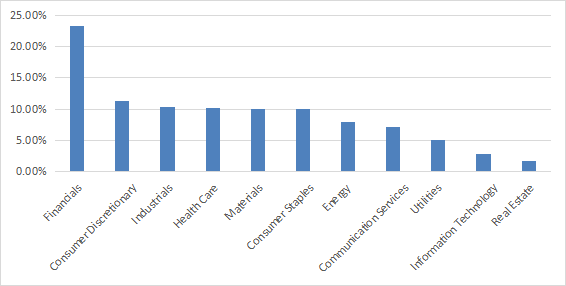

The top sector is financials with 23.3% of assets. Other sectors are below 12%.

Sector breakdown ( chart: author; data: WisdomTree)

The top 10 holdings, listed below, represent 22.6% of the portfolio. The Australian mining company BHP Group is number one, with 4.69%. Risks related to individual companies are moderate.

|

Name |

Ticker / Exchange |

Weight |

|

BHP Group Ltd |

BHP AU |

4.69% |

|

Novartis AG |

NOVN SW |

2.50% |

|

Nestle SA |

NESN SW |

2.32% |

|

LVMH Moet Hennessy Louis Vuitton SE |

MC FP |

2.26% |

|

Shell Plc-New |

SHEL LN |

2.25% |

|

HSBC Holdings PLC |

HSBA LN |

2.18% |

|

TotalEnergies |

TTE FP |

1.95% |

|

Roche Holding AG |

ROG SW |

1.59% |

|

Rio Tinto Plc |

RIO LN |

1.54% |

|

Toyota Motor Corp |

7203 JT |

1.34% |

Past performance compared to competitors

The next table compares return and risk metrics of DOL and five non-hedged international dividend ETFs since 2/1/2008:

- SPDR S&P International Dividend ETF (DWX),

- WisdomTree Global ex-U.S. Quality Dividend Growth Fund (DNL),

- iShares International Select Dividend ETF (IDV),

- First Trust Dow Jones Global Select Dividend ETF (FGD),

- Invesco International Dividend Achievers ETF (PID).

|

Since Feb 2008 |

Total Return |

Annual Return |

Drawdown |

Sharpe |

Volatility |

|

DOL |

36.07% |

2.01% |

-57.76% |

0.17 |

18.38% |

|

DWX |

2.13% |

0.14% |

-66.86% |

0.08 |

21.05% |

|

DNL |

104.95% |

4.76% |

-37.47% |

0.32 |

17.75% |

|

IDV |

35.85% |

2.00% |

-65.31% |

0.19 |

21.42% |

|

FGD |

60.80% |

3.12% |

-66.21% |

0.22 |

21.15% |

|

PID |

57.37% |

2.98% |

-63.23% |

0.23 |

19.44% |

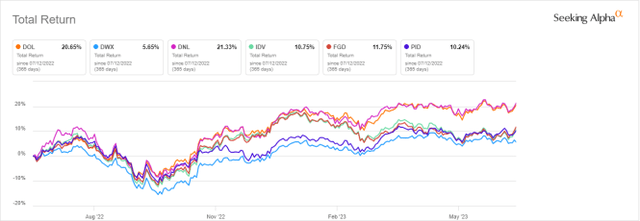

DOL is among the worst performers in total return and risk-adjusted performance (Sharpe ratio). However, it is in second position in the last 12 months:

DOL vs. competitors, last 12 months (Seeking Alpha)

The share price has lost 8.5% since inception and it has been flattish since 2009. To make it worse, the cumulative inflation in the U.S. has been almost 50% in the same time (based on CPI).

DOL share price history (Seeking Alpha)

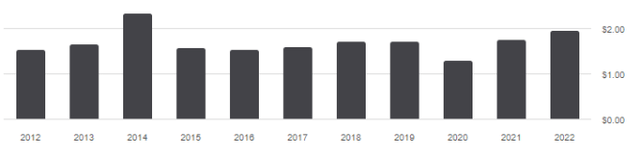

The annual sum of distributions has increased from $1.54 per share in 2012 to $1.94 in 2022. It means a 10-year growth rate of 27.9%, which is not far from the cumulative inflation during the same period: 29.3%. Nevertheless, the next chart shows there is no steady trend in distributions.

DOL distribution history (Seeking Alpha)

Takeaway

WisdomTree International LargeCap Dividend Fund ETF holds 261 dividend stocks from developed markets excluding North America. Japan is the heaviest country in the portfolio. The fund is well-diversified across countries and holdings, but it is quite heavy in financials. The yield is attractive and the fund has outperformed a number of competitors in the last 12 months, but share price and distribution history is underwhelming when taking inflation into account.

Read the full article here