The news is out.

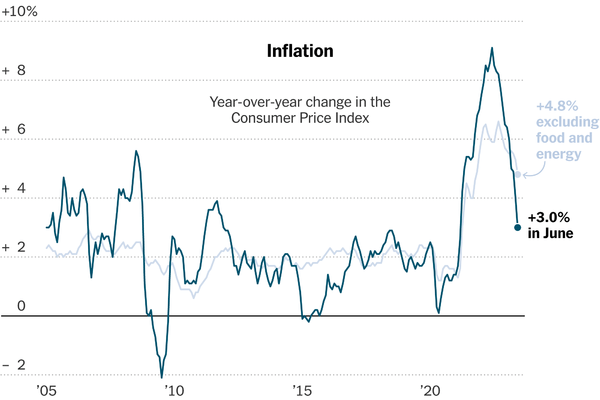

In June, the rate of inflation in the United States, as measured by the Consumer Price Index, fell. Year-over-year, the rate of inflation came in at 3.0 percent. The number was down substantially from the May number.

Consumer Price Index (New York Times)

Year-over-year, the Core CPI inflation rate came in at 4.8 percent, also down from the previous month.

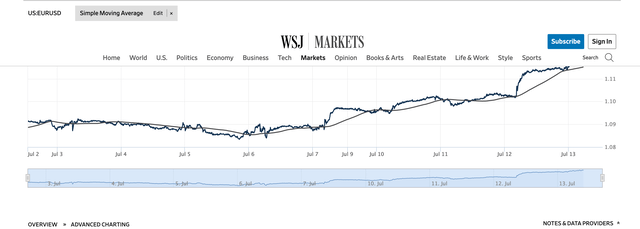

As the inflation numbers were announced, the value of the U.S. dollar declined.

Morning trading on Thursday, July 13, also showed that the U.S. dollar was losing value. Here is the chart showing the value of the U.S. dollar relative to the Euro. When the chart is moving upwards, the value of the U.S. dollar is going down. At 9:30 am Thursday morning, one Euro cost $1.1185. On July 5, the price was $1.0850 for one Euro.

US Dollar vs. Euro (Wall Street Journal)

What’s going on?

Usually when the value of a currency falls, it is because the inflation rate in that country is rising relative to that of other countries.

Here, we have the opposite happening.

To get a bigger picture, let’s look back in time a little.

Tighter Money

On March 16, 2022, the Federal Reserve began to tighten up its monetary policy to fight inflation.

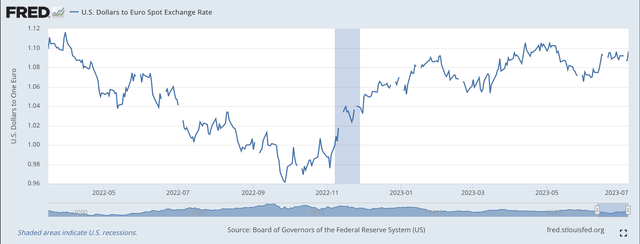

Let’s see what happened to the value of the U.S. dollar since the Fed began to tighten policy.

U.S. Dollar vs. Euro (Federal Reserve)

As can be seen in the chart, the value of the U.S. dollar began to strengthen almost immediately after the Federal Reserve announced is policy of quantitative tightening.

Investors started putting money into the U.S. dollar because the monetary policy of the Federal Reserve was seen to be more restrictive than what other central banks around the world were doing.

The U.S. dollar rose in value in foreign exchange markets.

This is what analysts expect to happen when monetary policy is seen to be relatively tighter in one country than in others.

But, wait. It seems as if in September 2022, investor attitudes changed.

On September 27, 2022, the value of the U.S. dollar closed just under $0.9600 for one Euro.

And, then it started heading up.

What happened?

Looser Money?

Officially, the Federal Reserve changed nothing.

But, something must have happened. Investors in late September 2022 seemed to believe that other central banks in the world were acting in a more restrictive way than the Fed.

And, this belief seems to have carried over into the present time.

The Federal Reserve may still be engaged in quantitative tightening, but, relative to other central banks, investors seem to believe that the Fed is not being as tight as it might be… or, as tight as it should be.

In early February 2023, it took $1.0900 to buy one Euro.

As can be seen in the chart, the value of the dollar remained around this level until the past two weeks or so.

Now, we are close to seeing it take $1.1200 to buy one Euro.

What is going on?

What Is The Fed’s Goal?

Well, for one thing, other central banks have tightened up considerably through the fall of 2022 and up to the current time.

But, secondly, the Federal Reserve does seem to have “eased off,” balance sheet-wise in the fall and sophisticated investors may have caught onto this move earlier than many us did.

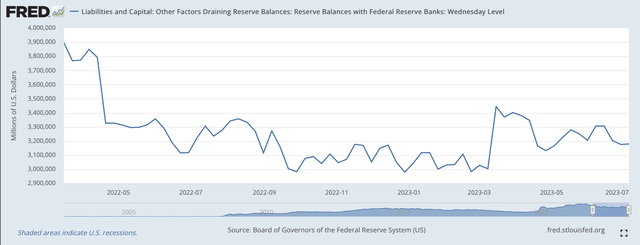

Note what happened to commercial bank “excess reserves” in the fall of 2022.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

The line item titled “Reserve Balances with Federal Reserve Banks” can be used as a proxy for the “excess reserves” of the banking system. This is a measure of the liquidity in the banking system.

Right after the Fed began its exercise in quantitative tightening, the “excess reserves” in the banking system took a substantial dive.

However, toward the end of September 2022, excess reserve stopped falling. Excess reserves seemed to “bottom out” right around $3.0 trillion.

How did the Fed accomplish this?

Well, the Federal Reserve continued to see its securities portfolio decline… that is, quantitative tightening continued on as before.

But, the Fed used something called reverse repurchase agreements to “offset” the impact of some of the securities held outright that were leaving the Fed’s portfolio.

Reverse repurchase agreements are when the Fed buys securities, thereby putting reserves into the banking system, under an agreement to resell the securities in one or two days, thereby removing the reserves from the banking system. Knowledge of these transactions taking place is limited.

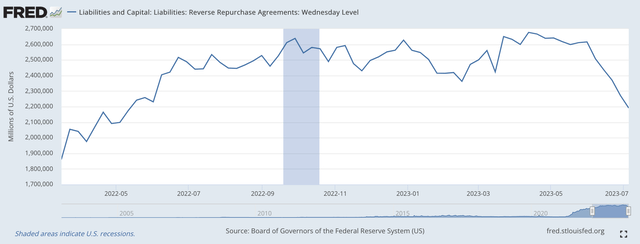

Reverse Repurchase Agreements (Federal Reserve)

Note that reverse repos rose into the fall of 2022, and reached a total of more than $2.6 trillion by September 28, 2022.

Thus, although the Fed was allowing securities to run off from its securities portfolio, the Fed, with its other hand, was seeing reserves go back into the banking system through the repo market.

So, the Federal Reserve was not tightening up as much as it had led people to think.

However, note the timing.

The “excess reserves” in the banking system seemed to hit a floor right around the end of September and the value of the U.S. dollar seemed to begin to fall right around the end of September, after rising since the middle of March 2022.

One could make an argument that sophisticated investors saw the adjustment the Federal Reserve was making in its management of monetary policy and began to sell U.S. dollars where they had been buying them since the middle of March.

That is, the Federal Reserve’s monetary policy was not as “tight” relative to the moves of other central banks around the world as had been perceived up toward the end of September 2022.

The next factor in this picture is the state of the banking industry.

During the Covid-19 pandemic and following economic recession, the Federal Reserve pumped trillions of dollars into the financial system.

As a result of the “asset bubble” created by the Fed, banks, other financial institutions, and even many non-financial organizations still have lots and lots of “cash” available.

The United States economy is not wanting for money.

And, the Federal Reserve plans, as far as they have been released to us, indicate that the Fed will not attempt to remove most of the reserves pumped into the economy during the effort to protect the United States from further tragedy.

So, here we are.

The “tight” monetary policy of the Federal Reserve does not seem to be getting us a “stronger” U.S. dollar.

The U.S. is not getting a stronger U.S. dollar out of this because the United States is not willing to tighten up monetary… and fiscal policy… as much as is needed to support the U.S. dollar.

I believe that we will come to regret this position.

Read the full article here