Dominion Energy (NYSE:D) has offered investors a fascinating ride as the company seems to continue searching for its mission. I have owned D for well over 9 years, first through ownership of its short-lived Cove Point LNG public offering (Dominion Midstream) in 2014, then by its acquisition of South Carolina’s SCANA Corp in 2018, and finally through buying and selling its common shares. The latest admission by management that it is still seeking a profitable purpose should be relatively concerning for long-term investors.

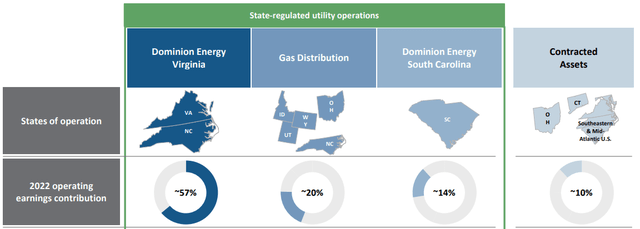

Dominion Energy is one of the largest regulated utilities in the US. According to their website, D provides state-regulated electricity and natural gas service to about 7 million customers in 8 states. In addition, D operates electricity generating facilities (28,600 mw capacity) using a combination of “all of the above” fuel sources and includes the country’s 2nd largest solar portfolio. D owns a partial interest in an LNG facility in MD, Cove Point. Dominion Energy Wexpro develops and produces natural gas reserves, with ventures in Wyoming, Colorado, and Utah. The graphic below, from D’s 4th quarter investors presentation, outlines the states of regulated operation:

Profile of States of Operations (investors.dominionenergy.com)

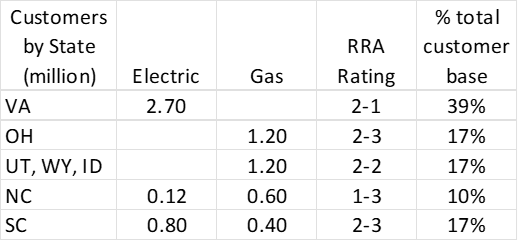

From this graphic and adding the number of customers in each state found in various Dominion Energy filings and presentations, the following table can be developed to further analyze D’s current regulated business profile. The table lists the state, the number of regulated customers by service type, the rating of each state’s regulatory support by S&P’s Regulatory Research Associates (1-1 is Most Supportive, 2-2 is Average, and 3-3 is Least Supportive. Note: I prefer state’s oversight to be rated as Above Average 1-1, 1-2, 1-3, and 2-1), and the total number of customers by percentage.

Customers, RRA Ratings by State (GMI, dominionenergy.com)

Interestingly, by customer count, Dominion Energy services about equal number of electric (57%) and natural gas (43%) customers. In addition, 49% of customers are in preferred states rated 1-3 (NC) and 2-1 (VA) and 17% are in states with Average (UT, WY, ID) and 34% are in states with Below Average (OH, SC) rating for regulatory oversight. Contracted Assets from the graphic above represents the Cove Point LNG facility and long-term contracted solar and wind generating facilities.

A few years ago, Dominion Energy made a financial commitment to become a major player in the East Coast offshore wind business. D is in the process of developing both an offshore wind farm off the coast of Virginia and has contracted to build a $500 million specialized ship used in the construction of offshore wind assets. When fully constructed 27 miles off Virginia Beach in 2026, D’s Coastal Virginia Offshore Wind will provide sufficient electricity to power 660,000 homes.

At one point, management seemed to be moving in the direction of being a multiple utility and energy midstream conglomerate. Dominion purchased Questar Natural Gas in 2016 for $4.4 billion, creating a powerhouse natural gas company with FERC-regulated natural gas transmission, the largest FERC-regulated natural gas storage network in the country, LDC businesses in western states, the only Mid-Atlantic LNG export facility, and natural gas E&P company. Midstream assets figure heavily into the Questar deal. This is in addition to its extensive electric utility footprint offering power generation, transmission, and distribution along the eastern seaboard.

Then, the “strategic” reviews and flipping of assets began. Dominion Midstream partnership units were bought back, returning Cove Point LNG terminal fully to D, where a 50% interest has subsequently been sold. Much of the Questar and Dominion owned FERC-regulated pipelines have been sold to Berkshire Hathaway (BRK.B) (BRK.A), and when Mr. Buffett had purchased his fill (BRK.B owns 18% of the total capacity of FERC-regulated gas pipelines in the US and reportedly Mr. Buffett was concerned with government approval of more), D turned to Southwest Gas (SWX) to finish the disposal of Questar assets. Management’s previous strategic review resulted in the disposal of all FERC-regulated assets.

As an investor who appreciates the benefits and stability of the higher allowed ROE historically offered by the FERC over state-regulated assets, the midstream asset disposal reduced Dominion’s investment attractiveness.

And the company is at it again.

In September 2022, management announced a very aggressive 2022-2026 5-yr capital investment plan of $37 billion, including $10 billion for offshore wind development, and an additional $36 billion in capital expenditures 2027-2035. But in November 2022, management announced another total company strategic review of its businesses. I agree that times change, and situations change, and business directions need to respond and change as well. However, it seems Dominion is more akin to a sailboat participating in the current around the world Ocean Sailing Race losing a rudder and finding themselves adrift. Due for completion by a 3rd quarter 2023 investor presentation, the “new business plan” is almost guaranteed to involve some level of asset sales and realignment of billions in capital investments.

It seems management is looking for buyers of several asset groups, starting with finding an offshore wind partner and its regulated natural gas LDC distribution business, followed by its 50% interest in Cove Point. However, buyer interest seems weak at the moment, especially when other utilities, such as New England-based Eversource (ES), are also looking for partners to contribute capital for offshore wind development. Gas LDC businesses are also not a hot commodity, especially with the current political assault on their existence.

Currently, what Dominion Energy will look like in 2024 and beyond is impossible to tell. I find some of the matrix of D intriguing, such as the high percentage of utility customers in beneficial regulatory environments and an extensive on-land solar generating portfolio with “all of the above” fuel diversity exposure. However, I think offshore wind will become an albatross for utilities, and D’s $10 billion bet seems a bit expensive and risky.

I started selling down my position in early 2019, taking advantage of rallies between the high-$70s and high-$80s, with my last sale in late 2020. The remaining shares are what I consider a low-average position value, and I am giving serious consideration to exiting the position. It is difficult to recommend an investment stance with the uncertainty of what investors will own post September 2023. Which assets are being retained, which are being sold, what is the long-term earnings potential, and what will the balance sheet look like? Investors do not know the answers and it becomes difficult, at best, to place a current valuation of Dominion Energy shares – or even to determine how “safe” the dividend is. It seems Morningstar has lowered Dominion’s growth prospects to 5%, or below sector average of 6% to 9%.

I rate it as a Hold but am leaning on a Sell recommendation. Personally, I prefer Southern Company (SO) and beaten-down Emera (OTCPK:EMRAF), but the entire US political climate towards energy, combined with a ballooning utility cost/rate structure, is giving me pause on the sector.

Read the full article here